Political tailwind from the USA and promising projects in Europe

US Senate Democrats scored a dramatic victory in early August for President Joe Biden's efforts to combat climate change. They passed legislation that would provide hundreds of billions of dollars for clean energy sources and accelerate the US transition away from fossil fuels. The so-called "Inflation Reduction Act," which appeared to be dead just weeks ago and is now headed to the House of Representatives, would accelerate US emissions reductions and put the country on a path to cut greenhouse gases 40% below 2005 levels by 2030. Hydrogen is a key component of these goals.

In the meantime, public planning around climate action is in full swing in both Norway and the EU. An analysis by Greensight suggests that with appropriate investments in green hydrogen, any amount of coking coal and natural gas used for thermal processes in the metals industry can be replaced. That is because H2 functions as a fuel and is used to generate heat, which can be used for drying or calcining. Similarly, it can be used as a chemical component in processes such as polymer production or serves to reduce sulfur content in the refining of fossil fuels.

The Norwegian titanium industry is testing green hydrogen as a reducing agent, just as it is being used in SSAB's HYBRIT project in northern Sweden. And fertilizer manufacturers are using hydrogen to produce ammonia, the main precursor for nitrate-based fertilizers. Emissions from Norwegian industry totaled 11.4 million metric tons of CO2 in 2020, but this figure could be considered to drop by at least 15% with the introduction of green hydrogen. In theory, an even greater reduction is possible, but for some processes the economics are not yet in place. To achieve this reduction, 520,000 tons of the gas would need to be produced annually, or 1,425 tons per day.

Europe is becoming increasingly greener, and hydrogen will play a crucial part in this. The European Union is committed to putting its energy systems on a more climate-friendly footing. The stated goal is to save about 2,800 megatons of CO2 by 2050. Hydrogen, along with other alternative energies, will be an important part of the EU's overall strategy for integrating energy systems. The EU is also currently considering whether there should be an obligation for governments to offset part of the price difference between hydrogen and conventional fuels or feedstocks. So far, however, no budgets have been decided for this, but Norway's proposal remains a viable way forward.

Can Nel ASA handle the high market growth?

Since mid-2022, Nel has been led by a new manager. After more than five years, CEO Jon André Løkke has vacated his post for Håkon Volldal, who joins the group from Norwegian company Q-Free.

"At Nel, our vision is all about 'Empowering generations with clean energy forever'. Our technology allows people and businesses to make everyday use of hydrogen, the most abundant element in the universe."

The new man, Håkon Volldal, brings extensive experience from McKinsey & Company as well as from various leadership positions at Tomra Systems. Løkke then moves to the Supervisory Board. The exchange needs a strong leader who can access more lucrative sales with good networking than was the case under the old management. In the months from May to July, the new man at the helm was praised accordingly, and the share price rose by a good 40%.

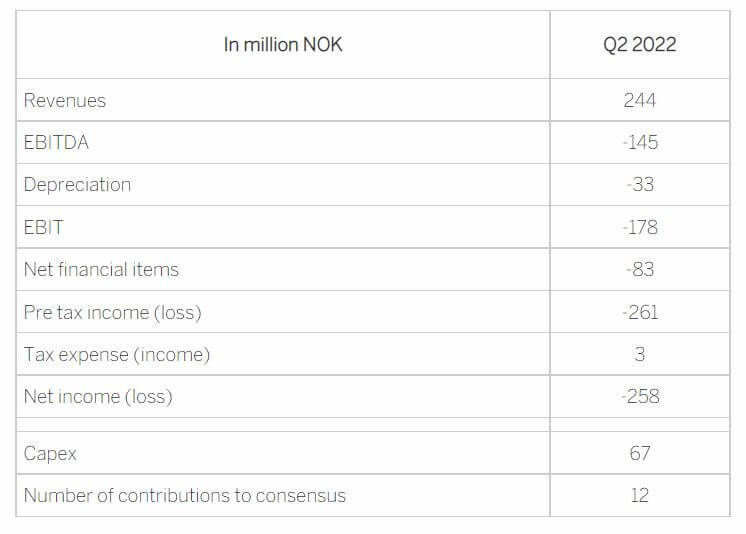

Expectation check: What analysts estimate in advance

The experts surveyed expect sales of NOK 244 million in the 2nd quarter, compared with NOK 163.7 million a year earlier. EBITDA is expected to show a net loss of NOK 145 million. The bottom line is a net loss of NOK 258 million, or NOK -0.143 per share. This is the expectation of 12 experts surveyed.

Even before the numbers, US bank JPMorgan reiterated its rating for Nel at "Underweight" with a price target of NOK 11.10. At a current price of NOK 15.75, this calculates a negative price potential of around 30%. According to JPMorgan, the hydrogen producer's revenue will be the decisive factor, but it is also controllable depending on progress in the projects due to IFRS regulations. JPMorgan expects the operating result (EBITDA), however, to be a full 11% below the average market forecast. The major Canadian bank RBS takes an entirely different view. They see everything "in butter" before the figures and leave their "Outperform" rating with a price target of NOK 23. It remains to be seen what will happen, but there is a great deal of nervousness just before the figures.

Operating performance through the first half of 2022

Nel ASA presented the following figures on August 11:Sales rose from NOK 163.7 million to NOK 183 million in the second quarter, which is a growth of just under 12%. However, analysts had expected NOK 244 million, so the deviation is significant on this point. The bottom line is still a loss of NOK 0.18 per share, which also differs by around 25% from expert estimates. EBITDA turned out to be NOK -197 million after NOK -120 million, while order intake reached NOK 236 million in the second quarter. That is still 61% more than in the same quarter last year, and at NOK 1.439 billion the order book is fuller than ever. A further capital increase in the first half of the year enabled Nel to expand its cash position to over NOK 3.6 billion by the reporting date. That means the Company's cash position can be described as very comfortable. All in all, however, the quarterly figures are clearly below the consensus estimates of the experts.

Not at the end of the quarter, but already for the new billing period, the Company announced a record order for 200 MW of alkaline electrolyzer stacks. The single order is worth NOK 450 million and could increase further through ongoing adjustments. Due to the continued positive market development, Nel has also made a final investment decision for the second production line at the Herøya plant, which will increase the annual production capacity for alkaline electrolyzers to approximately 1 GW. Nel will invest in a second fully automated 500 MW alkaline production line there at an estimated NOK 350 million. The plant is scheduled to come on stream in April 2024.

"The high level of activity in the second quarter led to the signing of the largest order the Company has ever received, a contract that will have a very positive impact on the Company," says Håkon Volldal, CEO of Nel.

Still struggling with high costs, Nel's continued expansion of the organization, in line with its growth strategy, is negatively impacting profitability. The increase in personnel costs is based on the hiring of experienced project, production and technical staff. In addition, supply chains remain depressed, resulting in increased raw material costs and delayed deliveries.

As a result, the current figures are likely to be subject to a fresh assessment. Nel, of course, hopes to shine by reporting weak numbers combined with a strong outlook.

The outlook for the coming years

Management did not provide an outlook for the full year; they are sticking to reporting individual orders and leaving the market to assess the current successes in the company. In its conference, however, Nel emphasizes its technological leadership and sustainable corporate philosophy. CEO Volldal emphasizes that Nel is one of the few companies in the industry that can handle any hydrogen industry requirement with its current setup. Analysts at S&P Market Intelligence expect revenues of NOK 1.087 billion in 2022, so the bar remains high for H2. Revenues are expected to grow to around NOK 4.4 billion by 2025, representing a compound annual growth rate (CAGR) of 42%.

"Political support and real incentives are emerging, and investment costs for plants are decreasing. Long-term green power purchase agreements and offtake agreements are feasible, and financial institutions have advanced their thinking on financing green hydrogen projects. These are all important prerequisites for the realization of larger projects," Volldal said.

Interim conclusion - Highly valued but with good prospects

Overall, the European market leader in the hydrogen business is doing well. Now, if the budget plans for the already approved H2 future investments are implemented by the governments, nothing will stand in the way of a positive development of the industry. Without government subsidies, however, it will be difficult.

Despite all the rosy prospects, Nel ASA is currently priced at a price-to-sales ratio of over 20 and is thus anything but cheap from an analytical point of view. Despite the recent doubling of the share price, its competitor Plug Power from the US has a sales ratio of 16, which means that Nel is certainly not a bargain from a peer perspective. The entire hydrogen sector is still ambitiously valued and thrives on the "climate rescue fantasy" of public clients. The first share price reactions today show a discount of only 3%, so the stock market is prepared to value the positive prospects in today's statements higher.

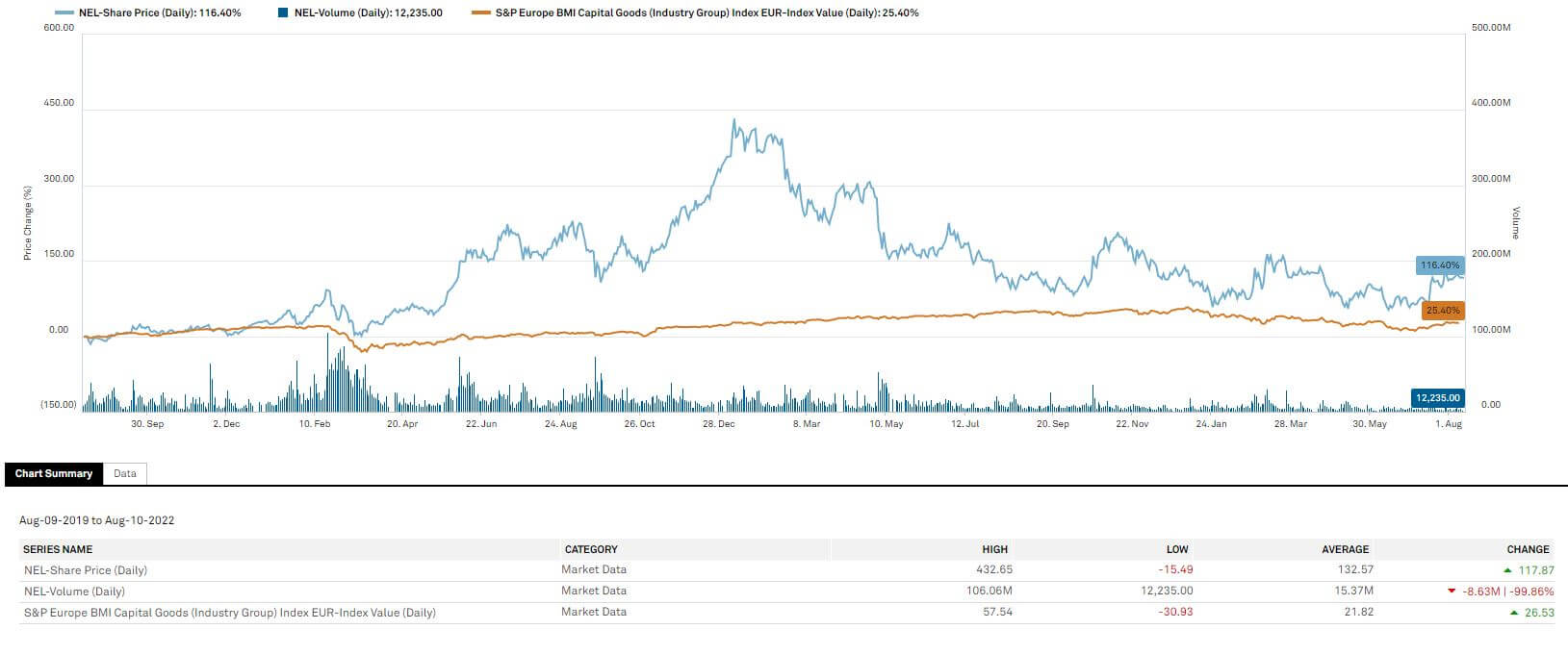

The three-year performance of the Nel ASA share compared to the BMI-Capital Goods EUR-Index Value (Daily) shows a relative outperformance of 116.4% over a three-year period. From a chart perspective, caution is advised below the EUR 1.50 level. If this support does not hold, a price decline to around EUR 1.25 must be expected. After all, the EUR 1.10 mark also offers good support on the downside so far.

This update is based on the initial Report 01/2022.