The current sword of Damocles is called "interest rate cut."

Taking a closer look at the current situation on the capital markets, one concludes that the impending recession in Europe and the ever-louder calls for interest rate cuts by the central banks will likely increase the pressure on prices even further. With numerous strikes, the working population is documenting its displeasure at the rapidly rising prices and is demanding double-digit wage adjustments in some cases. This sets in motion the so-called "wage-price spiral," as higher input costs at companies lead to a further passing on of increased costs to consumers. In combination with declining economic output, economists speak of a "stagflation scenario," i.e. a period of low or even regressive growth and rising price levels.

The current resource estimate is just the beginning.

On the one hand, central banks are obliged to promote currency stability, but on the other hand, the economic pressure to support a sputtering economy with falling refinancing costs also resonates. If a banking crisis is added to the mix, the dilemma for a currency guardian could not be greater. So, should the central banks initiate a new cycle of interest rate cuts in the second half of the year due to the situation, the pressure on currencies will increase. By then, at the latest, precious metal investments will likely experience a renaissance. Chart technicians have been pointing out for several months that the break of the resistance line of USD 2,050 in gold could be imminent. An increase of the precious metal quota in the portfolio should then prove to be a "golden grip".

An interesting project in West Africa

Those thinking of undervalued gold stocks should look closer at Canadian explorer Desert Gold Ventures. With the SMSZ project in Mali, Desert Gold owns one of the largest non-producing land areas in West Africa, covering 440 sq km. There are several producing mines in the neighborhood, including those of Barrick Gold, Allied Gold, Endeavour Mining, and B2Gold. More than 23 gold zones have been discovered in the area to date, which will be developed and analyzed for economic grades.

The zones on which the latest evaluations are based are located within a narrow 12 km radius in the southern half of the 440 sq km area. The current resource estimate totals approximately 1.1 million ounces of gold, with the majority in the "inferred" category, i.e. associated with a higher degree of uncertainty - a total of 769,200 ounces of gold (at a tonnage of 20.7 million and a grade of 1.16 g/t). The measured and indicated mineral resource totaled 310,300 ounces of gold at 8.47 million tonnes grading 1.14 g/t gold.

In southern Mali, on the border with Guinea, the Canadians also own the much smaller Djimbala project. There are several producing mines nearby, such as Hummingbird Resources' Komana mine, which is directly west of the Djimbala project, and Endeavour Mining's Kalana mine, which is about 18 km to the south. Initial drilling has encountered gold grades of up to 12.65 g/t at 3 m depth. However, work is currently focused on the project below.

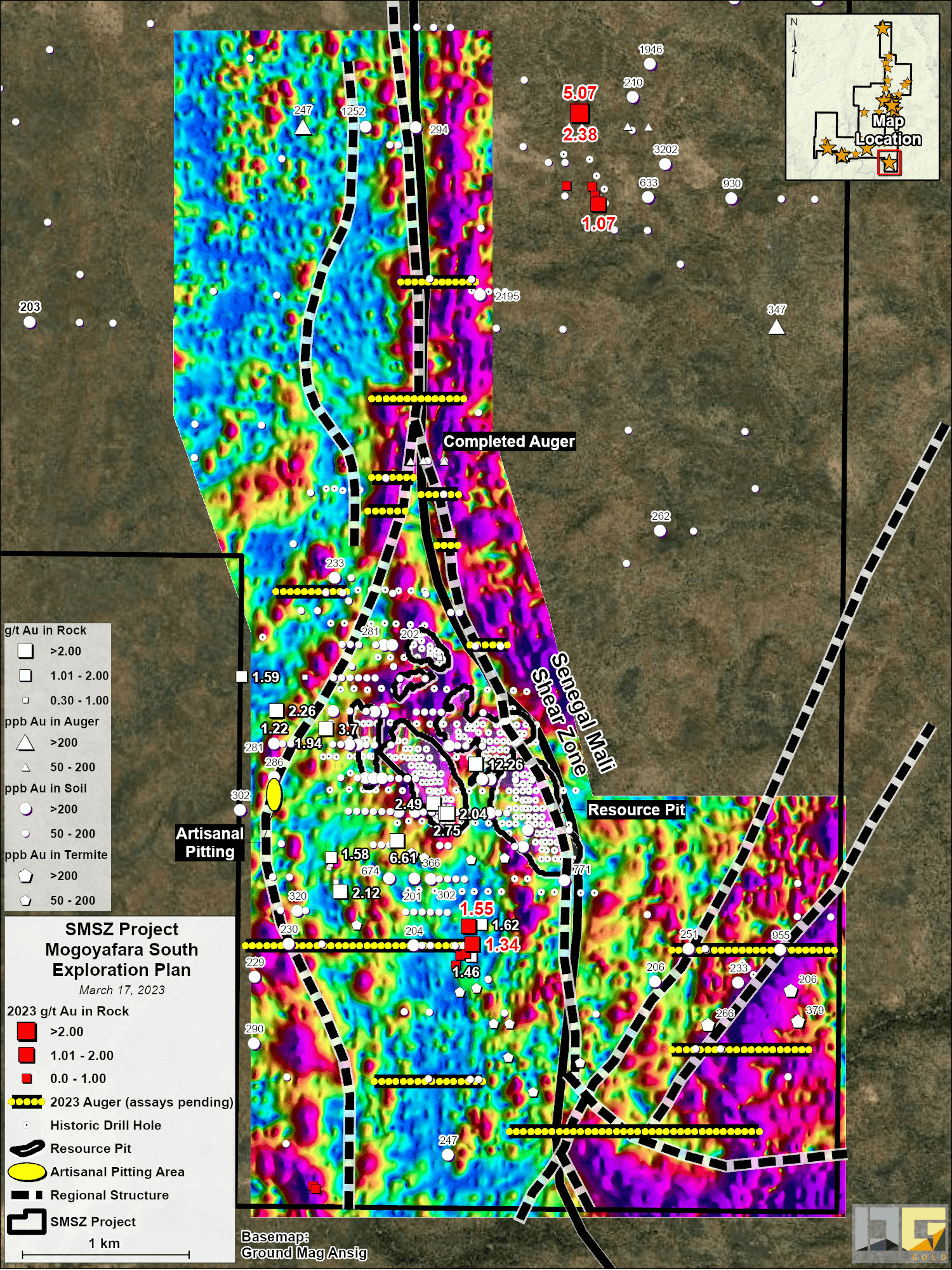

News from the Mogoyafara South and Gourbassi West North Zones

As of mid-March, Desert Gold has completed 445 drill holes in the SMSZ area covering over 2,067m on priority soil and structural targets near the Mogoyafara South and Gourbassi West North gold deposits, including commencing development of a new 400m long and 50 to 75m wide zone approximately 500m south of the Mogoyafara South gold deposit (estimated to contain 412,800 ounces of gold grading 1.05 g/t). Initial rock samples from this site have returned up to 1.55 g/t gold. Another new mining site is located approximately 1,000m east of the Mogoyafara South trend. There, samples from two 50m long and 2 to 5m wide artisanal workings have returned values up to 5.04 g/t gold.

While the extraction of gold by illegal workers through manual prospecting is a nuisance, the results of these artisanal activities provide interesting insights into the size and economics of the deposit itself. In the end, these actions help geologists in the field identify targeted drill points and more accurately determine the thickness of the resource.

Desert Gold CEO Jared Scharf: "I am always pleasantly surprised when new artisanal mining sites appear on our SMSZ concession area. This recent activity reinforces our belief that we will discover new gold zones on our property as we continue to work. I am also pleased to report that we have been able to drill more holes than planned and are still under budget."

The collected grab samples have been delivered to a contracted laboratory for analysis, and the results are currently eagerly awaited. The planned drill program totals a massive 35,000m, and neighboring producers are expected to keep an eye on Desert Gold's activities. Positive results should spread quickly. Desert Gold is working to follow up and expand known gold zones. Management believes the zones mentioned are the largest gold systems ever discovered on the SMSZ property to date.

Increased acquisition activity in the neighborhood

It had been quiet in the gold sector for a long time, but rising inflation and precious metals prices are fueling takeover fantasies worldwide. Mid-tier producer B2Gold recently made news after agreeing to a takeover with the management of neighboring competitor Oklo Resources. This draws attention to Desert Gold, as all of the aforementioned Tier 1 mines near the SMSZ project each produce more than 500,000 ounces of gold per year at very low costs of around USD 800 per ounce (AISC). B2Gold's Fekola mine is also located in the Senegal-Mali shear zone, not far from two other mines of industry giant Barrick Gold. The region is highly interesting and may be on the verge of the next consolidation. At the end of 2022, the Moroccan Managem Group struck at IAMGold. They bought their exploration projects in the tri-border area of Senegal, Mali and Guinea, also located in the Senegal-Mali Shear Zone (SMSZ). Resident Barrick Gold and B2Gold have been abundantly inactive in recent months but have full coffers. With declining remaining mine lives, new properties are needed to maintain production over the medium term. So time is ticking for Desert Gold, as each additional resource expansion increases the potential takeover price if a deal is struck.

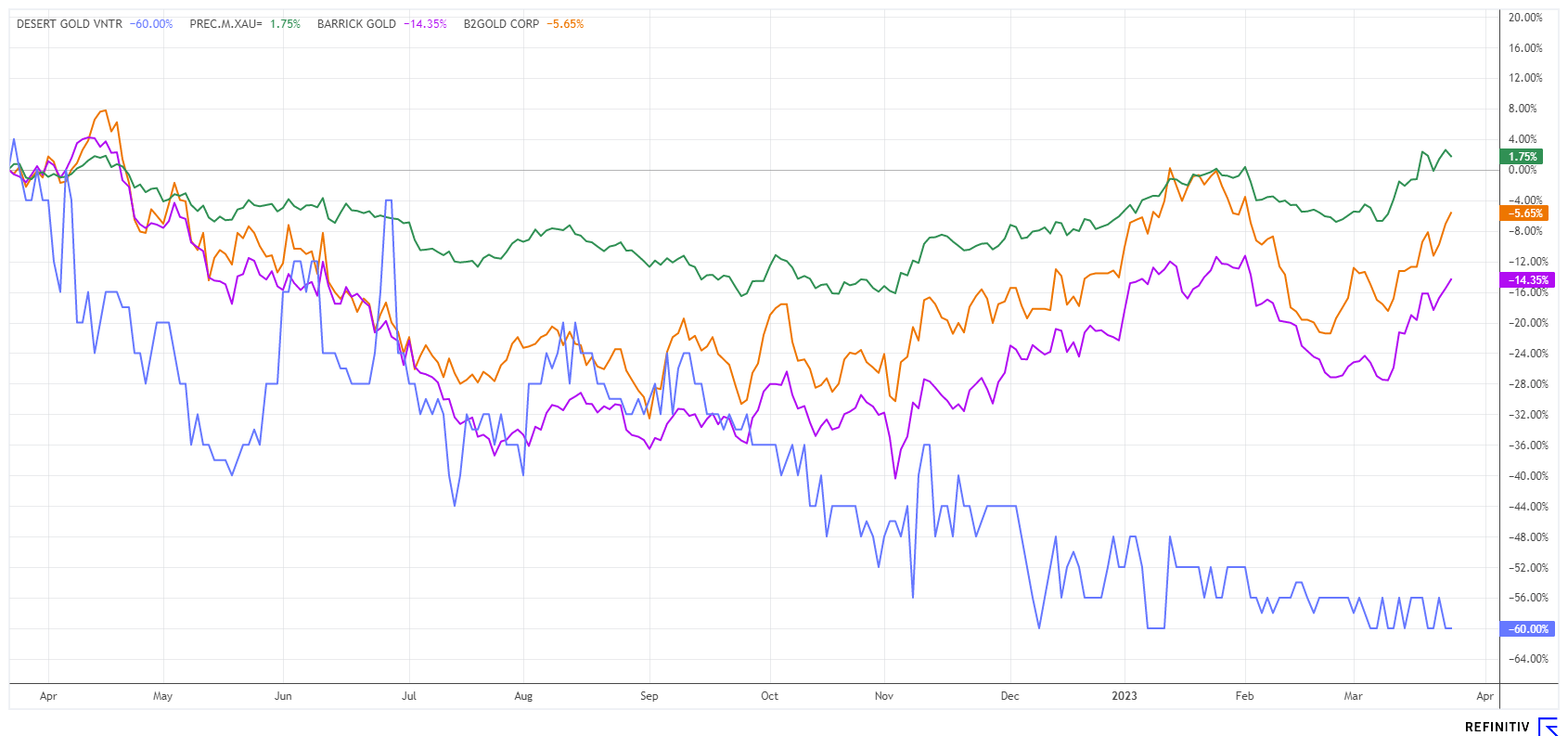

Interim conclusion: Momentum argues for appreciation

Desert Gold shares are in good company in the current downtrend in the Juniors. However, investors should not overstate the current situation because in all recent precious metals starting trends, producing mines rise first. The recent positive development of the majors Barrick and B2Gold is already clearly visible in the chart. Should the first takeover activities make the rounds, junior explorers will very quickly come into the focus of investors and be able to make disproportionate speculative gains. For the potential portfolio allocation in precious metals, a healthy mix of physical metal, larger to mid-sized producers as well as selected exploration companies with potential for admixture is recommended.

Just before the turn of the year, Desert Gold managed a major financing. After an announced private placement of 24.28 million units at a price of CAD 0.07 per share plus warrant, the management managed to increase it to 57.14 million shares. This flushed almost CAD 4 million into the coffers and guarantees the planned drilling work in 2023. Should gold technically break out of the sideways trend, the sails are set for Explorer shares. Listed in Canada and Frankfurt, Desert Gold has a solid shareholder structure and is a liquid investment with several 100,000 shares traded daily.

The update is based on the initial report 11/21.