Deutsche Bank - Money house back in business

A brief look at its founding in Berlin in 1870

The roots of today's commercial bank go back to the activities of founding member Adelbert Delbrück in 1869 from Berlin. With eight other representatives from the banking industry, the founding committee of today's Deutsche Bank was formed. The application for a concession to become a joint-stock company was approved by the Prussian Ministry of Trade in a preliminary decision on January 22, 1870. The process had been driven forward by Minister Itzenplitz and the benevolent Prussian Prime Minister Otto von Bismarck. On April 9, 1870, Deutsche Bank began operations in a two-story building at Französische Strasse 21. Just one year later, with 50 employees, it moved into more prestigious premises at Burgstrasse 29, in the immediate vicinity of the stock exchange.

Deutsche Bank Aktiengesellschaft is now Germany's largest credit institution in terms of total assets and number of employees. Headquartered in Frankfurt am Main, the Company operates as a universal bank and maintains major branches in London, New York City, Singapore, Hong Kong and Sydney. In 2020, it employed around 37,300 people in Germany and a total of 84,700 worldwide. The bank places particular emphasis on investment banking with the issue of shares, bonds and certificates. Under the DWS Investments brand, Deutsche Bank is the largest provider of mutual funds in Germany, with a market share of around 26%. Deutsche Bank Group ranks eighth in Europe in terms of size, far ahead is number 1, the major French bank BNP Paribas.

In Private Banking in Germany, Deutsche Bank's market share, including Postbank, was recently around 15%. After the savings banks and the group of cooperative Volks- und Raiffeisenbanken, Deutsche Bank is number three in its home country. The bank is classified as a systemically important financial institution by the Financial Stability Board (FSB) and has been on the list of globally systemically important banks since 2011. It is therefore required to have a capital add-on of 1.5 percentage points measured against Basel III standards.

It offers products and services in retail and corporate banking, transaction banking, lending, asset and wealth management, and targeted investment banking for individuals, small and medium-sized enterprises, corporations, governments and institutional investors. Deutsche Bank is the leading listed bank in Germany with strong European roots and a global network.

Special role in the 2008 financial crisis

Since the outbreak of the global financial crisis in 2007/2008, Germany's leading financial institution, with a history that goes back 150 years, had made negative headlines on many occasions. However, Deutsche Bank played a special role in the Lehman scandal. Subprime loans were seen as the trigger for the global financial crisis. Poorly secured mortgages from U.S. home buyers were also bought up by Deutsche Bank, bundled into extremely complex financial products, given top ratings and resold to banks as safe investment products. When the market collapsed, the bonds became worthless in one fell swoop. Yet Deutsche Bank had long since bet internally on a crash - and demonstrably made a lot of money doing so. In 2013, the bank was sentenced to pay an initial fine of $1.9 billion to Freddie Mac and Fannie Mae, two U.S. mortgage lenders that were nationalized at the time. **In 2017, the bank reached a settlement with the U.S. authorities. Initially, the amount in question was USD 14 billion, which would have bankrupted Deutsche Bank. In the end, USD 7.2 billion in fines have been paid to the United States to date.

Another scandal for the history books

Euribor and LIBOR are abbreviations for certain reference interest rates. Euro Interbank Offered Rate (Euribor) and London Interbank Offered Rate (LIBOR) indicate the terms at which banks lend money to each other in euros and other currencies. They are considered important benchmarks for interest rates on short-term loans and larger financial transactions, such as mortgages and derivatives. In 2013, the European Commission fined six major international banks EUR 1.7 billion because some traders had manipulated interest rates. Deutsche Bank was fined the largest chunk, EUR 725 million, and was later fined a further USD 2.5 billion by British and U.S. authorities.1

Modern banking is complex and many business models turn out to be a "misstep" in retrospect. Deutsche Bank has always proactively cleared up and settled its obligations with the supervisory authorities and the courts. Today, the bank distances itself from such practices and lays the foundation for a sustainable and internationally relevant business policy. All the scandals of recent years have not only caused the bank to suffer a considerable loss of reputation, its share price and thus its stock market value also remain in the cellar. Since its high of around EUR 90 in 2007, the share price has lost around 85% over a 15-year period, even though it has rallied 180% since reaching a low at around EUR 5. Today, the market capitalization has almost reached the level of EUR 30 billion again.

Transformation to more sustainability in modern banking

Sustainable banking (also social banking, ethical banking, green banking, sustainable banking, etc.) describes a specific type of alternative private-sector banking business that pays particular attention to social and environmental concerns and is thus especially committed to sustainability. An alliance of banks with this orientation is the Global Alliance for Banking on Values.

The term sustainable banking is nevertheless not clearly defined, in media and scientific publications different terms can be found, such as social banking, social bank, ethical bank or the term Ökobank. In science, the special orientation towards values and the real economy is also emphasized. A clear distinction from social business, which goes back to Nobel Peace Prize winner Muhammad Yunus, is difficult.2

"For 150 years, we have been helping companies of all kinds do business around the world."

Sustainability is an important pillar of Deutsche Bank's transformation program. While improving sustainability criteria also requires investments, e.g. building expertise, increasing internal ecology or implementing ESG data technology, the bank does not give a concrete figure for these investments. Much of the investment is determined within the department responsible for the change of program.

Specifically, Deutsche Bank has set a goal to reduce the overall fuel consumption of its fleet and, where possible, to install solar roofs on its sites. The selection of operational vehicles is to be designed based on sustainability criteria in order to create a business case for the use of e-cars and hybrid vehicles. ESG impacts are to be made transparent within the customer business, and ESG training concepts will be implemented and certified for all consultants in 2022. The level of digitalization in service processes is to climb above the 60% mark. Within each product category, one ESG innovation has already been presented in 2021.3

Peer group of major European banks

The European banking market was considered divided until a few years ago. Large banks and local institutions use their proximity to customers to score points in personal service. Then digitization began and the cards were reshuffled. Today, it is no longer necessarily the private relationship that counts for net-savvy private customers, but rather the good accessibility and service diversity in the digitalized bank. The classic revenue generators in the personal closing business have thus been substituted in banking by transparent fees and commissions, which are calculated from the underlying transaction via a consent button. **Banks today are scalable and comparable in their product world.

In recent years, this has given rise to thousands of fintech companies that have completely digitized individual banking services and institutionalized them as specialized competencies. Examples include the various financing platforms such as crowd banking or the wave of new start-ups among neo-brokers. So, step by step, the institutions complemented their direct personal service world with digitized offerings and thus a new world of financial services with various degrees of digitization emerged. In addition to their online offering, the market leaders still rely on personal availability. The winners in this market are the institutions that can combine both worlds and still maintain people as the link between customer and account.

In the European banking sector, we find the 'Who's Who' in international banking as a peer group to Deutsche Bank. This is based on total assets. According to this ranking, Deutsche Bank is only in eighth place with EUR 1.58 trillion. The leading banks are the French and British BNP Paribas and HSBC Holdings. Both have total assets of over EUR 2.9 trillion. The only German competitor, Commerzbank, is ranked 24th on this list. Here is a brief overview shortened to the 12 largest banks:

| Rank | Bank | Country | Total assets as of June 30, 2020 in USD billion |

|---|---|---|---|

| 1 | BNP Paribas | France | 2.945 |

| 2 | HSBC Holdings plc | UK | 2.923 |

| 3 | Credit Agricole Group | France | 2.470 |

| 4 | Banco Santander S.A: | Spain | 1.766 |

| 5 | Barclays plc | UK | 1.707 |

| 6 | Societe GEnerale S.A. | France | 1.632 |

| 7 | Group BPCE | France | 1.609 |

| 8 | Deutsche Bank AG | Germany | 1.580 |

| 9 | ING Groep N.V. | Netherlands | 1.106 |

| 10 | Lloyds Banking Group | UK | 1.076 |

| 11 | UBS Group AG | Swizerland | 1.064 |

| 12 | Credit Mutuel | France | 1.045 |

Company profile at a glance

Deutsche Bank has been present in the market for a good 150 years. It covers all segments of a modern commercial bank and addresses all customer groups. In addressing and serving them, all channels of communication are open. For some time now, the Asset Management division has even had a digital investment platform, the robo-manager ROBIN. With its investment in the fund company DWS, the bank has access to Germany's largest fund-based asset manager. The bank has about 1,900 locations and manages customer assets of about EUR 1.5 trillion.

Operating performance until the end of 2021

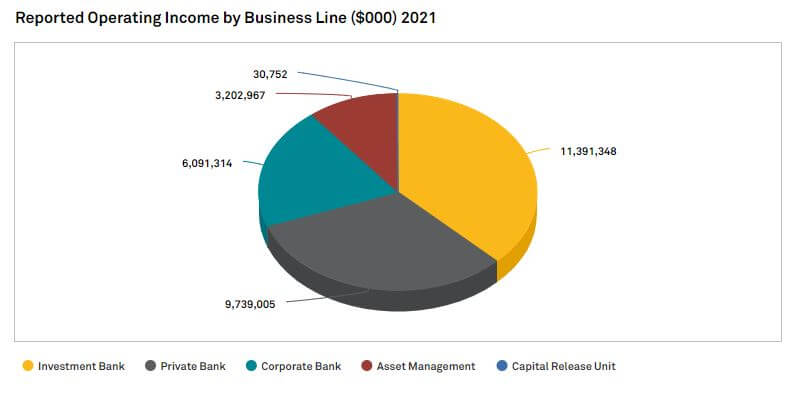

The operating revenue shares in the business units exceeded the EUR 11 billion mark in the investment banking sector, closely followed by the retail banking sector with EUR 9.7 billion. The Corporate Customers sector contributed EUR 6.1 billion, while Asset Management generated EUR 3.2 billion. At Group level, unadjusted total revenue amounted to EUR 30.0 billion and was distributed as follows:

Deutsche Bank achieved an adjusted pre-tax profit of EUR 3.4 billion in 2021, while after-tax profit reached EUR 2.5 billion and more than quadrupled compared to 2020. This was Deutsche Bank's best result since 2011. In the fourth quarter, pre-tax profit was only EUR 82 million; here, the costs for implementing the transformation were fully processed. A distribution of around EUR 700 million is planned for shareholders.

Profits increased in all four core business areas. After-tax return on average tangible equity (RoTE) was 6.4% compared to 4.0% in 2020. The capital release unit has already more than met its year-end 2022 targets in reducing risk-weighted assets (RWA). RWA were reduced from EUR 34 billion to EUR 28 billion during 2021.

The bank's revenue growth continued in 2021: Adjusted Group revenues increased by 6% to EUR 25.4 billion. The positive momentum continued in the fourth quarter, where revenues increased by 8% to EUR 5.9 billion. Already 97% of the total restructuring costs expected by 2022 have been processed with the 2021 balance sheet. The allowance for losses on loans and advances fell by 71% to just EUR 515 million in 2021. It thus corresponded to 12 basis points of the average credit volume.

"We see it as our job to help our customers navigate this complex environment and facilitate their transformation to a more sustainable economy."

Common Equity Tier 1 (CET1) ratio was 13.2% at year-end 2021. Leverage ratio (at full implementation) was 4.9%; taking into account transitional arrangements, the ratio was 5.0%. Sustainable financing and investment reached EUR 32 billion in Q4. Since the beginning of 2020, the cumulative volume amounts to EUR 157 billion, of which EUR 112 billion is attributable to 2021 alone. That means the bank is fully on track to more than achieve the target set in 2020 of at least EUR 200 billion by the end of 2023.

Deutsche Bank has lowered its leverage ratio target (assuming full implementation of regulation) for 2022 from around 5% to around 4.5%. This supports targeted growth of the balance sheet to enable higher earnings in the corporate and retail banks. In addition, this allows for higher leverage of the unit to free up capital than previously predicted in order to protect the economic interests of shareholders. The new leverage ratio target remains well above the regulatory requirement of 3.75% for 2023.

| DEUTSCHE BANK AG | 2020 | 2021e | 2022e | 2023e |

|---|---|---|---|---|

| Sales (interest & commissions) | 27.435 | 30.054 | 28.219 | 28.642 |

| Pre-tax profit (unadjusted) | 2.477 | 5.677 | 6.569 | 6.648 |

| Net profit (unadjusted) | 930 | 3.523 | .3.577 | 3.941 |

| Return on Equity (adjusted) | 1,7% | 6,3% | 6,4% | 7,0% |

| Net interest margin | 1,3% | 1,2% | 1,6% | 1,4% |

| Earnings per share (EPS in EUR) | 0,44 | 1,68 | 1,73 | 1,91 |

| Book value per share (BVPS in EUR) | 31,9 | 31,4 | 33,4 | 35,5 |

| Price-earnings ratio (P/E) | 32,2 | 8,5 | 8,2 | 7,4 |

Analysts surveyed by S&P Global Market Intelligence expect interest and commission revenue to reach EUR 28.64 billion by 2023, roughly a 4% increase. Consistent cost reduction programs within the ongoing transformation will result in an increase in pre-tax profit from EUR 2.48 billion to EUR 6.65 billion. The most extensive measures today still lie in branch closures and mergers of locations. In its multi-channel setup, Deutsche Bank will therefore be less available on the ground and more available digitally. At banks, the cost factor of personnel is still a key variable for the achievable net profit. Analogous to the increase in net profit, earnings per share will also develop from currently EUR 0.44 to an estimated EUR 1.91 in 2023. Over the course of four years, the price/earnings ratio thus decreases to 7.4 from 32.2 in 2020. Germany's largest commercial bank has successfully mastered the effects of the financial crisis and the minus interest rate phase initiated by central banks, and successfully implemented its restructuring from 2018 to 2021.

Outlook: Have the promises made in 2020 been kept so far?

At its Investor Deep Dive in Frankfurt in December 2020**, Deutsche Bank reiterated that it aims to achieve an after-tax return on tangible equity of 8% in 2022 and distribute EUR 5 billion in capital to shareholders from 2022. This is based on the progress made in implementing the transformation strategy and the good results of the core business areas with significantly improved profitability from 2020 and 2021.

To management's credit, the ECB's ongoing minus interest rate phase combined with historic bond-buying programs has weighed heavily on the margin situation in the European banking industry. As a strategic guideline, many institutions have fixated on generating commission income, mainly from their investment banking and wealth management mandates with affluent customers. These business lines have been greatly expanded and are now among the mainstays of operating performance.

"Our transformation progress and financial performance in 2021 provide a good starting point to achieve our target of 8% return on equity in 2022 according to CEO Sewing."

The Board of Directors decided on January 26, 2022 to launch a EUR 300 million share buyback program to be completed in the first half of 2022. All necessary regulatory approvals have been obtained. The Executive Board also plans to propose a cash dividend of EUR 0.20 per share for the financial year 2021. In total, this would mean a capital distribution of around EUR 700 million to shareholders - as a first step towards the previously announced goal of returning capital of EUR 5 billion to shareholders over time.

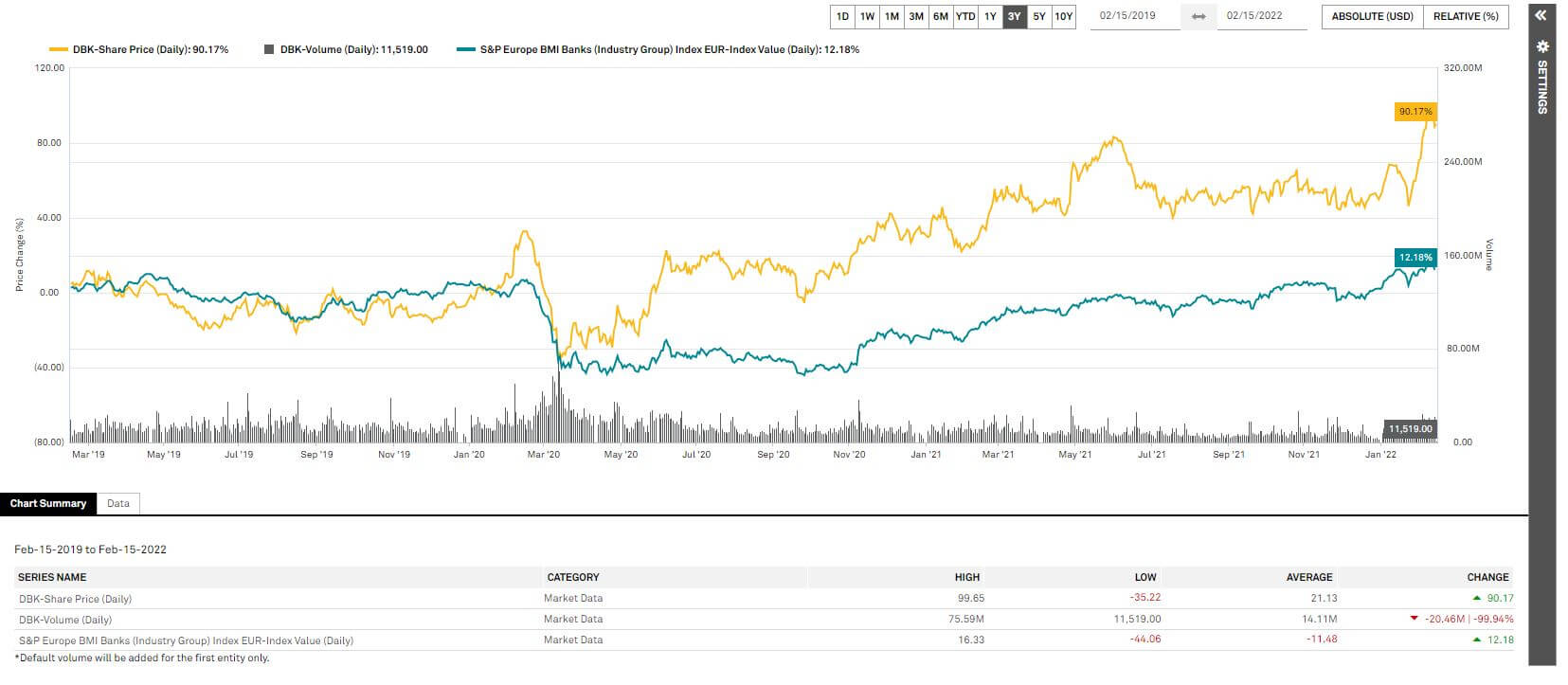

The three-year performance of Deutsche Bank shares illustrates the positive development compared to the European banking sector since the beginning of the Corona pandemic in March 2020. The initially tenacious progress to transform the Group finally bore fruit over the last 12 months. The share price outperformed its benchmark by 78%. This was achieved by very few industry players, all of whom have to cope with the pandemic conditions. Deutsche Bank is already well advanced in its development and well positioned for the interest rate turnaround that has now been heralded.

Conclusion - strategy seems to work out

In the last quarter of 2021, the credit and capital markets saw an inflation-driven turnaround in long-term interest rates. Central bank comments now also signaled an end to the historically low interest rate phase. Financing will become more expensive, and the vexed question of minus interest rates in account management will also soon be history. This discussion was a disruptive factor in the communication of banks with their best customers, who kept significant deposits in the accounts.

Banks, institutions and private individuals were provided with credit funds at virtually "zero conditions" for a long time. But at the turn of the year, the U.S. Federal Reserve announced a gradual exit from its bond-buying program. The dramatic inflation trend in 2021, with rates doubling year-on-year in some cases, is sending some warning signs to the capital markets. In January, this even shocked the U.S. statistics agency with a +7.5% month-on-month inflation rate. As a result, this boosted the 10-year mortgage rate by a full 80 basis points.

Normalization: A key earnings driver for all banks is eliminating capital alimentation by central banks. Money lending and liquidity parking are again invoiced at a positive interest rate. This principle has been completely undermined by the effects of the financial crisis since 2008 and now seems to be normalizing with the end of expansionary monetary policy.

Ceteris paribus, if interest rates continue to rise, it can be assumed that some upcoming prolongations in the SME sector will lead to an increasing insolvency rate and thus to higher valuation allowances in the loan portfolio. On the other hand, the positive effects from a significant margin expansion should be a boost for the European banking industry.

At Deutsche Bank, net interest income can be expected to show a strong upward trend in the years 2022 to 2025. As a result, earnings in the traditional banking business will also rise again. Overall, Deutsche Bank is very well positioned in the competitive European environment. The homework has been done, and the transformation of the last five years could now lead to a harvest phase. The valuation discount to the peer group is currently still too large.

Based on a 52-week low of EUR 8.98, experts expect a slightly positive share price development in the current year 2022. However, the price targets appear to be too low across the board for the new interest rate set-up on the capital markets. This is likely to deliver a few more share price surprises.