Clearly visible upgrade

One thing in advance, the efforts of the last months have clearly paid off. The vision of Smartbroker Holding CEO André Kolbinger to create the "most attractive online broker in Germany " is clearly shown in the first teaser, which can be viewed at www.smartbrokerplus.de. Here the integration of fundamentally new functions is to be recognized, which were optimized after newest customer requirements. The focus here is clearly on the customer.

That here the 25-j?hrige experience of the Smartbroker group, with its four range-strong stock exchange portals wallstreet-online.de, boersenNews.de, FinanzNachrichten.de and ARIVA.de flowed in, is clearly evident. Thus, the latest trends, news and signals from the various forums flow into the Community tab at Smartbroker+. "State of the art" are also the revised dashboard as well as watch lists and financial overviews. In addition, a newly developed onboarding process makes opening a securities account much easier and faster.

Go Live is imminent

In a few weeks, according to the company management, the start of the early access phase will take place, where both the APPs for Android and iOS, as well as the modern frontend for the desktop application can be tested. The first phase starts with all German trading venues. After that, the proven smartbroker offering is to be integrated bit by bit. The transfer of securities portfolios is then scheduled to take place in October. Speaking of the product range: With the establishment of a smartphone app, a state-of-the-art desktop application and the offerings of a classic broker, Smartbroker Holding AG clearly demonstrates its unique selling proposition. Thus, the discrepancy in the company valuation to the peer group such as Scalable Capital or Trade Republic should be questioned once again.

Annual figures without surprise

In parallel to the latest development of Smartbroker+, the group delivered the audited figures for the full year 2022, which, however, did not contain any further surprises compared to the preliminary figures. Thus, revenues according to HGB were EUR 52.8 million, compared to EUR 56.8 million in the previous year. The transaction business, of which the smart broker is by far the largest source of revenue, contributed just under EUR 19 million to Group revenue. The four stock exchange portals generated revenues of around EUR 34 million in the media sector, with an EBITDA margin of 43%, amounting to approximately EUR 15 million. Overall, EBITDA before customer acquisition costs amounted to EUR 12.8 million.

For the current year 2023, Smartbroker Holding AG expects revenues of between EUR 51 and 56 million. After customer acquisition costs, EBITDA is expected to be between EUR 1 million and EUR 4 million. As CEO Kolbinger mentioned in earlier discussions, 2023 is a "further, final bridge year ". From 2024 onwards, the smartbroker+ is then expected to contribute to full-year revenue growth, and for the first time also strengthen the Group's profitability.

Annoying "Payment for Order Flow" Ban

A rather vexing issue for online brokers at the moment is the EU's ban on "Payment for Order Flow" (PFOF) from 2026. While classic neobrokers feel threatened for their business model, smart brokers are likely to be affected only to a minor extent, according to analysis firm Montega. The PFOF revenue share currently amounts to around 10 to max. 15% of group revenue. The lion's share of this is accounted for by derivatives partners, while refunds from stock exchange operators are of very little commercial significance for smart brokers. The Hamburg-based analysts continue to recommend Smartbroker Holding as a buy with a target price of EUR 14 over the next 12 months.

Interim conclusion

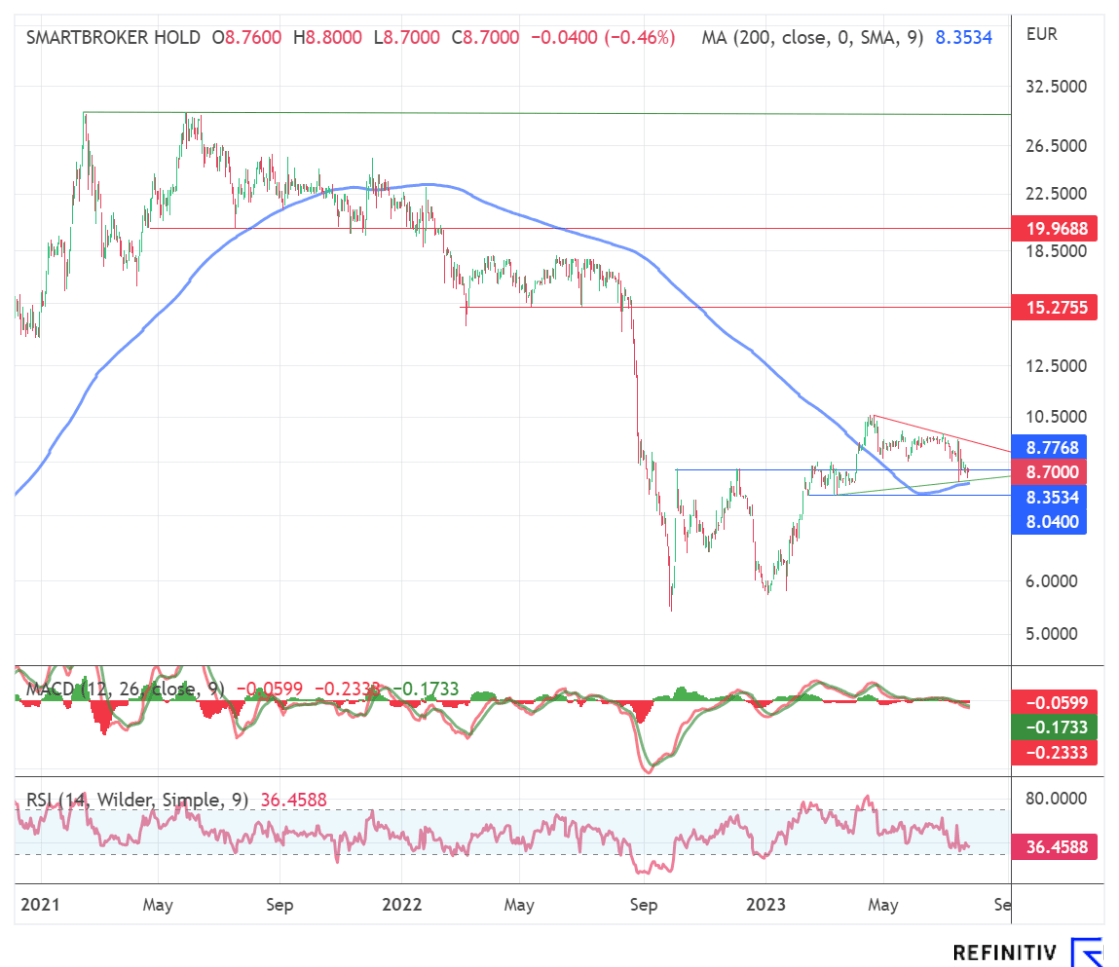

The launch of the latest generation broker, Smartbroker+, has been successful after the publication of first teasers and shows on the one hand the user-friendliness and on the other hand the integration of many community modules, which in our view should attract a new, younger target group. In addition, with the launch of the smartphone app, Smartbroker Holding AG has the same tools as a conventional neobroker, but paired with the product offering of a full-service broker. As another unique selling point, which in our view should give a bonus to the valuation, is the connected financial community with over 850,000 users. The market capitalization of Smartbroker Holding AG currently stands at EUR 142.39 million. At the latest after the final launch of Smartbroker+, the share could free itself from its consolidation phase.

The update is based on the initial report 11/2021