Completion of PEA lays foundation for significant upside

Desert Gold Ventures (WKN: A14X09 | ISIN: CA25039N4084 | Ticker symbol: QXR2 | TSX-V: DAU) has released the results of its first Preliminary Economic Assessment (PEA) for the Barani and Gourbassi deposits in western Mali. The analysis envisages a low-cost open pit operation with a production rate of around 220,000 tonnes per annum (18,500 tonnes per month) and a mine life of over 17 years. A total of 113,500 ounces of gold are contained, of which approximately 97,600 ounces can be recovered using a simple process (gravity and CIL) with an average recovery rate of 86%. Assuming a gold price of USD 2,500 per ounce, the net present value of these actions after taxes is USD 24 million, the internal rate of return (IRR) is 34% and the payback period is a low 3.25 years. If the gold price rises to current levels of USD 3,366, the NPV increases to USD 54 million, the IRR to 64% and the payback period decreases to 2.5 years. The potential is even greater when you consider that the initial calculation only covered less then 10% of the land area owned. These are excellent parameters for a small exploration operation. Mining will begin in Barani East, where a mobile processing plant will be installed and later relocated to Gourbassi.

Here is an overview of the highlights of the PEA:

- Net present value of USD 24 million after tax and internal rate of return (IRR) after tax of 34% based on a gold price of USD 2,500/ounce, USD 54 million at the current gold price of USD 3,366.

- Financing requirement of USD 16 million with initial investments of USD 15 million and ongoing investments of USD 9 million over the 17-year mine life.

- All-in Sustaining Cost ("AISC") of USD 1,352 per ounce.

- Projected average gold production of 460 ounces/month or 5,500 ounces/year.

- Payback period after taxes of 3.25 years at a base price of USD 2,500/oz gold.

- Cumulative cash flow of USD 71 million after taxes over 17 years based on base assumptions.

- Total recoverable gold production of 97,600 ounces.

- Average strip ratio for the entire operation is estimated at 2.47:1.

Management sees even more potential

CEO Jared Scharf comments on the analysis: "*We are very pleased to present such a strong mine plan. With less than 10% of the SMSZ project's gold resources included in this study, there is tremendous potential to improve the project's economics and significantly expand operations over time. We have deliberately designed a mining solution that is both modular and flexible from a processing standpoint, providing us with maximum operational flexibility going forward. The focus will remain on exploration of the SMSZ project, particularly gold zones and prospect areas near the initial mining sites at Barani and Gourbassi. In addition, the Barani East small-scale mine license allows for ore processing of up to 36 kilotons per month. This means that we can double production from the current PEA plan of 18 kilotons per month. *Given the numerous brownfield exploration targets in close proximity to the initial Barani open pit, management believes that this operation has a high probability of being significantly expanded over time."**

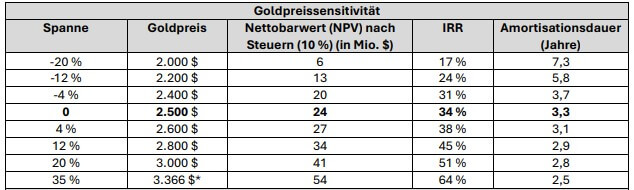

Strong leverage to the gold price

The SMSZ project has strong leverage to the gold price, as demonstrated by the sensitivity analysis in the table below. In the base case scenario of $2,500 per ounce, the project has an after-tax NPV (10%) of $24 million and an after-tax IRR of 34%. At a higher gold price of $3,000 per ounce, the after-tax NPV increases to $41 million with an IRR of 51%. If prices above the USD 3,300 mark per ounce of gold are actually realized on sale, an NPV of USD 54 million could even be achieved. The positive and negative leverage effects are illustrated in the following table. These sensitivities are for illustrative purposes only and assume that all other parameters remain constant.

Mineral resource estimate holds further upside potential

The current Preliminary Economic Assessment (PEA) for Desert Gold's SMSZ project focuses exclusively on oxide and transition mineralization within optimized open pit pits at the Barani East, Barani Gap, Gourbassi West, and Gourbassi West North deposits. These four zones collectively contribute approximately 113,500 ounces of gold to the mine plan (after deducting mining modification factors), at an average grade of 0.95 g/t Au and a projected gold recovery rate of 86% through conventional CIL processing, representing approximately 97,600 ounces of recoverable gold. Notably, the study does not include some of the smaller pits identified during the PEA that may offer additional potential in future technical work. In addition, the current cut-off grade for reporting the Mineral Resource Estimate (MRE) is 0.2 g/t Au.

Total measured and indicated (M&I) resources now total 11.12 million tonnes grading 0.94 g/t Au for 336,800 ounces, while inferred resources total 27.16 million tonnes grading 1.01 g/t Au for 879,900 ounces. Key exploration targets such as Mogoyafara South, Linnguekoto West, and the Keniegoulou area were not included in the current PEA. However, they collectively host significant inferred resources and represent clear upside potential for future expansion.

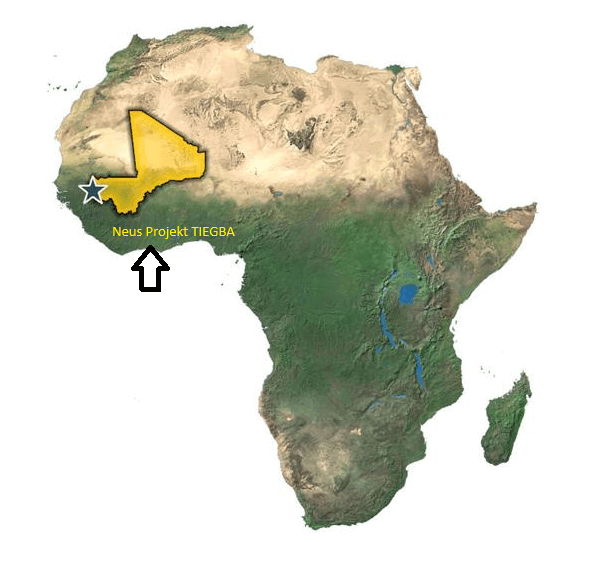

Recently announced: Option to acquire the Tiegba Gold Project

The news for Canadian gold explorer Desert Gold (WKN: A14X09 | ISIN: CA25039N4084 | Ticker: QXR2 | TSX-V: DAU) could hardly be more positive. With the recent signing of an option agreement to acquire 90% of the Tiegba Gold project in Côte d'Ivoire, the Company is taking an important step towards expanding its portfolio and diversifying its regional presence in West Africa. Tiegba covers an area of 297 square kilometers in one of the most investor-friendly and politically stable regions of West Africa – an area with excellent infrastructure and a rapidly growing mining environment. The project is located in the Birimian greenstone belt, one of Africa's most prolific gold-bearing regions, with historical soil data from Newcrest Mining indicating a 4.2-kilometer gold-in-soil anomaly. Values of over 900 ppb gold have been measured in some areas, which is well above the regional average. This strategic expansion opens up new growth potential in one of Africa's most exciting gold markets, which is attracting attention due to increasing political stability, favorable tax conditions, and low operating costs.

GBC analysts to reassess Mali and Ivory Coast Assets

The Company is in advanced discussions with potential partners to secure financing for the start of construction in Barani East as soon as possible. With the current mineral resource estimate, figures for the SMSZ area in Mali are becoming increasingly concrete, and initial production is now within reach. Given this, GBC Research analysts are set to conduct a reassessment. It is anticipated that the current market valuation of approximately CAD 20 million, including all present values from future production and the new properties in Côte d'Ivoire, will be significantly upgraded. All studies agree that there is still considerable valuation potential due to the strong momentum of gold prices.

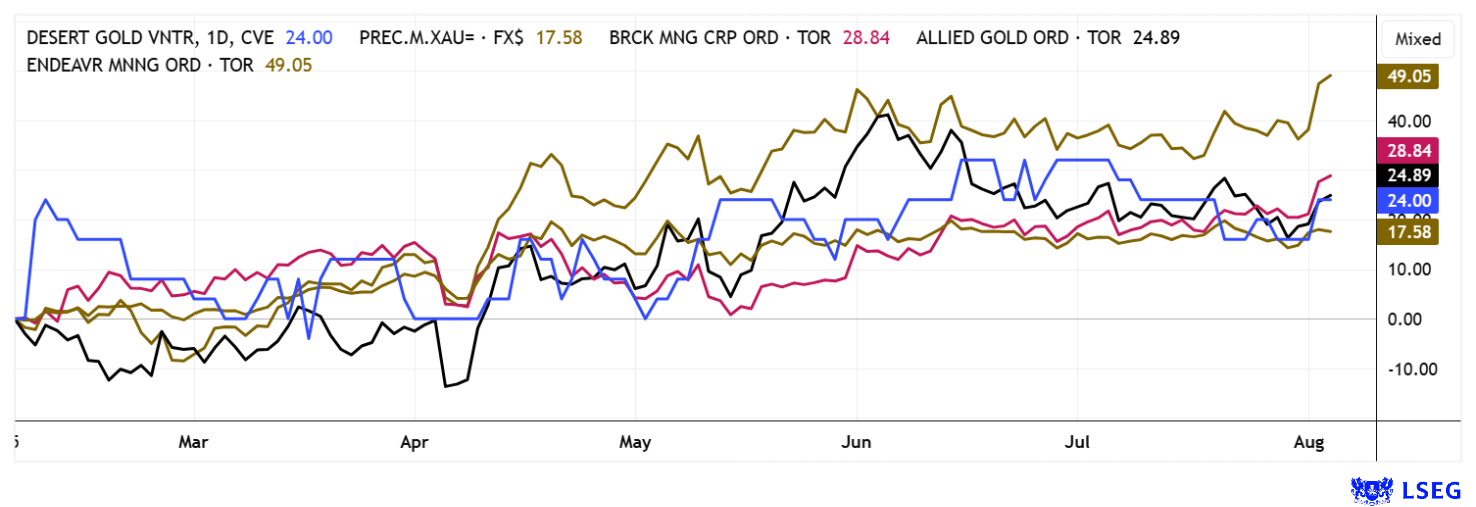

CONCLUSION: The sleeping giant in the West African gold boom

Central banks worldwide have purchased over 1,000 tons of gold reserves in 2024 alone, a clear signal of the growing loss of confidence in fiat currencies. While large gold producers are already benefiting from this development and increasing their market capitalization, exploration companies and juniors like Desert Gold are still lagging far behind in terms of revaluation. In regions such as Côte d'Ivoire, heavyweights like Barrick Gold, Endeavour Mining, and Allied Gold, with valuations in the billions, are pushing ahead with new projects, a clear indication of West Africa's enormous potential. In comparison, Desert Gold's current market capitalization of only EUR 12.5 million seems almost grotesquely low.

With advanced projects in Mali, ongoing resource expansion and the recently published Preliminary Economic Assessment (PEA), Desert Gold is positioning itself as a hot candidate for a new discovery on the market. The planned commissioning of a modular mine with low investment costs, solid extraction rates and a life span of over 17 years creates solid fundamentals. Major banks such as Goldman Sachs, J.P. Morgan, and BoA are already forecasting gold prices of over USD 3,200 to USD 3,900 for 2025/26. In this environment, Desert Gold's share price could quickly rise to many times its current value if further progress is made and gold prices rise.

This update follows our initial report 11/21.