Infineon Technologies AG - An overview

Infineon Technologies AG is a leading global supplier of semiconductor solutions, in the application areas of security, mobility and energy efficiency. With around 50,000 employees worldwide, the Company generated revenues of approximately EUR 11.1 billion in fiscal year 2021 (ending September). The segment result was EUR 2.07 billion, corresponding to a margin of 18.7%. The growing population, the increase in megacities and the rising global energy demand require new solutions in many areas of our modern life. Semiconductor and system solutions from Infineon help make our everyday lives easier, safer and more environmentally friendly. Small and barely noticeable from the outside, semiconductors are indispensable companions in everyday life. They feed regenerative energies into power grids with virtually no loss, reduce power consumption in computers, secure digital data exchange and drive motor vehicles more energy-efficiently. Thanks to sustainable production concepts, Infineon has been listed in the Dow Jones Sustainability™ World Index for several years.

Groundbreaking acquisition pushes Infineon to 8th place

Still under recently departed CEO Reinhard Ploss, Manager of the Year 2020, Infineon changed its focus from product to system solutions, which meant a more holistic and customer-oriented approach. The Company grew organically, but also through acquisitions in the US, most recently in 2020 with the purchase of US chipmaker Cypress for a whopping EUR 9 billion. With this acquisition, Infineon Technologies moved up to eighth place globally, strengthened its position in North America and broadened its product portfolio. And while there are several examples of the turbulence into which German groups can fall due to major takeovers, particularly in the US, these transactions under Reinhard Ploss have taken place quietly and, so far, quite successfully.

In terms of chips for industry, the world's largest market.

China is conquering the chip market in leaps and bounds

Five years ago, semiconductors were sold in the People's Republic for the equivalent of around EUR 11.4 billion, which corresponded to a global market share of 3.8%. By 2020, however, sales have skyrocketed to the equivalent of EUR 34.9 billion, or 9% of the global market, reports industry association SIA. According to these data, the EU and Japan, each with a 10% share of the global market, are still very slightly ahead of China in terms of chip production and sales, but given the growth there, they are also likely to be overtaken soon.

In terms of industrial chip consumption, China has been the world's largest market for many years. To attract companies, the US, China and the European Union rely on subsidy programs. In February, the EU Commission announced plans to mobilize EUR 15 billion in additional public and private investment for chip production by 2030 through an initiative called the European Chips Act.

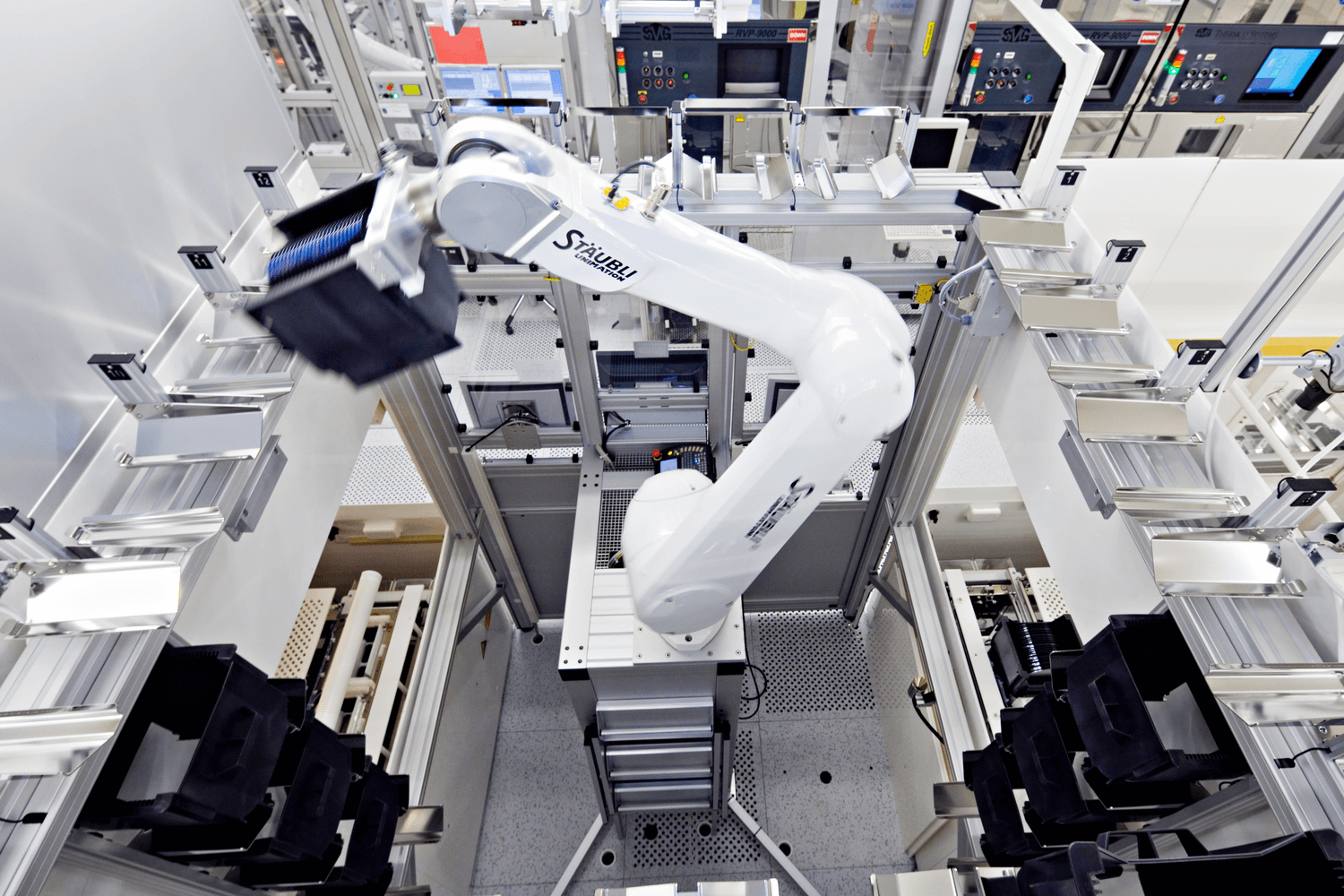

Sensible expansion into Carinthia

Infineon has been quietly pushing ahead with its expansion for years. The group invested EUR 1.6 billion through its Austrian subsidiary in the new plant in Villach, Austria, where production started last August. Former CEO Ploss described the Infineon site in Carinthia as the "root of power semiconductors." In addition to its headquarters in Villach, Infineon Austria has subsidiaries in Vienna, Graz, Linz and Klagenfurt. In Austria, 4,500 people work for the group, almost 2,000 of them in research and development. Research expenditure reaches almost EUR 0.5 billion per year, making the Company one of the most research-intensive companies in Austria. Unlike in Germany, finding qualified employees is somewhat easier in Austria.

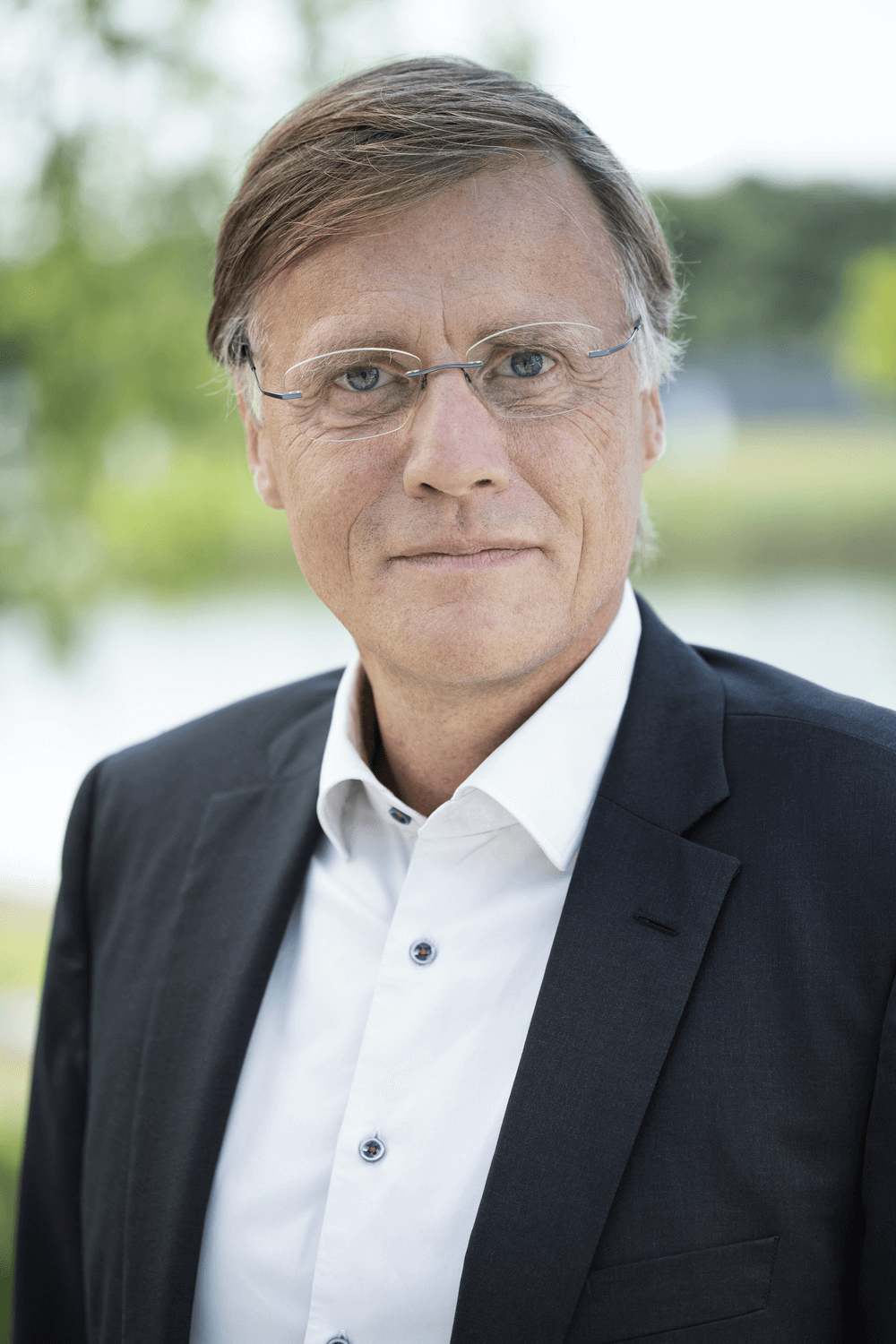

Management Board change in spring 2022

There was a significant change at the top in the current year. As of April 1, 2022, Jochen Hanebeck, the Chief Operating Officer, took over the management of the Company. The previous incumbent, Reinhard Ploss, is leaving the Company and retiring. He had been at the helm since 2012 and played a key role in guiding the Group through the financial crisis. His record is positive, as he had taken over Infineon at a time when the Company was suffering from a slowing economy and had to make extreme savings. Since then, the manager has put the Company on a solid growth and profit course. Sales of EUR 3.9 billion in fiscal 2012 turned into a good EUR 11 billion by 2021, and profits of EUR 427 million most recently became EUR 1.17 billion.

The current change represents continuity. Hanebeck - like Ploss before him - is a true homegrown and already worked for Infineon when the Company still belonged to Siemens. Like Ploss, who holds a doctorate in engineering, Hanebeck comes from the technical side with a degree in electrical engineering. And he has been a member of the Group's Management Board since 2016, so he has been involved in setting the course in recent years, such as the billion-dollar acquisition of US competitor Cypress Semiconductors.

The megatrends on the menu

In recent years, Infineon has consistently focused on global megatrends that will continue to shape the world in the future: Demographic and social change, climate change and the ever-increasing scarcity of resources. Special topics here are increasing urbanization and the digital transformation of society. The growth areas of energy efficiency, mobility, security as well as IoT and Big Data are also derived from these megatrends. In these markets, Infineon focuses on the structural drivers, i.e., areas that will grow disproportionately in the long term due to the aforementioned changes or that have great innovation potential. The coronavirus pandemic has not changed these underlying assumptions.

"Customers are snatching the chips out of our hands, the timing is perfect".

The global semiconductor market is booming

The PwC study "Opportunities for the global semiconductor market" predicts years of strong growth for the global semiconductor market. The authors forecast that global chip sales will rise to USD 575 billion in 2022. Based on the USD 481 billion in the boom year 2018, this would correspond to a compound annual growth rate (CAGR) of 4.6%.1

The study differentiates industry growth by semiconductor type, application area and region. In Europe, the automotive industry will become the main sales market for chip manufacturers - ahead of the business with chips for data processing. A key growth driver in the automotive sector is semiconductors to support energy systems, autonomous driving and artificial intelligence (AI). Electric and hybrid cars contain roughly twice as many semiconductors as conventional vehicles. Global sales of chips to support AI for alternative powertrains, infotainment, driver assistance systems, driving safety and other automotive applications will rise to nearly EUR 68 billion by 2022. Yet the huge AI chip potential in autonomous driving cars is still completely untapped. However, PwC also sees the chip boom as a warning signal for European manufacturers, as they have considerable pent-up demand for semiconductors for AI solutions.

Operating performance through Q2 2021/22

At Infineon, consolidated revenues increased by EUR 139 million, or 4%, to EUR 3.298 billion from EUR 3.159 billion in the previous quarter. Sales increased in the Automotive (ATV), Industrial Power Control (IPC) and Connected Secure Systems (CSS) segments, while they decreased slightly in the Power & Sensor Systems (PSS) segment. Gross margin was 42.9% in the second quarter of the current fiscal year, up from 41.5%, and segment profit rose to EUR 761 million from EUR 717 million in the first quarter of fiscal 2022. The much-noted segment profit margin improved slightly from 22.7% to 23.1% in the previous March quarter. In contrast, operating profit barely changed, landing at EUR 618 million after EUR 617 million. Basic earnings per share from continuing operations improved slightly to EUR 0.36 from EUR 0.35. The figures were in line with analyst expectations.

Outlook: Corporate figures 2021/22 to 2024/25

At an assumed EUR/USD exchange rate of 1.10 (previously 1.15), revenues of EUR 13.5 billion are expected for fiscal 2021/22, with a fluctuation range of EUR 500 million. Sales in the ATV, CSS and IPC segments are expected to grow disproportionately, while PSS is expected to grow in-line. The segment profit margin should remain above 22%; nevertheless, the purchasing side, especially for energy, is a component that could negatively impact the margin. Capital expenditures, defined by the Company as investments in property, plant and equipment and other intangible assets including capitalized development costs, of around EUR 2.4 billion are planned for fiscal 2021/22. The focus here is on expanding capacity in front-end production to continue to meet the expected growth in demand in the medium term. Analyses and consensus figures can be found on the Company's website, which is also permanently maintained. Investors thus have clear guidance and estimates for Infineon in front of them. As a result, the potential for surprises in the figures should be quite low.

| Infineon Technologies AG (in millions of EUR) | 2021/22 | 2022/23 | 2023/24 | 2024/25 |

|---|---|---|---|---|

| Sales | 13.472 | 14.519 | 15.792 | 17.222 |

| EBITDA | 4.383 | 4.699 | 5,339 | 6.039 |

| EBITDA-Marge in % | 32,5 | 32,2 | 33,8 | 35,1 |

| EBIT | 2.522 | 2.707 | 3.208 | 3.680 |

| Net profit | 1.878 | 2.082 | 2.283 | 2.694 |

| Price/sales ratio (P/S) | 2,8 | 2,6 | 2,4 | 2,2 |

| Earnings per share (EPS) | 1,47 | 1,60 | 1,73 | 2,00 |

| Price/earnings ratio (P/E) | 19,4 | 17,9 | 16,5 | 14,3 |

Analysts surveyed by S&P Market Intelligence expect revenues to increase by almost 27% by the 2024/25 fiscal year compared to current sales volumes. The EBITDA margin will increase only slightly overall from 32% to just under 35%. Based on a current P/E ratio of 19.4, this will drop to around 14.3 by 2024/25. Should the economy experience a dip due to high energy and procurement prices, Infineon is also likely to experience stronger revisions from fiscal years 2023 onwards. For the current fiscal year ending September 30, one can still be very positive that Infineon can meet or even exceed its guidance.

Brief analysis

Strengths

- Positioning as one of the industry leaders in the semiconductor business

- Innovation driver in specialty chips

- Solid balance sheet positioning

- Mitigation of supply chain issues through global sourcing

- Good diversification across multiple segments

Weaknesses

- Relative dependence on Germany as a location

- International dependence on raw materials

- Higher costs in international comparison

- Shortages of important precursors could burden production

Conclusion - Well positioned further ahead

Faster increase in production facilities announced

Leading chip manufacturers worldwide are expanding their plants. Infineon has also committed to increasing its production capacities: Chief Production Officer Rutger Wijburg announced that in the future the German chipmaker would "decide every two or three years" on a major investment. To counteract the shortage of semiconductors in many areas of industry, Infineon plans to expand its production capacities at an accelerated pace in the future. Until now, the rhythm for opening new fabs has been more like four to five years. The market situation probably requires greater concentration and a significant increase in the pace of investment.

Exogenous influences on the rise

The war in Ukraine is leaving its mark. The Ukrainian companies Ingas and Cryoin have stopped supplying high-purity neon gas, which is used in semiconductor production. The two companies account for a significant portion of the world's high-purity and ultra-high-purity neon supply. Currently, however, chipmakers such as TSMC believe they have enough high-purity neon; Infineon has not yet commented on these issues. Nevertheless, the exogenous influences from the side of important precursors or raw materials are likely to become more and more relevant. From an economic perspective, one can only hope that the current boom in demand will not be followed by a steep crash due to global distortions.

For growth markets, the current high inflation could become a danger.

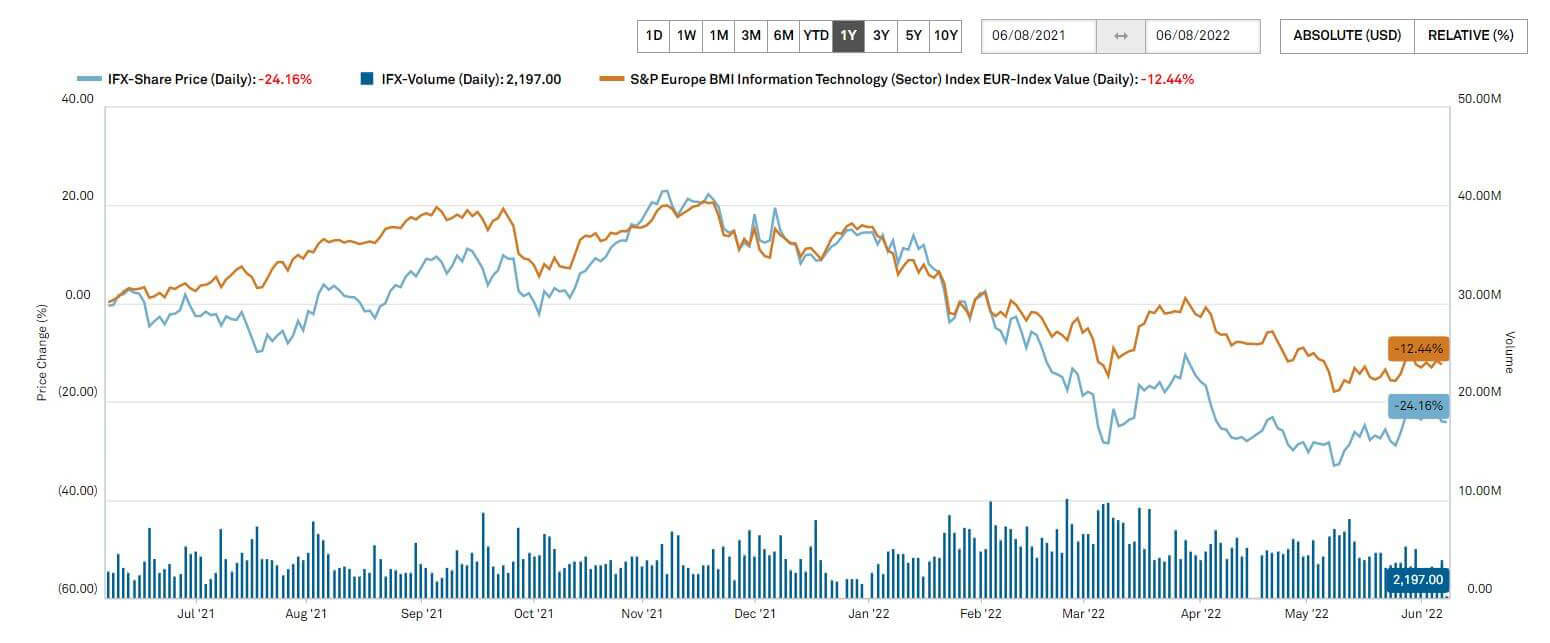

The technical correction is well advanced

The three-year performance of the Infineon share compared to the BMI Information Technology EUR Index Value (Daily) shows a relative underperformance of 42% over a three-year period. That is due to the partly extraordinary performance of Nvidia, Intel and AMD.

However, Infineon also reveals a strong recovery movement after the Corona sell-off in March 2020 of about 50% until today (at the peak even more than 60%). With the big NDX correction, IFX shares fell by almost 46%, but the entire sector lost much more in the same period. Chart-technically, an important support is shown in the area of EUR 25 to EUR 27, with overcoming the zone 32 to 34 there are new buy signals.

Despite all risks, the share is an interesting growth stock

The dramatic inflation development in 2022 with partly doubled rates compared to the previous year sends some warning signs towards growth markets, especially in the area of highly valued technology stocks. While semiconductor companies are currently encountering a dried-up supply market, a slowdown in the economy, coupled with rising prices, threatens a significant drop in orders starting in the fall. With the current boom in demand, Infineon could nevertheless even exceed its forecasts for the current 2021/22 fiscal year. The Company is currently well-positioned and is benefiting from the global shortage situation. The share is trading at EUR 28.6 today. Of 24 current analyst opinions, 19 are positive. Only Jeffries & Company issued a sell vote with a price target of EUR 23 at the end of May. The average of all available analyses results in a median price target of EUR 43.85. 2