E-mobility and renewable energy - Where do the necessary metals come from?

In an increasingly unstable economic environment, experts see major supply risks for important elements. Whether gallium, chromium or rare earths - many metals are indispensable for modern technology. In the most comprehensive analysis of the criticality of 62 elements to date, researchers have now determined where supply bottlenecks or shortages threaten. As it shows, the supply risk is particularly high for the metals needed for the highly specialized tasks in high-tech devices. Iron, copper and tin, but also almost all other metals of the periodic table, make our modern civilization possible. Without them, most technical applications would not exist - from cars and computers to televisions and cell phones. Conversely, this also means that if these raw materials become scarce, this could have fatal consequences for the economy and society 1 .

Tungsten - An indispensable raw material

Tungsten is a chemical element with the element symbol W and atomic number 74. It is one of the transition metals, and in the periodic table it is in the 6th subgroup (group 6) or chromium group. Tungsten is a whitish shiny heavy metal of high density, which becomes brittle even at very low impurities. It is the chemical element with the highest melting and boiling points. Its best-known use is therefore the filament in incandescent lamps. The largest deposits are found in China, Peru, the USA, Korea, Bolivia, Kazakhstan, Russia, Austria and Portugal. Tungsten ores are also found in the Ore Mountains. Safe and probable world deposits currently amount to 2.9 million tons of pure tungsten. The most important known deposit of tungsten in Europe is located in the Felbertal in the Hohe Tauern (province of Salzburg in Austria).

Whether in the semiconductor business, aerospace, automobiles or smartphones. Tungsten is only used in small quantities everywhere, but nothing works without the metal.

Why tungsten is indispensable to our lives is clear from the variety of applications: from cell phones, circuit boards, dental drills and light sources to darts and golf clubs, giant mining drills, power plants and nuclear reactors, cars, planes and trains - and life itself. Many people know tungsten from classic light bulbs, but the metal is in demand from the automotive industry, aviation, in medical technology and telecommunications. Recently, tungsten has also been considered a battery metal because the metal is suitable for replacing the controversial cobalt. Asian manufacturers such as BYD are also hoping to increase the proportion of tungsten in the sought-after traction batteries to improve charging performance, endurance and safety. If the development continues, tungsten demand could go through the roof. **Currently, however, there is too little of the material available on the world market.

Many eyes are looking toward South Korea

Almonty, through its subsidiary Woulfe Mining Corp, owns a 100% interest in the Almonty Korea Tungsten (AKT) project in South Korea. The deposit hosts one of the largest tungsten resources and was the leading global tungsten producer for more than 40 years. It has the potential to produce 50% of the world's tungsten supply (ex-China production). The Korean operating environment is very competitive, with relatively low material and labor costs, low taxes, and no government royalties. Projected capital costs are significantly lower than most comparable Western projects. The AKT property is located 187 km southeast of Seoul, about a three-hour drive via expressways and local highways. Mine access is well developed, with a paved road running within several hundred meters of the old mill site and forest roads crossing the property. The property consists of 12 mining claims totaling 3,173 hectares, the main tungsten mineral is scheelite (calcium tungstate, CaWO4), which contains >95% of the coveted tungsten. Some bismuth and gold have been historically recovered. In 2022, the Austrian Plansee Group was acquired as both a new major shareholder and a customer for the tungsten mined at Sangdong.

Update at the International Investment Forum (IIF)

CEO and founder Lewis Black outlined his extraordinary position in the tungsten market at the IIF in September. With a planned mine life of 90 years, it is expected to supply at least 30% of the non-Chinese global market share. According to his estimates, the Sangdong mine is expected to be the largest tungsten mine outside China when it comes on stream next year. A vertically integrated downstream nano-tungsten oxide processing plant will also be built to supply the South Korean battery anode industry. The long-term purchase agreement with the Plansee Group shows how great the hunger for the rare raw material is. This agreement has a term of 15 years and guarantees Almonty a cash flow of USD 590 million. The current tungsten prices have increased by 48% over a period of 12 months, making the project even more profitable. The top priority of those responsible is now to meet the budget. Construction progress is currently even slightly ahead of schedule, so from today's perspective, commissioning is already expected in the third quarter of 2023.

External financing successively provided by KfW

The mine expansion in South Korea is being financed on a pro rata basis by a loan from KfW-IPEX-Bank and amounts to a total of USD 75.1 million. The disbursement is made according to the progress of the project; in August there was the second tranche of USD 4.1 million for the next construction phase. Construction of the mine is expected to be completed by mid-2023, when production will begin. In the summer of 2022, the mine achieved a significant milestone by reaching the -1 level of the adit at the hanging wall gallery, despite an intense rainy season. This will allow further exploration and mining work to be carried out in the mineralized zone. "We are pleased that the Sangdong Mine infrastructure has passed this stress test. We see this as a testament to the quality of the engineering work and studies that have been conducted over the past several years in anticipation of the construction of our world-class Sangdong tungsten mine," stated President and CEO Lewis Black.#.

Once production is in place, prospects will follow

Recently, US carmaker Tesla succeeded in signing long-term contracts in China for the supply of key battery metals. At the same time, market insiders stress that the situation for Western customers in China is becoming increasingly uncertain. This means strategic metals from sources outside China are becoming more relevant again. Market experts, such as Lewis Black, emphasize that the industry must now work with the metals that are on the market. "There is no other option at the moment," the business leader said in an interview with Cheddar News. At the same time, Black clarifies how risky it is to have no other options, "especially when you are dealing with jurisdictions that declare one thing and act completely differently," he said.

"Almonty Industries specializes specifically in the strategic metal tungsten." - Lewis Black, CEO

Almonty Industries is one of the core producers of tungsten outside of China with the goal of significantly reducing the Western world's dependence on tungsten from China. In addition to the tungsten mine in Sangdong, the Company also sits on a significant resource of molybdenum. Added to this is its geographic location, on the one hand in Europe, and on the other in South Korea, one of the most advanced Asian countries with battery producers Samsung and Toshiba. **This gives Almonty high strategic importance and makes the Company a hot takeover candidate.

Conclusion: Fully financed and well on schedule

Almonty has now taken all the steps that will make this important project a success. Mine construction is fully funded and progressing on schedule. With the mines already in place, Almonty is moving into a new size category in the medium term. This changes the perception of international commodity investors from explorer to producer. If the market realizes that new tungsten capacity is finally available outside of China, there could also be a bidding war for Almonty. With the backing of other major companies looking for a reliable source of the metal, Almonty Industries is well positioned in the strategic metals market.

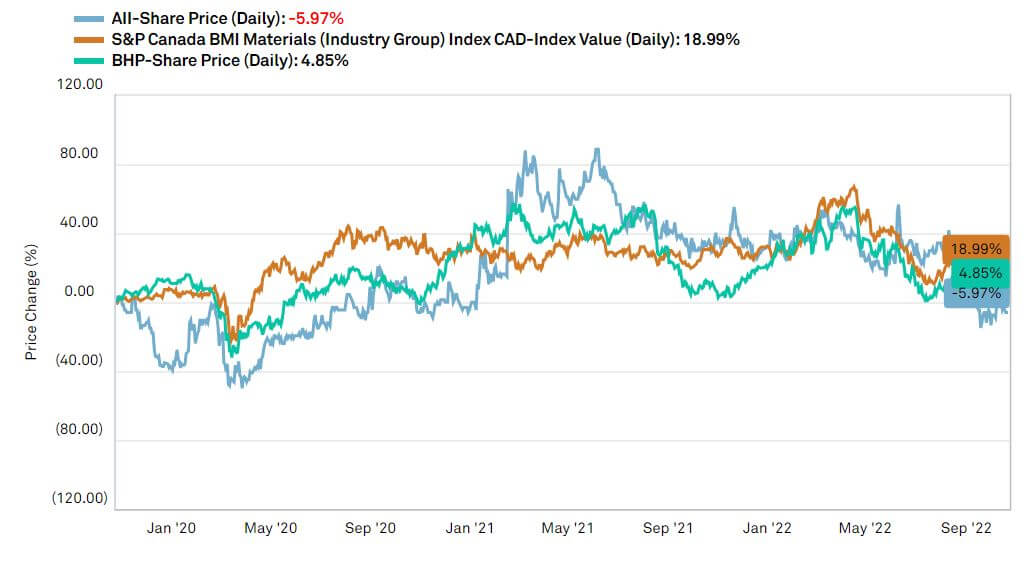

The three-year performance of Almonty Industries Inc. stock compared to the S&P Canada BMI-Materials Index shows a relative underperformance of approximately 25% to date. Compared to an industry leader in mining, Australia's BHP Billiton, the gap is slightly better at -11%. However, the underperformance only occurred in the last three months under review; in the years prior, Almonty Industries was able to hold its own with the industry average. Junior commodity markets have now been correcting for 24 months.

Overall, the stock shows a perfect long scenario in the strategic commodities environment with the possibility of significant appreciation over the next 24 months. Analysts at First Berlin have taken a fundamental view on the medium-term outlook and rate the stock a "buy" with a price target of CAD 1.70. Currently, the share is trading at a low CAD 0.64, but trading volumes are increasing.

This update follows our initial Report 12/2021.