Wicheeda as a marketing weapon

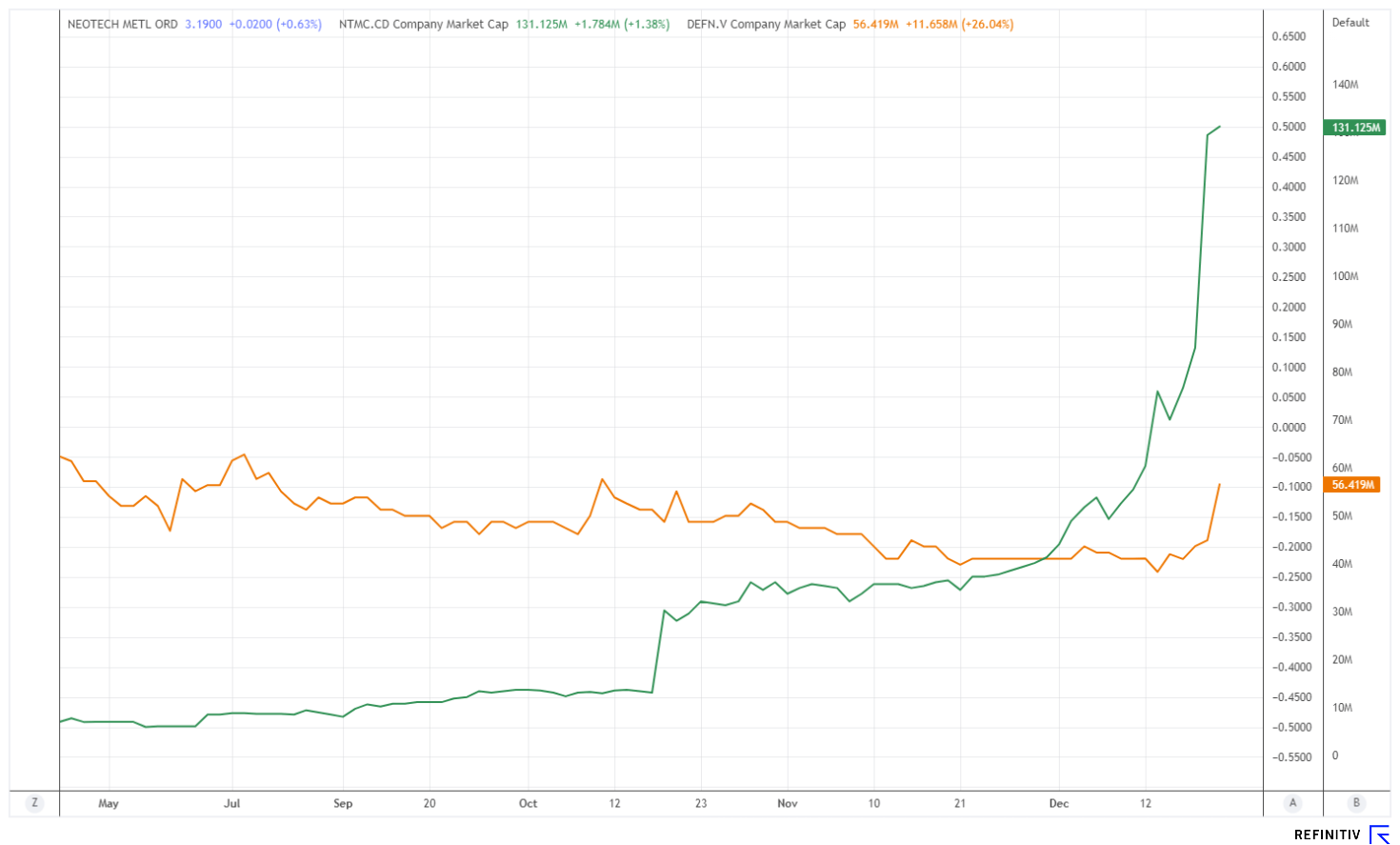

when it comes to commodity shares. However, with the German listing of the exploration company Neotech Metals in mid-November, this is expected to change rapidly. Since then, the Company, which focuses on the development of rare earth metal projects, has gained up to 515% at its peak. The market capitalization exploded to CAD 131.25 million. The Company advertises 40 rare earth claims on its Homepage, which are located close to Defence Metals' flagship Wicheeda project, which aims to produce around 10% of the global supply of rare earth metals by 2027. The absurdity lies in the fact that Neotech Metals has a valuation in excess of CAD 130 million, while the market value of Defense Metals with the advanced project and the potential due to the excellent metallurgy is only CAD 56.42 million.

Unmistakable similarities to the Mountain Pass mine

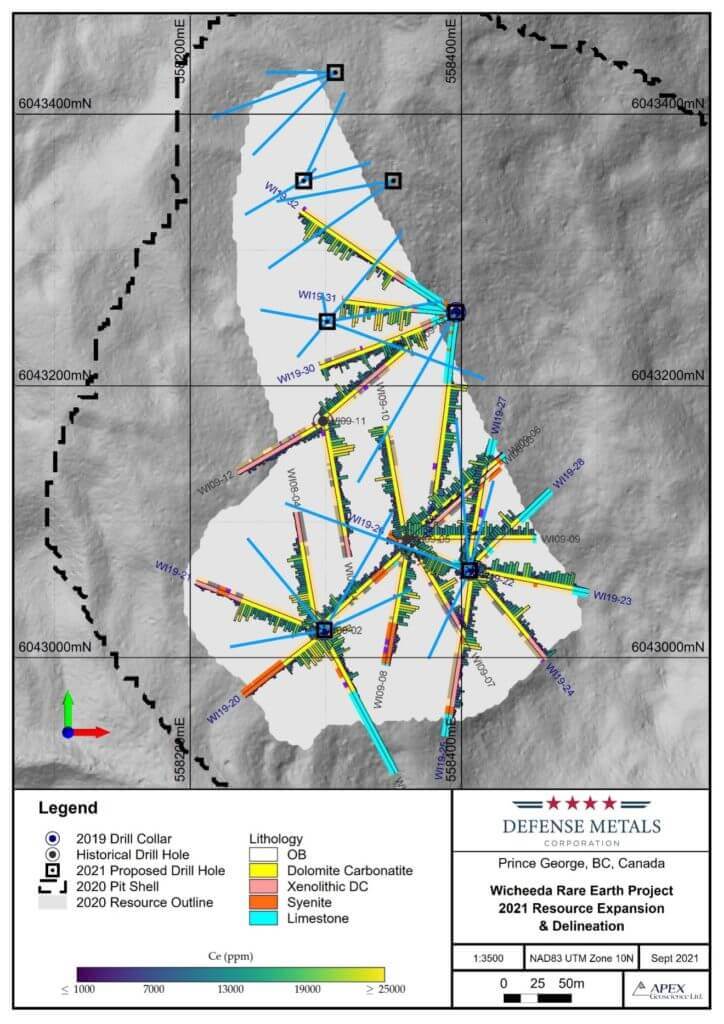

The chances of Wicheeda developing into the second highly profitable production site for critical metals in North America, alongside the Mountain Pass mine in Nevada, USA, are excellent. The 100% company-owned property of Defense Metals consists of 12 mineral claims covering an area of 6,759 hectares, approximately 80 km northeast of the city of Prince George in British Columbia. The infrastructure is first-class. The property is close to infrastructure, including hydroelectric power lines and gas pipelines. The nearby Canadian National Railway and major highways provide easy access to port facilities in Prince Rupert, the closest major North American port to Asia.

In terms of economic metallurgy, Wicheeda is similar to the Mountain Pass mine, whose operator MP Materials, is listed on the Nasdaq with a market capitalization of USD 3.23 billion. Both projects have discovered coarse crystalline bastnäsite and parisite, which can be easily exposed and are considered favoured rare earth metals.

Increase in mineral resource estimate

After the mineral resource estimate was increased in the third quarter, the NI 43-101 technical report was filed at the end of October. The Measured Mineral Resource was 6.4 million tonnes with an average rare earth oxide (TREO) grade of 2.86%. The Indicated Mineral Resource is 27.8 million tonnes with an average TREO grade of 1.84%, while the Inferred Mineral Resource is 11.1 million tonnes with an average TREO grade of 1.02%. Overall, the combined Measured and Indicated Mineral Resources total 34.2 million tonnes at an average TREO grade of 2.02%. This exceeds the previous estimate by 17% in TREO grade and 31% in tonnage ratio. The increases are based on additional well data for 2021 and 2022 and an updated geological model.

There were further positive surprises with regard to the flotation tests, which showed recovery rates of over 80% for a concentrate with 45% TREO at low energy consumption. The rare earth oxides and carbonates produced from the pilot plant were then sent to global customers for testing. Defense Metals' next major goal is to complete the pre-feasibility study in the first six months of next year.

Interim conclusion

The demand for rare earth metals produced ex-China continues to increase due to the trade war between China and the US and the escalating geopolitical tensions. Apart from a few mines in Australia and the US, there are currently hardly any alternatives in the Western world to reduce dependence on the Asian economic power. Defence Metals' Wicheeda project could create a new player that will produce around 10% of current global output in the future. With a market capitalization of around CAD 56 million, the Company is significantly undervalued compared to projects with less substance and a far less advanced stage of development.

The update is based on the initial report 03/2022