Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 19.04.2023 | 04:44

Stock News: Infineon AG - Chips, chips, chips

With the shutdown of nuclear power plants in Germany, there is a huge need for additional energy sources and types of generation. In Berlin, renewable solutions are favored, although fossil fuels have been increasingly used since the Ukraine crisis began. The semiconductor industry is integral to the Greentech wave because many intelligent chips are needed to control charging cycles, energy storage and battery management systems. Today, an electric vehicle is operated with 4 times the computing power of a conventional combustion vehicle of the last generation. The semiconductor specialist Infineon, from Munich, is ideally positioned for intelligent chips, and business is booming.

Zum KommentarKommentar von André Will-Laudien vom 17.04.2023 | 07:30

Stock news: Almonty Industries - Strategic metals for the energy transition

On the EU list of the most critical metals globally, tungsten appears with a value of 7 on a scale of 0 to 8, ranking higher than iron, cobalt, copper, and titanium. Since the Russian invasion of Ukraine, demand for the rare element has increased again, as tungsten is used as a hardening metal in alloys for the defence and high-tech industries. In 2024, an additional 5% of the world market volume will come from the South Korean Sangdong mine, further contributing to the depleted supply market. This is an important milestone for Almonty Industries.

Zum KommentarKommentar von André Will-Laudien vom 14.04.2023 | 04:44

Stock news: ThyssenKrupp is planning the big hit

It is finally happening! The era of nuclear power plants in Germany has come to an end. The new government in Berlin is sticking to the coalition decisions of 2011 and will phase out nuclear power by April 15, 2023. Because of the current energy crisis, there had been a small extension, but now it is over. According to announcements by the governing Green Party, Germany will be able to generate its energy entirely from renewable sources, with nuclear energy and fossil-fuel power generation giving way to sustainable wind, solar and hydroelectric power plants. Hydrogen is to be a new addition to the game. It is now being used as an energy wildcard for all problems. But how long will it take to make industrial production sufficiently affordable? With its H2 subsidiary Nucera, ThyssenKrupp will play a major role in the race against global warming.

Zum KommentarKommentar von André Will-Laudien vom 12.04.2023 | 07:30

Stock news: Barrick Gold - If not now, when?

With a gold price of USD 2,032, there was a noticeable jolt through the precious metal community at the beginning of April. This is because the price came very close to the important mark of USD 2,050, the double high from 2020 and 2022. In addition to manifested inflation, poor economic development and emerging crises in the financial sector, there are currently many reasons that speak for higher precious metal prices. Especially in times of political instability, investors are looking for a "catastrophe hedge" in their portfolio. Over the past 25 years, gold has gained 8.6% per annum, offsetting any loss of purchasing power. Now the technical barriers are in place - if they fall, there is no stopping producers like Barrick Gold.

Zum KommentarKommentar von André Will-Laudien vom 12.04.2023 | 04:44

Stock news: Globex Mining ready for the gold rally

High inflation, geopolitical risks and political upheavals are the breeding ground for rising precious metal prices. A key driver for the rising demand for gold is the price development on the foreign exchange market. Due to the recent disappointing economic data and recent turbulences in the banking sector following the bankruptcy of several regional banks in the US, the US dollar has depreciated significantly. As a result, gold is becoming cheaper on the world market, which is boosting demand. In March 2023, the bankruptcy of Credit Suisse noticeably startled investors and pushed the price of the troy ounce near the old high from 2011. The technical breakout is still to come, but momentum is high and the underlying conditions promise a new cycle for precious metals - good news for Globex Mining's portfolio. Over 200 projects are delivering cash flow and need to be revalued by the market!

Zum KommentarKommentar von André Will-Laudien vom 03.04.2023 | 04:44

Stock news: Tocvan Ventures on the rise

Interest rates and inflation have remained at a high level for several months. Due to the constant loss of purchasing power, wage and salary payments will likely have to be increased more than employers would like following various strikes. This could set in motion a wage-price spiral leading to further price indicator increases. Precious metals are a classic hedge against monetary devaluations, as they have been for 100 years. It should only be a matter of time before gold and silver can rise to new record highs. We see the current timing as an excellent entry point into the precious metals. Tocvan Ventures is making great strides in Mexico, and the share price is finally showing muscle.

Zum KommentarKommentar von André Will-Laudien vom 28.03.2023 | 05:30

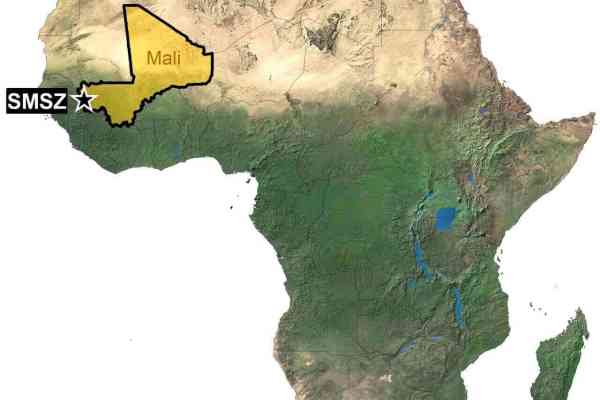

Stock news: DESERT GOLD - Takeover fantasy with rising gold prices

Since the resurgence of the banking crisis in 2023, precious metals have again been in high demand among investors. In anticipation of a further manifestation of inflation, investors are looking with hope for value stability. The fact is that since the end of the 1990s until today, gold could achieve 8.6% growth per year, more than any other asset class over such a long period. The criterion "value stability" is therefore historically proven because gold appreciated strongly in the last 100 years also against any form of paper money. Gold has already gained about 8% since the beginning of 2023. Commodity fund manager Leigh Goehring is pessimistic and even expects a "decade of inflation". We are looking at an interesting gold project in Western Mali with outstanding prospects.

Zum KommentarKommentar von André Will-Laudien vom 15.03.2023 | 04:44

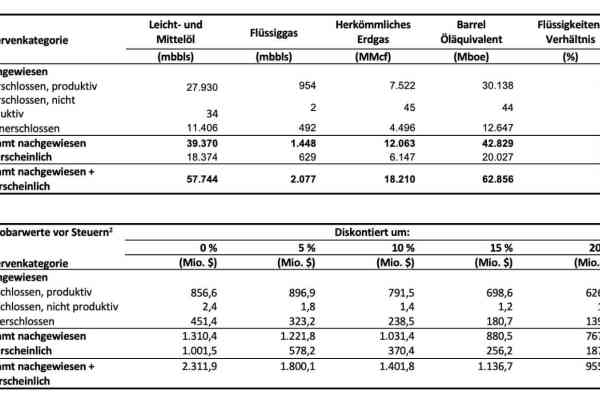

Stock news: Saturn Oil + Gas - Strong reserve expansion reported

Again good news from Saskatchewan. Shortly after the successful acquisition of the Ridgeback properties, Saturn Oil & Gas reports a new resource estimate that does not even include the new assets. Rather, year-end 2022 shows how much injected and proved reserves have increased since the Oxbow and Viking expansions. Net asset value per share rises to CAD 6.92, just shy of analysts' price targets. We do the math.

Zum KommentarKommentar von André Will-Laudien vom 01.03.2023 | 13:30

Stock news: Saturn Oil + Gas - The deal is in the bag

Despite climate change, the world is still heavily dependent on fossil fuels. There is already a political consensus in Europe that these will soon no longer be used primarily in combustion engines. Nevertheless, there is a global understanding that mobility alone cannot be responsible for all changes. Instead, it must be a complete transformation of industry, energy production and human consumption patterns. Saturn Oil & Gas is meeting a small portion of the world's oil and gas needs with a strong focus on sustainable production. We provide an update from Calgary.

Zum KommentarKommentar von André Will-Laudien vom 23.02.2023 | 04:44

Stock news: BASF - Gas crisis, which gas crisis?

An important component of the global effort to protect the climate is clean energy generation and storage. Efficient electricity use requires high-performance storage systems that allow energy to be used regardless of the time of day. The chemical industry has been working for decades on processes that enable more efficient exploitation of our resources. For the chemical giant BASF from Ludwigsburg, Germany is not an easy terrain for innovative research and development due to its high-cost structure. We provide an update from Ludwigshafen.

Zum Kommentar