The vitamins of the metals

At first glance, the name "rare earths" is misleading because the metals are similarly abundant in the earth's crust as copper or lead. However, rare earth metals generally occur in low concentrations and are usually mixed together, making them not only technically difficult to separate but also costly, considering the environmental impact. Rare Earth Elements (REE) are 17 elements of the periodic table, including the 15 lanthanides as well as scandium and yttrium. A basic distinction is made between light and heavy rare earth elements. On average, the four light rare earths cerium, lanthanum, neodymium and praseodymium account for more than 95% of rare earth occurrences. The share for the 13 heavy rare earths dysprosium, erbium, europium, gadolinium, holmium, lutetium, promethium, samarium, scandium, terbium, thulium, ytterbium and yttrium is less than 5%.

Rising demand

In the wake of technological developments in recent decades, rare earth metals can be found in almost every aspect of life. The list of products in which these elements are used is almost endless, including smartphones, computer hard drives, MRI devices, catalytic converters, alloys, permanent magnets and batteries. The so-called technological spice metal received an additional boost in demand due to the proclaimed climate targets. In addition to raw materials such as lithium, cobalt or nickel, rare earths are essential, without which neither an electric car nor a wind turbine would function. In a study 1 , the International Energy Agency (IEA) calculated how strongly the demand for these minerals and metals will increase in the near future if the world pushes ahead more strongly with the energy transition in order to achieve its climate protection goals from the Paris Agreement. An electric car, for example, requires 6 times as many minerals as a combustion engine, and an offshore wind turbine even 13 times more than a gas-fired power plant with the same output. If the climate targets are to be achieved by 2040, at least 4 times as many minerals will be needed as today; if climate neutrality is declared by 2050, 6 times as many would be needed.

Fuel for the energy transition

Neodymium is of the greatest importance for the energy turnaround for strong permanent magnets in electric motors and wind turbines. Permanent magnets are the largest end-user market for rare earth metals, with a market share of 30%, followed by catalysts with 26% and polishing agents with 13%. Rare earth permanent magnets are made from alloys of rare earths (Nd, Pr, Dy, Tb) as well as iron and boron.

Up to 4kg of the metal alone can be found in a conventional electric car, and for a more efficient generator of a wind turbine about 217.52 kg per MW of dysprosium, neodymium and terbium are produced.

more minerals are needed to build an electric car compared to a combustion engine.

The strong expansion of renewable energies and the transformation of the transport sector are already causing excess demand. The number of electric vehicles for passenger transport has increased from 450,000 units in 2015 to almost 3.2 million in 2020. Global electric vehicle penetration is expected to increase to 34 million units by 2030.2 The use of neodymium-iron-boron magnets in electric vehicles and wind turbines is expected to be the largest growth application for NdPr demand, resulting in a supply gap of 22kt by 2025 and 51kt by 2030. Tight supply and rising demand are reflected in the price trend of neodymium oxide. While a kilogram still cost around EUR 55 in March 2020, a historic high of over EUR 244 per kg was reached in March 2022.

Strategically important for the defense industry

In addition to the renewable energy sector, the needs of the defense industry are also steadily increasing. Neodymium-iron-boron magnets are considered the strongest permanent magnets in the world. They are contained in many military weapons systems, such as precision-guided weapons, satellite and stealth technologies, unmanned vehicles, and modern communications systems. They are strategically important to the functionality of modern and increasingly networked armed forces, which is why a growing number of countries view securing access to these elements as essential to future economic and military stability. At a time of growing geopolitical tensions, NATO countries are seeking to limit the enormous dependence on a single supplier.

China controls the market

The nervousness of Western countries is understandable; the Middle Kingdom has a virtual monopoly on the rare earth metals value chain. Until 2010, China was the almost sole producer of rare earth oxide equivalents, with 92%. Since then, this share has shrunk to below 60%, as other countries such as Australia, the USA, Myanmar and Vietnam have resumed production. However, there can be no talk of easing here, as China dominates not only mining but also downstream processing. This consists of three areas: Mining and processing to produce a rare earth concentrate (global share 87%), smelting and separation to produce rare earth oxides (91%) and refining to produce rare earth metals and alloys (94%). 3 Thus, the Middle Kingdom controls the entire value chain up to the production of components such as permanent magnets or, increasingly, end products such as batteries or computers. As shown in the table, the United States produced 38,000t of rare earth oxide at the Mountain Pass mine in 2020, representing 15% of global production. However, this has so far been sent to China for processing, as there are no separation facilities in the United States to date.

| Production (in t REO) | Country | Ore Conc | Mixed Chemical Conc | Separate Oxides |

|---|---|---|---|---|

| 140.000 | China | China | China | China |

| 38.000 | United States | United States | China | China |

| 30.000 | Myanmar | Myanmar | Myanmar, China | China |

| 25.000 | Wicheeda | in Projektion | ||

| 17.000 | Australia | Australia | Malaysia | China |

| 3.000 | India | India | India | India |

| 4.000 | Madagascar | Madagascar | China | China |

| 2.700 | Russia | Russia | Estonia | Estonia |

The West must act

In addition to ample tax revenue from a skyrocketing price of neodymium praseodymium (NdPr) oxide, Beijing is also gaining greater influence at the negotiating table and can use the critical raw material as leverage. The trade war, which has been escalating for years, has already prompted the Trump administration to counter China's dominance in the sector by seeking alternative sources ex-China for rare earths. In addition, more refining capacity is to be built. Back in 2017, rare earth metals, along with a number of other minerals, were declared "critical minerals" and enshrined in a regulation:

of the global share in smelting and separating to produce rare earth oxides is in the hands of China.

"The United States is dependent on foreign sources for critical materials. This import dependence is a problem when it puts supply chains, US companies, and material users at risk. Many foreign sources of critical materials are concentrated in just one or two countries. The nation's dependence on foreign sources of critical materials creates a strategic vulnerability for both our economy and our military in the face of adverse foreign government actions, natural disasters, and other events that could disrupt supplies."4

The European Commission considers rare earths to be one of the most resource-critical commodities. They are of the highest economic importance and at the same time have a high supply risk. They play a critical role in European industry, in both traditional and emerging applications, including aerospace and defense. This realization has led to a significant push to develop alternative sources of mined and processed REE supply outside of China.

Advancing mining projects in North America

Production sites in the Western world are few and far between. Besides the Australian mines of Lynas and Iluka Resources, there has been only one rare earth mine in the US in the recent past. The mine in Mountain Pass, California, owned by publicly traded MP Materials, produced 15% of the world's output in 2020, according to the US Geological Survey, making it the second-largest global production source next to the Bayan Obo mine, a mine in the Inner Mongolia Autonomous Region of the People's Republic of China. In late 2020, the Pentagon announced it would provide $9.6 million in support to MP Materials to add processing and separation capacity to the Mountain Pass operation.

According to management, the NASDAQ-listed company, which has a market capitalization of $6.95 billion is expected to resume refining separated rare earth oxides in 2022 to restore the entire magnet manufacturing supply chain in the United States. A light rare earth element processing plant is also to be built in Hondo, Texas, in cooperation with Australia's Lynas. With investments of more than $220 million and support from the US government, MP Materials is also investing in a new plant in Fort Worth, Texas, which is expected to produce 1,000t of magnets per year, equivalent to a capacity of approximately 500,000 electric motors. 5

The mine for the western world

Everyone should be aware that the Mountain Pass mine is far from sufficient due to the high demand, especially from the renewable energy sector. The construction of additional production facilities in North America is intended to minimize the political and strategic risk of dependence on Chinese REE supplies. The Wicheeda project, which was 100% acquired by publicly traded Defense Metals in early January, shares strong metallurgical similarities with the only profitable mine in the Western Hemisphere to date, the Mountain Pass mine. It has the potential to become one of the most significant global deposits of rare earth metals, according to the Preliminary Economic Assessment (PEA).

Optimal infrastructure

The Wicheeda concession area is 2,008 ha in size, located approximately 80 km northeast of the city of Prince George, a center of mining in Canada, in British Columbia, and is strategically located on a major logging road that connects to Highway 97. In addition to a major hydroelectric transmission line and gas pipeline, the project is located near a line of the Canadian Railroad. Rail and road access is also available to the Port of Prince Rupert approximately 500 km to the west.

First-class management

Another plus point of Defense Metals is the top-notch management team. In addition to CEO Craig Taylor, who drove the project from the exploration stage to the recently completed PEA, Dr. Luisa Moreno, a well-known and respected rare earths analyst, was recruited as President and Director.

net present value after tax was estimated for the Wicheeda project in the preliminary economic assessment.

Moreno is also a board member and director of several green materials and technology companies. With directors William H.Bird, Kristopher J.Raffle, Ryan Cheung, Maximilian Sali and Andrew Burges, the Company also has excellent expertise and decades of experience in leadership positions at publicly traded companies. With the appointment of John Goode, an internationally recognized expert in the processing of rare earth metals, the Supervisory Board has also been qualitatively expanded.

Perfect prerequisites at Metallurgy

The second prerequisite, in addition to the rare earth metal content, for a mine to operate profitably is metallurgy. Economical metallurgy requires that the minerals and the rare earths they contain are chemically and physically such that they can be easily removed by favorable processing techniques. For example, bastnäsite and monazite are considered to be the most favorable to process. In addition, these rare earth minerals must be present in the rock as coarse, well-crystallized grains. When the Mountain Pass mine was discovered in 1950, coarse crystalline bastnäsite and parisite were discovered and were easily exposed, thus becoming the preferred rare earth metal. The Wicheeda deposit also has the same coarse crystalline metals that can be processed inexpensively using conventional methods.

Economic evaluation shows potential

At the end of November last year, the preliminary economic assessment (PEA) results for the Wicheeda project were announced, showing strong financials and significant production potential. This resulted in an after-tax net present value of CAD 516.5 million using a discount rate of 8%. The PEA assumes an open pit operation with a processing plant throughput of 1.8Mtpa with a stripping ratio of 1.75:1 over a mine life of 19 years and annual REO production of 25,423t.

Positive development

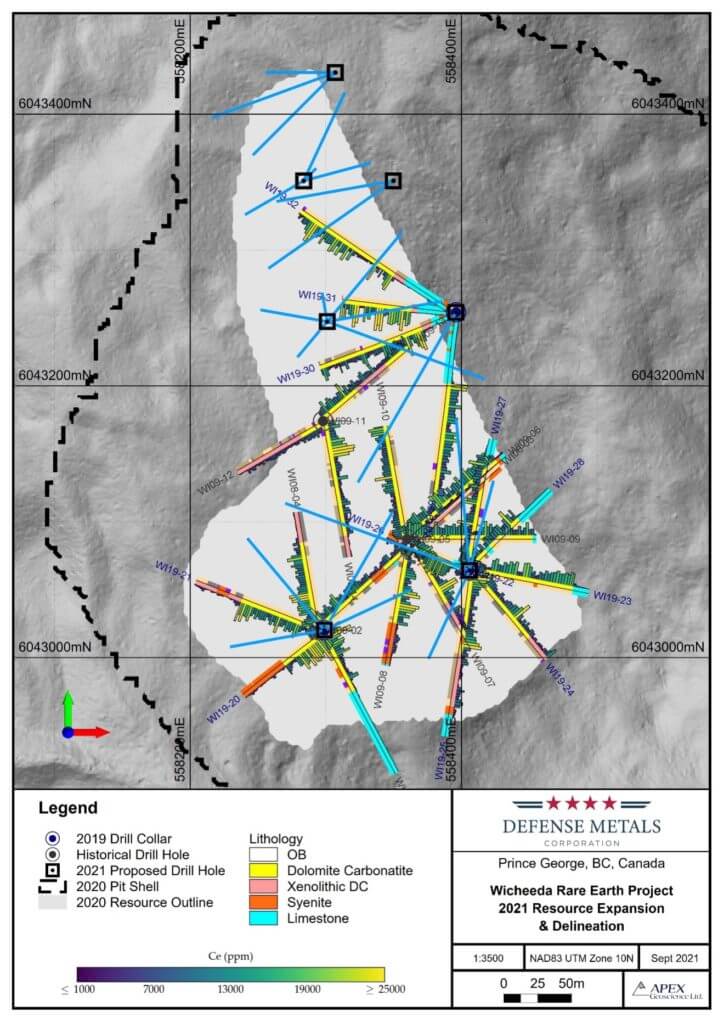

Earlier this year, the Company undertook a 29-hole, 5,349m resource expansion and diamond drilling program at the Wicheeda property in anticipation of the PEA. Positive drill results have been coming in weekly since early February. With the March 2 announcement, all four holes intersected high-grade rare earth mineralization. The best hole intersected 3.17% rare earth oxide over 196m. The highest grade to date was encountered in hole 38 with over 6% rare earth oxide. The latest report again encountered 32.23% rare earth oxides over 162m. These results with the deep drilling expand the mineral resource and extend the potential mine life. Thus, from today's standpoint, the mine would already rise to the top producers in the world.

Project Highlights

- Favorable mineralogy

- First class infrastructure

- Experienced team

- Conventional metallurgy

- Long-term environmental work

- Increasing demand for rare earth metals

- Strategically important raw material

Undiscovered pearl

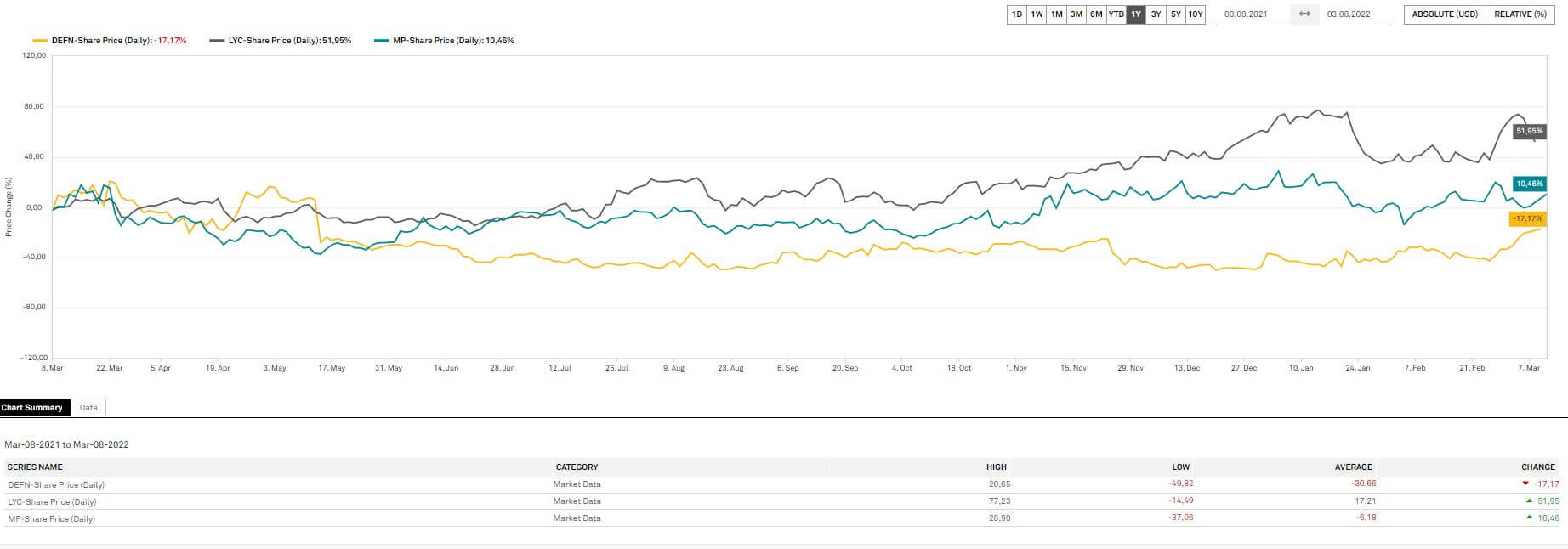

The share price has indeed risen to CAD 0.35, the equivalent of EUR 0.25, in the wake of historically high underlying values in recent days. However, Defense Metals' stock market value of EUR 40.5 million clearly lags behind the peer group. From this point of view, the Canadians should be considered as an attractive takeover candidate by larger companies such as Lynas or MP Materials. In addition, consolidation is currently taking place in the industry. With further positive drilling results and the targets issued by management, Defense Metals should increase in value in the coming months. For example, the pre-feasibility study is expected to be completed by the first quarter of next year at the latest, at which point the Company will be able to proceed with the demonstration plant and feasibility study. In terms of deposit type, grade, saleable concentrate and size, Defense Metals compares well with the Mountain Pass mine already in production. The Wicheeda project is expected to be in production in about five years and, as it stands today, could become one of North America's major producers.