The next coup in Canada

Saturn Oil + Gas Inc. announces another transformative acquisition. This time, it is an agreement to acquire synergistic assets in the Viking area of west-central Saskatchewan for approximately CAD 260 million. The Viking Acquisition puts Saturn in possession of additional production of approximately 4,000 barrels per day (boe/d of which approximately 98% is light oil and liquids). This is coupled with strong net cash flow and 140 new properties strategically located in the Viking region. It is one of the most attractive light oil resource areas in North America. The Viking Acquisition complements Saturn's existing light oil resource and integrates adjacent properties in southeast Saskatchewan within the well-known Frobisher and Midale deposits. The acquisition increases daily production by more than 50% at full load to approximately 11,400 boe/d.

Synergy effects through infrastructure advantages

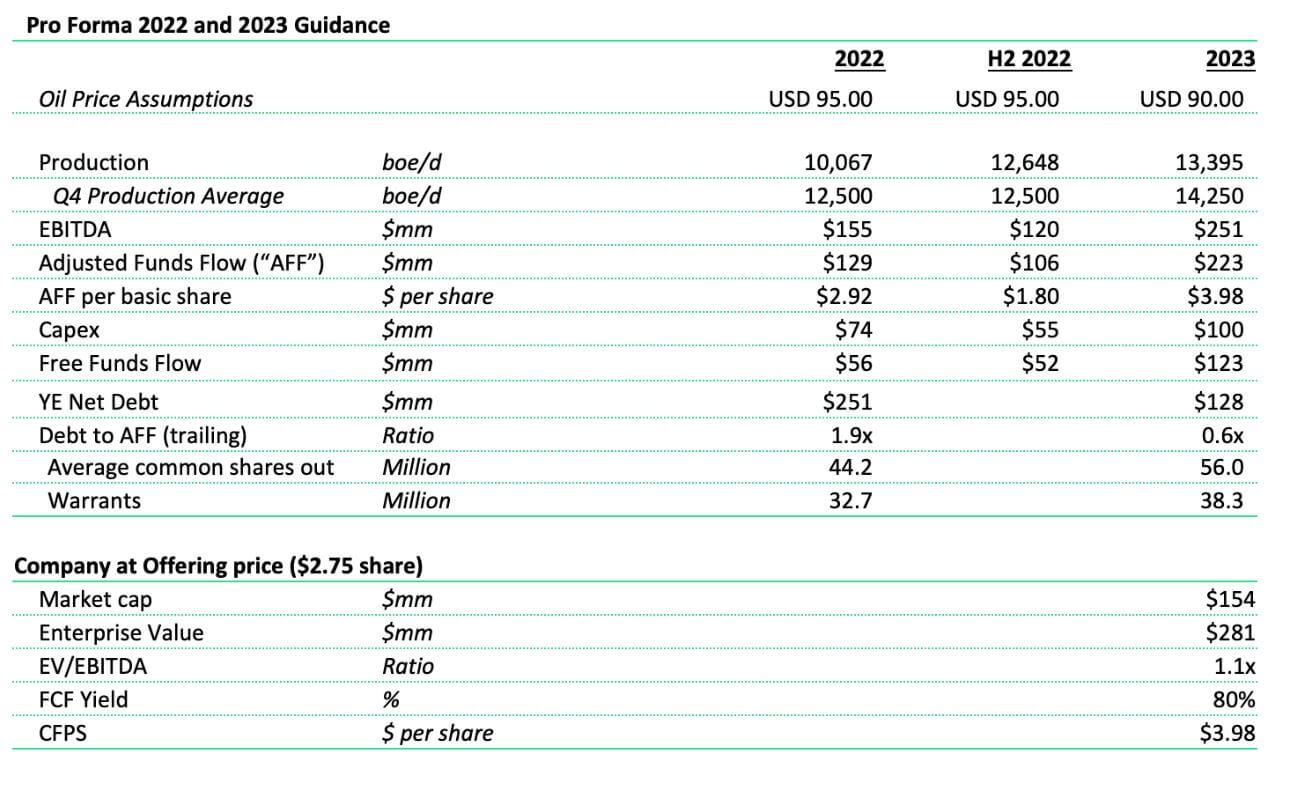

This transaction again raises the most recently revised 2023 adjusted cash flow guidance to CAD 223 million, or approximately CAD 3.98 per share. Strong net gains can be achieved to a floor in the oil price of approximately CAD 50 for Edmonton Light, which at current levels supports the generation of significant free cash flow. It will be used primarily to reduce debt and fund near-term organic growth.

On the cost side, Saturn will benefit from synergies in available infrastructure, which will further reduce operating costs per boe. For example, the acquisition of Viking is forecast to reduce royalties from approximately 15% to 12% and reduce operating costs per boe by an estimated 16%. Saturn expects further cost savings in transportation, labor and processing costs from the additional processing capabilities provided by the Viking Acquisition. The expansion of the production base continues to drive operational efficiencies and high plant utilization, which currently remains below 60%. With larger production volumes, fixed and variable costs can be better allocated across operations. The growth strategy makes sense, especially from this point of view.

CEO John Jeffrey commented: "This significant transaction represents another important milestone for Saturn as we execute on our strategy to build a scalable portfolio of assets that generate free cash flow and support both near- and longer-term development. At the same time, we are diversifying our production across several highly economic projects to improve our sustainability."

Bought deal financing combined with term loans

The acquisition of Viking will be financed through a CAD 200 million increase in the existing senior secured term loan ("Senior Secured Term Loan") and through a guaranteed bought-deal financing for expected total proceeds of CAD 65.0 million. Free cash flow, which can be used to reduce debt and fund organic growth, increases significantly and enhances shareholder wealth over the medium term.

In connection with the signing of the definitive agreement for the acquisition of Viking, Saturn has entered into an agreement with a syndicate of underwriters led by Canaccord Genuity Corp. and Eight Capital for the issuance and sale of approximately 23.6 million subscription receipts on a bought deal basis. The subscription receipts will be offered at a price per unit of CAD 2.75, raising aggregate gross proceeds of approximately CAD 65.0 million ("Bought Public Offering"). The Company has also granted the Underwriters an over-allotment option to purchase up to 3.5 million additional Subscription Receipts on the same terms and conditions as the Bought Public Offering, exercisable no later than 30 days after the closing of the Offering.

Each subscription warrant represents one share with no additional payment and one-half of one warrant with an exercise price of CAD 3.20 and a term of 12 months. If the Viking Acquisition is not completed as described above within 120 days after the closing date of the Offering, or is terminated at an earlier date, the gross proceeds of the Bought Public Offering and the pro rata entitlement to interest earned or deemed to have been earned on the gross proceeds of the Offering, net of all applicable withholding taxes, will be paid to the holders of the Subscription Receipts and such Subscription Receipts will be simultaneously cancelled.

Saturn expects to enter into an amended and restated senior secured term loan agreement with its US-based lender regarding the provision of an additional CAD 200 million term loan. The loan is subject to an interest rate of CDOR + 11.5% and will be amortized over three years, with 50% repayable in the first year, 30% in the second year and 20% in the final year. Based on forecasts of production numbers and commodity prices, Saturn expects to repay the entire loan well ahead of scheduled payment dates. Closing of the Further Amendment Agreement is subject to the execution of mutually acceptable loan documentation that complies with the terms of the written commitment and satisfaction of customary closing conditions, including all conditions to closing of the Viking acquisition.

The mid-term strategic plan is coherent

The Viking acquisition is consistent with Saturn Oil + Gas' strategy to become a leading publicly traded light oil producer through the acquisition and development of undervalued, low-risk projects that support the building of a strong portfolio of cash flowing assets with strategic development opportunities.

Integrating new properties into Viking increases diversification, which lowers overall exposure to risk and implements a more sustainable investment strategy. The Company expects to maintain Viking's production at a level of approximately 4,500 boe/d with 35 to 40 wells per year, which includes free cash flow of over CAD 85 million per year with upside potential. Base production can be easily recovered year after year due to the stable, long-life assets and production optimization underlying the recent drilling.

Reserve curve guidance remains solid, with break-even at Edmonton Light prices of at least CAD 50/bbl. The Viking Acquisition is expected to strengthen Saturn's risk management portfolio and allow the Company to significantly improve its average realized price for hedged oil to provide greater upside potential in a strong pricing environment.

Crude oil produced in the area is sold through the Mid-Sask pipeline at Kerrobert, while gas is marketed under one-year supply contracts. Saturn also benefits from its hedge inventory as the existing out-of-the-money hedges will be significantly diluted by the Viking Acquisition, allowing the Company to capture more of the upside potential of the current strong pricing environment. The hedge curve will move in Saturn's favor over time as positions are eliminated with each quarter and additional spare trading capacity is created.

The field benefits from responsible capital deployment for decommissioning and reclamation programs with limited inactive liabilities and a strong Limited Liability Rating ("LLR") of 3.50. Emission reduction potential is possible through tie-in points at Hershel and Plato for gas sales, gas injection potential based on modeling results, and bitcoin and power generation with produced gas.

Saturn Oil + Gas presents the following planning figures for 2022/23:

Interim summary: A further expansion step

Saturn Oil + Gas is consistently pursuing its growth strategy, which may seem somewhat surprising from the outside in the current high-price environment, but the internal plans to improve cost efficiency and reduce debt are coherent. Strong production growth is steadily increasing net available cash flow, which is accelerating deleveraging and creating further reserves for investment in organic capability expansion.

The Company is asking existing shareholders to be a bit more patient in achieving sustainable returns. However, the design of the current deal is such that it significantly increases the international perception of the small Canadian company and further enables the financing of strong growth. The increasingly large production shares, which can be sold freely without hedging, further increase earning power. Even though we are more likely to see lower oil prices than the current crisis-driven USD 120 by the end of the year, Saturn Oil + Gas' medium-term strategy should work out. Investors can take advantage of the current downward movement to re-enter or discount according to individual risk appetite.

The update is based on our initial Report 11/21