Nel ASA - The Visionary for a Green Europe

As outgoing CEO Jon André Løkke stated in 2022, Nel ASA has set out to make Europe the world's first carbon-neutral continent. "It is time to turn Europe's hydrogen ambitions into reality. We need a clear and predictable regulatory framework that provides certainty and adequate incentives for renewable hydrogen technologies," says Løkke. Nel can make a major contribution to supply stability with its Greentech infrastructure.

Calculations show that hydrogen is the most abundant element in the universe

With the Climate Protection Act passed in June 2021, Germany has tightened its climate targets. CO2 emissions are to be reduced by 65% by 2030 compared to 1990, and by as much as 88% by 2040. The long-term goal is to be climate positive by 2050, meaning to achieve a negative CO2 emission - sounds ambitious!

With programmes running into billions, Spain also wants to become a superpower for green hydrogen by 2030. Enagás wants to invest almost EUR 5 billion to build pipelines and storage facilities, according to reports at a hydrogen conference in Madrid. Then there is the construction of an undersea pipeline called "H2MED" from Barcelona to Marseille, which is expected to cost around EUR 2.5 billion and is one of the most important bilateral issues between Spain, Portugal and France. Enagás estimates that Spain will have a production potential of up to three million tonnes of H2 annually by 2030. 1.3 million tonnes of this green hydrogen will be consumed domestically and the rest will be exported to other European countries via H2MED. According to expert estimates, this will correspond to about 10% of the total demand in Europe. In addition to Enagás, Iberdrola, the French hydrogen producer Lhyfe and Nel are also involved in the large-scale project.

Nel expects significant growth from the European projects. The analysts at Refinitiv Eikon estimate that the group's turnover will increase by 76% in 2023 and by a further 65% in 2024 to NOK 2.5 billion. The Norwegians are not expected to become profitable until 2026. The Norwegian order book stands at over NOK 2.1 billion (+107% compared to the previous year), and the war chest contains NOK 3.5 billion. Good conditions for continued high growth.

Portfolio adjustments set clear course

Following the sale of its stake in American truck manufacturer Nikola, the Norwegian hydrogen specialist is also divesting its shares in HYON. The timing for the divestment is unfortunate. Nel ASA is not only tinkering with solutions to enable hydrogen to make the big breakthrough as an energy carrier in the future. The Norwegians are also invested in other companies and until recently held 17.7% of the less well-known Hyon AS. But that has now changed abruptly. About 9.8 million HYON shares were sold, the proceeds from this amount to about NOK 7 million. It was probably not really worth it for Nel, as Hyon AS has already been in a strong downward trend since its IPO last year. Both transactions confirm the assumption that Nel will go its own way, independent of strategic investments, conserving resources and increasing its own investment opportunities.

Promising cooperation with German HH2E

In early January, the German energy company HH2E initiated the purchase of electrolyzer capacity from the Norwegian hydrogen specialist Nel. Nel Hydrogen Electrolyser AS, a subsidiary of Nel ASA, has agreed with HH2E on a FEED (Front End Engineering and Design) study and a letter of intent for two 60 MW electrolysis plants in Germany. The FEED study will be launched once the contract is awarded and the parties intend to conclude a contract for the delivery of the electrolyzers in the first half of 2023. Both are a big step into the H2 future for Germany and Norway.

"These projects are important for the energy transition in Germany and Europe, and we are pleased to support our partner HH2E in its efforts towards a greener society", says Håkon Volldal, CEO of Nel.

HH2E's two envisaged 60 MW plants will be among the largest green hydrogen production systems announced to date in Europe. Both plants are in the first phase and can be significantly expanded if needed. The hydrogen produced will be used for industrial applications, transport & logistics and local heat supply. Overall, HH2E is aiming for an electrolyzer capacity of 4 GW by 2030, making it one of the most important H2 companies in Germany.

Interim conclusion: Rally 3.0 soon to be completed?

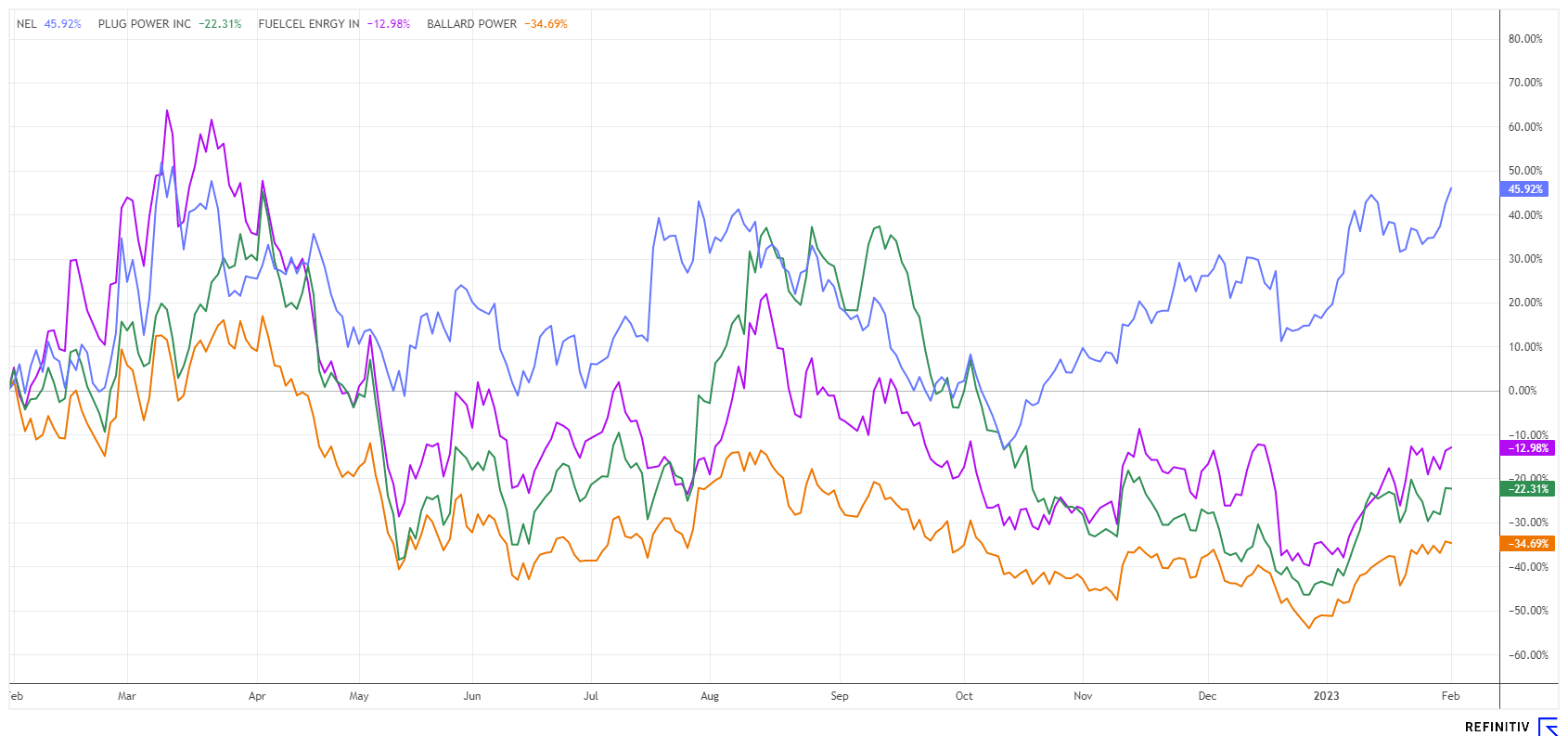

The stock of Nel ASA has risen nearly 50% in just 12 months and is currently performing well in the market. Compared to the H2 sector, Nel ASA has a clear outperformance of over 60%, while peer companies FuelCell Energy, Plug Power, and Ballard Power are lagging behind with -13%, -23%, and -35% respectively, during the observation period. These companies were already the losers of 2022 with declines of up to 75% and have yet to recover.

Nel ASA shows itself to be fundamentally much stronger than in the past months, but without further momentum it seems to remain at current prices for now. As the European market leader, the Company is benefiting from increasing investment budgets of the EU governments, which are still manageable from the public side. This means that investments at Nel remain high, as is usual in the industry, so that reaching the break-even point will demand some patience from shareholders. Fundamentally, Nel is still ambitiously valued with a 2024 P/E ratio of 10.

From a technical point of view, a sideways movement around EUR 1.60 would not be the worst scenario, but from a chart perspective, the share price should not fall below EUR 1.45 again. This would at least preserve the chance of an upward breakout with prices above EUR 1.70. The outperformance compared to the sector could also continue for a while because of the fundamental strength. In the medium term, however, the unusual strength in the development should level out again, as the technical momentum play has recently weakened noticeably. **Despite all the Greentech euphoria at the start of the year, a tight stop should be pulled in at EUR 1.42 in order to save the gains made over time.

Note: Nel ASA is expected to release its 2022 financial results on February 28th.

The update is based on the initial report 01/22.