European Lithium – Europe's key to critical raw materials

The global competition for battery metals and rare earths is entering the next round. The price of lithium, the "white gold" of the energy transition, has fluctuated between CNY 50,000 and CNY 80,000 in recent years, most recently trending upward again. While China continues to dominate the supply chains for battery metals, the West is attempting to tap into its own sources in order to reduce its strategic dependence. In Europe, one name is particularly in focus: European Lithium Ltd. The Australian company has set itself the goal of becoming the first supplier of battery-grade lithium from European sources. With projects in Austria, Ireland, Ukraine, and a stake in one of the world's largest rare earth deposits in Greenland, European Lithium plays a central role in the geopolitical raw materials strategy. The EU wants to cover at least ten percent of its critical raw material needs from its own production by 2030. European Lithium's activities are perfectly in line with this goal and could make it the new shooting star in the raw materials sky.

The Wolfsberg Project – Austria's ticket to e-mobility

At the heart of the Company is the Wolfsberg lithium project in Carinthia, Austria. It is considered the first fully approved lithium deposit in Europe and forms the backbone of the planned European battery supply chain. The deposit is strategically located in the vicinity of growing battery and automotive clusters in southern Germany and Central Europe. With a long-term offtake agreement with BMW, European Lithium has secured an industrial anchor that underpins the project's economic viability. In the future, the extracted lithium hydroxide will be processed in Saudi Arabia - a step that creates competitive advantages thanks to low energy costs and logistical efficiency. If Wolfsberg goes into production as planned in 2027, it could become a symbol of European raw material sovereignty.

From Carinthia to Greenland - Investments with strategic depth

European Lithium has now developed its structure into an investment company for critical raw materials. At its heart is its majority stake in NASDAQ-listed Critical Metals Corp. (CRML), which operates the Wolfsberg project and also has a stake in the massive Tanbreez rare earth project in Greenland. Tanbreez is one of the largest approved deposits worldwide and contains high concentrations of heavy rare earths, which are indispensable for high-tech, defense, and energy technologies. CRML recently signed a letter of intent (LOI) with REalloys Inc., under which REalloys is expected to receive approximately 15% of the rare earth concentrate production from the Tanbreez project for 10 years.

Executive Chairman Tony Sage comments: "Tanbreez is one of the most strategically important rare earth projects in the world. This offtake agreement marks another significant step into the US market and paves the way for expanded supply within American processing networks. Our partnership with REalloys underscores our shared goal of building a resilient, fully independent supply chain that reduces dependence on China and strengthens North America's industrial future."

Through partial sales of Critical Metals shares, which have recently appreciated significantly, European Lithium has recently generated approximately USD 50 million in fresh capital without diluting its shareholders, a masterstroke of financial strategy. A share buyback program launched at the same time highlights management's confidence in the intrinsic value of the Company. The valuation gap between the balance sheet value and the stock market price could thus increasingly close.

New projects in Europe – Focus on Ireland and Ukraine

In addition to Austria, European Lithium is working on expanding its European portfolio. In Ireland, the Leinster Lithium Project was acquired, which has historical drill holes with high lithium grades of up to 3.75% Li₂O. The project is considered one of the most promising hard rock deposits in the EU. It is now the focus of international partners, including the Chinese group Ganfeng, which is currently reevaluating the area. European Lithium also owns two properties with considerable potential in Ukraine. Once the political situation stabilizes, Dobra and Shevchenkivske could become key factors in European raw material supply. The reopening of the Australian embassy in Kyiv and Western investment plans indicate that Ukraine could become an important location for critical metals in the long term.

Lithium remains the bottleneck of the energy transition

Despite short-term price fluctuations, lithium remains one of the scarcest and most important raw materials of the coming decades. Studies by the International Energy Agency predict a tenfold increase in demand by 2050. The rapid expansion of electromobility and stationary energy storage in particular is driving this trend. While North America and Europe are attempting to stabilize their supply chains through their own mining projects, China remains the clear leader, accounting for around 80% of global lithium hydroxide production. Projects such as Wolfsberg are therefore becoming increasingly important, not only economically but also strategically. Their ESG-friendly approach to mining without chemical additives is fully in line with the environmental requirements that are increasingly becoming a prerequisite for mining permits in the EU.

Conclusion: Rapid development shows further need for reassessment

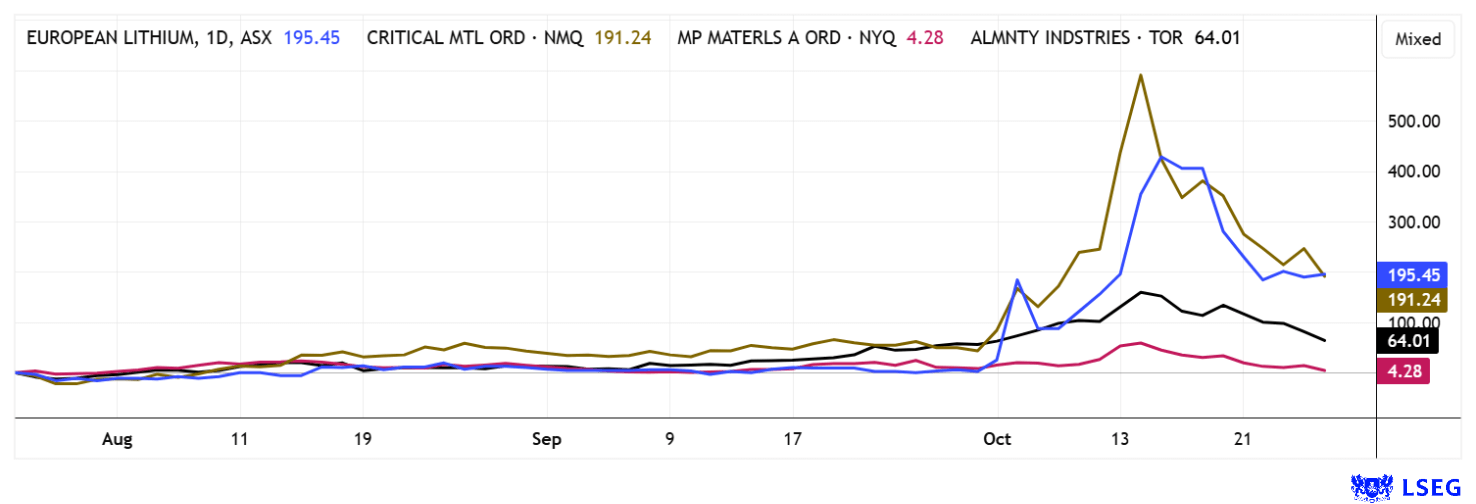

European Lithium exemplifies Europe's attempt to achieve technological independence in critical raw materials. With the Wolfsberg project nearing production readiness, its stake in Critical Metals, and access to rare earths in Greenland, the Company possesses substantial value that is not yet adequately reflected on the stock market. Management is making targeted use of capital measures to address this undervaluation. A comparison of charts since October shows the rapid adjustment of prices within the sector.

In recent trading days, both CRML and European Lithium have seen large price swings after market participants speculated about possible US government involvement in critical metals projects. CRML CEO Tony Sage comments on this in a recent interview with Lyndsay Malchuk at the International Investment Forum. youtu.be/4LsysG1g0xo

With a market capitalization of AUD 400 million or USD 260 million, the value of European Lithium shares currently reflects a significant discount to its remaining 53.04 million shares in Critical Metals. At prices around USD 13, the 50% stake is valued at USD 689 million. It can be assumed that a value adjustment will take place in the coming months. Against this backdrop, European Lithium shares represent a bargain among traded companies with active stakes in critical metal projects.

This update follows our initial report on European Lithium dated December 27, 2024

researchanalyst.com/en/report/european-lithium-ltd-the-winning-trump-share.