Focus on multiple sclerosis – Breakthrough with cladribine

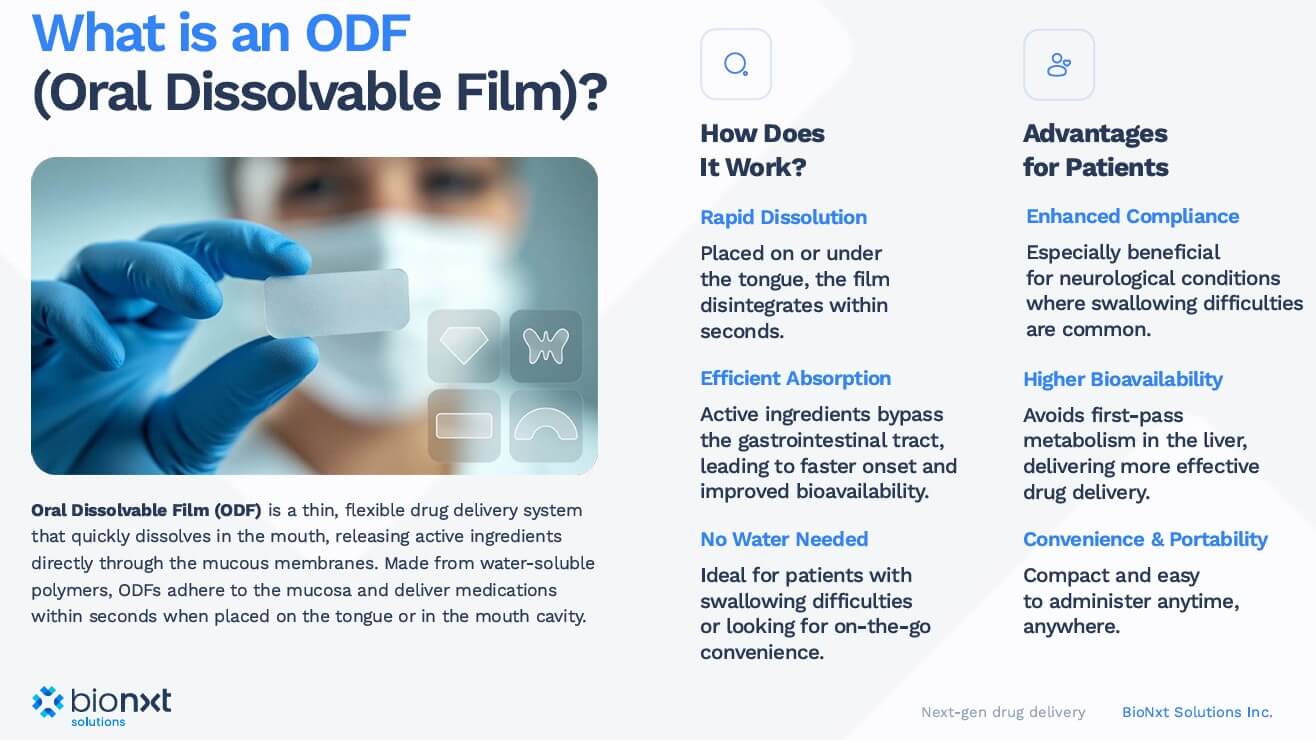

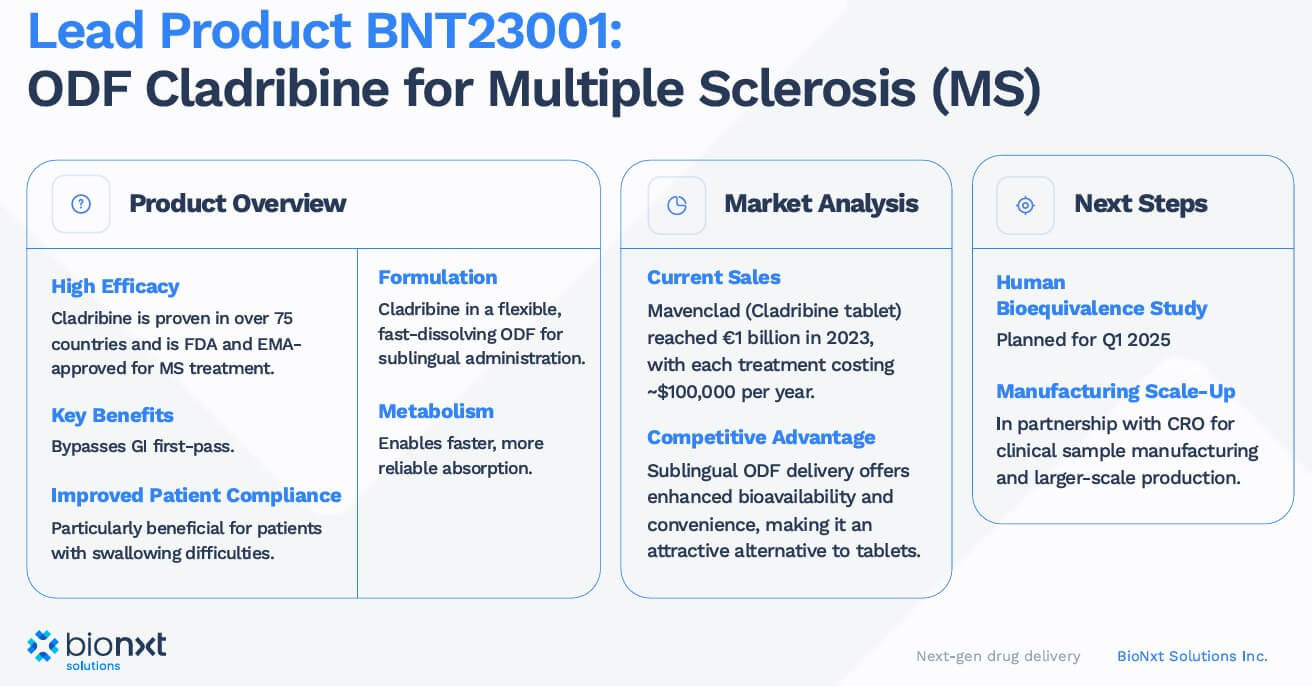

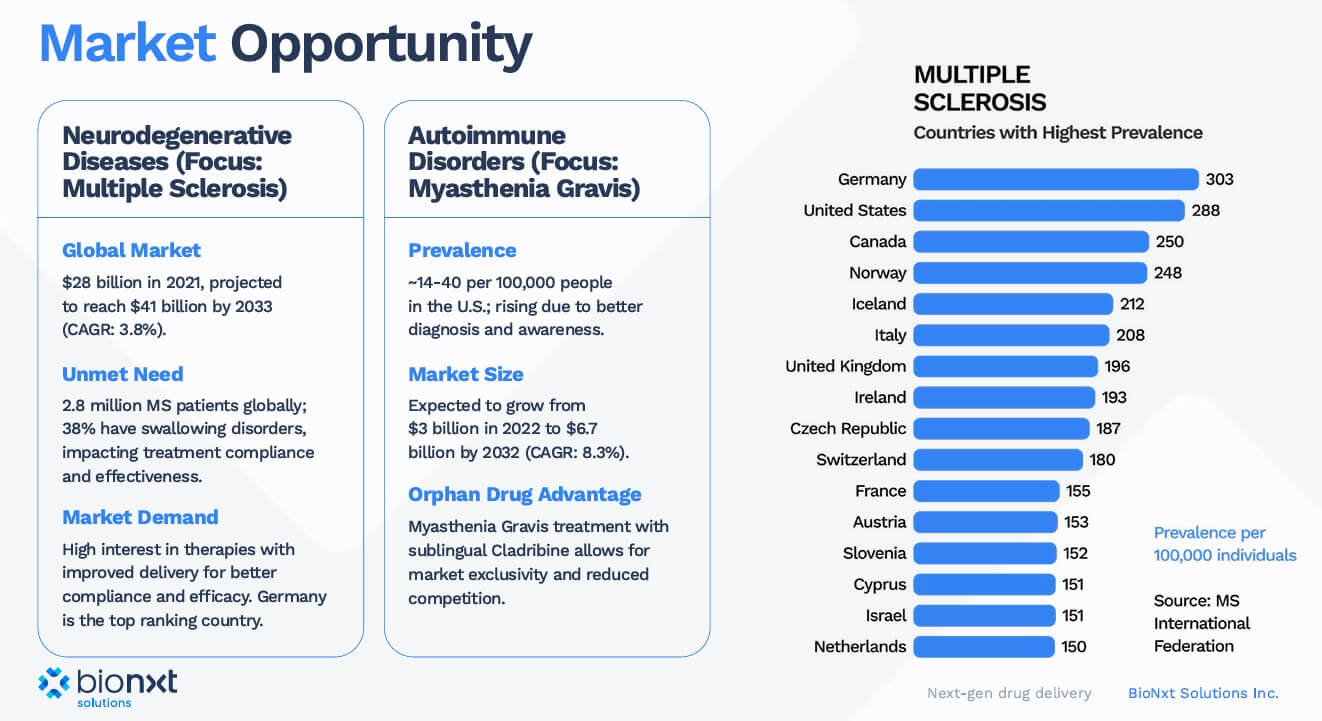

The lead project, BNT23001, is a sublingual oral dissolvable film formulation of cladribine. Until now, cladribine has been administered as a tablet (trade name Mavenclad, Merck KGaA), which is absorbed through the digestive tract. However, many MS patients suffer from dysphagia, or swallowing disorders, which makes oral intake challenging. BioNxt elegantly circumvents this problem: the active ingredient is absorbed directly into the bloodstream via the oral mucosa, eliminating the burdensome route through the stomach, intestines, and liver. This not only improves patient adherence but also enhances bioavailability.

A glance at industry shows that there is enormous potential here: companies such as Roche and Biogen generate billions in revenue with drugs for MS. Ocrevus (ocrelizumab) brought Roche around USD 7.6 billion in 2024, while Tecfidera (Biogen) brought in USD 4.4 billion, but is increasingly being replaced by generics after the patent expired. Biogen's Tysabri (with sales of USD 2 billion) and Novartis' Gilenya (also with sales of around USD 2 billion) have also lost their patent protection. These patent expirations are intensifying competition and making new approaches, such as BioNxt's, particularly valuable. With a successful bioequivalence study in Europe, BNT23001 could quickly gain market share, particularly in areas where existing therapies are losing their patent protection.

Patent applications in the home stretch

BioNxt has strategically secured its intellectual property rights. In early August 2025, it was announced that both the European Patent Office (EPO) and the Eurasian Patent Organization (EAPO) had accepted the core claims for cladribine melt films. This means that formal patent granting is imminent. Applications are also pending in the US, Canada, Japan, Australia and New Zealand. Of particular interest is the fast-track procedure requested in the US, which shortens the Patent Office's decision to a maximum of twelve months. This means that BioNxt could expect to be granted a US patent as early as spring 2026 – in the world's most important pharmaceutical market. Even more crucially, the patent covers not only cladribine, but the entire platform technology for sublingual drug delivery. This opens up a potential window of protection well into the 2040s – a massive competitive advantage.

Strategic opportunities in competition

The big players are not sleeping either. Merck KGaA is currently testing cladribine in a Phase III study for the rare autoimmune disease myasthenia gravis. This confirms the medical relevance of the active ingredient far beyond MS. For BioNxt, this could result in both potential cooperation with Merck and the possibility of a future takeover. After all, with patents expiring, large pharmaceutical companies have an increased interest in innovative technologies that open up new revenue streams for them. Precisely because the margins of established blockbusters are shrinking due to generics, companies with young, well-protected active ingredients and platforms are becoming more attractive. BioNxt fits the bill perfectly here.

Entry into the obesity market

The next bombshell followed at the end of June. BioNxt has started developing a feasibility study for an oral disintegrating film (ODF) formulation of semaglutide. Semaglutide is a GLP-1 receptor agonist, marketed under the names Ozempic, Rybelsus, and Wegovy, and is used successfully worldwide to treat type 2 diabetes and obesity. The study will examine whether the BioNxt platform offers a user-friendly, non-invasive alternative to existing injections and large tablets. The aim is to evaluate the compatibility of semaglutide with ODF technology and to obtain initial development data for optimization and patent strategy.

Semaglutide represents a rapidly growing market, with the GLP-1 segment forecast to reach approximately USD 157 billion by 2030. The new ODF (Oral Dissolvable Film) variant could significantly improve therapy through greater comfort and accessibility, as it dissolves quickly in the mouth and is easily administered. The feasibility program includes the selection and initial testing of the active ingredient, evaluation of peptide stability and film integrity, and the collection of technical data for possible patent applications. BioNxt plans to continue the project as soon as the semaglutide active ingredient becomes available, with the aim of filing an initial patent application in the third quarter of 2025.

Anti-aging as an additional pillar

In addition to MS and obesity, BioNxt is working on further applications of its dissolvable film technology. Particularly promising is its entry into the rapidly growing anti-aging and longevity market, which is projected to reach a volume of USD 93 billion by 2027. Here, the German subsidiary Vektor Pharma TF GmbH is developing innovative thin-film preparations for hormonal and age-related indications, including the potential to prolong fertility and promote healthy aging.

Market size for anti-aging by 2027.

BioNxt is thus not only tapping into a second growth area, but also diversifying its risk and positioning itself in a future segment with double-digit growth potential.

New research center and management development

The opening of a modern laboratory in Munich marks another milestone. Here, BioNxt can leverage state-of-the-art technologies and a robust biotech cluster. ** With experienced executives such as Dr. Florian Sahr, Dr. Wolfgang Wagner, and Dr. Oleksandr Zabudkin, the management team has been specifically strengthened to accelerate research, development and business development. This combination of infrastructure, expertise, and a clear growth strategy gives BioNxt a head start over smaller competitors.

Conclusion: This could be the next takeover target

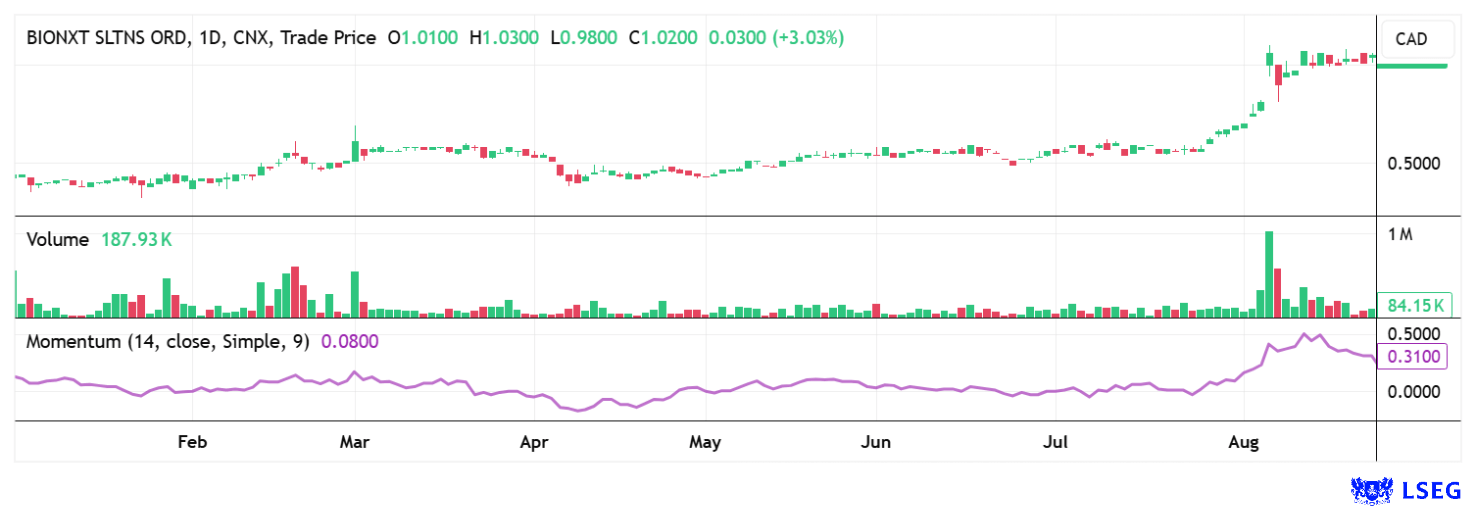

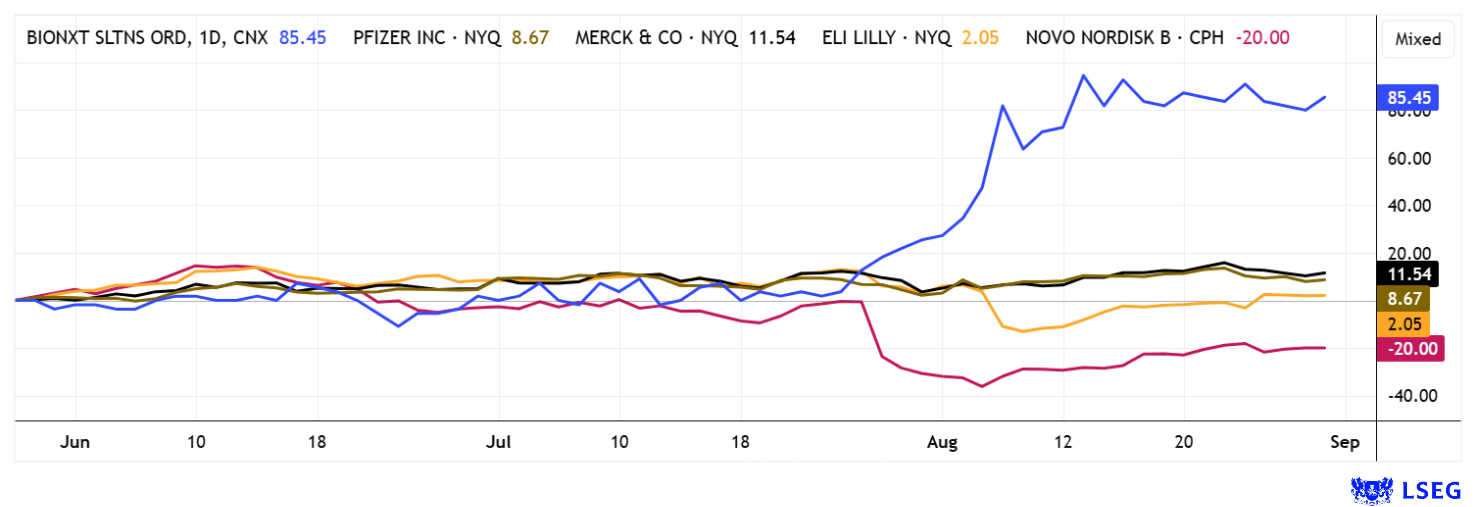

The cards are on the table: With cladribine, BioNxt is addressing a market worth over USD 20 billion that is set to grow strongly in the coming years. With its innovative dissolvable film technology, the Company is solving a real patient problem, protecting itself with a broad patent family and opening up enormous opportunities through fast-track procedures in the US. At the same time, the expansion into the obesity and anti-aging sectors is fueling additional excitement. The fact that Big Pharma is on the hunt for new blockbusters also makes BioNxt a desirable target for takeover. The stock has recently gained momentum but continues to trade below previous highs of over CAD 2. However, the current rate of increase is very impressive.

For investors with courage and foresight, this presents an opportunity to get in early on a biotech company with real commercialization prospects – and to potentially benefit from partnerships or takeover offers. To finance the projects, convertible loans totaling CAD 2.5 million have been placed in recent weeks. This is an effective tool for further growth, because if the strike price is exceeded, the bonds are converted into shares, and the Company no longer carries debt. With an eye on future markets, BioNxt currently offers an exceptionally exciting risk/reward profile.