Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 04.06.2024 | 04:45

POWER NICKEL - World-class polymetallic discovery

+++ World-class discovery of nickel, copper, cobalt, gold, silver, lead, platinum and palladium

+++ Adjacent to a nearby to highway with direct access to green carbon neutral power

+++ Quebec, Canada, is one of the top jurisdictions for sustainable mining in the world

+++ Secured Dr. Steve Beresford, the top, internationally recognized geoscientist and polymetallic specialist as a special advisor

Miracle drill results could represent an opportune solution to the critical metals shortage. In a world of great geopolitical instability, industrial producers are seeking a secure supply of strategic metals. Power Nickel (ISIN: CA7393011092 | TSXV: PNPN) has large deposits of strategic metals in Canada. Having foundational similarities to the largest discoveries to date, the astonishing core results are uncovering just how large these deposits could be. Combine that with the best jurisdiction for raw materials and explosive growth is possible. The recent share price performance provides an early foretaste. Let's dive deeper!

Zum KommentarKommentar von André Will-Laudien vom 14.05.2024 | 04:45

Share news: GLOBEX MINING - Raw materials in abundance

The world is in turmoil. Numerous geopolitical conflicts, such as between China and Taiwan, as well as unrest in Argentina and the Kashmir region, are aggravating the political worldview almost daily. Added to this are the ongoing armed conflicts in Ukraine and between Israel and the Middle East. An escalation in which the US and NATO could also be involved can no longer be ruled out. Investors' need for security is, therefore, constantly increasing. If the central banks do little to combat inflation, the hope of interest rate cuts will likely remain unfulfilled for some time to come. This brings precious metals to the fore. Their prices have risen sharply in the last 6 months. Globex Mining's extensive commodity portfolio is facing a significant revaluation in this mixed situation.

Zum KommentarKommentar von André Will-Laudien vom 08.05.2024 | 03:00

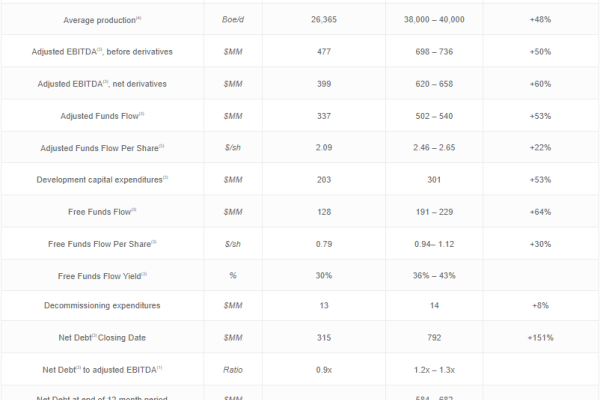

Share news: SATURN OIL + GAS - The next leap in growth

Despite all political efforts to make energy supply entirely renewable, it must be recognized that this goal will only be feasible in certain zones of the planet. In the northern hemisphere, there are many hydroelectric power plants, and solar and wind power are already being integrated into the global energy transition. However, in countries such as China, India and Brazil, demand is so great that it can only be met with fossil fuels. Producers of fossil resources exist around the globe, with the largest deposits currently found in Saudi Arabia, Russia, Africa and North and South America. Canada holds reserves for the next 250 years. Saturn Oil & Gas has set itself the task of building a medium-sized producer there. With the acquisition of further oil and gas assets in Saskatchewan, production capacity will increase to 38,000 to 40,000 barrels of oil equivalent per day - another transformative development.

Zum KommentarKommentar von André Will-Laudien vom 25.03.2024 | 04:45

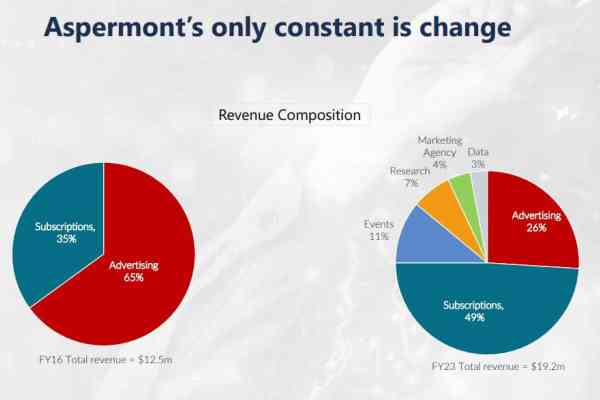

Share news: ASPERMONT - In pole position for commodities

Information is the necessary oxygen for the capital markets. Given rising inflation rates, geopolitical uncertainties and disrupted supply chains, international networking is more important than ever. The world is in a phase of deglobalization, in which dependence on distant suppliers reveals the vulnerability of industrial business models. Anyone purchasing large quantities of raw materials and supplies today is looking for reliable partners and secure transportation routes. The Australian company Aspermont can look back on a 560-year history and has been actively building its network of decision-makers for several years. The Company collects important industry information from the industrial and raw materials sectors. The business approach is now proving to be a blockbuster in a changing world. With the publication of the 2023 figures, Aspermont highlights important fundamental changes for the future. The change has begun, and it is happening fast!

Zum KommentarKommentar von André Will-Laudien vom 18.03.2024 | 04:45

Share news: DESERT GOLD - The train is leaving the station

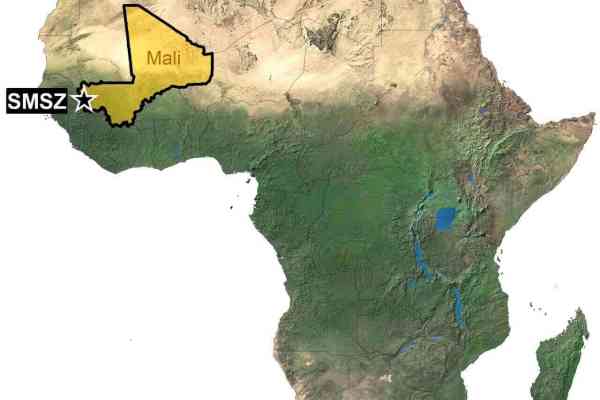

The gold price is in a good mood again. After forming a top between USD 1,600 and USD 2,100 for almost four years, it managed to break above the old high in March. The new all-time high now stands at USD 2,195. It is no wonder that this new level needs to be solidified first. Last week, the precious metal consolidated slightly to USD 2,150. In the medium term, this is not a disaster, as investors have now rediscovered the asset class. Initially, the producers of gold and silver have already risen by 10 to 15% from their lows. A special story is unfolding in Mali, West Africa. Here, Desert Gold is progressing step by step and attracting a lot of attention. The price of the favourable share has already doubled. So, the train has left the station, and the potential for a takeover is a multiple of the current valuation.

Zum KommentarKommentar von André Will-Laudien vom 14.03.2024 | 04:45

Share news: SATURN OIL + GAS - New record highs for 2023

Fossil fuels have been in high demand again in recent months. On the one hand, global conflicts and the operation of weapons technology are not devouring solar power, and on the other, the German government has cut short its own e-mobility strategy by ending the environmental bonus. The desire for momentum in this area now gives way to harsh reality. Sales of e-cars are falling so sharply that German premium manufacturers are once again considering new combustion models. All of these trends play into the hands of the Canadian commodities company Saturn Oil & Gas. For several years now, the Company has recognised the increased demand for oil and gas and is consistently expanding its production capacities. Figures have now been released for 2023 that represent a quantum leap for the still-young company.

Zum KommentarKommentar von André Will-Laudien vom 07.02.2024 | 04:45

Share news: DESERT GOLD - All signs point to a storm

Amid ongoing geopolitical tensions, gold is increasingly emerging as a safe-haven currency. While global gold mine production has risen by 26% since 2010, it has increased by almost 60% in Africa and more than doubled in at least 10 African countries. Africa has traditionally been a major producer of raw materials, deriving its economic growth from the establishment of mining operations. In Ghana, for example, currently Africa's largest gold producer, gold accounts for around a quarter of the value of total annual exports. If gold mining is carried out responsibly, it can act as a catalyst for significant positive change. Canadian explorer Desert Gold has been active in Mali since 2015 and is now entering the most exciting phase in the Company's history.

Zum KommentarKommentar von André Will-Laudien vom 02.02.2024 | 04:45

Share news: SATURN OIL + GAS - New resource assessment gives wings

In the international concert of the energy transition, it is up to resource-rich countries to continue supplying their abundant reserves to the market. Europe is naturally not very well endowed with significant oil or gas reserves, so the focus is more on renewable energy sources. However, anyone who needs fossil fuels is bound to turn to external suppliers for their energy requirements. Industrial sectors that traditionally cannot do without oil or gas due to established manufacturing processes are particularly affected. At the onset of the Ukraine crisis, the German government turned to the raw materials giant Canada and negotiated extensive supplies of LNG gas and strategic metals. The Canadian raw materials company Saturn Oil & Gas has recognized this demand and is consistently expanding its production capacities. The crucial factor in this context is the conviction that fossil energy will still be needed for many decades. Saturn Oil & Gas is, therefore, ideally positioned today.

Zum KommentarKommentar von André Will-Laudien vom 24.01.2024 | 04:45

Share news: ALMONTY INDUSTRIES - Time is running out

The geopolitical climate is becoming increasingly frosty. The Ukraine crisis, which has already lasted almost two years, was joined by the Hamas terrorist attack against Israel in October 2023. What poses a huge challenge for international politics in terms of safeguarding mutual interests is no less dangerous for industry. Power blocs are forming, increasingly distancing themselves from the West and pursuing strict self-interests. In the Russia-China axis, in particular, it must be assumed that the climate towards the US and its allies will remain frosty and spill over into other areas. It is no coincidence that governments have placed important metals on the strategic procurement list. Tungsten is the metal for ultra-hard and heat-resistant surfaces and is part of a challenging scarcity debate, as 85% of the metal is mined in China.

Zum KommentarKommentar von André Will-Laudien vom 06.12.2023 | 04:45

Share news: DESERT GOLD - In the starting blocks for at least 1 million ounces

There is currently plenty of fuel for gold investors. On the one hand, there is the technical breakout attempt at the beginning of December with prices around USD 2,150 - a new all-time high. On the other hand, there is the uncertainty caused by numerous geopolitical conflicts, which appear to be intensifying. Inflation, which is manifesting itself despite falling inflation, and the constant expansion of government debt are also fueling turmoil, particularly in the US dollar-dominated region. Added to this are the efforts of many BRICS countries to expand their sphere of influence to countries rich in raw materials and to distance themselves from the US dollar in the long term. These intentions are being driven by the China-Russia axis, which seems to be becoming more and more entrenched since the invasion of Ukraine. Anyone wishing to consider this potpourri of framework conditions in their investment strategy should look to Africa. Vast reserves of raw materials lie dormant there, and traditionally, the connection to Western investors is good. This is because they create jobs and bring critical development services to the country. The Canadian explorer Desert Gold Ventures is focusing on the Senegal-Mali-Shear Zone (SMSZ). Not without reason, as the drilling completed in 2023 has already delivered industrially usable mineralization grades in gold.

Zum Kommentar