The starting signal has been given

After a long run-up, it finally happened at the beginning of October. dynaCERT's HydraGEN™ technology is now a certified process and part of the VERRA organization's range of applications. On October 4, 2024, VERRA published a release titled "Revised Vehicle Fleet Efficiency Methodology" (https://verra.org/methodologies/vmr0004-improved-efficiency-of-fleet-vehicles-v2-0/). What sounds highly technical is of immense value to dynaCERT because now, with a comparatively low entry cost of around CAD 6,000 per vehicle, customers can be offered an environmental solution that both offers 15% fuel savings and also generates emissions certificates. Large-scale carbon reductions are a major political issue, particularly for fleet operators, mines, and public transportation.

Given the availability of this patented technology, public pressure on the many transport companies with their hundreds of vehicles should soon rise. According to the official vehicle statistics, the USA leads in freight transport with around 15.5 million trucks on the roads. In the 27 EU countries, there are about 6 million, and around 700,000 heavy goods vehicles are registered in Canada. This is in addition to buses used in public transport, which need to be regularly renewed for safety reasons alone. dynaCERT has invested around CAD 100 million over its 20-year history to produce a product ready for series production. With the recent certification by VERRA, global sales can now begin under new conditions. As awareness increases, mandatory installation in new vehicles is even conceivable, especially as diesel engines have long been criticized for emitting excessive amounts of harmful substances.n The ball is now in the court of policymakers.

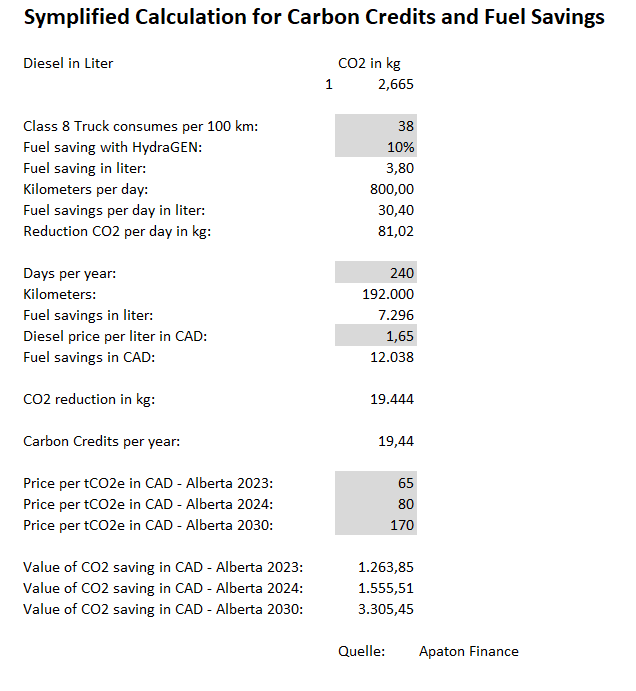

A simple model calculation shows the enormous potential

The revenue potential for the coming months is now clear. Based on the many preliminary discussions in recent months, dynaCERT should be able to invoice several orders. The Company has been particularly active in the mining sector recently. Here is an exemplary model calculation assuming the installation of a HydraGEN™ unit at a wholesale price of CAD 6,000 in a 40-ton truck. For smaller vehicles, the relative savings decrease, and the amortization period increases by a few months.

Result: Fuel savings and the sale of certificates lead to full amortization of the entire investment in less than 6 months. For larger fleets, the purchase price per unit decreases, and when considering large buyers like logistics service providers or e-commerce companies, the potential is even greater. If a sales target of approximately 10,000 units for 2025 is considered realistic, the half-year revenue of around CAD 785,000 as of June 30, 2024, could quickly rise into the single to double-digit million range. This would enable dynaCERT's business to finance itself independently in the medium term.

Strengthening of management with Bernd Krüper

This year, dynaCERT strengthened its leadership team by adding the experienced German industrial manager Bernd Krüper. He served as CEO of the Hatz Group in Rott for more than 6 years. His 18 years of industry experience also led him to the companies Rolls-Royce Power Systems AG, Tognum AG, and MTU Friedrichshafen GmbH. He is now tasked with marketing the certified technology to a broad audience and supporting key developments.

Bernd Krüper comments on dynaCERT's technology: "dynaCERT's hydrogen technologies for retrofitting diesel engines are an economically attractive contribution to environmental protection. The diesel engine will continue to be used in many areas of modern society for a long time to come. At dynaCERT, we are proud to offer an innovation that can reduce fuel consumption and environmental pollution. In my experience, which spans several decades in the world of engines around the globe, the increasing ESG efforts demand solutions that the transportation industry urgently needs. dynaCERT already has such a solution available today."

Cooperation with Cipher Neutron closes the loop

Technologically, dynaCERT has positioned itself particularly well by collaborating with Cipher Neutron. Together, they have already landed several major orders since the summer of 2023. For example, joint projects include the manufacture of anion electrolysers for the production of green steel. With AEM electrolysers for the production of green hydrogen and reversible fuel cell technology, hydrogen can be produced without the use of platinum group metals (PGMs) such as platinum, iridium, and ruthenium. This makes Cipher Neutron's AEM electrolysers one of the most sustainable solutions currently available commercially for the large-scale production of green hydrogen. The technology of reversible fuel cells allows for operation in both directions to produce electricity from hydrogen and also hydrogen from water. The reversible fuel cells are an attractive alternative to conventional storage systems such as batteries, as frequent charging is no longer necessary and long-term maintenance is reduced.

Moving forward with VERRA certification

dynaCERT plans to share the VERRA-registered carbon credits equally with the users of the HydraGEN™ technology. In addition to the financial incentive resulting from the sale of carbon credits, the coupled telematics software now also allows users of the HydraGEN™ technology to quantify the reduction of their greenhouse gas emissions. This quantifiable impact is a critical criterion to drive sales of HydraGEN™ technology to large-scale customers. dynaCERT's HydraLytica telematics system eliminates the need for human intervention and obtains all data objectively and automatically from the internal combustion engine's ECU.

Dr. James Tansey, Director of dynaCERT and CEO of Carbon Done Right Developments (TSXV: KLX), a publicly-listed company focused on carbon credit development that has built a portfolio of over 43,000,000 tonnes of carbon credits to date, stated: "VERRA's methodology is particularly suited to support dynaCERT's customers who want to reduce their carbon footprint using the Company's HydraGEN™ technology. In addition, dynaCERT's HydraLytica telematics are expected to be very well received in the carbon credit markets."

Interim Conclusion

For the Canadian company, VERRA has opened up a new dimension for implementing ESG-compliant solutions in the vehicle market. The potential could prove to be exponential with appropriate sales momentum. VERRA was founded in 2005 by leading environmental and business representatives who recognized the need for better quality assurance in voluntary carbon markets. The organization now serves as an internationally operating management agency that develops the various standards and programs it administers. It also sees itself as an incubator for new ideas that can generate significant environmental and social value at scale. Headquartered in Washington, DC, the organization's staff works in various parts of the world. VERRA is a registered 501(c)(3) non-profit organization in the United States and is held in the highest regard internationally.

The dynaCERT share reacted dynamically to the VERRA news with a 50% jump in price from CAD 0.20 to CAD 0.30. The value is currently consolidating in the direction of CAD 0.25. Management now expects that the sales talks that have been ongoing for months can be brought to a positive conclusion. With the 15% stake in Cipher Neutron, the Company has also gained significant expertise in the production of modern electrolysers. At around CAD 117 million, the current market capitalization is still very low given the range of solutions and the significant expansion of business opportunities. Furthermore, the current valuation only covers a fraction of the investments made in recent years. With its current set-up, dynaCERT should be able to achieve a significant market position in the hydrogen ecosystem as early as next year.

CEO Jim Payne will report on the latest developments at dynaCERT and be available to answer questions on October 15, 2024, at 16:30 CET, as part of the 12th International Investment Forum. Click here to register for free.

This update is based on our initial report 11/2022