A super project in West Africa

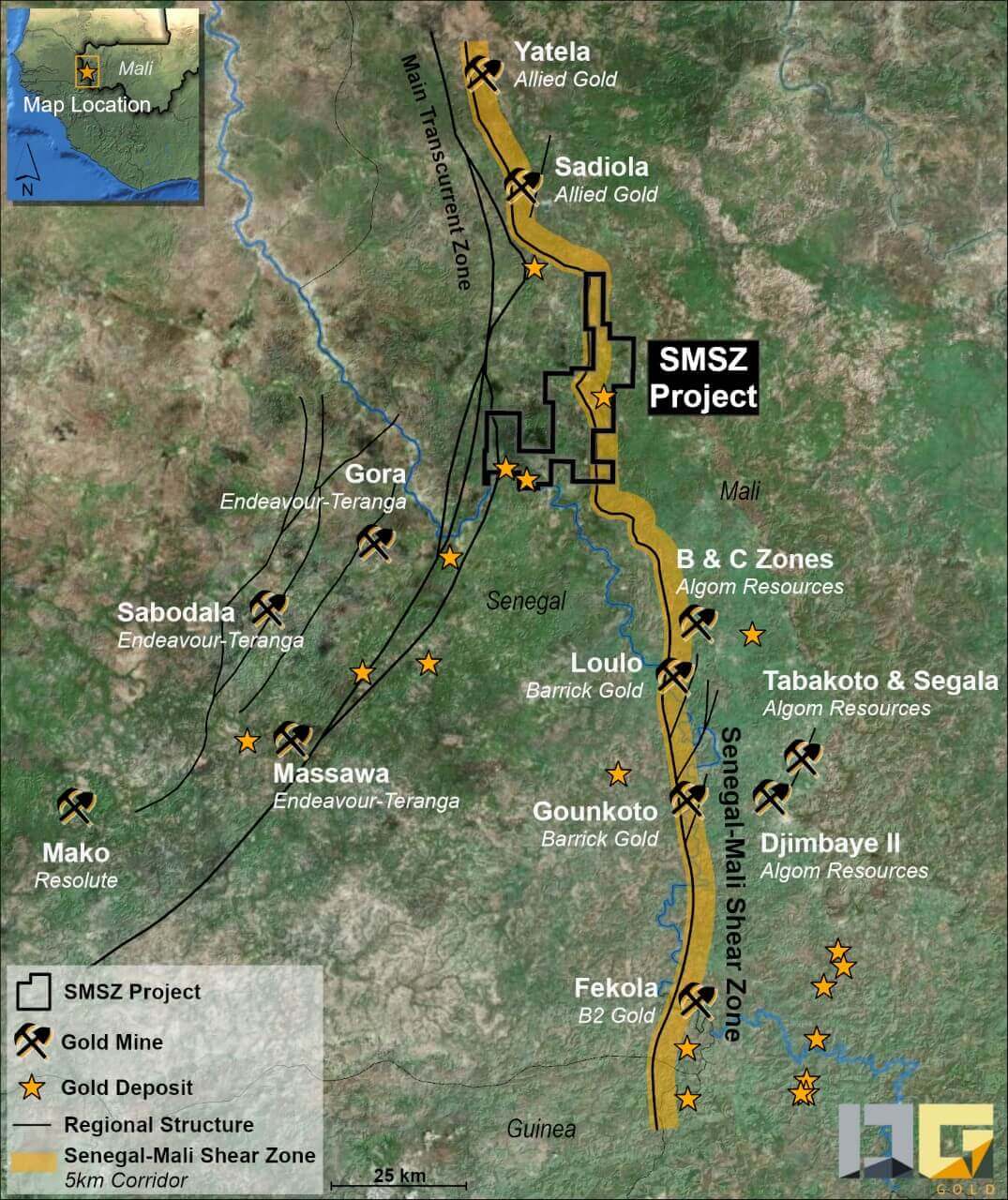

Those thinking about undervalued gold stocks should take a closer look at Canadian explorer Desert Gold Ventures. With the SMSZ project in Mali, Desert Gold owns one of the largest non-producing land areas in West Africa, with 440 sq km. In the neighborhood, there are several producing mines, among others from Barrick Gold, Allied Gold, Endeavour Mining, and B2Gold. More than 23 gold zones have been discovered in the area to date, which will be developed and analyzed for economic grades.

The current resource estimate is just the beginning

The zones on which the latest evaluations are based are located within a tight 12 km radius in the southern half of the 440 sq km area. The current resource estimate totals approximately 1.1 million ounces of gold, the majority of which is in the inferred category, i.e. associated with higher uncertainty - a total of 769,200 ounces of gold (at a tonnage of 20.7 million and a grade of 1.16 g/t). The measured and indicated mineral resources (measured & indicated) totaled 310,300 ounces of gold at 8.47 million tonnes at a grade of 1.14 g/t gold.

In southern Mali, on the border with Guinea, the Canadians also own the much smaller Djimbala project. There are several producing mines in the vicinity, such as the Komana mine of Hummingbird Resources, located directly west of the Djimbala project, or the Kalana mine of Endeavour Mining, which is located about 18 km south. Initial drilling has encountered gold grades of up to 12.65 g/t at 3 meters depth. Work is currently focused on the above SMSZ project.

Following good results, a major drilling program is now on the agenda

The most recently released data from the first three core holes drilled at the Gourbassi West North zone at the SMSZ project, which were drilled to test the depth extent, underscore the potential of the gold explorer. All three holes intersected zones of gold mineralization. The top intercept, 124m long, assayed 1.08 g/t gold, including 1.85 g/t gold over 41.1m and 0.7 g/t gold over 30.6m. In addition, the data demonstrate that gold mineralization extends to a depth of at least 175m. Previously, only a depth extension of 35m could be documented.

A 35,000m drill program is planned to continue in the current year, which includes 10,000m of potential drilling aimed solely at resource delineation. Overall, Desert Gold intends to follow up and expand known gold zones, with plans to initially focus on Mogoyafara South and Gourbassi West North. Desert Gold believes these are the largest gold systems ever discovered on the SMSZ property to date.

Increased acquisition activity in the neighborhood

Mid-tier producer B2Gold recently made news after reaching an agreement with the management of neighboring competitor Oklo Resources for a takeover. Although Oklo's project appears relatively small, the proximity to B2Gold's open pit Fekola mine probably tipped the scales here. This draws attention to Desert Gold because all of the aforementioned Tier 1 mines near the SMSZ project each produce more than 500,000 ounces of gold per year at a very low cost of around USD 800 per ounce (AISC). B2Gold's Fekola mine is also located in the Senegal-Mali shear zone, as are two mines owned by industry giant Barrick Gold. Desert Gold is on the clock, as the potential takeover price increases with each additional resource expansion.

For a long time, it had been quiet in the gold industry. Since Agnico Eagle acquired Kirkland Lake Gold, there have been no major takeovers. But with the 4.8 billion offer from Agnico-Eagle and Pan American Silver for Yamana, the merry-go-round is spinning again. Just before Christmas, Morocco's Managem Group struck a deal for IAMGold. They bought from the Canadians their exploration projects in the tri-border area of Senegal, Mali and Guinea, which are also in the Senegal-Mali Shear Zone (SMSZ). Barrick Gold and Newmont Mining have been fairly inactive over the past few months but have full coffers.

Interim conclusion: Fully funded into the new year

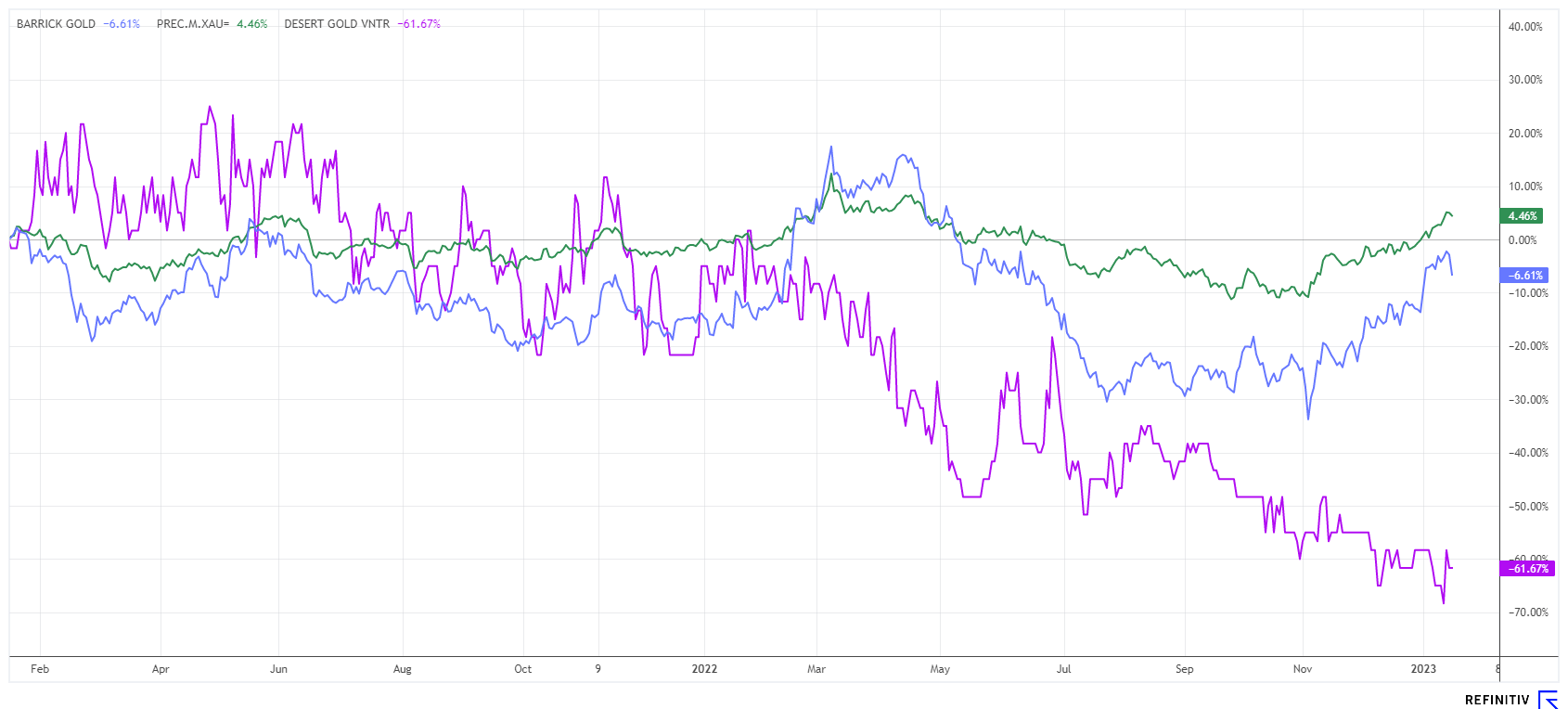

The Desert Gold share, like all juniors in Canada, has taken a beating through December. The so-called "tax-loss season" encourages domestic investors to offset plus and minus holdings at the end of the year in a tax-optimized manner. This increases the selling pressure on stocks that had previously underperformed. In addition, the gold price had lost about USD 400 since summer, but the technical indicators are now pointing strongly upwards.

CEO Jared Scharf is nevertheless convinced that he will be able to prove in the coming months that a mining operation at the 440 sq km SMSZ project promises a high level of economic success. Shortly before the turn of the year, Desert Gold secured major financing. On December 2, 2022, the Company announced that it conducted a private placement of 24.28 million units at a price of CAD 0.07 per share plus warrant. However, afterwards the management expanded the placement to 57.14 million shares, nearly CAD 4 million. That would provide sufficient funds to develop the SMSZ project further. The next announcements in 2023 should free the DAU share from its slumber and ensure a rapid revaluation.

This update is based on the initial report 11/21