Antibody-drug conjugates (ADCs) are one of the megatrends in the healthcare sector. As an article published earlier this year in the journal "Nature Reviews Drug Discovery" highlights, companies have invested heavily in this area in 2023. In addition to one of the largest biotech takeovers of Seagen by Pfizer (volume USD 43 billion), Abbvie's purchase of Immunogen for USD 10.1 billion also caused a sensation last year. This development is set to continue in 2024: a few weeks ago, Roche paid USD 50 million to collaborate with the Chinese ADC specialist MediLink Therapeutics. BioNTech is also cooperating with the Chinese. But what are ADCs, and why are they in such high demand?

Blockbuster potential? Study shows: AccuTOX® can do even more than expected

to USD 326.4 billion. These are the market expectations for chemotherapeutics until 2027, according to Statista.

In simpler terms, ADCs are biopharmaceuticals where an active ingredient piggybacks on an antibody. In this way, active ingredients are also intended to trigger a specific immune response in addition to the drug's primary action. ADCs are also commonly regarded as drug enhancers. The Canadian biotech company Defence Therapeutics has been active in this field for years with its patented Accum™ technology. Accum™ has the ability to simplify the cell transport of all active ingredients. Defence Therapeutics is already collaborating with the French nuclear medicine company Orano. Numerous other applications are also conceivable. Vaccine projects against cancer, for example, are well advanced - Defence plans to initiate Phase I trials in 2024 for its ARM vaccine against established tumors. The latest achievement, however, concerns the novel chemotherapeutic AccuTOX®, which is also about to enter Phase I trials.

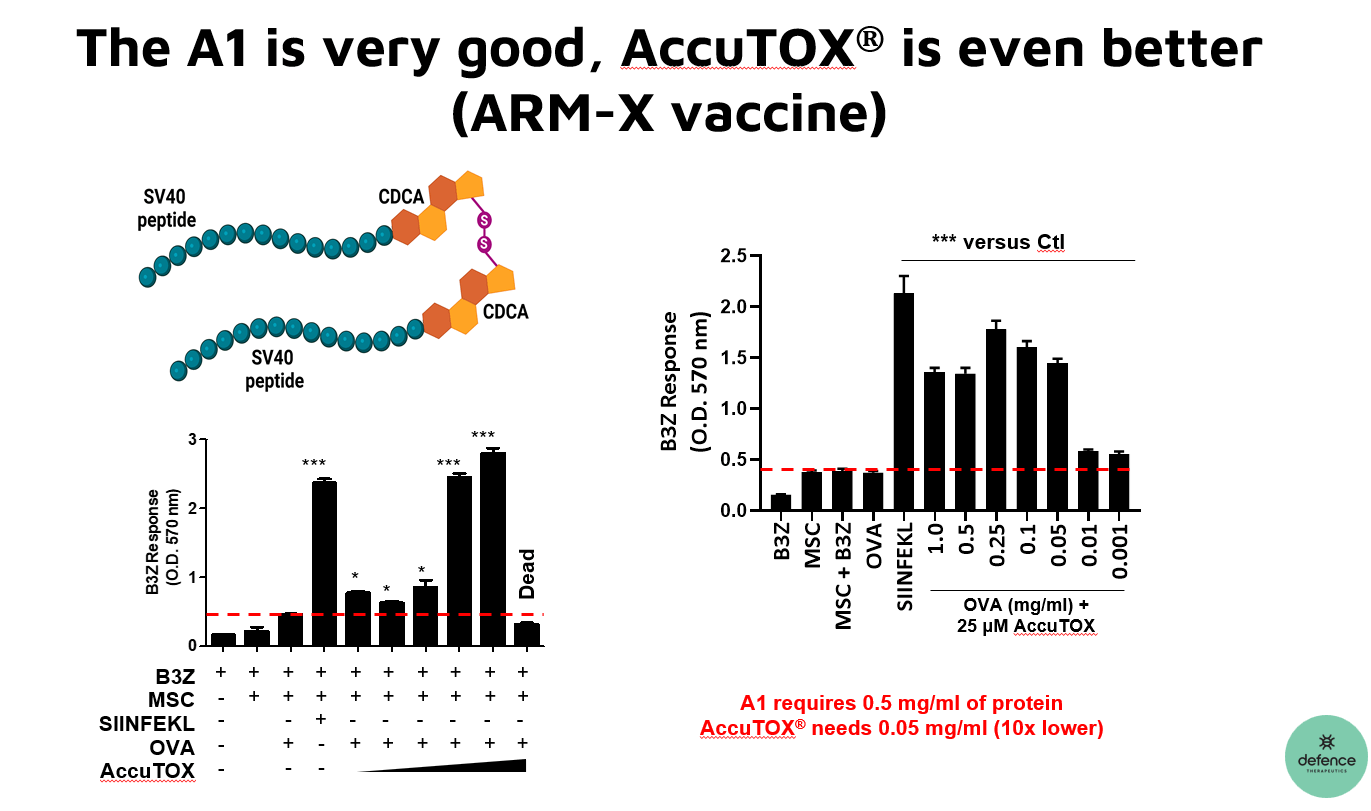

Defence Therapeutics has made numerous advances in this area in recent months. AccuTOX® was originally planned as a pure chemotherapeutic agent. The observation: if Accum™ is administered in a highly concentrated form, it can damage cancer cells to the extent that they die - the result: AccuTOX® as an independent technology. In addition to this finding, Defence Therapeutics has now demonstrated in scientific studies that AccuTOX® is capable of converting mesenchymal stem cells (MSCs) into antigen-presenting cells. This significantly expands the functionality of AccuTOX® and promotes an immune response against cancer cells in various ways. This could lead to AccuTOX® being viewed by the market as a potential blockbuster.

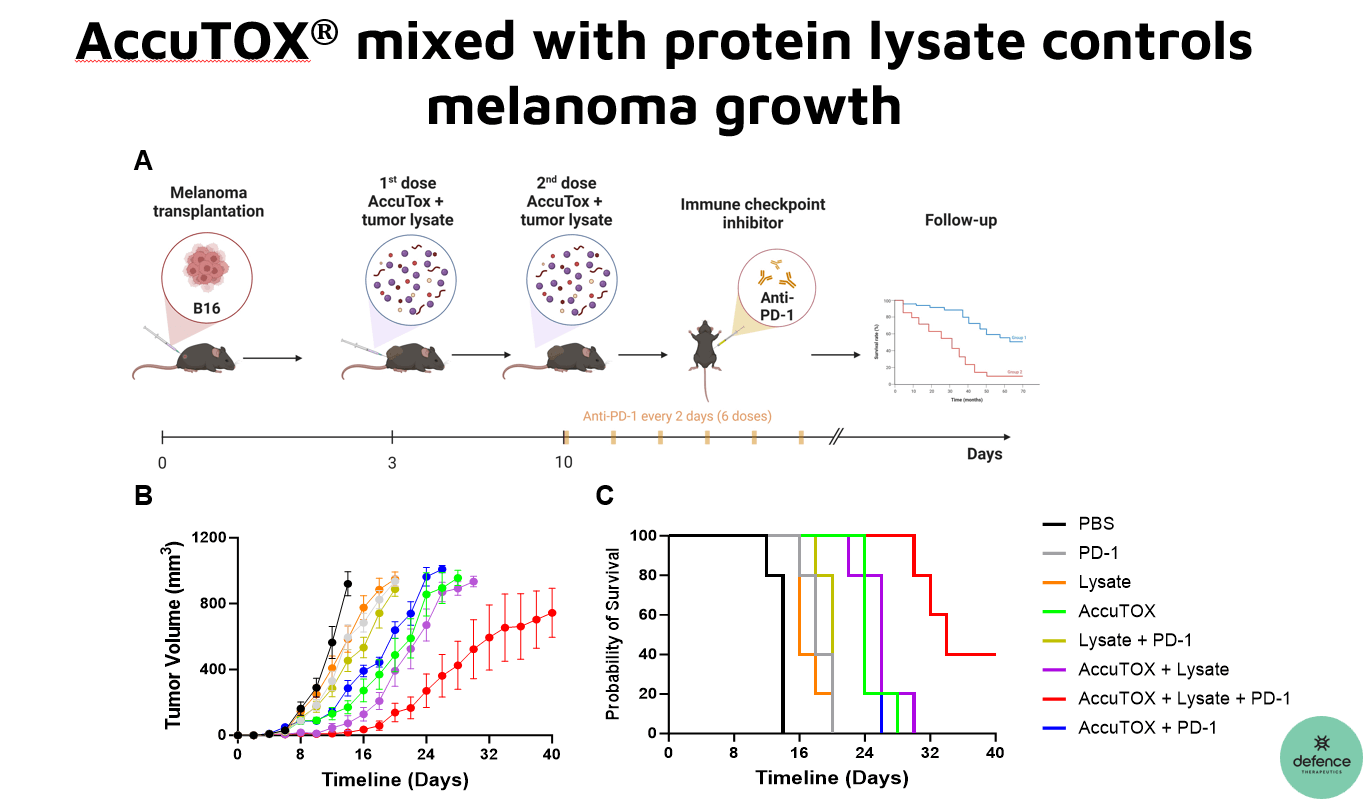

Compared to the technology at an earlier stage, AccuTOX® is now said to require only around a tenth of the protein to trigger an immune response. This has several advantages: Firstly, the risk of adverse reactions is reduced, and secondly, costs are likely to be lower. Defence Therapeutics was also able to show that the combination of AccuTOX® and an antigen (tumor lysate) leads to slower growth of melanomas in mice and higher survival rates. Overall, the latest findings indicate that AccuTOX® 48 has improved anti-cancer properties while retaining all the positive properties of the original Accum™ molecule. Added to this is the synergistic effect with immune checkpoint inhibitors, making the technology highly flexible and thus combinable with other solutions - all features that capture attention.

Several potential revenue streams make Defence Therapeutics interesting

While the study on the new findings regarding AccuTOX® has not been published yet, the study design and reasoning are convincing. This was confirmed by an independent scientist active in cancer research, to whom we have already been able to present the study. Ultimately, however, AccuTOX®, like any new active ingredient, has to assert itself against already proven approaches. However, the likelihood of success is not improbable. In particular, the latest findings that AccuTOX® can also trigger specific immune responses distinguish the technology from traditional chemotherapeutics. Just a few months ago, AccuTOX® received approval for a Phase I trial from the US Food and Drug Administration (FDA). Last year, the renowned City of Hope University Hospital in the Los Angeles area was won over for the complicated application process. The clinic, which submits up to 50 applications to the FDA each year and stands for cutting-edge medicine according to the phrase "bench to bedside", is also to accompany the Phase I study on Accum™. Before it can begin, the latest version of the active ingredient must be produced. Defence Therapeutics is currently carrying out preparatory work for this.

With its versatile Accum™ platform and the latest findings on AccuTOX®, Defence Therapeutics is an exciting biotech bet. The Company is acting in precisely the areas where big pharma is looking to gain a foothold. In addition, Defence Therapeutics' business model is predestined for license agreements. Similar to the collaboration with Orano in the field of nuclear medicine, the solutions based on Accum™ could also give new impetus to other biotech projects. Even projects that previously failed due to excessive toxicity could be given a second chance thanks to the drug-enhancing properties of Accum™.

Reasons for the drop in share price

submitted by the renowned City of Hope Hospital each year.

Just over a year ago, the share price was still scratching the CAD 4.85 mark - today, it is trading at CAD 1.97. There are no operational reasons for this decline. In the past year alone, the Company successfully applied to the FDA for a Phase I trial in collaboration with a renowned research hospital, reached a milestone in its partnership with Orano, reported successes in vaccine research, and demonstrated that the chemotherapy drug AccuTOX® has much more potential than initially expected. So, where did the share price drop come from?

Despite the progress made, Defence Therapeutics is working on its projects at an early stage. It will be years before approval is granted. At the same time, biotech research is cost-intensive. Investors became particularly aware of this in 2023, a challenging year for growth companies. However, Defence closed a financing round a few weeks ago, while at the same time takeover activities in the biotech sector are picking up speed again - precisely in the areas in which Defence Therapeutics offers convincing solutions. Added to this is the prospect of falling key interest rates at the latest in the second half of the year, which generally also supports growth stocks.

Conclusion: Comeback candidate for speculative investors

Given the broad range of applications for Accum™, the new findings on the chemotherapeutic AccuTOX®, which is about to undergo the clinical approval process, and the current moderate valuation of around CAD 87 million, the share is a comeback candidate waiting in the wings. Even a takeover bid from a major player cannot be ruled out - large corporations could easily finance the further activities of Defence and, in return, receive a flexible multi-tool encompassing cancer therapy, mRNA, and vaccines. There is also potential on the market: Above the CAD 2 mark, the share could pick up speed and exit the downward trend. Speculative-minded investors should make a note of this stock.

The update is based on the initial report 12/2021