A powerful collection of data

Over the past seven years, the Australian B2B expert has successfully transformed the venerable publishing house, with a combined brand history of 560 years, into a next-generation media platform. Today, we see a market leader in digital business-to-business media in the mining, energy, and agriculture sectors. The Company's key asset is a database of 8 million contacts of board members and executives from key international industries. The task now is to develop these valuable components into a powerful company with market leadership.

gross margin at mid-year 2025

Like a spider in its web, Aspermont is in the process of converting its sophisticated network into paying digital customer connections. This can only work through excellent service and unrestricted market access. The added value lies in speed, depth of information, and relevant delivery across many digital channels. The Mediatech company currently serves sectors that employ 22% of the world's population, which corresponds to around one-fifth of global gross domestic product. In just seven years, it has managed to transform itself from a purely membership- and advertising-driven company into a digital platform. Today, advertising revenue accounts for only 28% of total revenue, while membership fees already account for 72%. Significant additions to the business model include events, accounting for 11% of revenue, marketing, accounting for 17%, and data management, accounting for 3%. With more than 3,000 customers, Aspermont generates at least AUD 1,000 in recurring revenue per client. Average revenue per user (ARPU) has grown from AUD 1,046 in 2020 to AUD 2,493 today - clear evidence that the Company's transformation into a modern digital platform is well underway.

From publishing house to digital AI platform: "Mining-IQ"

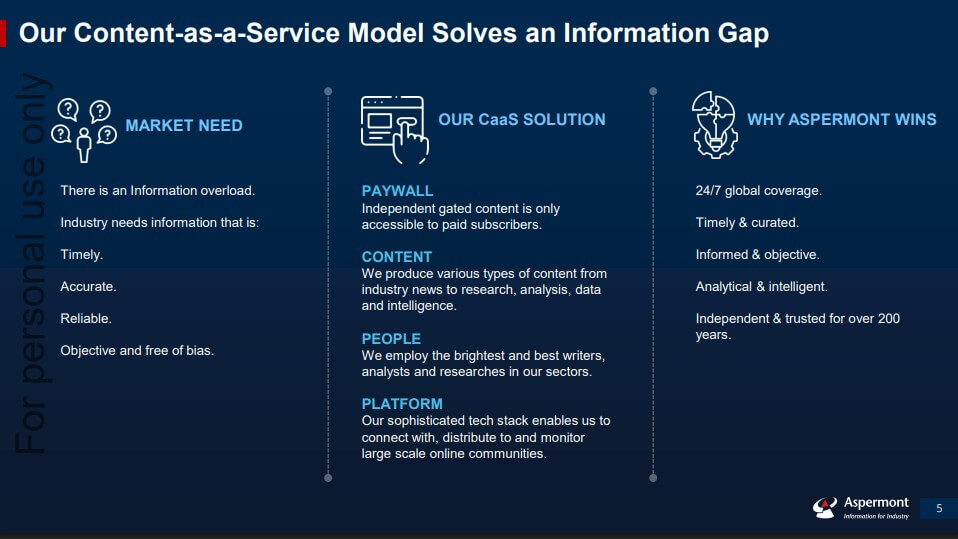

In just seven years, Aspermont has transformed itself from a traditional publisher into a digital B2B media leader. Its platform now reaches millions of users, connects over 8 million industry contacts, and delivers real-time, decision-critical information. The transformation is reflected in the Company's revenues: while advertising used to account for the majority of revenues, today more than half come from memberships, supplemented by events, research, marketing, and data management. The result is a resilient, diversified business model that supports sustainable growth.

With the launch of the Mining-IQ.com platform, Aspermont is opening the next chapter in its development. Mining-IQ bundles global data sets to enable in-depth analysis of project pipelines, ESG performance and investor sentiment - transforming the Australian company into a data intelligence provider for the commodities and mining sector. The new Mining-IQ platform brings together all of the Company's global data sets and offers a range of advanced analytics products specifically for the commodities and mining industry. It enables the assessment of mining risks, tracks project pipelines, and provides detailed insights into ESG performance, investor sentiment, and management trends. With integrated modules such as World Risk Analytics, Project Pipeline Index, and ESG Mining Company Index, users can compare and filter risks and opportunities for mining projects worldwide based on data and analyze them across various development criteria.

A groundbreaking partnership with Rio Tinto

Thanks to new AI partnerships, such as with Rio Tinto, historical archives are being digitized and made available as a searchable, company-specific database, with exclusive access rights for partners in the introductory phase. The platform operates on a subscription basis and provides interactive dashboards, benchmarks, and customizable reports for decision-makers and investors. The agreement with Rio Tinto includes over 200 years of archive material from the Mining Journal and Mining Magazine. The content will be digitized and integrated into an AI platform. The project is not only of strategic importance, but also has an economic value of AUD 550,000, which Rio Tinto is contributing to. Rio Tinto will have exclusive access for six months, after which the platform will be opened to the market as a subscription model.

A quantum leap in information for new premium users

For all authorized users, the generated archive data offers unique historical insights that are not otherwise available on the market. Users benefit from machine-readable, in-depth information on project development, technology, safety, and management trends in the raw materials industry. This provides decision-makers and analysts with well-founded data- and risk-based benchmarks that measurably improve operational processes, strategic planning, and investment decisions. This exclusivity offers competitive advantages in an industry characterized by volatility and new technologies, for example, with leading indicators on price developments and supply chain risks. While other market participants only gain access later, subscribers can help shape innovation and data transformation and gain a head start in developing new business opportunities.

Strong financing for the expected growth spurt

To finance its growth, Aspermont recently raised AUD 1.75 million from European institutional investors at AUD 0.007, well above the market price. This is supplemented by a share purchase plan for existing shareholders on the same terms. Subscription amounts range from AUD 2,000 to AUD 30,000 per investor, with a total of up to AUD 1.25 million to be raised. The offer period runs from September 1 to 15, 2025, with allocation and trading of the new shares commencing on September 18 and 19, 2025, respectively. All relevant terms and conditions are set out in the offer prospectus dated August 29, 2025, subject to changes in the schedule. The funds will be used to scale Mining-IQ, further AI-powered data projects, and strengthen the balance sheet.

CEO Alex Kent summarizes: "Mining-IQ and our AI partnership mark the beginning of a new era for Aspermont. We are evolving from a media and research company to a global provider of data intelligence solutions for the commodities industry."

Conclusion: New strategy implies valuation jump

In the wake of deglobalization, the importance of robust, reliable networks is coming into focus. This is particularly true for industries that rely on sensitive supply chains. The dependence of Western economies on commodity-heavy monopolies in Asia is thus gradually losing importance. With its platforms in the core sectors of mining, energy, and agriculture, Aspermont has established itself as an indispensable partner and successfully repositioned itself in a complex geopolitical situation. With its combination of traditional media expertise, unique archive material, strong capital base, and strategic partnerships, the Company is on the threshold of a dramatic revaluation.

Given the favourable outlook in the resurging commodities market since late 2024, we believe this will lead to a complete revaluation in the coming months. With a price-to-sales ratio of 2.2, organic revenue growth (CAGR) of 11% and gross margins exceeding 60%, the stock appears very favorable compared to its peer group. For those looking to capitalize on the megatrend of "data intelligence in the commodities sector", this is a highly compelling opportunity.

This update follows on from the initial report 01/2022.