Reserve valuation raised to 62.9 million barrels of oil equivalent

Yesterday, Saturn Oil & Gas Inc. released the latest results of an independent reserve evaluation of the Company's crude oil and natural gas assets effective December 31, 2022 (per National Instrument 51-101). This reserve report does not yet include the acquisition of Ridgeback Resources Inc., which was finalized in February 2023.

The present value of developed reserves including the Ridgeback acquisition, rises to new heights

Ridgeback's reserves are still reported separately. The latest measurements provided 62.9 million BOE of total proved and probable reserves, an increase of 24% from the previous year. In addition to the calculated cash value of CAD 791.5 million, an additional CAD 883.7 million is being added from the current Ridgeback acquisition.

A discount factor of 10% was applied. Of the original 452 gross drilling locations, 64% are in the Oxbow asset and 36% in the Viking asset; the high oil weighting with TP+P reserves is 95% light and medium oil and natural gas liquids. In 2021, total locations had remained at 354, meaning 98 well sites were successfully developed. The following table summarises Ryder Scott's estimated reserves for the Company and the net present values ("NPV") of future pre-tax net revenues based on projected prices and costs, as included in the most recent Reserves Report.

The recalculation was already commissioned at the end of 2022 and does not yet include the addition of the most recently acquired Ridgeback properties. Broken down to the individual share, the inclusion of developed and producing oil wells alone equates to a fully diluted net present value per share of CAD 6.92 as of year-end 2022. If the proved and probable reserves are added, this value increases even further to CAD 12.88 per share.

With Ridgeback, reserves increase 111%

Saturn completed its acquisition of Ridgeback Resources Inc. on February 28, 2023. The following tables summarise Ridgeback's estimated corporate reserves and the net present values of future pre-tax net revenues, based on prices and costs presented, as forecast by Sproule Associates Ltd. ("Sproule"), effective December 31, 2022. Ridgeback's February 17, 2023 reserves valuation includes 100% of Ridgeback's oil and gas properties as of December 31, 2022, and was also prepared in accordance with NI 51-101 by Sproule. Using these figures as a basis, the following picture emerges:

High net cash flow accelerates debt reduction to the end of 2025

According to forecasts, Saturn will be able to increase its production rate to over 31,000 BOE per day in H2-2023 under the new setup. According to management's calculations, the WTI (West Texas Intermediate) oil price is expected to generate an operating return of approximately USD 48 per BOE, resulting in annualized net operating income (NOI) of CAD 311 million. That generates annualized free cash flow of approximately CAD 232 million, 60% of which can be invested in debt repayment and 40% in production expansion. With current net debt of CAD 545 million, the duration of the projected debt repayment is approximately 2 1/2 years. Free cash flow yield increases to approximately 70% in 2023.

Saturn Oil & Gas has hedged 54% of its planned 2023 production to meet the payment obligations from the borrowed capital raising without market impact. The hedge rate decreases from 44% to 5% in subsequent years between 2024 and 2027, as does the average price of contracts from USD 72 in 2023 to USD 59 in 2027. It is expected that management will use good market phases to increase the hedge ratio in subsequent years.

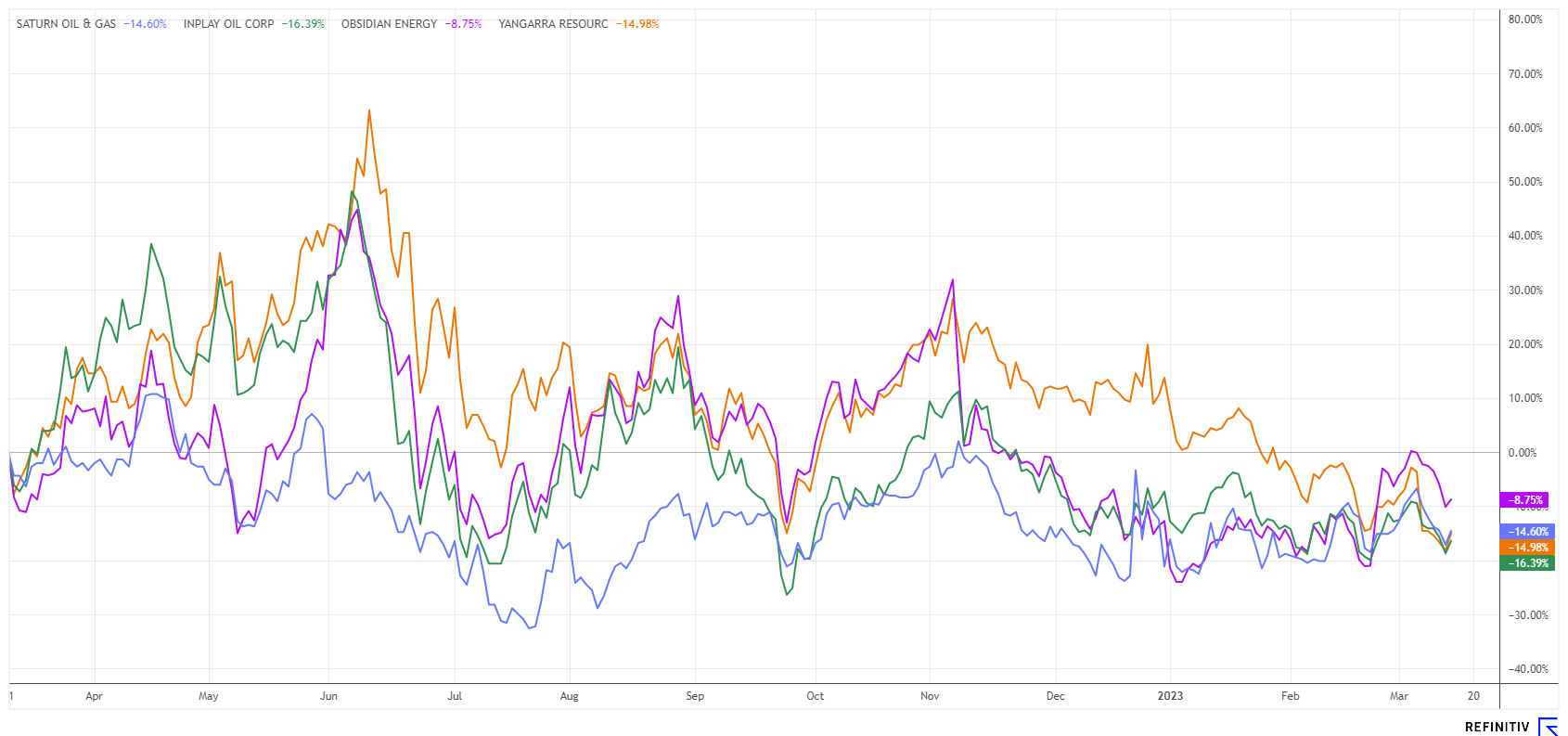

Interim conclusion: Falling oil prices slow value recovery

The Ridgeback acquisition is another quantum leap for the Canadians as it ad hoc elevates Saturn from the district league to the major league. Overall, it doubles light oil production from Saturn's existing and adjacent core growth project in southeast Saskatchewan. The Ridgeback concession areas in southeast Saskatchewan are directly east and adjacent to Saturn's existing production and development area. This makes them a perfect synergistic fit, operating out of Saturn's Carlyle operations centre. The entire concession area covers approximately 700 drilling locations with a life of approximately 15 years.

The Company's total valuation (EV) increases with the new share number and using the current stock market price of CAD 2.56 to currently just under CAD 976 million. The path to becoming a mid-tier producer is thus no longer far. For Saturn Oil & Gas, this transformation opens up the opportunity to enter institutional portfolios. Professional investors were already on board with the last transaction, and with the Company's new size, funds should also become aware of the SOIL share. Saturn is currently trading at an EV/adj EBITDA ratio of around 1.3. If the factor is set to the industry average of 5, then a fair value per share of around CAD 10.00 would be appropriate from today's perspective. Before the transaction, the research house Velocity had already issued a "Buy" rating and a 12-month target of CAD 8.00. **Hindering the closing of the valuation GAP at a factor of 5 times EV/adj EBITDA could be the currently falling oil price. However, a valuation improvement will likely be reflected in the next quarterly reports.

The update is based on the initial report 11/21