Almonty counters China's dominance

The Western world is facing a raw materials crisis with geopolitical implications. Around 70% of the most important critical metals are found in China. Now China has drastically tightened its export controls on critical minerals – strategically important metals such as gallium, germanium, antimony, and, more recently, tungsten are particularly affected. These raw materials are indispensable for the defense industry, semiconductor production, and high-tech manufacturing. China dominates the entire supply chain for many of these raw materials – from mining to processing and refining. For some metals (like gallium and graphite), China's share of the global market is over 80-90%. Countries such as the US, Germany, Japan, and South Korea are particularly affected, as they need these metals for semiconductors, batteries, chips, lasers, fibre optics, wind turbines, and electric vehicles. **The principle of hope can backfire, as the actual implementation of recent announcements will ultimately depend on the upcoming talks between Trump and Xi Jinping in Beijing. There is still hope that the interests of the West will not be entirely sidelined and that there will not yet be any rationing. Almonty Industries (WKN: A414Q8 | ISIN: CA0203987072 | Ticker symbol (FRA/USA): ALI/ALM) is already strategically positioned to fill the emerging gap as early as 2025.

From zero to full throttle: Sangdong transforms itself into a profit generator

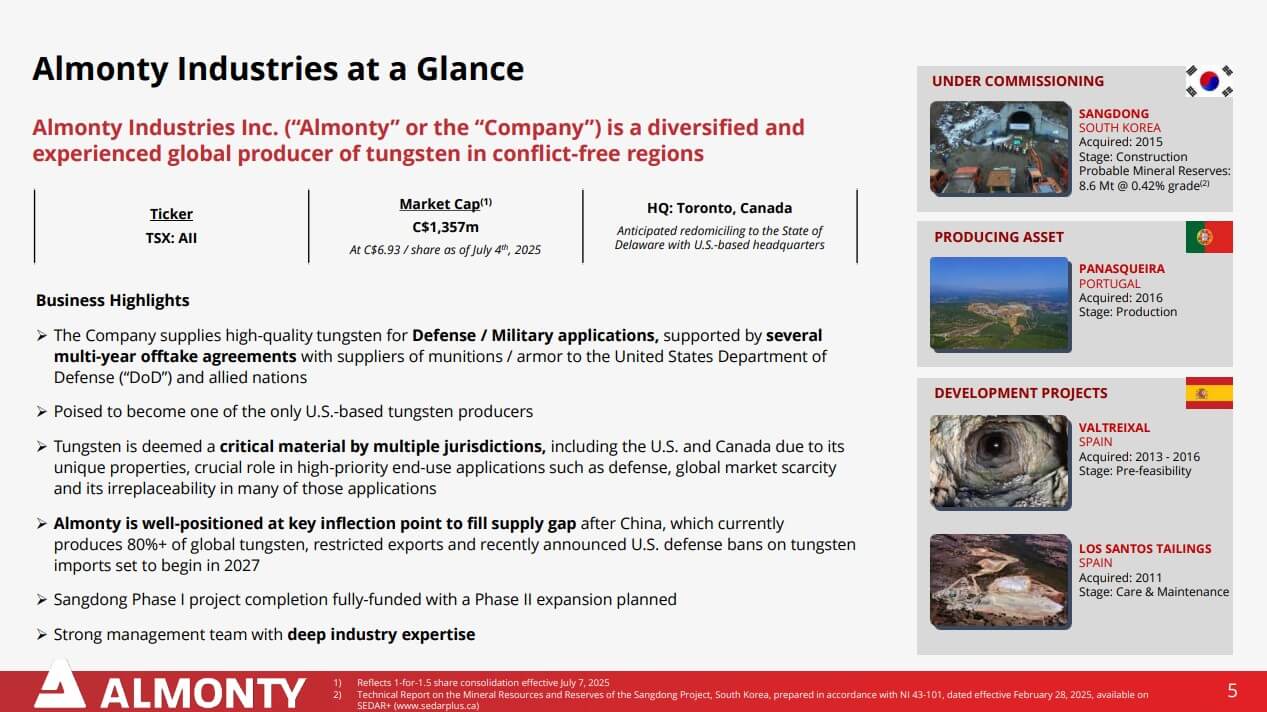

Almonty Industries is about to start up its new processing facilities at the Sangdong Mine in South Korea. The eagerly awaited launch is planned for the second half of 2025 and will put the Company in a league of its own. It will create one of the most important tungsten sources outside China with a planned life span of over 90 years and first-class ore grades. Almonty is responding purposefully to the critical supply situation: Since the US has not had its own commercial tungsten production since 2015, the project will make a key contribution to security of supply for strategically important industries such as defense, aviation, and high tech.

“Almonty will start with an initial production of 2,300 tons and aim for an output of 4,600 tons after 12 months.”

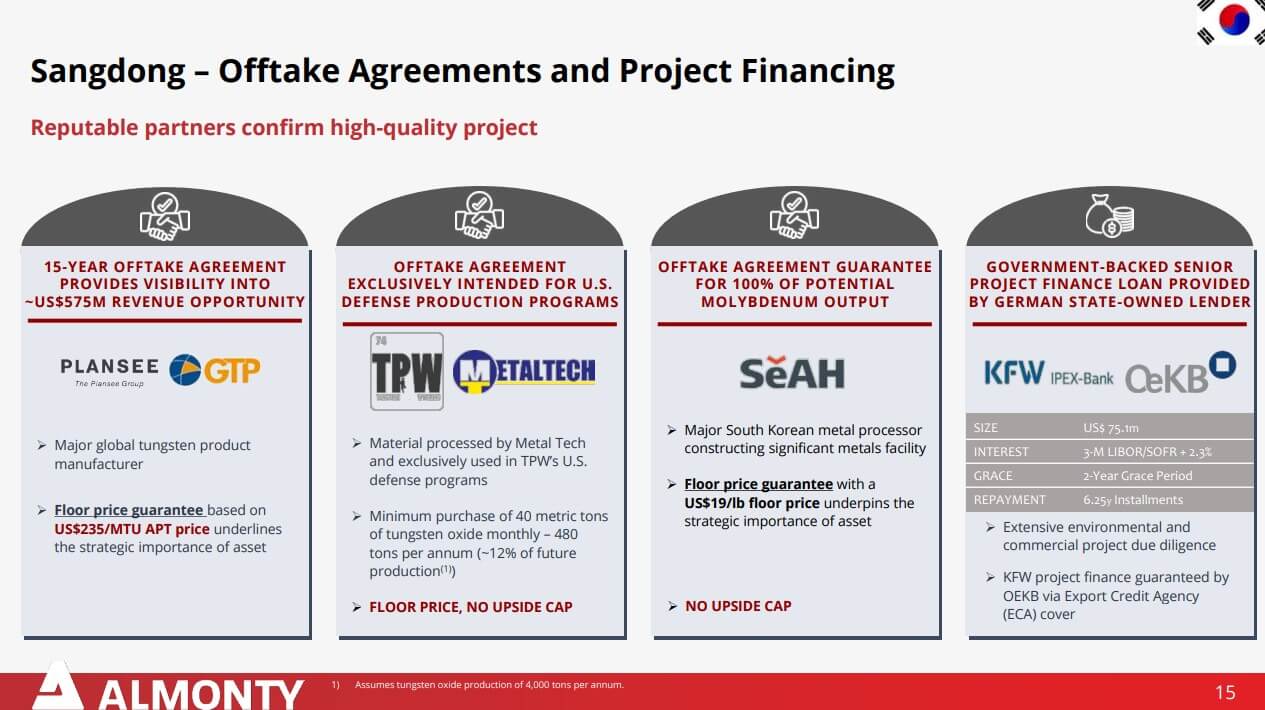

Almonty also offers solutions for Europe: Through partnerships such as with the Plansee Group and through its stake in Deutsche Rohstoff AG, supply from South Korea is secured, even under challenging trading conditions. The current market dynamics highlight the need for action: According to industry experts, automobiles contain around 300 g of tungsten, much of which is lost, and reserves are dwindling. Forecasts predict that Western companies will soon face supply shortages. Governments are desperately seeking alternatives and are turning to Almonty as a reliable supplier. Thanks to a globally coordinated sales network, including off-take agreements for the US markets and reliable partnerships in Europe, Almonty will become the central source of tungsten with the ramp-up of the Sangdong mine – at a time when the markets need new solutions more urgently than ever.

Analysts need to recalculate

With its NASDAQ listing in July, Almonty Industries' share price rally initially peaked before profit-taking set in. However, the setback could prove to be a buying opportunity for investors, as the fundamental investment story remains intact and the recent “quiet period” now allows for increased market communication. Analysts expect massive jumps in revenue and profits in the coming years: D.A. Davidson forecasts revenue growth from CAD 120 million to CAD 420 million by 2028, with EBITDA increasing from CAD 70.8 million to CAD 261.3 million and net income reaching CAD 213.2 million. The price target is CAD 7.00 with a "Buy" rating.

Sphene Capital analyst Peter Thilo Hasler updated his calculations in July and also sees considerable potential: He raised his price target for Almonty from CAD 5.20 to CAD 8.40. The Munich-based expert expects significant revenues of over CAD 144 million and EBIT of CAD 53.8 million as early as the late start of operations in 2026. The bottom line is expected to be net income of CAD 37.4 million, or CAD 0.13 per share. Earnings per share of CAD 0.41 are expected for 2027. Based on today's share price of CAD 6.36, the share would currently be valued at a 2027 P/E ratio of 15.5. Given the high market momentum, this ratio could even exceed 30. The metrics speak for themselves.

GBC Research also anticipates dynamic growth: CAD 154 million in revenue in 2026, and as much as CAD 315 million the following year - leading to a price target of CAD 8.25. Other firms forecast the following price targets: B. Riley values the share at CAD 6.00, Alliance Global Partners at CAD 6.75. Cantor Fitzgerald is particularly optimistic, rating Almonty as a "Buy" and issuing a price target of CAD 9.00.

Huge valuation difference in the peer group

MP Materials Corp. is the benchmark for performance and strategic importance in the critical metals market. With its Mountain Pass project in California, the Company operates the largest rare earth mine in the Western world and set new standards for US raw material security in 2024 with record production of over 45,000 tonnes of REO and 1,294 tonnes of NdPr oxide.

Financially, the situation is as follows: Revenue in 2024 was approximately USD 204 million, almost three times the 2019 figure, with analysts expecting revenue to increase to just under USD 800 million by 2028. Against the backdrop of record prices, the market capitalization has recently swelled to over USD 13 billion, a whopping increase of over 300% since the end of 2024 and currently 15 times Almonty. This development reflects the global shortage of rare earths and the geopolitical realignment, especially as the decoupling from China as a supplier is being pushed forward massively, and demand for high-performance magnets for electric vehicles, wind turbines, and defense equipment is rising rapidly. Investors are recognizing this with valuation multiples that are many times higher than those of other Western competitors, such as Almonty Industries. Almonty shines with an EV/sales valuation of 3.45 for 2027 with comparatively low key figures. The example of MP Materials illustrates that where global shortages shape market dynamics, exceptional operational performance coupled with political and industrial relevance can lead to massive valuation premiums.

Conclusion: Use setbacks to build long-term positions

Western raw material supplies are currently colliding head-on with the geopolitical power bloc of China. Anyone who still thinks in terms of past partnerships in this environment is underestimating the tectonic shifts in the metals market. Today, global interests require a broad geographical footprint and multi-layered safety nets. The EU has already experienced the painful consequences of how quickly prices can skyrocket when a significant portion of supply, as was once the case with energy, is abruptly cut off. Applied to tungsten, this means a clear strategic upgrade for Almonty. The Company is moving into a key role as scarcity scenarios that have been ignored for years are suddenly being priced in at a rapid pace. China's export restrictions, US initiatives to secure raw materials, and Almonty's reliable implementation of its own roadmap are providing additional tailwinds for CEO Lewis Black.

Conclusion: Looking at the current share price, it is clear that the market is increasingly recognizing Almonty's strategic importance. Those who have waited until now will have to accept higher entry prices in an environment where supply and the geopolitical situation leave little room for a sustained correction. Still, the recent consolidation to just below CAD 6.00 could be used as an opportunity to strengthen positions. Another boost comes from the inclusion in the S&P/TSX Global Mining Index. Institutional investors have now been shaken awake and must act!

Here Click here for the latest video of CEO Lewis Black with RADIUS RESEARCH.

This update is based on our initial report 12/2021.