Deutsche Bank - The first half year had its qualities

Looking back at the half-year results, Deutsche Bank can be pleased about the highest after-tax profit since 2011. In the second quarter, pre-tax profit rose 33% YOY to EUR 1.5 billion, while after-tax profit increased 46% to EUR 1.2 billion. The after-tax return on average equity (RoE) reached 7.1% in the second quarter, up from a low of 4.9% in 2021. The cost/income ratio improved to 73%, up from 80% in the second quarter of 2021. In the core bank, which includes all four business units excluding the capital release unit (CRU), pre-tax profit rose 21% YOY to EUR 1.7 billion in the second quarter.

"With the highest half-year profit since 2011, we have once again proven that we can increase our revenues and earnings even in a difficult environment," says CEO C.Sewing.

The results after six months read even better. Here, after-tax profit increased by a full 31% to EUR 2.4 billion. The after-tax return on average equity (RoE) rose from 5.8% to 7.2% in the same period. Ordinary income increased by 6% to EUR 6.6 billion, while noninterest expenses decreased by 1% to EUR 4.7 billion. The core business areas made varying contributions to the core bank's profit growth. For example, the corporate bank doubled its profit to EUR 534 million, whereas income in the investment banking area increased by only 1% to EUR 1.1 billion. Nevertheless, this area remains one of the earnings pillars. Private Banking finally earned money again with EUR 463 million, after this division remained narrowly in the red in the previous year. In the newly identified target area of asset management, profits fell by 6% to EUR 170 million, which was of course also due to the sharp reduction in assets under management.

ECB's fight against inflation should be in focus

Due to the extremely high inflation, Deutsche Bank CEO Christian Sewing is calling for a determined countermeasure in monetary policy. Overall, he believes that the German economy has enough resilience to cope well with the expected recession, but this requires central banks to act quickly and decisively now. In this respect, a very important meeting of the European Central Bank will take place on September 8, 2022. The pressure is accordingly great to raise interest rates in the euro area significantly, because inflation in the euro area climbed in August to a record high of 9.1%. Economists expect a further climb in the coming months, which, on the other hand, will place a heavy burden on refinancing conditions for SMEs via the interest rate side. In addition, there is a rising insolvency rate, which has not yet been visible due to public bridge measures.

"Many people can still fall back on their savings to cope with higher prices - and many companies are still adequately financed. But the longer inflation stays high, the greater the pain and the social dynamite will become," Sewing warned on the sidelines of the banking summit. The president of financial regulator BaFin, Mark Branson, summed up: "At the moment, the loan books are healthy." But money houses must be managed in such a way that not every loan default is a disaster, said the head of the Federal Financial Supervisory Authority.

Risk provisioning in the lending business: The climate is getting rougher

Loan loss provisions rose to EUR 233 million in the second quarter, up from EUR 75 million in the same quarter of the previous year. The bank had made net reversals of EUR 36 million here in the same period of the previous year. This development reflects deteriorating macroeconomic conditions, which were only partially offset by improvements in other portfolio parameters. Provisioning for non-performing loans increased from EUR 111 million to EUR 181 million in the same period, mainly due to the absence of major releases as in the previous year.

"Given the resilience we have demonstrated in the first half of the year, we reaffirm our earnings guidance for 2022, which we had raised earlier this year."

The bank continues to expect its provision for loan losses to be approximately 25 basis points of average loans in 2022. This expectation is measured against the current uncertain environment, including management's belief that economic conditions could deteriorate further.

Outlook to 2025: Uncertainty dominates

Deutsche Bank confirms its revenue expectation of EUR 26 billion to EUR 27 billion for the full year 2022, despite the fact that the macroeconomic environment deteriorated in the second quarter, and the bank expects a challenging second half. As a strategic guideline, it has fixed on generating fee income, mainly from its investment banking and wealth management mandates with affluent clients. **These business lines have been strongly expanded and are now among the main pillars of the Company's operating performance. However, it is precisely here that there could be declines, as the weak capital markets mean that less commission income is expected.

The bank also reiterates its intention to further reduce costs and implement its 2022 plan. However, it faces increasing cost pressures due to factors outside its control. These include higher than expected bank levies, inflation, unforeseen costs related to the war in Ukraine, and litigation. In addition, the Bank has decided not to cut strategic investments in its control functions, personnel, and technology to drive efficiency and growth. These investments are important in view of the Bank's long-term strategy, which it presented at the Investor Day on March 10, 2022.

In light of the earnings and cost development, Deutsche Bank has updated its financial targets for 2022: The bank continues to target an after-tax return on average tangible equity (RoTE) of 8% for the group and more than 9% for the core bank. However, it sees it as more challenging to achieve these targets due to the current operating environment.

Analyst estimates point to growth

Analysts surveyed by S&P Global Market Intelligence expect interest and fee revenues to reach EUR 26.3 billion by the end of 2022, roughly equivalent to a 3.5% increase. Consistent cost reduction programs within the ongoing transformation will result in an increase in pre-tax profit from EUR 3.39 billion to EUR 5.23 billion. The most extensive measures today are still branch closures and mergers of locations. In its multi-channel setup, Deutsche Bank will thus be less available on the ground and more available digitally. In line with the increase in net income, earnings per share (GAAP) will also develop from currently EUR 0.93 to an estimated EUR 1.64 in 2023. Over a period of four years, the price/earnings ratio will thus decrease to around 5.2 after 27.4 in 2020. There will also be a regular dividend again. After a distribution of EUR 0.20 for 2021, the yield is to be developed successively to between 7 and 9%. These figures are based on the current share price of EUR 8.15.

Conclusion - Strategically well positioned, but cyclical headwinds

Deutsche Bank has done its homework in internal restructuring. Unfortunately, the economic situation in Central Europe is becoming increasingly tense, which will have a lasting impact on the earnings portfolio. Management is urging policymakers to take countermeasures in the looming crisis, which will also weigh on the major bank's loan portfolio. Another cause for concern is the reduced purchasing power of private individuals, who are increasingly losing their propensity to consume due to persistent inflation and are also not making credit-financed purchases. **Although the bank is now able to achieve a positive interest margin again, the declining volume of lending is resulting in lower income from the lending business. Overall, it can be assumed that the strategic changes of recent years will bear fruit in the long term, but whether the repositioning can cushion the war's short-term consequences remains questionable. A bank per se can only do good business in a friendly economic environment. The investment banking, asset management and entrepreneurial bank units in particular are therefore likely to face even tougher times.

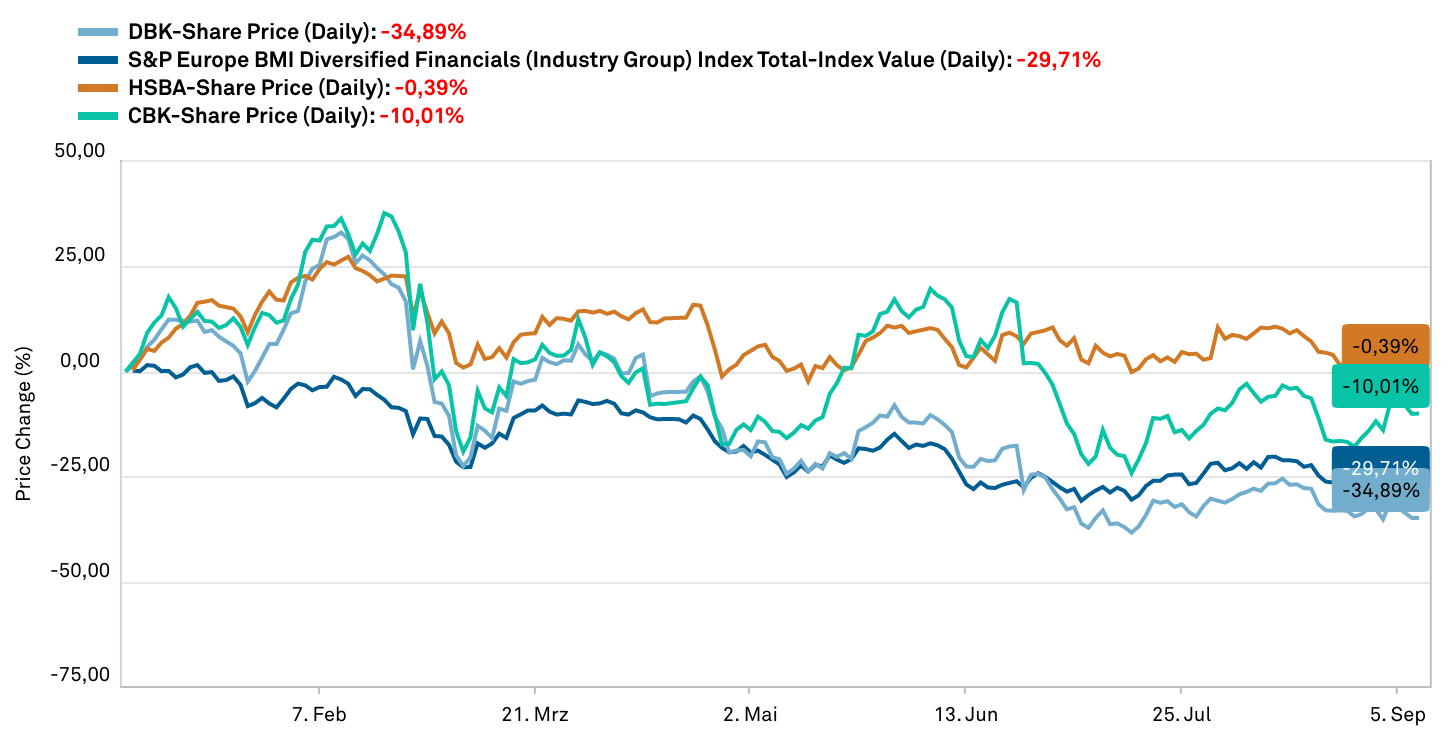

Chart-wise, Deutsche Bank's share price reached a new low of EUR 7.53 in July. Compared to its peers Commerzbank and HSBC, it shows a glaring underperformance of 28% to 35% since the beginning of the year. The share price is also down 22% compared to the European sector index. There is a need to catch up here.

A slightly positive performance for the year had already been expected in February, but this has now been significantly revised following the Ukraine conflict. Nevertheless, the share is trading at around only one-third of its book value. The 18 analysts surveyed by S&P Global Market Intelligence see an average 12-month price target of EUR 11.40, with highs and lows marking a broad range of EUR 17.30 to EUR 5.80.

This update is based on our initial report 02/2022.