E-mobility and renewable energies - Where will the necessary metals come from?

Researchers determine supply risk

Whether gallium, chromium or rare earths - many metals are indispensable for modern technology. Where supply bottlenecks or shortages threaten, researchers have determined the critical relevance of 62 elements in a comprehensive analysis. As it shows, the supply risk is particularly high for metals needed for highly specialized tasks in high-tech devices. **Iron, copper and tin, but also almost all the other metals in the periodic table, are what make our modern civilization possible because, without them, most technical applications would not exist - from cars and computers to televisions and cell phones. Conversely, however, this also means that if these raw materials become scarce, this could have fatal consequences for the economy and society.

Thomas Graedel of Yale University in New Haven** and his colleagues have comprehensively determined how critical the future supply of all 62 metals and transition metals of the periodic table is. Over the course of five years, they analyzed not only the deposits and reserves of the individual raw materials in the world, but also whether there is a risk of bottlenecks due to extremely uneven distribution of deposits or other socio-political aspects, how great the environmental risk is during mining, and also whether the element in question could be replaced by another. The result: At least for iron, zinc, copper, aluminum and some other metals that have been in use for a long time, things still look good: "They are relatively common and also occur geographically widely distributed," Graedel explains in the study.1

High energy costs, mine closures and the pandemic are putting pressure on extraction rates. Prices are rising.

Deposits and political risks

The situation is different, however, for some metals that are needed for electronics and thin-film solar cells, among other things: According to the report, there is a threat of a shortage of indium, arsenic, thallium, antimony, silver and selenium in particular: "These metals have small, geographically limited deposits and are usually only extracted as by-products of other metals.

The situation is similarly critical for other rare earth metals. 90 to 95% of these rare earths come from China, so researchers see enormous risks here for an artificially induced shortage. Political instability could also jeopardize the supply of tantalum. That is because a large part of this metal is mined in the Democratic Republic of Congo, which is marked by civil war.

Another group of metals could become scarce, according to researchers, because demand is high, but there are no adequate substitute materials. This includes some metals that are used primarily as alloys in steel. This group includes indium, chromium, magnesium, manganese, rhodium, yttrium, tungsten and some rare-earth metals.

"It is indisputable that the modern technology of our world is dependent on the constant availability of all these metals - now, and in the future," the researchers state. "It would therefore be very short-sighted if we were to exploit one or more metals to such an extent that there would be nothing left for future technologies." That was the experts' conclusion.2

Tungsten - Indispensable raw material

Although tungsten is classified as a rare metal, it can be found in many countries. The International Tungsten Industry Association (ITIA), a non-profit trade association, represents the industry worldwide, with members ranging from miners to processors, consumers to traders. Why tungsten is essential to our lives is evident from the variety of applications, from cell phones, circuit boards, dental drills and light sources to darts and golf clubs, giant mining drills, power plants and nuclear reactors, automobiles, airplanes and trains - and life itself."3

Tungsten is a chemical element with the element symbol W and the order number 74. It belongs to the transition metals; it is in the 6th subgroup (group 6) or chromium group in the periodic table. Tungsten is a whitish shiny heavy metal of high density, which becomes brittle even at very low impurities. It is the chemical element with the highest melting and boiling points, and its best-known use is the filament in incandescent lamps.

The largest deposits are found in China, Peru, the USA, Korea, Bolivia, Kazakhstan, Russia, Austria, Spain and Portugal. Tungsten ores are also found in the Ore Mountains in Germany. Safe and probable world deposits currently amount to 2.9 million tons of pure tungsten. The most important known tungsten deposit in Europe is located in the Felbertal in the Hohe Tauern (province of Salzburg in Austria). Tungsten is considered a so-called conflict raw material because its mining in developing countries is associated with human rights violations, corruption and money laundering. Since 2021, EU importers have therefore had to meet special requirements along the supply chain. This plays into Almonty's hands because Almonty has imposed high sustainability standards on all its sub-operations and sites and is known for its prudent business practices. 4

Company profile at a glance

Tungsten is essential to today's high-tech industries: from power and lighting to aerospace, telecommunications and medical technology - all need the rare raw material. **Almonty Industries supplies it.

The Canadian-based company specializes in mining, processing and shipping tungsten concentrate. In its early hours, the company acquired distressed and underperforming assets in the tungsten mining sector. These historic acquisitions date back to 2011, with two mines from Spain and Portugal still in the portfolio. In addition, Almonty is investing heavily in the development of new mines. The Sangdong Mine in South Korea, and in northwestern Spain, Valtreixal. Production at the Sangdong mine is scheduled to start as early as mid-2022, and so far the company says it is well on schedule. Currently, the road and river diversion project is being implemented in compliance with strict environmental and sustainability standards.

Almonty CEO Lewis Black expressed confidence at the Investor Conference IIF (International Investment Forum)5 : "This project is being built in line with our ESG program, so it is more of a 100-year event rather than the usual 30 years."

The Sangdong mine is expected to be the largest tungsten mine outside China once it comes on stream next year. With about 85% of global production currently coming from China, Almonty will likely account for about 30% of non-Chinese tungsten production in a few years. Almonty is thus of considerable strategic importance.

The early properties in Europe

Europe is more of an industrial market. Key customers here come from the automotive, defense, and aerospace sectors. Although the business scales much better in Asia and offers greater opportunities from an investor's perspective, Almonty remains committed to the market in Europe and, if anything, is even expanding its involvement there, as evidenced by the development project in Spain. This is good news for supply stability with important raw materials in the European economic zone.

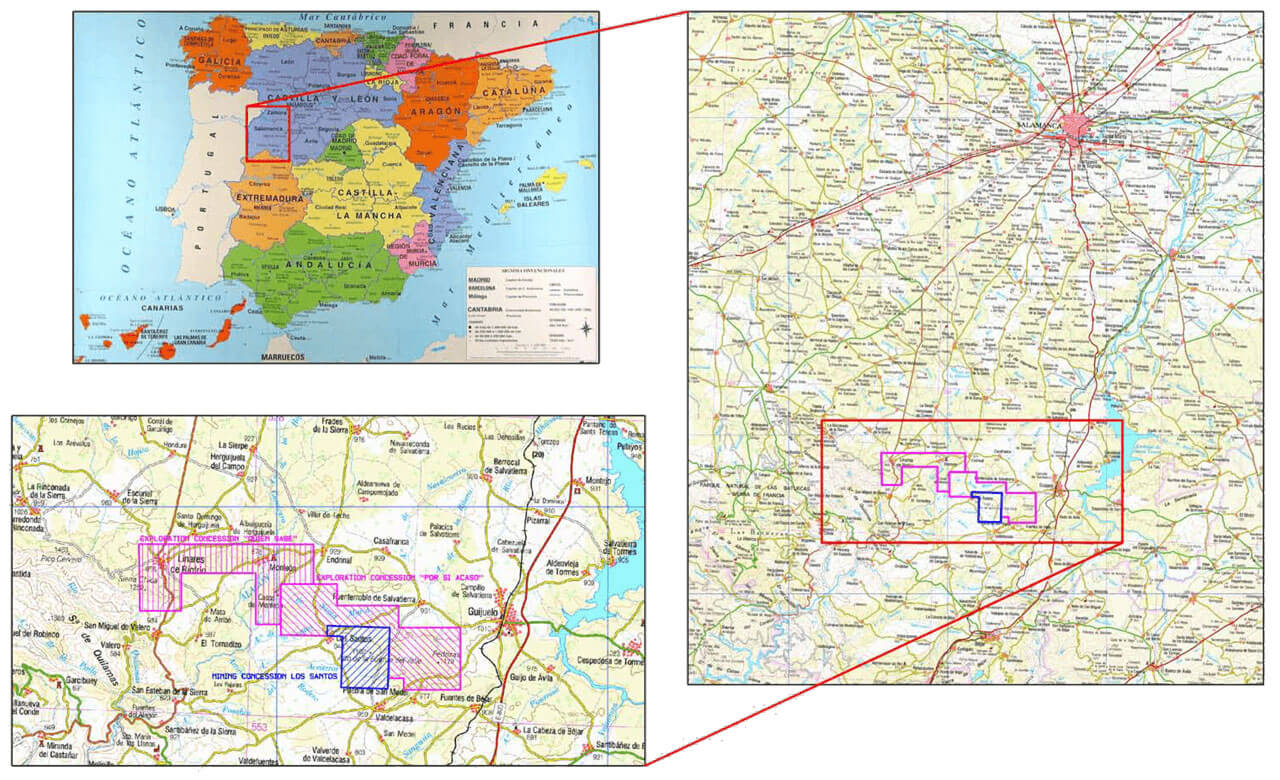

Almonty acquired the Los Santos mine in September 2011. Located about 50 km from Salamanca in western Spain, it is an open pit mine currently producing tungsten concentrate. Almonty has focused on optimizing operations, significantly reducing costs and improving tungsten recovery rates. To date, this has resulted in a recovery rate of approximately 50% WO3 as a result of sustained testing and trials. A significant improvement over the 35-40% recovery rate achieved in the initial post-treatment phase.

In addition, in 2015, Almonty acquired all shares of the Valtreixal Sn-WO3 project in northwestern Spain. It is located approximately 250 km from the Los Santos tungsten project and was acquired by the locally active conglomerate SIEMCALSA - the same group involved in the historical development of the Los Santos mine.

In Portugal, Almonty owns a 100% interest in the Panasqueira tin tungsten mine in Covilha through its indirectly owned subsidiary Beralt Tin and Wolfram (Portugal) SA. Beralt is the oldest Portuguese mining company, with discovery granted on September 15, 1881. The official mining license dated May 24, 1896, after which the mining company Sociedade de Minas de Wolfram em Portugal was established to extract tungsten directly from Panasqueira. The industrial use of the raw material was developed for the first time in the world at that time. In 1911, the Tungsten Mining and Smelting Company was founded, which acquired all rights to the concessions, including buildings, equipment and 125 hectares of land. World War I led to a period of accelerated expansion and growth of the mining operation beginning in 1914. The production rate was increased, the plant was enlarged, and a tin furnace was installed. The number of workers at the mine increased to 800. In addition, the company allowed individuals to work small surface vein exposures in the concession area, an activity in which about 1,000 people participated. They sold their small finds to the mine, earning minimal additional income.

With the end of World War I until 1928, mining activity was heavily dependent on the price of tungsten. During this period of uncertainty regarding the tungsten price, the search and restoration of tin was intensified. The tungsten price recovered in 1934 and remained high until the end of World War II. These were the years of peak production at the mine. The tungsten price fell sharply again after the end of the war and did not rise again until 1950 due to the Korean conflict. Since 1974, the company has accelerated the mechanization of underground operations to further reduce labor costs. Because of its history, the mine in Portugal today employs miners whose fathers and grandfathers have worked there, as the mine has been in operation for 126 years. After years of low-margin mining, it now looks like tungsten may also be declared a critical metal within the EU. This puts domestic sources under strategic protection and ready for industrial use. Today, the two Almonty projects in Portugal and in Spain are well-positioned.

If such projects are shut down for reasons of short-term profit, they cannot easily be reactivated because there is simply a lack of skilled workers.

The Giga project in South Korea

However, things are getting exciting in Asia. Almonty owns a 100% stake in the Almonty Korea Tungsten (AKT) project in South Korea through its 100% subsidiary Woulfe Mining Corp. The deposit hosts one of the largest tungsten resources and was the leading global tungsten producer for more than 40 years. It has the potential to produce 50% of the world's tungsten supply (ex-China production). The Korean operating environment is very competitive, with relatively low material and labor costs, low taxes, and royalty-free, meaning that projected capital costs would be significantly lower than most comparable Western projects.

The AKT property is located 187 km southeast of Seoul, an approximately three hour drive via well-developed expressways and local highways. The nearest settlement is Sangdong village, located 0.5 km from the site. Mine access is well developed, with a paved road running within several hundred meters of the old mill site and forest roads crossing the property. The property consists of a total of 12 mining claims covering a total area of 3,173 hectares. The main tungsten mineral is scheelite (calcium tungstate, CaWO4), which contains more than 95% of the coveted tungsten, with smaller amounts of wolframite. A good mixture for industrial extraction of the metal.

An interesting admixture: molybdenum

Another component of the rock takes on weighty significance under feasibility analyses. For within the Sangdong property, molybdenite is found as an admixture of tungsten mineralization. It commonly occurs beneath skarn mineralization near the underlying granite and especially in the Jangsan Quartzite. The Almonty Korea Moly (AKM) project is located on the Almonty Korea Tungsten property and is a large molybdenum-quartz vein deposit identified by KTMC in 1980-87 in the Sangdong area. The "Deep Moly" deposit has a similar origin, but is completely separate from the Sangdong tungsten mine, physically and geologically. It is located in a quartzite unit below the WO3 Sangdong mine, between shale and the deeper granite, with a vertical thickness of up to about 400m below the skarn.

Further exploration is planned to start in 2022 to define the significant tonnage and higher average values of this mineralized quartzite more accurately. KTMC's 22 vertical holes over 12,390m have provided a preliminary resource estimate of 16.3 million tonnes of high grade molybdenum (0.40% MoS2) and 120 million tonnes of lower grade (0.13% MoS2). The Deep Moly Zone is open from the northeast to the northwest; the potential of this deposit is possibly one of the largest molybdenum deposits in Southeast Asia. Tungsten and molybdenum mining can be accomplished with similar infrastructure and equipment, thus the some synergies can be exploited within the mine. 6

Highlights.

- important strategic tungsten properties outside China

- geographic proximity to Europe enables direct delivery

- good financing progress secures milestone plan in South Korea

- first-class management with good track record

- low company valuation based on expected cash flows (DCF)

- potential takeover candidate

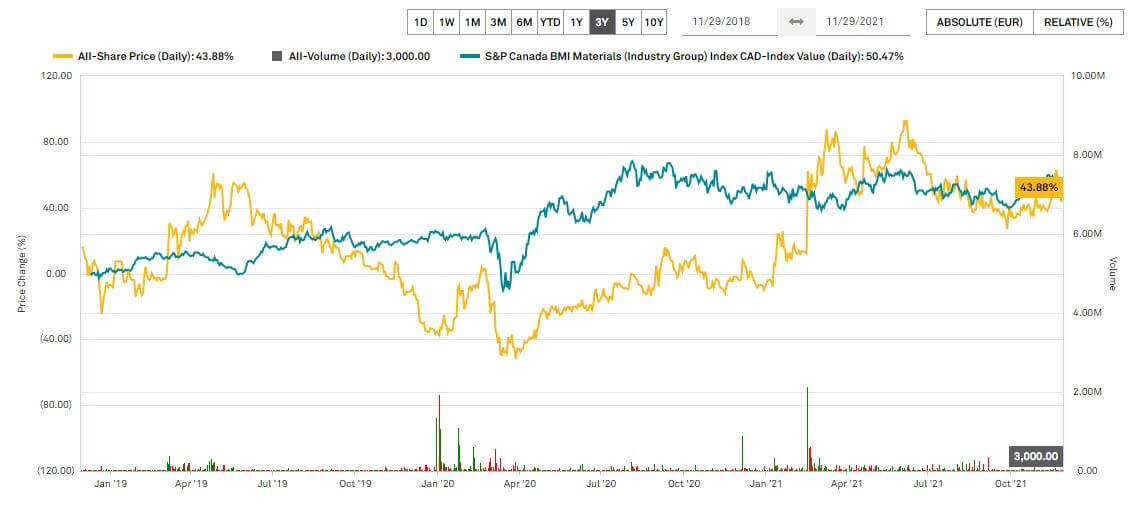

Market and company indicators

Well positioned for world markets

The topic of "strategic raw materials" plays right into Almonty Industries' hands. Political pressure around the issue of decarbonization is causing the global demand for nickel, lithium and rare earth metals to explode. Since 2019, there has already been excess demand for most metals due to mine closures. The energy transition is still at the beginning of its long-term cycle, with German industry having only really put electrification on the map in 2020. The Paris climate resolutions are being taken very seriously, especially in Europe. Then, complicating matters, even under Joe Biden, the ongoing trade disputes with China keep coming up. Beijing seems intent on imposing strict export controls on 17 industrial metals, including rare earths. Global dependence on China is putting pressure on commodity strategists in Western industrialized nations, leading to persistent price premiums.

The shortage continues

The same problem exists with the strategic metal tungsten, which is irreplaceable in many forward-looking technologies due to its unique properties. And the dependencies don't just affect the chip industry - no, pretty much all high-tech industries have to live with this uncertainty factor.

With the financing completed and the project plan finalized, the mine should start in mid-2022.

Almonty has worked its way forward almost unnoticed in the last few years and will now become a producer in the next few years. In addition, there is the geographical location, on the one hand in Europe, and on the other hand in South Korea, one of the most advanced Asian countries with battery producers Samsung or Toshiba. Almonty thus has high strategic importance and also makes it interesting for the large commodity groups. They are swimming in money due to the high cash flows and are looking for strategic expansions of their portfolio.

Tungsten - cobalt substitute for modern battery technologies?

Finally, a special focus should be placed on the potential applications of tungsten. All over the world, development departments for e-mobility are researching the "Super Battery". What would be necessary here is a dramatic reduction in charging times and a better energy yield resulting from the interaction of the battery metals. The use of tungsten has already provided some approaches to this, especially regarding material stability and heat resistance. There are said to be positive results on charging time already. The long-term replacement of the toxic and politically controversial cobalt is reason alone to continue alternative research in this area. We are likely to see surprises here as to what future developments in tungsten will bring.

Well financed into the final round

Equity capital has already been raised for the final start-up preparations for the mine in Korea. The German KfW Bank is providing the necessary debt financing for the development. In addition, with the Austrian Plansee Group, both a new major shareholder and a buyer for the tungsten mined in Sangdong could be won. The offtake agreement has a term of 15 years and guarantees Almonty an attractive minimum price for a sales volume of at least CAD 750 million. Therefore, with a current stock market value of around CAD 193 million, the Canadians appear to be anything but overvalued.