The next transitory step is completed

Saturn Oil & Gas Inc. has now completed the formal acquisition of the new assets in the Viking area of west-central Saskatchewan for a cash consideration of approximately CAD 248 million, following announcements in May and June.

"With the completion of the Viking acquisition, Saturn is firmly established as a sustainable developer of light oil in Canada," said John Jeffrey, CEO of Saturn. "We now have a total inventory of over 500 appraised well locations, as well as an extensive list of optimization candidates in our existing portfolio of wells and assets, giving Saturn the internal capability to grow production organically while aggressively reducing corporate debt."

The Viking acquisition bolsters Saturn's existing light oil assets in West-central Saskatchewan with new synergistic production, land and drilling locations. In scope, this translates to approximately 4,000 boe/d (~98% light oil and liquids) of cash flow intensive production and over 140 net sections in the Viking fairway. With a 250% increase in drilling inventory, the Viking acquisition further expands the size and scope of Saturn's Saskatchewan operations, complementing the Company's core area in Southeast Saskatchewan. The completion of the Viking acquisition provides Saturn with a scalable portfolio of free cash flow assets to support short- and long-term development, while diversifying the Company's production to improve its sustainability and financial resilience. The acquisition increases daily production capacity by more than 50% at full load to approximately 11,400 boe/d.

The Company is now focusing on organic growth

After completing recent acquisitions, Saturn is now looking to grow organically, as the potential of its company-owned properties is gigantic. This transaction again raises its most recently revised guidance for cash flow in 2023 to CAD 223 million, or roughly CAD 3.98 per share. Strong net gains can be achieved up to a floor in the oil price of about CAD 50 for Edmonton Light, allowing for the generation of substantial free cash flow at current levels. It will be used primarily to reduce debt and fund near-term organic growth.

Saturn kicked off its light oil drilling program in June 2022 with the spud of the first of approximately 50 horizontal wells, in addition to the 8 wells drilled earlier in the year. Drilling is expected to continue into the new year and approximately 90 new horizontal wells are expected to be drilled in 2023. Increased production capacity will enable an organically focused growth plan that will be fully funded by internal cash flow. The surplus will enable the drilling of approximately 140 new horizontal wells and the optimization of facilities and existing wells over the next 18 months. The Viking acquisition is delivering more than 300 additional well locations.

Financial fundamentals are gradually improving

On the financial side, Saturn expected increasing cash flow per share for 2022 as early as mid-year, rising from an original CAD 2.48 to CAD 2.71, and in 2023 it is expected to be as high as in the range of CAD 3.63 to CAD 3.87 per basic share. The much-anticipated net debt is expected to be reduced from the current estimated CAD 223 to approximately CAD 183 million by year-end 2022 and to approximately CAD 75 million by year-end 2023.

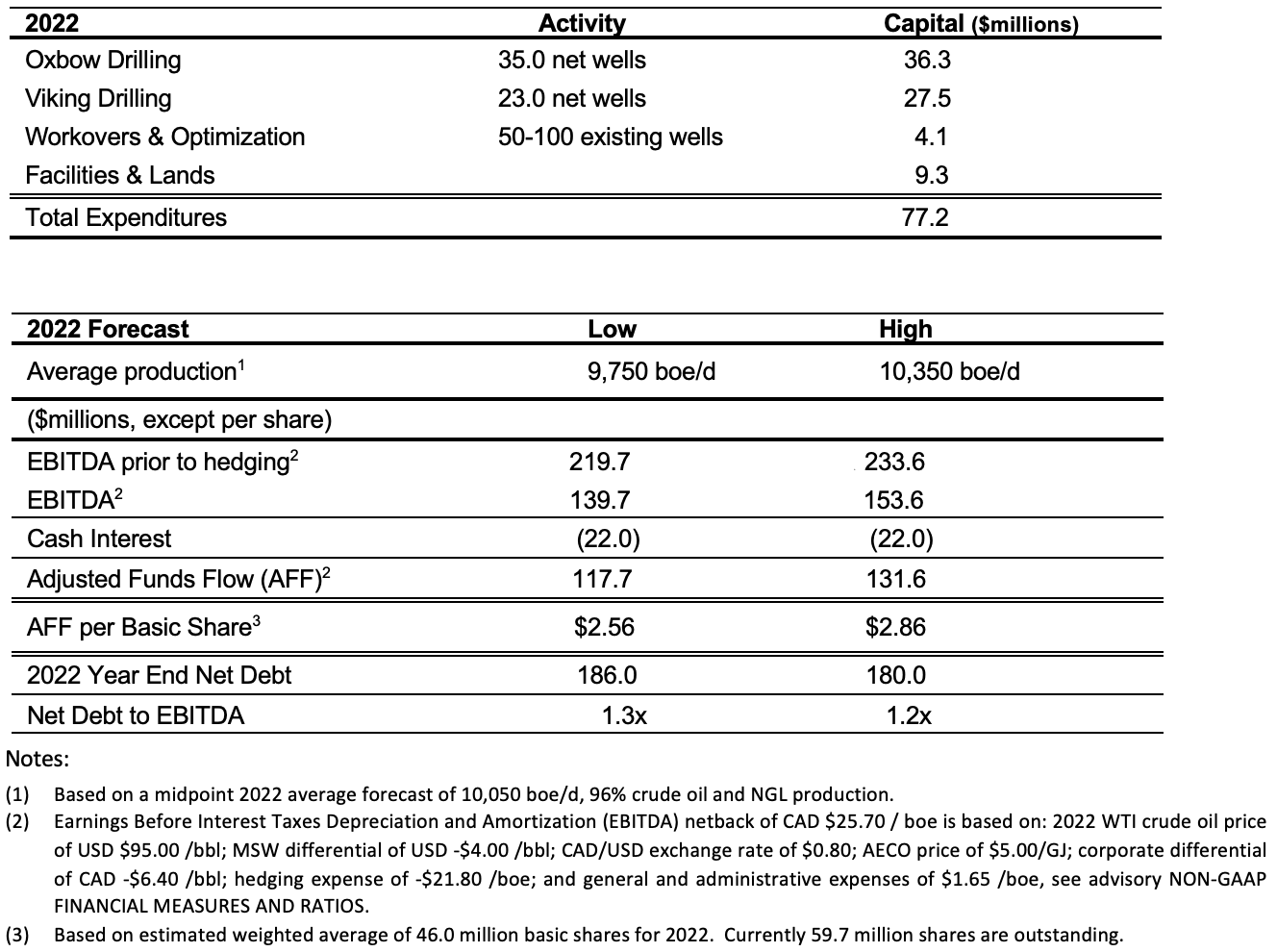

The following tables show budgeted field development activities in 2022:

In total, this still translates to CAD 77.2 million in capital expenditures for 2022, which will lift daily production to an average of 9,750 to 10,350 boe/d. Cash flow is forecast to be between CAD 117.7 and 131.6 million.

The outlook for 2023 remains promising

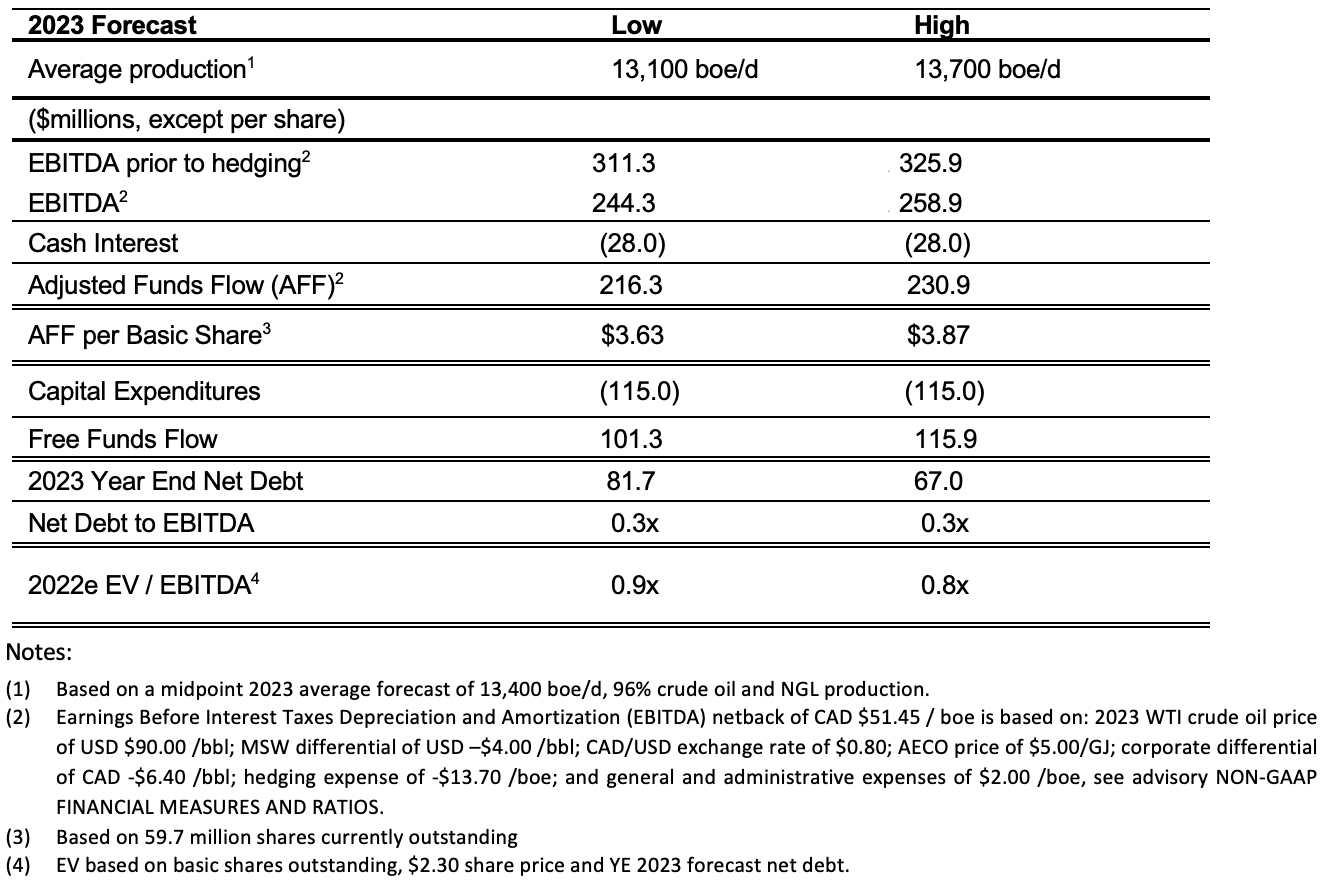

Based on the above figures, continued investment of CAD 115 million will achieve average annual production in the range of 13,100 to 13,700 boe/d, enabling secured EBITDA in the range of CAD 244 to 260 million. Average production will then reach levels between 13,950 and 14,550 boe/d in the fourth quarter of 2023, representing massive year-on-year production growth. Saturn's 2023 implied free cash flow yield should climb to between 74% and 85%, based on the Company's current capitalization of approximately CAD 137 million.

The following tables show budgeted field development activities in 2022:

Ensuring success by hedging at high levels

In view of the amount of financing and the necessary interest and redemption payments, Saturn cannot avoid hedging a certain quota of its production on the futures markets. This has now been done in recent weeks at quite decent prices, which must be considered successful even in the event of recessionary trends. Between June 2 and June 15, 2022, the Company has entered into a series of financial oil price hedges. The new hedges are expected to cover approximately 85% of forecast oil and NGL production, based on internal estimates of the Company's proven developed production profile for 2022 to 2026.

For the second half of 2022, Saturn has entered into WTI hedging instruments for an average volume of 2,783 boe/d at an average minimum price of USD 102.65 and for 2023 for an average volume of 2,366 boe/d at a average minimum price of USD 92.02. The future is difficult to predict, but with these hedge prices, Saturn Oil & Gas is perfectly positioning itself in the market in the current shortage situation. After all, an end to the war in Ukraine can also be expected to bring a strong easing in oil prices. **A further dramatic increase, on the other hand, is rather unlikely due to the weakening economy.

Details on the financing of the Viking acquisition

In order to finance the Viking acquisition, Saturn has entered into an amended and restated senior secured term loan agreement with its US-based institutional lender in the amount of CAD 200 million. The transaction also includes a bought deal equity financing of subscription receipts for aggregate gross proceeds of approximately CAD 75 million. As of the effective date of the Viking acquisition, each subscription receipt has now been exchanged for one new common share plus one-half of one warrant. Each full warrant is exercisable to purchase one share at an exercise price of CAD 3.20 per warrant until July 7, 2023, subject to adjustment in certain cases.

Trading of the Subscription Receipts on the TSXV ceased last week, trading on the TSXV of the underlying new share count commenced on July 7, 2022, and trading of the underlying warrants commenced on July 8, 2022 under the symbol (SOIL.WT.B). A total of 27,181,860 shares and 13,590,930 warrants were issued upon conversion of the Subscription Receipts. In addition, the Company closed its previously announced private placement of 145,573 private placement units at a price of CAD 2.75 per private placement unit for total proceeds of CAD 400,326. The private placement allowed participation of existing European shareholders and was taken as an opportunity for all of Saturn’s Calgary executives to increase their investment in the company. For the last three equity fundraising the Calgary executive team have stepped up and invested more each time.

Interim conclusion: The market fails to recognize the great opportunities of the current deal

Saturn Oil + Gas is demonstrating with this latest deal that they are putting the Company's growth through another acceleration. This may be somewhat surprising from the outside in the current high-price environment, but the internal plans to improve cost efficiency and lower debt are coherent. The substantial increase in production output is sharply increasing net available cash flow, which is accelerating deleveraging and creating further reserves for investment in organic performance.

The key to the new acquisition is that it was done at a low purchase price of under 2x the assets forward expected cash flow. With approximately 80% of the acquisition price being funded with debt Saturn is able to effectively double its near-term cash flow with the issue of a moderate number of new shares. Some new share issuance was unavoidable and a deal guarantee is made possible by the accompanying brokers through a predetermined price (a "bought deal"). This increases planning certainty and facilitates the raising of a considerable amount of external funds. The structure of the current deal is designed to significantly increase the international perception of the small Canadian company and to further enable the financing of strong growth in the future. Some high profile institutional investors weighed in to back the Viking acquisition with a group of five major money managers accounting for 50% of the CAD 75 million raised.

Increasingly over time more production can be sold freely without hedging as the contracts roll off, further increases future earning power. The current hedging levels between USD 92 and 102 are also comforting. If we encounter the unlikely event of oil prices trending lower into the end the year versus the current crisis-driven USD 120, Saturn Oil + Gas's medium-term strategy of price protection will almost certainly be successful. The current entry share price level of about CAD 2.20 is far below the recent funding and also more than 30% away from the next exercise hurdle of the warrants.

The update is based on our initial Report 11/21