The magic eye continues to evolve

Today, Volatus Aerospace is one of the leading players in the field of modern aerial and drone technologies for reconnaissance, logistics, and critical infrastructure monitoring. In recent years, the Canadian company has evolved from a young supplier to a highly specialized partner for government, industrial, and military clients. With deep expertise, innovative sensor technology, and more than a century of cumulative aviation experience within its team, Volatus delivers customized solutions based on both manned and unmanned systems (RPAS).

The goal is to help governments and businesses efficiently protect and maintain their complex infrastructure and security structures. In light of increasing cyber threats and geopolitical tensions, there is a growing need to monitor sensitive facilities using data and evaluate them with AI support—this is where Volatus offers state-of-the-art tools, training programs, and real-time analytics. With international partnerships such as the one with ARCO Worldwide Services for drone training in Nigeria and the cooperation with VoltaXplore to secure Canadian battery supply chains, the Company is also strengthening its global and technological independence. This creates a holistic ecosystem of technology, training, and service that offers sustainable added value to both civilian and defense customers.

Investment Highlights

Volatus Aerospace (WKN: A2JEQU | ISIN: CA92865M1023 | Ticker symbol: FLT)

- Highly specialized aerial data analysis as a unique selling point

- Development into a technical testing authority for critical infrastructure

- High security requirements of public-sector clients ensure a constant deal flow

- Global rearmament trends create strategic demand for defense-oriented solutions

- Limited competition due to complex certification and training requirements

- Significant growth potential through internationalization over the medium term

- Scaling enables exponential growth

- Highly liquid stock with a still low market capitalization of only CAD 440 million

Highly specific fields of application create exclusive space for dynamism

Just a few years ago, drones were considered toys for tech enthusiasts. Today, they are a billion-dollar tool driving industrial transformation. They monitor power lines, transport medical supplies, map terrain, protect borders, and deliver real-time data from the air. According to a recent analysis by Market.us, the global drone market is expected to grow from around USD 36 billion in 2024 to over USD 95 billion by 2034, representing annual growth of more than 10%. Key drivers include technological advancements, longer flight times, autonomous control, and the increasing integration of artificial intelligence.

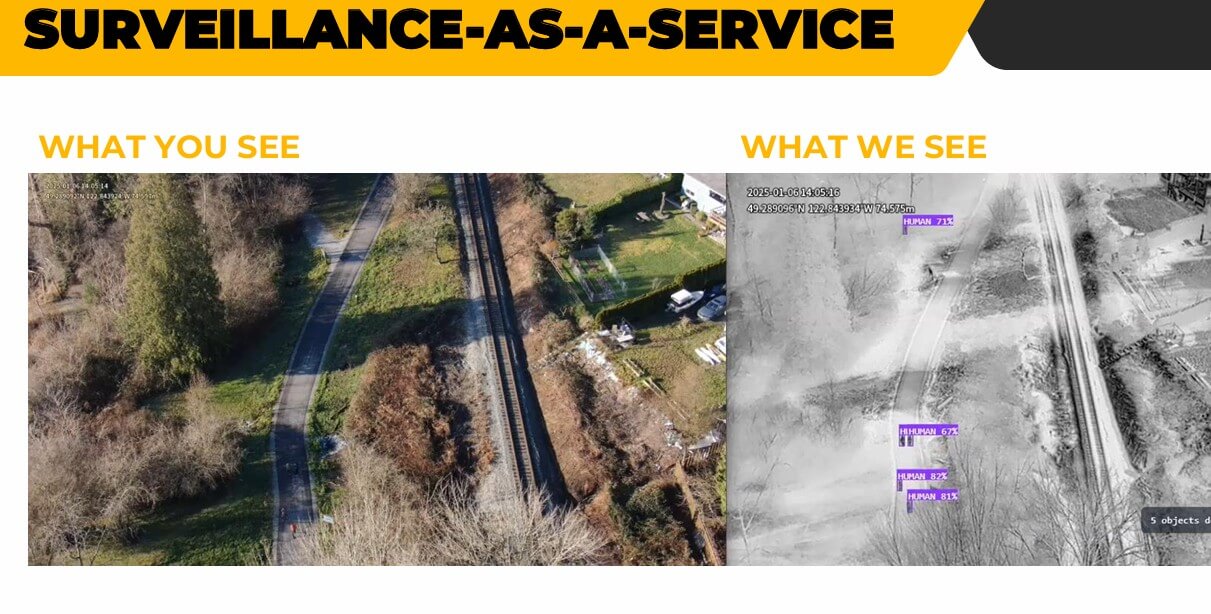

In this booming environment, Volatus Aerospace is one of the most innovative players. Using ultra-HD cameras, thermal imaging, and LiDAR sensors, Volatus drones capture vast amounts of data. The subsequent analysis is performed by AI-based software that automatically detects changes, material damage, or temperature deviations. This allows risks to be identified at an early stage and maintenance cycles to be optimized. This combination of hardware expertise and AI intelligence gives Volatus a strong unique selling point.

"*Artificial intelligence will revolutionize our inspection and analysis processes. It is the multiplier that turns data into valuable decisions*."

Global trajectory – Expansion and training as growth drivers

A key component of the Company's strategy is international scaling. Volatus has reached a milestone with its recently concluded partnership with ARCO Worldwide Services. Together, they are establishing professional drone training programs in Nigeria to certify local pilots according to international ICAO and SORA standards. Volatus is providing the Volatus Academy, a modular training program that will also be rolled out in other markets in the future. This positions the Company not only as a manufacturer but also as a provider of knowledge and technology. The training of pilots and technicians acts as a dual lever: it creates new revenue streams and, at the same time, promotes the safe, regulated use of drone technology worldwide.

Defense sector in focus: Security is becoming big business

At the same time, Volatus is expanding its presence in Europe and Africa, markets where geopolitical developments are driving increasing demand for aerial surveillance and border security solutions. NATO has already taken notice, and German Chancellor Merz also envisions billions being invested in modern drone technology. The war in Ukraine has clearly demonstrated how crucial drones have become for reconnaissance, logistics, and the protection of critical infrastructure. This development plays directly into the hands of companies like Volatus. Thanks to its comprehensive approvals for beyond visual line of sight operations, night flights, and missions in controlled airspace, Volatus is among the few providers worldwide that can become operational immediately. Cooperation agreements with Kongsberg Geospatial, MatrixSpace (radar technology), and Ondas Holdings (autonomous border security) expand the product portfolio to include key defense components. As a result, the Company’s focus is increasingly shifting toward military and security-related applications—a market with extremely high barriers to entry and long-term contracts.

Here is a recent interview with CEO Glen Lynch by Lyndsay Malchuk: "With full coffers to new growth milestones."

Conclusion: Momentum from new markets – scaling and cash flow

After years of intensive development work, Volatus has now made the leap into the scaling phase. Particularly relevant for Volatus shareholders in terms of growth is the consistent evolution from the former logistics service provider Drone Delivery Canada to a high-tech company for data, security, and aerial surveillance solutions. CEO Glen Lynch sees the potential for the next generation of autonomous drones to increasingly replace conventional aircraft and helicopters, with significantly lower operating costs and significantly improved performance parameters. With its own command and operations center in Toronto, a scalable business model, and growing order volume in North America and the NATO sphere, the signs point to dramatic expansion. The desired focus is increasingly shifting from hardware sales to high-margin service, data, and technology contracts, a move that should secure stable long-term earnings and predictable cash flows for the Company. New additions to the portfolio include defense and security solutions that allow Volatus to benefit specifically from global upgrades in aerial reconnaissance and critical infrastructure.

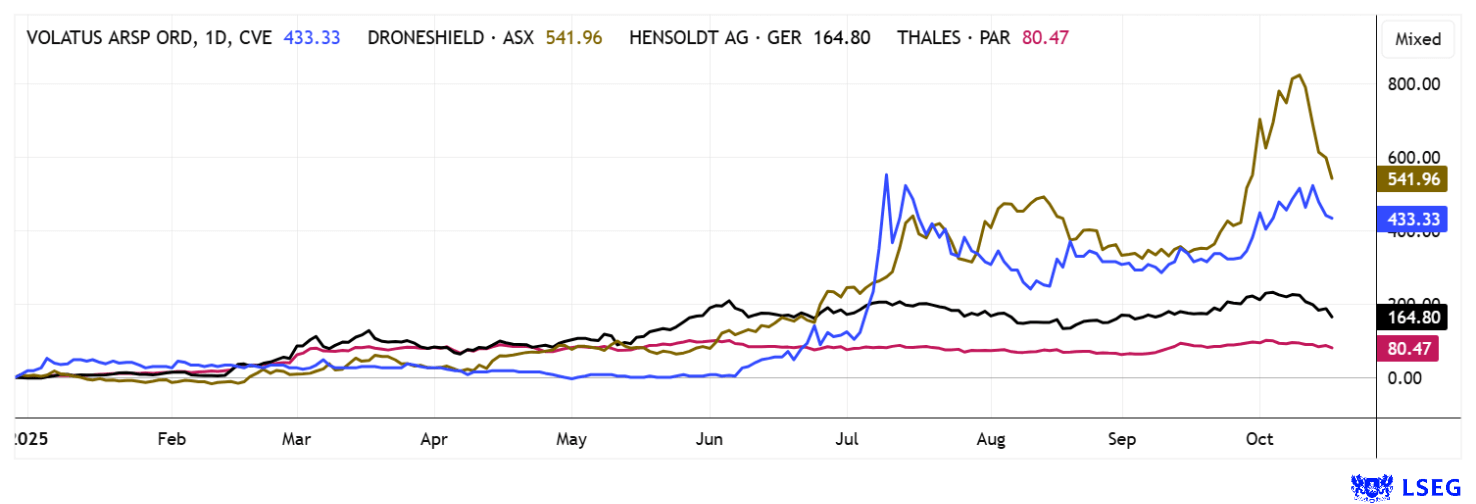

In the medium-term scenario, Volatus aims to expand international alliances, particularly in the US, Europe, and Africa, in order to accelerate market penetration. The ongoing defense projects could quickly catapult the company's valuation to new heights. Due to its hybrid structure of defense, infrastructure, and data services, the stock remains attractive compared to industry peers such as DroneShield, Hensoldt, and AeroVironment. Sustainable growth in orders and strategic acquisitions cannot be ruled out, especially as larger industry players are increasingly looking for integrated drone solutions.

Save the date: CEO Glen Lynch will represent Volatus Aerospace at the Maxim Growth Summit in New York from October 22 to 23. Together with CFO Abhinav Singhvi, he will hold numerous one-on-one meetings with institutional investors.