Bulls are forming

With the chart-technically and psychologically significant milestone of USD 30,000 being surpassed, the Bitcoin optimists are back from their hideouts and are outdoing each other with bullish price forecasts. Leading the charge, as always, is the co-founder and long-time CEO of MicroStrategy, Michael Saylor. For him, Bitcoin is the only institutionally investable asset in the crypto sector. On the other hand, the Bitcoin hodler has a negative outlook on the future of altcoins.

Decisive for a bull run of the world's largest cryptocurrency, as Saylor comments in a Bloomberg interview, are the currently ongoing regulatory measures of the SEC against crypto exchanges such as Coinbase and Binance, the upcoming Bitcoin halving in April 2024 and the increased hash rate. He believes that these factors will lead to a substantial increase in the value of Bitcoin, potentially multiplying its worth by hundreds in the coming years.

Somewhat more defensive, but no less optimistic, are the analysts of British Standard Chartered. The bank, which holds around USD 800 billion under management worldwide, sees a price target of USD 120,000 by the end of 2024 for Bitcoin, a potential of 300% at the current price. By the end of the current stock market year, the experts assume a price of around USD 50,000.

Significant catch-up potential

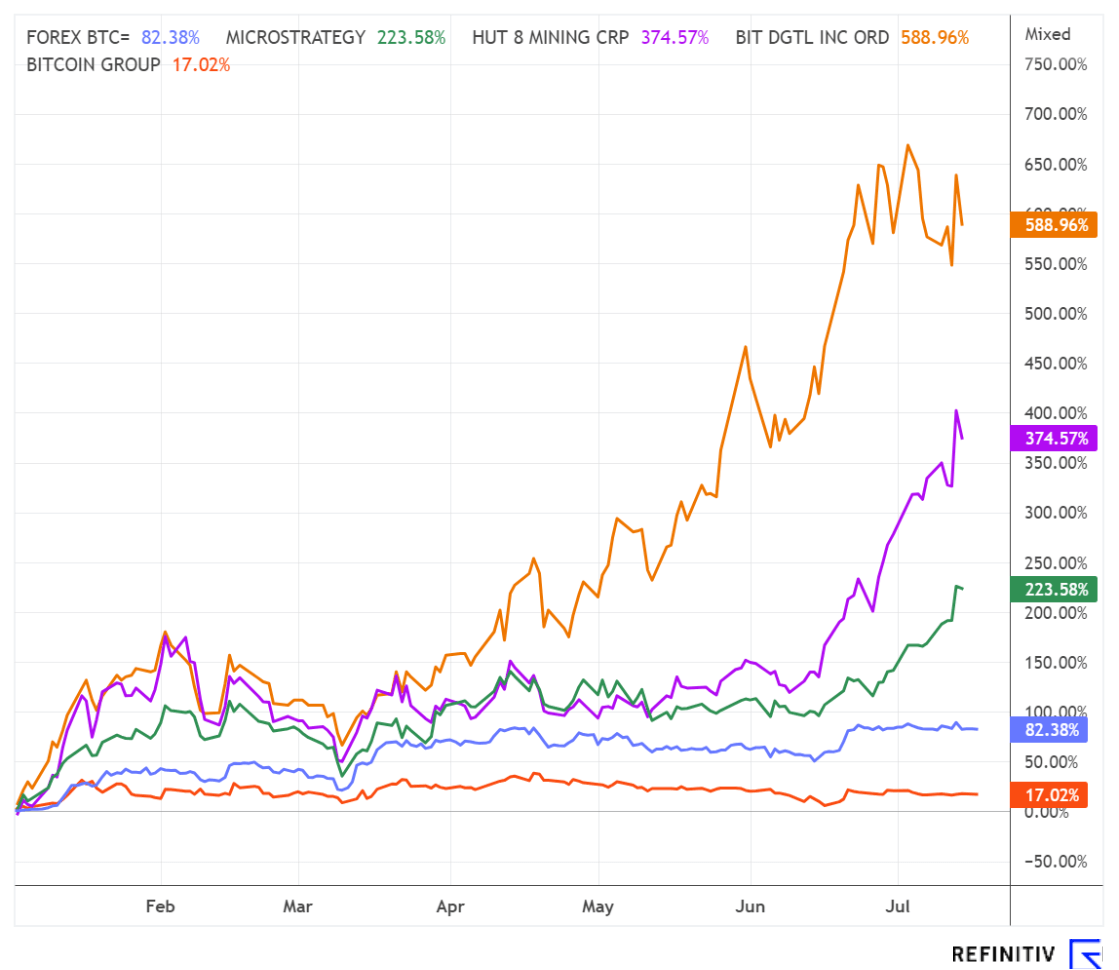

With a share price performance of 17.02% since January 2023, the Herford-based investment holding company, with an investment focus on innovative business concepts and technologies from the areas of cryptocurrencies and blockchain technology, has significant catch-up potential. Especially with regard to the business model as well as the lush Bitcoin and Ethereum holdings, the Company is likely to roll up the field from behind if prices rise sustainably.

With a market capitalization of EUR 110.75 million, Bitcoin Group SE holds 100% of the shares in futurum bank AG, which operates a trading platform for digital currencies such as Bitcoin, Bitcoin Cash, Bitcoin Gold, Ethereum or Dogecoin in addition to classic securities services at www.bitcoin.de. Likewise, it owns 50% of the shares in Sineus Financial Services GmbH, a financial services provider. It should be emphasized here that the "bitcoin.de" platform, which was able to marginally increase its customer base to 1.04 million despite the extremely weak fiscal year 2022, offers the highest possible regulatory security and transparency through BaFin regulation with a securities trading license. Due to the highest security standards, this would set the course for expansion into other European countries in the course of EU-wide, uniform regulation.

Drastic drop in earnings in a horror year

For the operators of crypto exchanges and companies that hold virtual currencies in their own portfolios, the past stock market year was one to forget. Even at the German flagship, revenues and earnings plummeted compared to the successful fiscal year 2021. For example, Bitcoin Group generated revenues of EUR 8.34 million in fiscal year 2022, down from EUR 25.39 million in the previous year. Earnings before interest, taxes, depreciation and amortization plummeted from EUR 19.75 million to EUR 1.37 million. After a profit of EUR 2.67 per share, the net result also slipped clearly into the red with EUR -0.48 per share.

Balance sheet remains healthy

Due to the setbacks, the balance sheet situation of Herford naturally shifted. However, the key figures can still be assessed as stable and offer significant room for improvement in a trend reversal that started at the beginning of the year. The equity ratio on December 31, 2022, improved from 72.99% to a high of 77.23%. Cash and cash equivalents decreased from EUR 20.28 million at the end of 2021 to EUR 14.88 million. Net crypto equity decreased to EUR 70.8 million in fiscal year 2022 from EUR 181.1 million as of December 31, 2021, due to exchange rate losses. The closing rates were EUR 15,496.24 for Bitcoin and EUR 1,114.17 for Ethereum. Non-current assets, which include cryptocurrency holdings, amounted to EUR 76,367,464.61 as of the reporting date. In contrast, current assets were fixed at EUR 18,605,556.03, resulting in a bottom-line balance sheet total of EUR 94,973,020.66 as of December 31, 2022.

Significant appreciation due to increased virtual currencies

Particularly in the case of non-current assets, the balance sheet situation has improved significantly since the beginning of the year. In its most recent publications, the Company only reported the total value of its holdings in euros. Resulting from the unit numbers of own holdings disclosed in the past with a ratio of around 85% in Bitcoin as well as 15% in Ethereum, the balance sheet item would have expanded to EUR 121.2 million with a value of Bitcoin holdings (around EUR 105 million) as well as Ethereum holdings (around EUR 16.2 million) alone. The balance sheet total would amount to around EUR 145.00 million if the remaining items were retained as of December 31, 2022. In comparison, the stock market value of Bitcoin Group SE amounts to EUR 110.75 million.

Crypto platform a gift

The holdings of Bitcoin and Ethereum alone, held by the wholly-owned subsidiary futurum bank AG, far exceed the current market capitalization by a large margin. Thus, invested investors receive the growing platform www.bitcoin.de, with over one million trading customers, for free. Compared to its peer group, Bitcoin Group also has the highest security standards with BaFin regulation. In addition, the holding company intends to continue its continuous dividend policy with a distribution of EUR 0.10. With a sustained rise in cryptocurrencies and a resulting significant increase in trading activity on their platform, the Germans have long-term multiplication potential. This could lead to the competition, which has so far rushed ahead, being outperformed in the next upward push.