Very good last quarter

What a stroke of luck. At just the point when the production areas are expanding, there is a price increase of more than 50% in oil. Saturn Oil & Gas put a lot of energy into the Viking deal that closed on July 6, 2022. An important detail of the acquisition contract was the effective date of the transaction was May 1, meaning Saturn profited from oil price spikes experienced in the early summer with a lowering of the transaction purchase price by the excess cash flows of May and June. Effectively the cash price of the Viking deal price was reduced by CAD 17.4 million from an initially reported price of CAD 260.0 million.

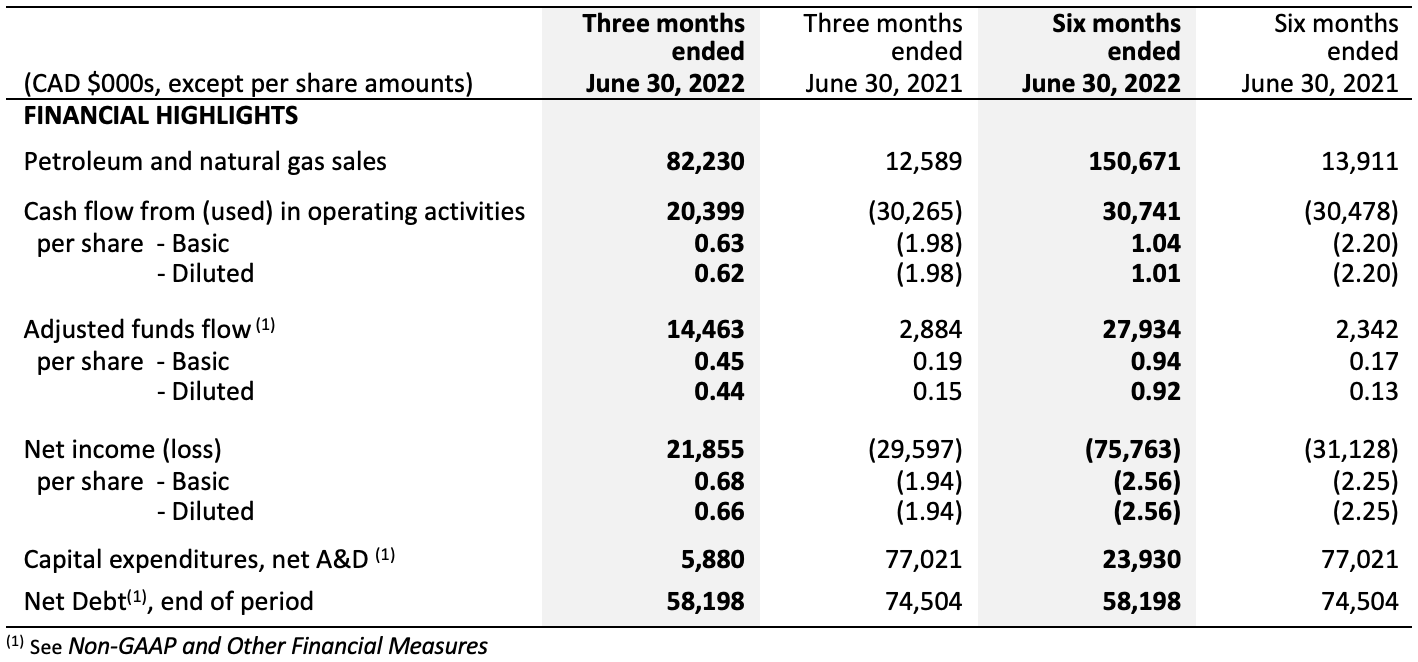

The record figures reported now in the second quarter of 2022 still refer to the operations prior to the Viking deal and read accordingly well because of the dynamic price development.

"Saturn's high-quality light oil production was complemented by exceptionally high global oil prices in the second quarter of 2022, resulting in record cash flow," says John Jeffrey, CEO of Saturn. "Focusing on increasing the Company's oil production capacity through growth-enhancing acquisitions in the first half of 2022 has laid the foundation for fully funded organic growth through future development drilling while rapidly repaying debt."

The Company can benefit today from this timely decision and looks to the future with confidence. In summary, Saturn reported the following figures for the second quarter: It achieved quarterly record oil and gas sales of CAD 82.2 million, with average daily production of 7,324 boe/d. High sales prices resulted in record adjusted EBITDA of CAD 18.0 million, with the new Oxbow fields making a significant contribution here. Cash flow reached another record CAD 14.5 million or CAD 0.45 per share.

Significantly, shortly after the close of the quarter, was the transitory acquisition of the synergistic assets in the Viking area, in western Saskatchewan, for a total cash consideration of CAD 242.6 million, which increased production by an additional 4,000 boe/d (98% light oil and liquids). The acquisition was even without this new acquisition's contribution, quarterly free cash flow reached a magnitude of CAD 8.5 million, which went directly to debt repayment. At the end of the quarter, this amounted to CAD 58.2 million, an 11% decrease quarter over quarter.

Source: saturnoil.com

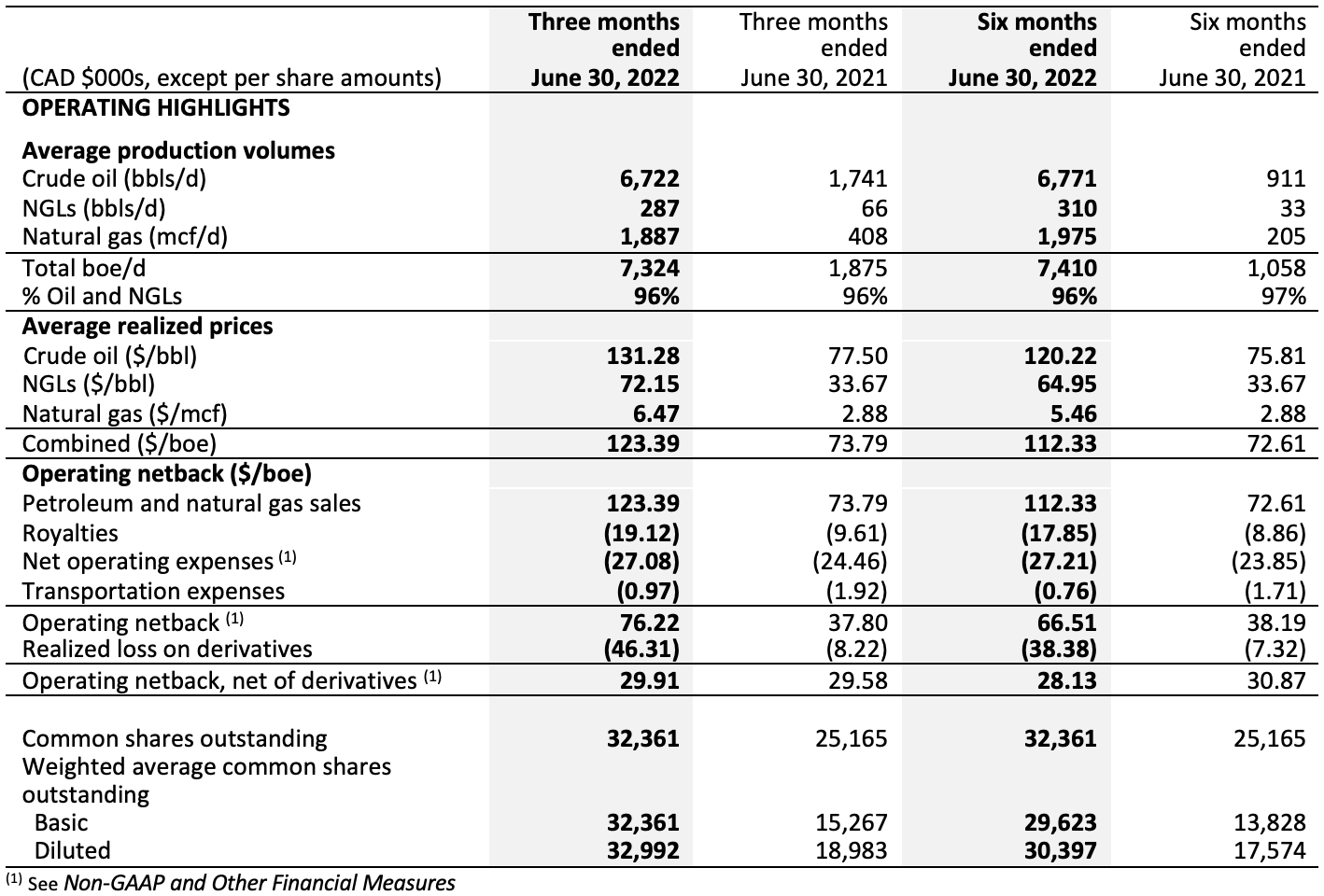

In addition to the good financial highlights from the second quarter, we also take a look at the excellent operating metrics:

Source: saturnoil.com

It continues with Viking and Oxbow

Saturn took another major step toward increasing light oil production in the second quarter of 2022 by signing the definitive agreement regarding the Viking acquisition completed on July 6, 2022. As a result, high quality output increased again by approximately 4,000 boe/d. Key to the operational success are low royalties and low operating costs, resulting in consistently strong cash flows at the newly developed properties. The Viking acquisition is a strong strategic fit with Saturn's existing Viking operations, adding 138 drilling locations on 140 sections of land.

The Company completed three horizontal wells in the second quarter of 2022 with a 100% success rate targeting Frobisher light oil at the Oxbow asset. Overall, drilling and oilfield activities during the said period were impacted by high precipitation weather, intermittent power outages and the usual road closures during early spring in Canada. Saturn acquired extensive seismic data in the Manor area following up on the two powerful horizontal wells drilled in the first quarter of 2022. Given the success to date and evaluation of the acquired seismic data, the Company has identified up to approximately 10 Tilston well locations in the Manor area on Saturn's Oxbow land holdings that will be a focus for future development.

Outlook: Cash flow in excess of CAD 200 million on the books starting in 2023

With the completion of the Viking acquisition on July 6, 2022, the new properties collectively represent 35% of the Company's total oil production. Viking is thus a major business unit generating a lot of free cash flow. The Company has budgeted a total of up to 23 horizontal wells at the Viking asset, making Oxbow the most important growth area for Saturn, with up to 30 horizontal wells budgeted for 2022.

As a result of strong operating results to date, the Company's above guidance is reiterated that average production in the fourth quarter of 2022 is expected to be 12,300 to 12,700 boe/d. Current production following the closing of the Viking acquisition is in excess of 11,000 boe/d based on field estimates. The transaction, now finalized in July, again raises the most recently revised guidance for adjusted cash flow in 2023 to CAD 223 million, or approximately CAD 3.98 per share. As the last hedging transactions were executed when WTI price levels were USD 110-120, profits from the derivative positions can be expected in the next quarters. Management could hardly have timed it better to lock in the strong economics of the Viking deal. This reinforces the positive visibility of the completely reorganized company, which was also able to lock in forward sales during a difficult period.

Dr. Thomas Gutschlag (founder of Deutsche Rohstoff AG) nominated for the board

Another positive announcement: Dr. Thomas Gutschlag, the former CEO and current Chairman of the Supervisory Board of Deutsche Rohstoff AG is nominated to join the Saturn Oil & Gas team as a new member of the Board of Directors. Dr. Gutschlag had co-founded Deutsche Rohstoff AG and successfully managed it since 2007. Under his aegis, the IPO of what was then Germany's first commodities conglomerate was successfully completed. During the subsequent period, Dr. Gutschlag also placed bonds with a volume of more than EUR 200 million and helped Deutsche Rohstoff AG achieve international success. The Company reached a market capitalization of more than EUR 160 million in 2022. After the Annual General Meeting in June 2022, the experienced manager moved to the Company's Supervisory Board and handed over the reins to his colleague Jan-Phillip Weitz.

For Saturn Oil & Gas, the addition of Dr. Thomas Gutschlag is a highlight, as European investors in particular have known him as a very successful manager for over 15 years. He will also be able to contribute his international and specific knowledge of the commodity markets to Saturn in a way that adds value. In particular, Dr. Gutschlag has extensive experience in capital markets in North America and Europe. The Company will be able to benefit greatly from this addition.

Interim conclusion: The sails are set

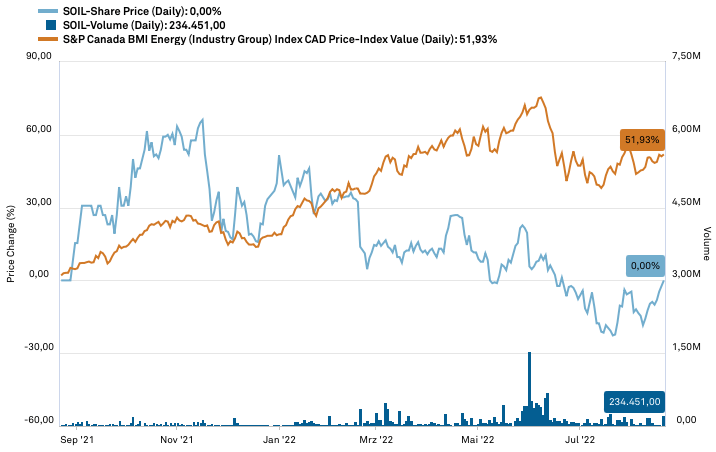

With the figures now known, the cash flow figures confirmed once again, and the positive growth in management, a new era could now be dawning for Saturn Oil & Gas. In the figures, we are adopting the most recently reported production figures, and the new guideline for the end of 2022 is: 12,500 boe/d. We will see what ideas Dr. Gutschlag will come up with, as he had already proven perfect timing with his US purchases during the oil crisis in 2008.

The current price level of about CAD 2.65 is below the last financing and also about 20% away from the next exercise hurdle of the warrants. Thus, this level should hold as a lower limit in the medium term. Current price targets of the last research studies were between CAD 7 and 12. The share should stand at this level in 24 months at the latest.

The update is based on our initial Report 11/21