Results convincing

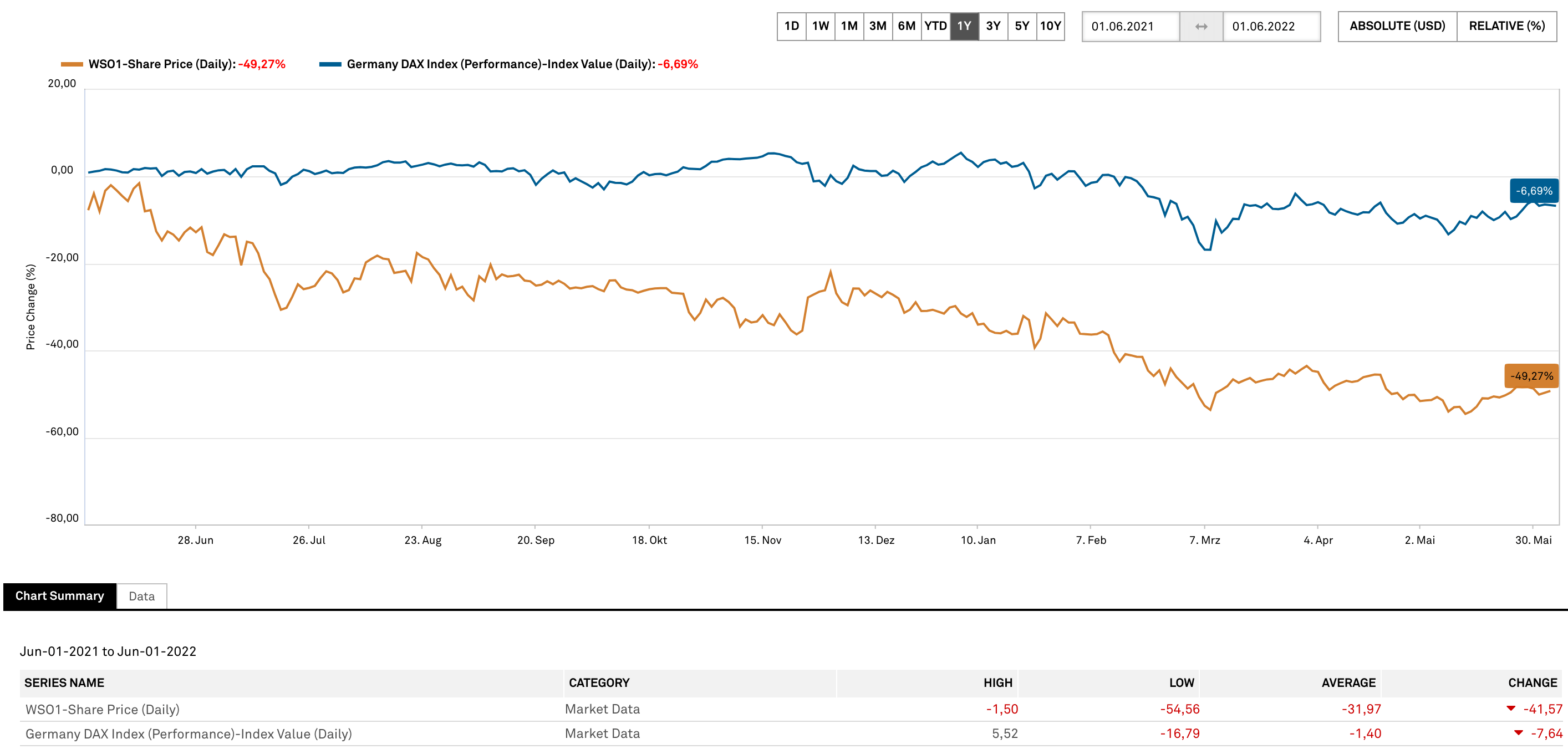

The share chart in no way reflects the positive operating performance. Despite repeated record results and a steady increase in assets under management to currently EUR 9.1 million, the correction of the share price since February last year amounts to around 50%. The audited consolidated financial statements now once again confirmed the strong full year 2021. Thus, the leading German operator of a neobroker and at the same time by far the largest publisher-independent financial portal operator was able to increase revenues by 82% to EUR 51.4 million in the full year 2021.

What is impressive here is that already after around two and a half years of existence of the Smartbroker, around 63% of the growth is already attributable to the transaction business, and around 37% is allocated to the portal business. Adjusted EBITDA before customer acquisition costs was EUR 17.5 million.

Smartbroker increasingly important

The name of the company's four established financial portals (wallstreet:online, finanznachrichten, ariva and boersennews) will not be changed. On the other hand, wallstreet:online AG is planning a change of name, whereby the significance of the Smartbroker is to be reflected in the name in the future. Thus wallstreet:online AG is to operate in the future under Smartbroker Holding AG in the case of a positive agreement at the annual general meeting on 24.06.2022. In parallel, the subsidiary wallstreet:online capital AG plans to change its name to Smartbroker AG.

Significant growth planned for the full year

According to the guidance presented in March, the Management Board expects growth of 25% year-on-year. In terms of revenue, earnings of between EUR 62 million and EUR 67 million are expected at the end of 2022, while operating EBITDA after customer acquisition costs is expected to amount to EUR 10 million to EUR 12 million, according to current plans. Operating EBITDA before these costs is expected to be EUR 16 million to EUR 18 million. The focus is clearly on the launch of "Smartbroker 2.0" in the second half of 2022, which should offer a fundamentally renewed user experience, an expanded product range and an optimized business model. The company will then benefit from higher revenue per trade, a degressive cost model and, prospectively, lower costs for new customer acquisition.

Optimistic analysts, insiders with willingness to buy

Throughout the bank, various analyst firms are positive. While Warburg Research sees good progress in the brokerage segment, but headwinds due to weak sentiment and rates the Berlin-based stock with "buy" and a price target of EUR 30, the Hamburg-based analyst firm Alster Research even sees unchanged EUR 32.00 as fair value. The current prices are definitely too favorable for founder and Supervisory Board Chairman André Kolbinger, who was able to get hold of around 84,000 shares at an average price of EUR 16.78 at the end of last month. Also on the buying side was CFO Roland Nicklaus, who acquired around 1,750 shares at a price of EUR 16.54.

Interim conclusion

Despite a convincing development in the operating area and a continued positive outlook, the share of wallstreet:online AG corrected significantly. This results in anticyclical extremely attractive entry opportunities in the long term. Both the Community and Transaction divisions grew considerably stronger than expected. With assets under custody of over EUR 9 billion, Smartbroker is by far the largest neobroker in Germany and is significantly undervalued compared to the peer group. The latest targets of the analysts result in a price opportunity of close to 100%. Another positive aspect is the fact that, in addition to the founder, the management is also gradually buying the shares of wallstreet:online AG.

The update is based on our initial report 11/21.