At a glance

Defence Therapeutics is a Canadian biotech company focused on development of vaccines and enhanced delivery of drugs into diseased cells. The company relies on platform technology that will serve as the basis for various solutions. Currently, the company is working on vaccines against skin and breast cancer and plans to start corresponding Phase 1 trials within the next six months.

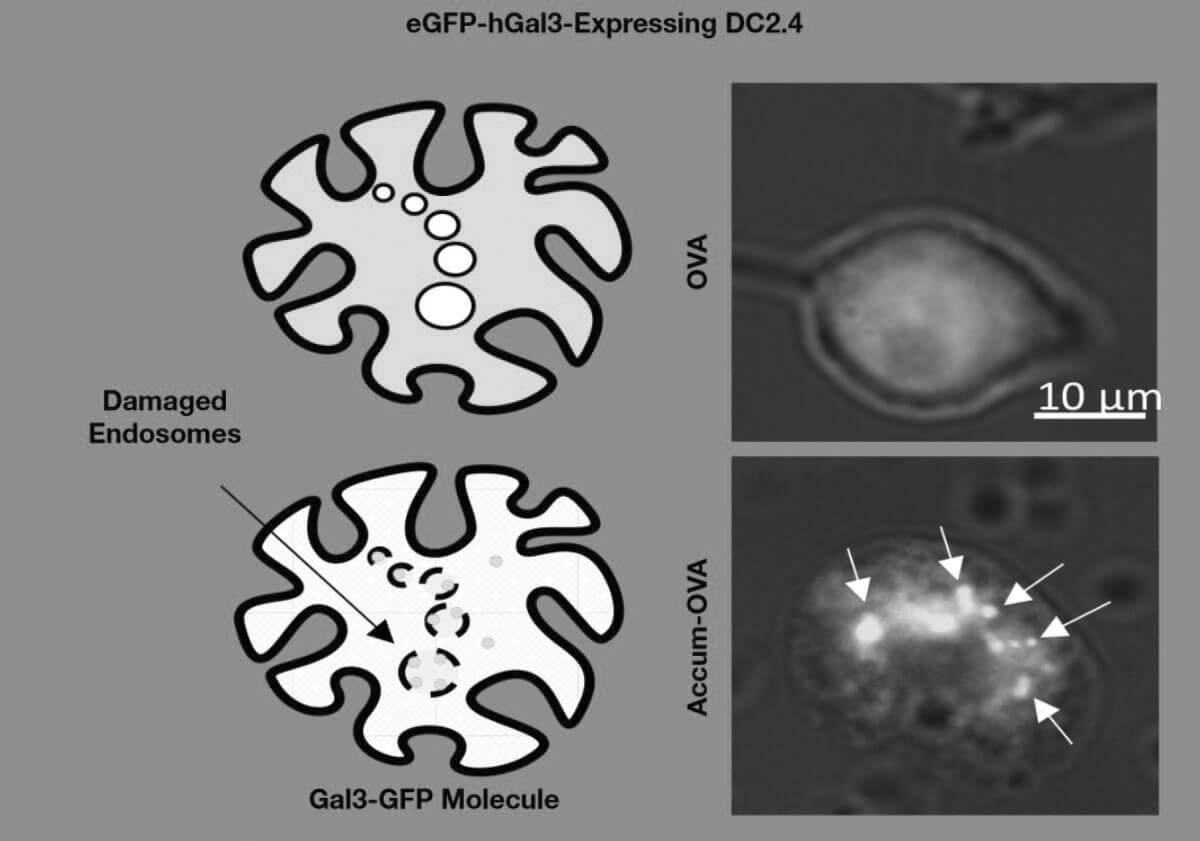

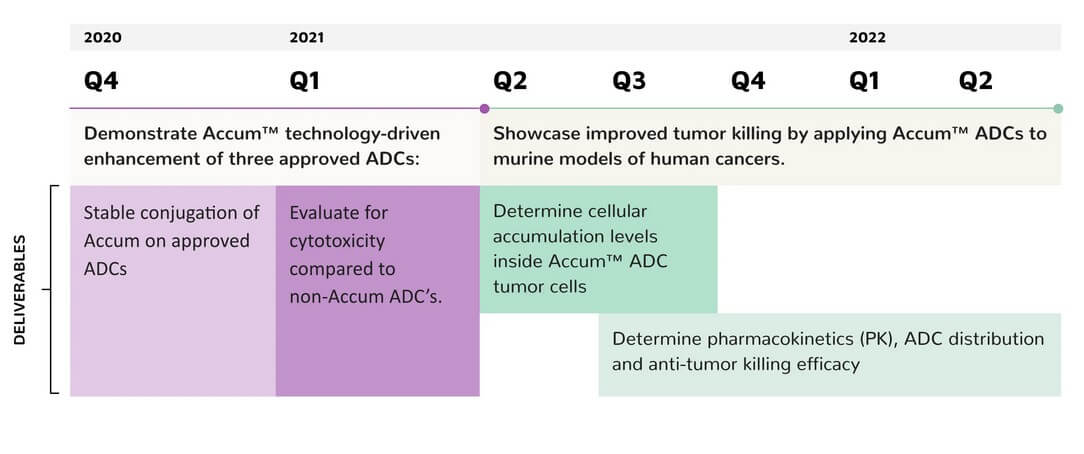

With the patented Accum™ technology, Defence Therapeutics offers a platform for so-called antibody-drug conjugates (ADC). In this process, a specific active ingredient is linked to an antibody by means of a peptide linker and thus reaches precisely where it is supposed to act. For example, into a tumor cell. Defence Therapeutics has data showing that Accum™ can significantly increase the efficacy of certain forms of therapy in combination with immune checkpoint inhibitors. Immune checkpoint inhibitors are targeted in oncology to block anti-inflammatory immune checkpoints to provide benefits during therapy. 1

A dynamic market

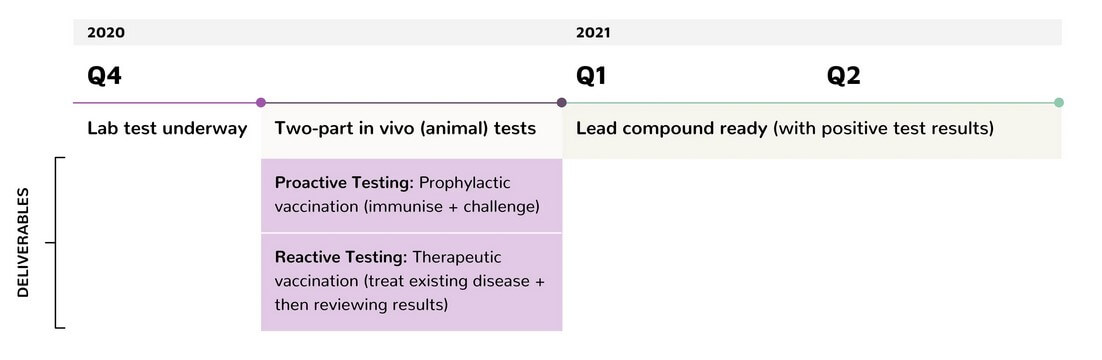

On the one hand, Defence Therapeutics specializes in the effective transport of drugs into diseased cells using antibody-drug conjugates (ADC) and acquired the Accum™ platform years ago for this purpose. Furthermore, Defence Therapeutics is active in the field of immuno-oncology and aims to develop vaccines against cancer. Within the next six months, Defence Therapeutics plans to conduct Phase 1 trials of its vaccine candidates against skin and breast cancer. During Phase 1 trials, the primary objective is to document the safety of a preparation or vaccine. Indications of potential doses and their efficacy are provided by phases 2 and 3.

Global immuno-oncology market

Global immuno-oncology market volume to 2027

The field of immuno-oncology is all about raising awareness of the power of the immune system to fight cancer. In recent years, research around this field has made great strides. However, the approach itself is anything but new: As early as 1867, the Bonn surgeon Wilhelm Busch placed a woman with cancer in the empty bed of a patient with erysipelas. As a result, the tumor shrank significantly. However, it is only today that the interaction between cancer cells and our immune system has been sufficiently researched to be able to take advantage of the effects. Our immune system functions in two ways: non-specifically against all pathogens or specifically with the help of a learned immune response. The latter is where immuno-oncology comes in, helping to activate the immune system or make it recognize specific cancer cells and their antigens.3 Market researchers at Research and Markets estimate that the immuno-oncology market potential will total $163.1 billion by 2027. In 2020, the market was only USD 63.9 billion in size. The annual growth rate until 2027 thus corresponds to 14.3%. 4

Antibody-Drug Conjugates (ADC) in the Global Market

Market researchers at Emergen Research expect the antibody-drug conjugates (ADC) market to reach a total volume of USD 20.01 billion by 2028. The market experts see annual growth at 25.8%. Analysts have identified intensive research, the growing importance of antibody therapies, and the increasing use of complex active ingredients as growth drivers.

Annual growth ADC until 2028

All of this is becoming necessary as the population in industrialized countries continues to age, increasing the need for therapies.5

Many large pharmaceutical companies, such as Merck, have also discovered a promising market in ADC. In September 2020, the group invested in manufacturing capacity at its company-owned site in Madison, USA, to produce ADC on a large scale. "ADCs have seen strong growth over the past decade and recent regulatory approvals demonstrate their potential as targeted therapies, commented a representative from Merck's Life Science business sector at the time."6

Special features of Defence Therapeutics

Unique selling propositions

As Defence Therapeutics points out with regard to its Accum™ platform itself, it offers several advantages. In addition to its use in ADC, the technology can be used in connection with vaccines against cancer as well as other vaccines, he said. Defence Therapeutics emphasizes in this context, in addition to higher efficacy (factor of 10 compared to other ADC), that there is no protein or antigen degradation or other interference when using Accum™. In clinical use of oncology drugs, it is common for cancer cells to be resistant to therapeutic agents. The use of Accum™ prevents this resistance, the company says. Also, the specific mode of action thanks to Accum™ ensures that fewer healthy cells are exposed to non-specific toxicity.

Accum™ technology is also used in the field of vaccine development. Here, it ensures that the immune response is up to 100 times stronger than with the actual antigen. This is expected to provide increased efficacy and lower costs in vaccine production. The platform approach to vaccine development is said to favor that vaccines can theoretically be developed against all viruses and infectious diseases. Also, the platform approach should allow for an improved ability to adapt existing vaccines to new challenges. 7

Goals - CEO sees himself as an intermediary

Within the next six months, Defence Therapeutics plans to start Phase I trials for the two vaccines against skin and breast cancer. The main focus here is on the safety of the vaccines. The company also wants to make progress in the efficient transport of active ingredients, emphasizing that the technology is basically suitable for transporting small molecules, antibodies, vaccines and oncolytic viruses. The latter are capable of infecting tumor cells, generating an immune response, or delivering specific drugs into tumors. According to Defence Therapeutics, the possibilities surrounding Accum™ are numerous. To more effectively leverage the technology's potential, the company can also envision making Accum™ available to third parties. "Especially around CRISPR technology, the use of Accum™ could be useful, explains Sébastien Plouffe, CEO of Defence Therapeutics. "Future revenue streams for our company could be either direct royalties, but also payments linked to specific milestones or royalties on sales. The potential in this area is very large. As of today, anything from a few million CAD to a billion is conceivable, Plouffe said. Just recently, Defence Therapeutics announced that Accum™ clearly improves the transport of CRISPR/CAS9 proteins into target cells, citing a factor of 9.

Increase in effectiveness of CRISPR protein transport thanks to Accum

Defence Therapeutics in analysis

CEO Sébastien Plouffe also sees himself as an intermediary in the industry, but he also appears to have a good eye on the competition. "A number of pharmaceutical companies are actively working on developing strategies to improve the release of their own compounds. Although their core strategies differ from ours, for example because they use nanoparticles, mRNA formulations or other alternative routes of delivery, Defence Therapeutics currently sees three primary competitors in addition to large pharmaceutical companies: Sapreme Technologies, Feldan Therapeutics and PCI Biotech, CEO Plouffe told researchnanalyst.com.

A portrait of the peer group

Sapreme Technologies (Utrecht, The Netherlands): a small preclinical-stage biotech (that just completed a Series A) working on an endo-lysosomal escape strategy to deliver oligonucleotides into liver cells, using its proprietary molecule SPT001.

Feldan Bio (Quebec, Canada): is focused on using its Feldan Shuttle technology, an intracellular delivery method, to deliver drugs into target cells. The technology relies on the use of cell-penetrating peptides fused to endosomal leakage domains to trigger the release of cargo into the cytoplasm of target cells.

PCI Biotech (Oslo, Norway): a biopharmaceutical company focused on developing therapeutic solutions to improve the treatment of cancer patients through its photochemical internalization (PCI) technology platform to trigger endosomal release of captured cargo.

All three companies are not currently publicly traded. Thus, in the absence of transparency obligations typical of the stock market, financials are scarcely available for Sapreme Technologies, Feldan Bio and PCI Biotech. However, all three companies and Defence Therapeutics have the same status as growth companies. This is accompanied by losses and regular financing rounds. While the three stocks outlined above are not investable and the companies publish information only sparsely, Defence Therapeutics reports regularly on developments and publishes figures. 8

| Key figures CAD, each as of June 30 | 2020 | 2021 | 2022e |

|---|---|---|---|

| Cash | $1.865.927 | $5.452.906 | - |

| outstanding shares | 18.465.714 | 35.220.774 | - |

| Market capitalization | $2.769.857 | $248.306.457 | - |

| Proceeds from issuance of securities (gross) | $2.277.000 | $6.440.265 | - |

| Research and development expenditures | $433.451 | $1.158.504 | $2.250.000 |

First analysts are on it

But how should these figures be evaluated? Especially in the case of growth companies, balance sheet losses can be interpreted in very different ways - depending on whether or not the respective investments are considered to make sense. Since Defence Therapeutics has already been on the market since 2017 and has received the trust of investors in various financing rounds, the company, which is active in no less than two growth fields, could offer a promising perspective. Analyst Julien Desrosiers from analyst firm GBC AG recently held a background discussion with CEO Plouffe and announced that he is working on a research study. In an interview with researchanalyst.com, the analyst held out the prospect of publication of the analysis in January. By then, Defence Therapeutics' growth prospects should be even more backed up with numbers. What the analyst is after is already indicated by the questions in the recently published interview.

Here, Desrosiers targets the platform approach around Accum™ and elaborates in the interview on the potential advantages of the technology in the area of approval procedures. Regulatory authorities often give thumbs down to classic ADC due to its high toxicity. Accum™ could bring advantages in this context. On this, Plouffe commented to analysts, "We have evidence (e.g. with trastuzumab) that AccumTM does not increase the toxicity of ADC. Quite the opposite. Lower dosing or shortening the treatment regimen may increase ADC efficacy, as less ADC is needed to achieve good results. That would further improve the toxicity of the product.

Already, Phase 1 studies around vaccines announced by the company in the coming months could shed light on the extent to which Accum™ addresses the ADC toxicity issue. 9

SWOT - a brief overview

Strengths

- Promising Accum™ technology

- Phase 1 cancer vaccine trials planned within six months

- Already listed on the stock exchange in early corporate phase

- Platform approach

Weaknesses

- Crucial studies still pending

- Track record still short

Opportunities

- Positive environment for innovative biotech technology

- Cancer vaccines as potential blockbusters

- Possible licensing business with Accum™

Risks

- Competition also from corporations, such as Merck.

- Technology might not catch on

Conclusion and outlook

Defence Therapeutics has promising projects and, thanks to its platform approach, is not always starting from scratch when developing new vaccines. For the company, this starting position offers time advantages in the development of new vaccines. With the fight against cancer, Defence Therapeutics has committed itself to one of the most pressing questions facing humanity. If trials with mice succeed, as already indicated, Defence Therapeutics would have a blockbuster vaccine in its portfolio overnight - parallels to BioNTech could then hardly be denied. The versatile Accum™ technology also offers the prospect of a licensing business that could be extremely lucrative thanks to revenue or profit sharing - and without tying up further capacities at Defence Therapeutics.

The company's perspective is primarily dependent on growth potential. Thanks to the platform approach and the possible licensing business, this potential is very high - provided Defence Therapeutics' products catch on. The Phase 1 trials around the two cancer vaccine candidates, planned for the coming months, will exclusively revolve around safety aspects. Safety is one of the biggest risks in the approval process of antibody-drug conjugates (ADC). The outcome of the Phase 1 trials alone is likely to be a landmark for Defence Therapeutics.