Entering a new league

Canadian resource company Saturn Oil & Gas reports record production in the fourth quarter of 2023, averaging 26,891 boe/d (82% oil and NGLs), compared to 12,514 boe/d (96% oil and NGLs) in the fourth quarter of 2022. The 115% increase is attributed to the acquisition of the Ridgeback properties in mid-2023.

barrels of oil equivalent/day is the achieved average value in the fourth quarter

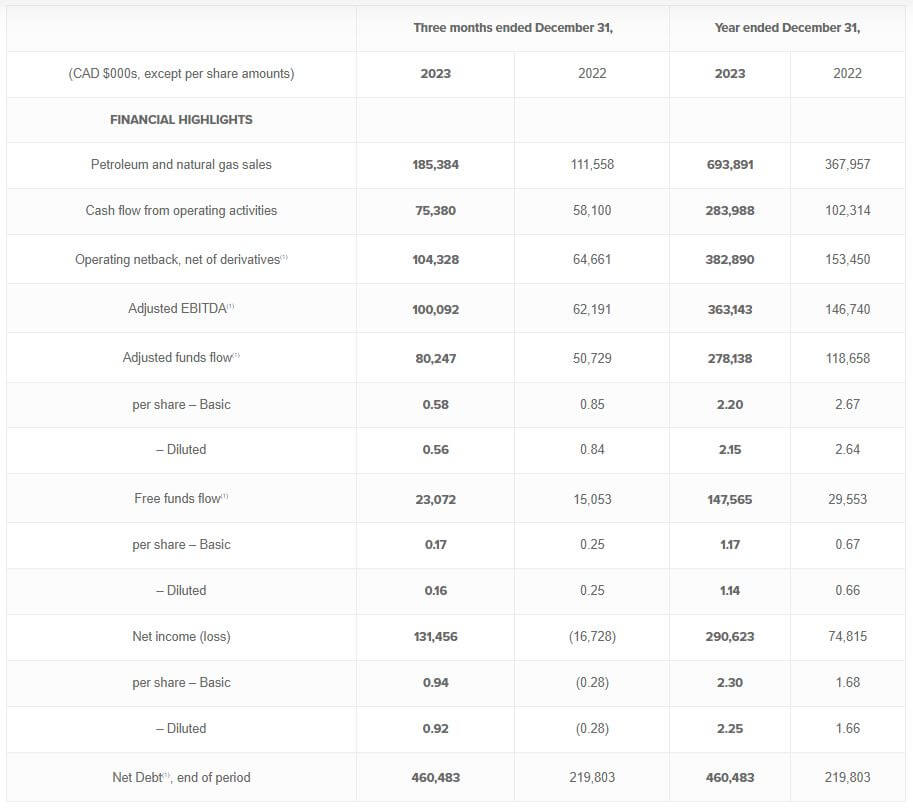

With this transformational integration, Saturn has entered a new league, with the enterprise value (EV) almost reaching the billion mark at CAD 855 million. The quarterly adjusted EBITDA rose above the CAD 100 million mark for the first time, compared to CAD 62.2 million in the previous year. From a cash flow perspective, CAD 23.1 million remained in the coffers, marking a 53% increase. With total investments totalling CAD 57.2 million, 19 horizontal wells were completed. With a current net debt of CAD 460.5 million, the net debt/cash flow ratio is now a low 1.4.

"Saturn made tremendous progress in 2023 and established itself as a company with significant and sustainable free cash flow. Not only have we doubled our production base compared to last year, but we have also built a substantial inventory of high-quality development wells to sustain current production levels for decades to come," said CEO John Jeffrey.

For the full year 2023, revenues from oil and gas sales increased from CAD 368 million to CAD 694 million. Net operating revenues reached CAD 383 million after CAD 153 million. The free cash flow per fully diluted share was CAD 1.14. Saturn had a total of CAD 278 million in free funds at the end of the year, which can be used for repayments and new investments. Fully diluted earnings per share reached a value of CAD 2.25, which is only 10% below the current share price of CAD 2.44. This puts the 2023 P/E ratio at a value of 1.1.

Below is an overview of the individual figures in the income statement for the years 2023 compared to 2022:

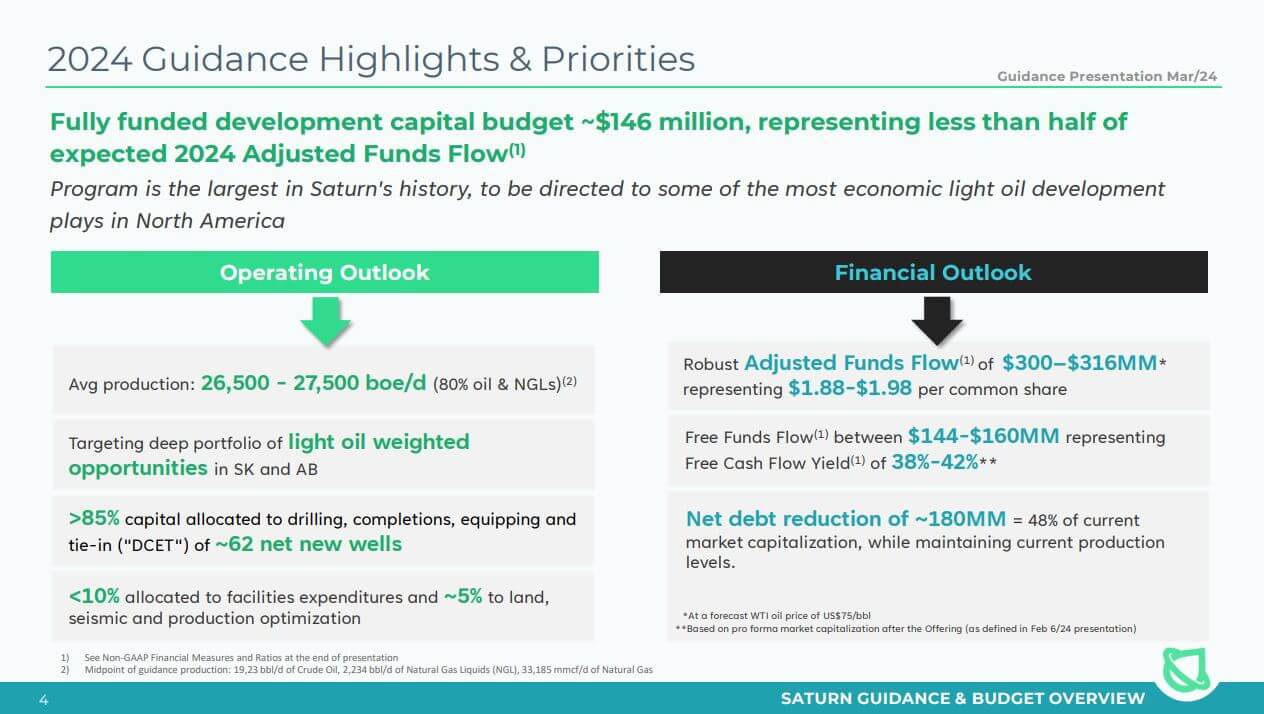

The sails are set for the current year

As a result of the successful 2023 drilling program and the acquisition of Ridgeback, Saturn's average oil and gas production in the fourth quarter of 2023 was approximately 26,891 boe/d, and average production reached approximately 28,000 boe/d in December 2023. The reserve report includes 680 gross drilling locations (576.6 net) in Saskatchewan and 199 gross drilling locations (150.6 net) in Alberta. The Company has an internally estimated additional 550 gross drilling locations (450 net) in Alberta and Saskatchewan, which, together with the booked locations in the reserve report, represent over 20 years of drilling inventory. External debt reached approximately CAD 460.5 million at the end of December; in its guidance for 2024, Saturn is now planning a complete debt repayment by the second quarter of 2026. However, an ongoing increase in production volumes could still positively impact the repayment schedule. Half of the free cash flows are intended for development. The budget for expansion investments is planned at CAD 146 million, with 62 new drilling locations to be connected. Overall, Saturn could make a total debt repayment of around CAD 188 million in the current year.

Interim conclusion: Analysts are confident

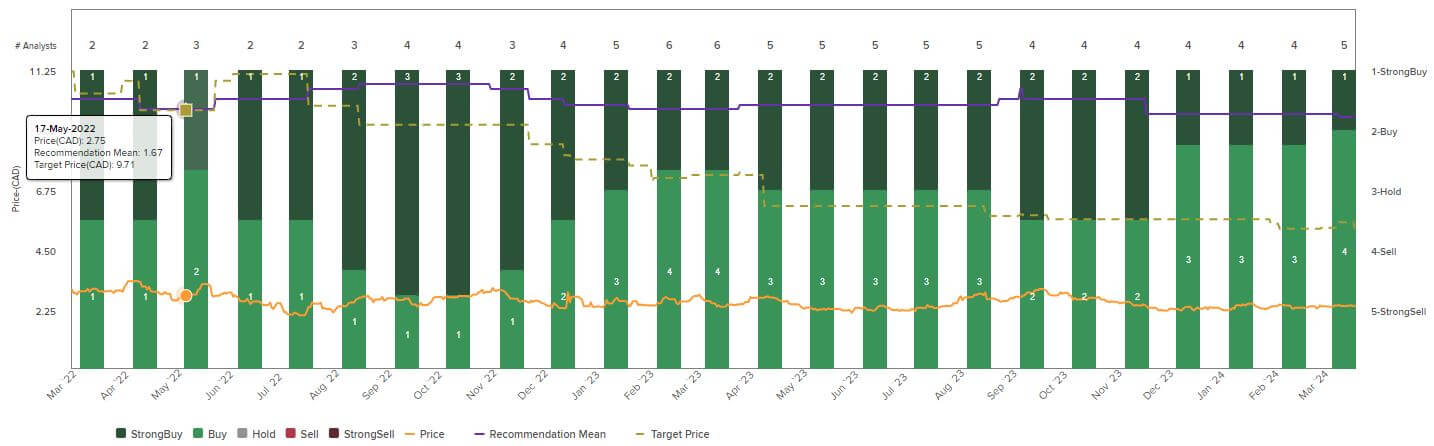

The price expectations of analysts on the Refinitiv Eikon platform currently range between CAD 4.45 and CAD 6.30 on a 12-month horizon. On average, five analysts expect a price of CAD 5.15 on a 12-month basis. However, this estimate could still change in the coming weeks, as the new figures are more likely to lead to upward adjustments. After all, the net present value of the proven reserves at the end of 2023 is CAD 6.72 per share (NPV/share). The Company had to accept a small setback in 2023 due to the horrendous wildfires in Alberta. For the current year, however, production volumes are expected to range between 26,500 and 27,500 boe/d.

Due to the size it has now reached, Saturn Oil is moving into the circle of institutional investors, and strategic investors may already have their eye on the up-and-coming company from Calgary. If oil prices can maintain the level of USD 75 to 80 (WTI) even in recessionary trends, nothing should stand in the way of Saturn's further upward development. In order to have more planning security, the expected oil price was set at USD 75 in the outlook. With a private placement of CAD 50 million, the Company was able to raise additional equity at the end of February. This improves the long-term capital structure and helps with the planned expansion of the active drilling fields. With an enterprise value of over CAD 850 million, the CAD 1 billion mark is likely to be broken in the current year, 2024.

Fundamentally, Saturn is currently trading at an estimated 2024 EV/adj EBITDA ratio of around 1.5. Considering the average industry valuation of approximately 4.8, a fair value per share of around CAD 7.00 to 8.00 would be expected from today's perspective. Due to the consolidation of properties and operational progress, synergy effects can now be realised from the recent acquisitions. With each further repayment, the intrinsic value of the share increases. Saturn will even be able to pay a dividend from 2026. This should be of particular interest to capital accumulation centres, as they require a steady return for their insured members. A medium-term adjustment of the share value to the new proportions should be expected.

Note: The full report can be found at saturnoil.com

This update is based on our initial report 11/21