Expansion phase launched

The growth momentum at the leading digital media company for B2B media in the commodities sector continues unabated, with the expansion of the highly scalable media platform underway on both a vertical and horizontal level. Global reporting is to be expanded with more international and multilingual content.

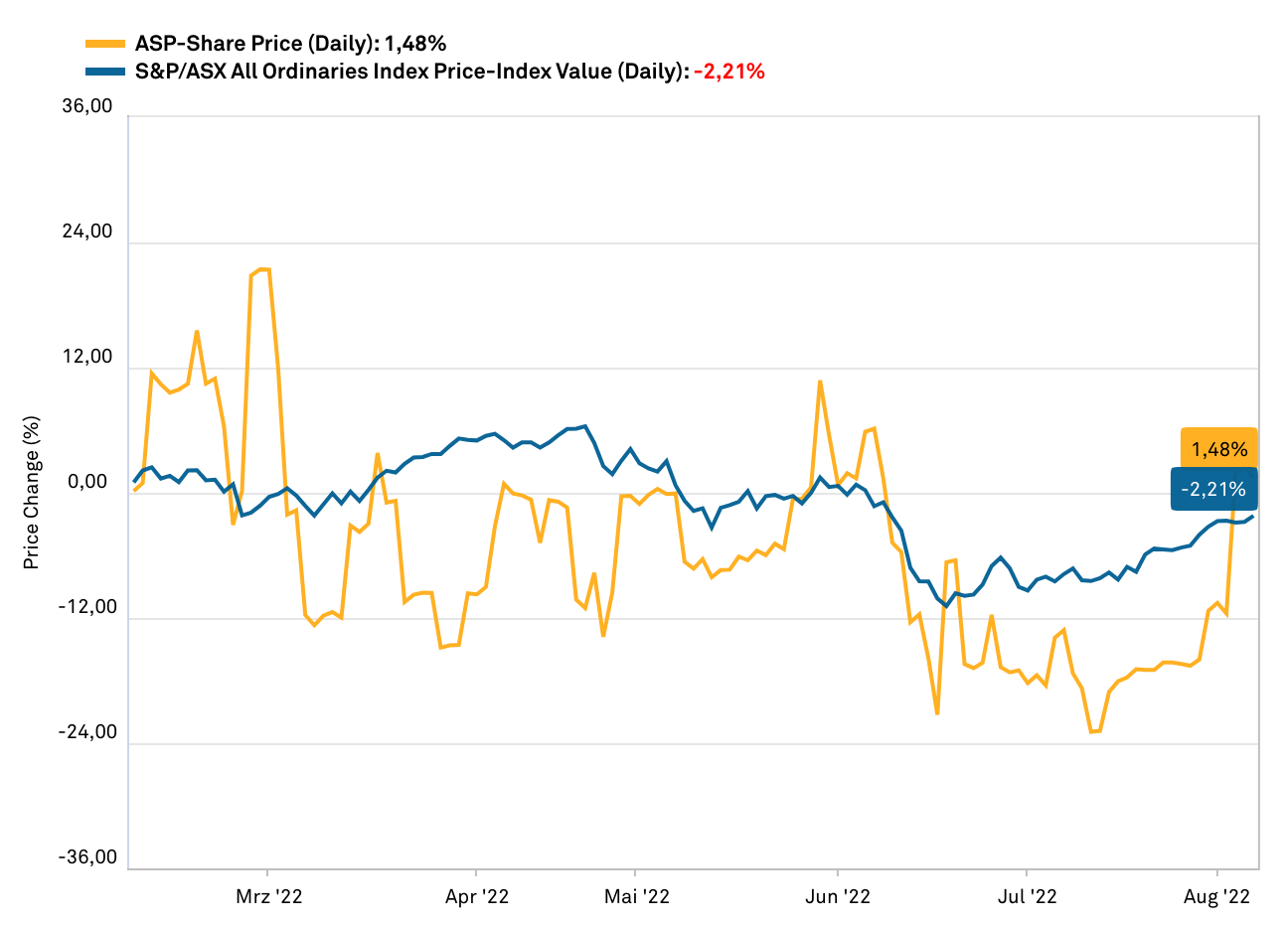

Around AUD 60 billion was the share of secondary issues of the total capital raised on the ASX in 2021.

Currently, Aspermont maintains four offices on different continents in addition to its Perth headquarters in Australia. Around 200 employees already work in offices in London/UK, Belo Horizonte/Brazil, Manila/Philippines and Singapore.

This is expected to result in strong growth in the number of subscribers. Currently, around 8 million contacts of executives from key industries are registered in Aspermont's database. In addition to geographic expansion, the modular "Horizon" platform is also to be extended to other industries. Before the end of this year, CEO Alex Kent plans to present the "Vision 2025", which includes the roll-out to all continents. We have already described the detailed structure of the business model in the initial Report 01/2022 .

Milestone reached

The goal of the Company's leader is clearly to leverage the value of the customer and drive monetization of the bulging database. By forming a joint venture with established and high profile partners International Pacific Capital (IPC) and Spark Plus, an association has been formed that is unique due to its decade-long network and is likely to enjoy a unique selling point within the commodities and financial markets on the Australian Stock Exchange (ASX). Aspermont, which holds the lion's share of the startup at 44%, has around 100,000 international qualified investors, of which 30,000 are Australian, in addition to around 8 million potential customers. IPC is a renowned Australian financial firm that specializes in working with high net worth clients. Spark Plus, a Singapore-based firm, in turn has a large hedge fund user base and specializes in roadshows for Asian companies.

Blu Horseshoe loves fintech

The conglomerate has now given rise to the digital financing platform "Blu Horseshoe", which aims to provide qualified clients access to the lucrative secondary issuance market on the ASX. The Australian Securities Exchange (ASX) is one of the ten largest stock exchanges in the world, with over 2,200 companies already listed and an average of over 120 new IPOs each year. There is also a strong link to the German market. Around one third, exactly 744 of the companies listed on the ASX, have a secondary listing on the Frankfurt Stock Exchange.

Yet the market for "secondaries" in particular is gigantic. While the volume on the ASX for initial public offerings (IPOs) is just about AUD 10 billion per year, AUD 60 million were placed in post-IPOs in 2021, corresponding to 76% of the total capital raised. 1

About one-third of ASX-listed companies are also second-listed in Frankfurt.

This is also the addressable market that Blu Horseshoe is targeting for its clients. The reason for this strategy is that, unlike IPOs, the secondary issuance market is often closed off to most qualified investors, and the broader investment community is usually completely left out of this form of financing. These offerings are to be made more transparent through the Blu Horseshoe platform, giving every client access to current deals. Closer information is callable here. The registration is free.

Clear unique selling proposition

Within Australia, two other competitors are already taking care of the secondary markets. In addition, there are smaller boutiques working on some ASX-listed placements and IPOs. However, an absolutely unique selling point and a distinct competitive advantage for Blu Horseshoe is the composition of the joint venture with partners Aspermont, IPC and Spark, who have a unique network as described above. It opens doors that tend to remain closed to competitors. The data since the launch in June shows that this network works above average. So far, 67 transactions could be made possible for qualified investors, corresponding to two trades per day at the current status.

High valuations in the peer group

Comparable on international terrain is the London-based placing platform PimaryBid. It, too, makes it easier for investors to invest in follow-on financings alongside IPOs. According to Sky News, the startup recently raised around USD 190 million on a post valuation of a whopping USD 690 million in a Series C financing. 2 In the process, global private equity giant SoftBank led the round. According to the report, existing shareholders were also on board. In earlier phases, well-known addresses such as the London Stock Exchange Group, Draper Esprit, OMERS Ventures, Fidelity International Strategic Ventures and ABN AMRO Ventures had joined. Of course, Blu Horseshoe and PrimaryBid are at different stages, but the potential is clearly demonstrated in these digital scaling monsters.

Interim bottom line

Growth continues unabated at debt-free Aspermont. In addition to existing divisions, the re-opening of live events after the Corona pandemic should still reveal significant special revenues in the upcoming third quarter numbers in early September. The Australians also celebrated their entry into the lucrative fintech business and another milestone in the Company's history with the launch of placing the platform Blu Horseshoe. Due to the modular and highly scalable platform, further projects such as "Resource Stocks" or the "Content" work platform are also expected to be launched in the near future, which could once again increase both the number and value of the customer. Aspermont currently has a market capitalization of just USD 36.97 million. Given the growing business, it would not be surprising to see CEO Alex Kent raise forecasts for fiscal 2022 and 2023.

Update follows our Report 01/2022.