Nel ASA - Solutions for a green future

Nel ASA is a global hydrogen pioneer from Norway, providing solutions for the production, storage and distribution of hydrogen from renewable energy sources. The Norwegian group supplies industry, energy and gas companies with world-leading hydrogen technology. The Company's roots date back to 1927, and in recent years the development and continuous improvement of hydrogen technologies has been driven forward. Today, Nel hydrogen solutions cover the entire value chain, from hydrogen production to relevant technologies and physical hydrogen refueling stations. They enable the industry to transition to green hydrogen and provide fast refueling for all fuel cell electric vehicles.

The 2050 climate change targets are more relevant than ever

The war in Ukraine exacerbates the need for the measures adopted in recent years to transform our energy supply. With the ad hoc shortage and accompanying price explosion of fossil fuels, dependence on Russia and China alone is a driving force in the European renewal process.

With the climate protection law passed in June 2021, Germany has tightened its climate targets. By 2030, CO2 emissions are to be reduced by 65% compared to 1990, by 2040, even by 88%. It was initially agreed to be greenhouse gas neutral by 2045, but the new government raised this target to 2050 in December 2021 due to unachievability. Germany thus wants to make its contribution to limiting global warming to well below 2 degrees, and if possible, to 1.5 degrees.

The past year 2021 was anything but successful for shares in the hydrogen and fuel cell sector. After a brilliant boom in the first half of the year, the signs pointed to a correction. However, in view of the energy transition and the importance of hydrogen technology, this sector in particular could experience a resurgence in the new year. Only recently, the German Federal Ministry of Economics, led by Green Party politician Robert Habeck, released EUR 900 million for the "H2Global" funding instrument.

While the use of wind and sun has long been established, this step is still to come for hydrogen. The EU's recent decision to produce around 20 million metric tons of hydrogen in 2030 to replace natural gas supplies from Russia is now likely to establish the use of the new green energy more quickly. Currently, Europe is still importing 50 billion cubic meters of natural gas to produce the so-called gray hydrogen. With a switch to new electrolysis processes using alternatively generated electricity, green hydrogen could replace about 12% of gas consumption in 2030, the Bloomberg Intelligence news agency predicts. Those would be the first steps toward a bit more independence, but dependence on energy suppliers will remain for several decades until an alternative infrastructure is fully installed.

Nel increases its European capacity

Recently, the Norwegian hydrogen company stated via press release that the Company would be willing to "increase its production capacity for electrolysers to meet the European Union's increased ambitions for renewable hydrogen." Currently, for example, NEL's electrolyser plant on Herøya can provide 500 MW of capacity to the market, with the possibility of expanding that up to 2 GW. CEO Jon André Løkke says the Company is determined to make Europe the world's first carbon-neutral continent. "It is time to turn Europe's hydrogen ambitions into reality. We need a clear and predictable regulatory framework that provides certainty and adequate incentives for renewable hydrogen technologies," Løkke says. Nel can significantly contribute to supply stability with its GreenTech infrastructure. However, investments remain so high that reaching break-even will require some patience from shareholders.

The bar was high, Nel remains slightly below it

On Wednesday, May 11, 2022, Nel presented its figures for the first quarter of 2022 with a slight delay. The analysts' expectations for sales could not quite be achieved, the loss on EBITDA basis even more than doubled compared to the same period last year due to high investments. Due to a successful private placement of NOK 1.5 billion, Nel still sits on a comfortable cash position of NOK 3.9 billion.

Sales increased by 36% to NOK 213 million or the equivalent of approximately EUR 20.8 million, although the consensus in the last expert estimate was NOK 259 million or EUR 24.6 million. The EBITDA loss increased noticeably from NOK 74 million to NOK 152 million, with net operating cash flow totaling minus NOK 159 million. Analysts were only expecting a shortfall of NOK 135.6 million in EBITDA. However, a look to the future promises further growth, as the order book climbed 19% to a new record level of NOK 1.289 billion.

Outgoing CEO Jon André Løkke comments, "We remain committed to our growth strategy and are convinced of the long-term potential of the industry. Both the order book and the pipeline are growing, and we continue to see good prospects for green hydrogen."

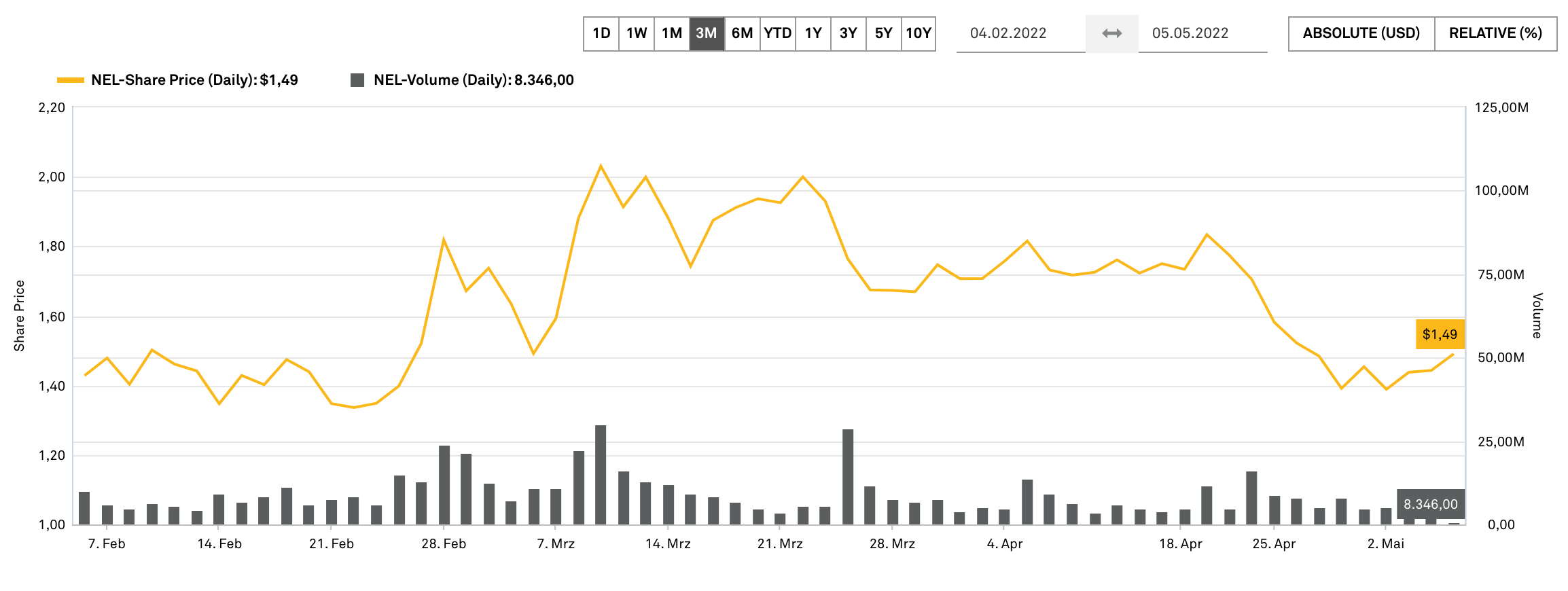

Our conclusion: Nel's figures are disappointing at first glance, but market participants should not lose sight of the high investments in the future technology "hydrogen". Nel is able to land large orders consistently, and the important further development of the technology is thus secured. The share price is now down almost 30% on a 12-month basis and has already corrected more than 65% from its high. The current valuation, based on estimated sales for 2022 of approx. NOK 1.2 billion, nevertheless remains ambitious at a factor of 15. Despite analysts' estimates remaining good, the share is only a noteworthy position in the current environment. From a chart point of view, it could drop to around EUR 1 in the current sell-off of technology stocks. If the overall market turns around, Nel is a technical momentum play of the first hour.

The update is on our initial Report 01/22.