Morphosys at a glance

From its foundation to the Neuer Markt

Morphosys AG is a biopharmaceutical company founded in 1992 and headquartered in Planegg, near Munich. The Company uses various antibody, protein and peptide technologies to research and develop its own and partnered drug candidates. Morphosys says it has more than 100 drugs in its pipeline that are being investigated for the treatment of a wide range of diseases. While many of these are being developed in partnerships with pharmaceutical and biotech companies, Morphosys has a proprietary pipeline focused on cancer. The Company's shares were first listed on the Neuer Markt on March 09, 1999, and are now part of the SDAX and TecDAX and listed on the Frankfurt Stock Exchange as well as the US NASDAQ stock exchange. 1

The biotechnological research approach

The Company uses several antibody, protein and peptide technologies to research and develop proprietary and partnered drug candidates. Morphosys' most important technology is an antibody library called HuCAL®, which scientists use to generate human antibodies. This collection comprises more than 10 billion different human antibodies in the form of a phage display bank. Morphosys provides the HuCAL® library to several partner companies in return for royalties, either for the development of therapeutic agents based on monoclonal antibodies or for research purposes. Morphosys also receives milestone payments in drug discovery partnerships upon the achievement of specific development goals (for example, delivery of an antibody against a given target, initiation of clinical testing with a HuCAL® antibody, approval as a drug). The more advanced a project is in development, the higher the individual payments typically are. Morphosys also receives a share of the revenues generated by finished drugs from the projects.

The first commercial products

Tremfya® (guselkumab), a drug based on the HuCAL® technology, is also already on the market. Tremfya was generated using Morphosys' proprietary antibody technology HuCAL® and received marketing approval in 2017 to treat psoriasis. In 2020, the US Food and Drug Administration (FDA) granted accelerated approval for Monjuvi® (tafasitamab-cxix) in combination with lenalidomide in patients with a specific type of lymphoma. Morphosys and Cherry Biolabs entered a licensing agreement for the innovative, multispecific hemibody technology in the same year. Morphosys and Xencor agreed to collaborate to explore further combinations with tafasitamab and Xencor's bispecific CD20xCD3 plamotamab. In 2021, Morphosys received conditional approvals for Monjuvi® (tafasitamab) in the European Union and Canada in combination with lenalidomide in patients with a specific type of lymphoma. In 2022, there was a disappointment in Alzheimer's research. The active ingredient Gantenerumab®, which was developed together with Roche, did not achieve any slowing of the clinical course of the disease.

Gamechanger - The Constellation Pharmaceuticals acquisition

In June 2021, the flags were raised in Planegg for expansion. In a complete surprise, Morphosys acquired the almost identically sized US company Constellation Pharmaceuticals for a whopping USD 1.7 billion (about EUR 1.4 billion at the time). The news was anything but well received on the stock market, with Morphosys shares subsequently plummeting by double digits as the price was deemed too high. Morphosys secured the support of Royalty Pharma to finance the acquisition of the US biotech company.

Constellation Pharmaceuticals did not yet have an approved product on the market and focused its clinical development on myelofibrosis and solid tumors. Morphosys intended the acquisition to strengthen its thin pipeline in the oncology field but will have to invest heavily in research and development in the following years in order to breathe life into the acquisition. The stock market took a negative view of the high purchase price and the increase in cash burn rate, sending Morphosys shares on a long downward slide since the acquisition. In June 2021, the share was trading at around EUR 60 - by the end of 2022, just 18 months later, the share price landed at its low of EUR 11.85, representing a market capitalization of around EUR 400 million. Morphosys goes down in stock market history with this takeover because, all in all, about EUR 3 billion in valuation was wiped out with this decision.

Focus on cancer research

Global market for immuno-oncology

global immuno-oncology market volume by 2027

The field of immuno-oncology is all about harnessing the power of the immune system to fight cancer. In recent years in particular, research around this field has made great strides. Immunotherapy for cancer aims to fight tumors with the help of the body's own immune system. Unlike chemotherapy, for example, the drugs administered do not directly target the cancer. Instead, they usually cause the immune cells to recognize, attack and destroy the cancer cells. Ideally, healthy body cells are not damaged in the process. The human immune system works in two ways: non-specifically against all pathogens or specifically with the help of a learned immune response. It is in the latter area that immuno-oncology comes into play, helping to activate the immune system or make it recognize specific cancer cells and their antigens.2 Market researchers at Research and Markets estimate the market potential in immuno-oncology to reach a total volume of USD 48.9 billion by 2027. In 2020, the market was only USD 17.3 billion in size. The annual growth rate until 2027 corresponds to a high 16.1%. 3

The development of small-molecule product candidates

In pharmacology and biochemistry, a class of active ingredients is referred to as small molecules if their molecular mass does not exceed about 800 g-mol. Due to their small size, these "small molecules" are able to penetrate cells and exert their effect there.

Small-molecule active ingredients are able to penetrate cells and exert their effect there.

The vast majority of currently approved drugs are small molecules. Research on small molecules at Morphosys is based on a comprehensive understanding of the "writer", "reader", and "eraser" classes of epigenetic regulators. More than ten years of experience in building this understanding has already been gained. Combined with the knowledge and capabilities in assay development, biochemistry, drug screening, medicinal chemistry and structural biology, it provides a strong foundation to continue to develop small-molecule epigenetic inhibitors in the future.

Operational milestones within reach

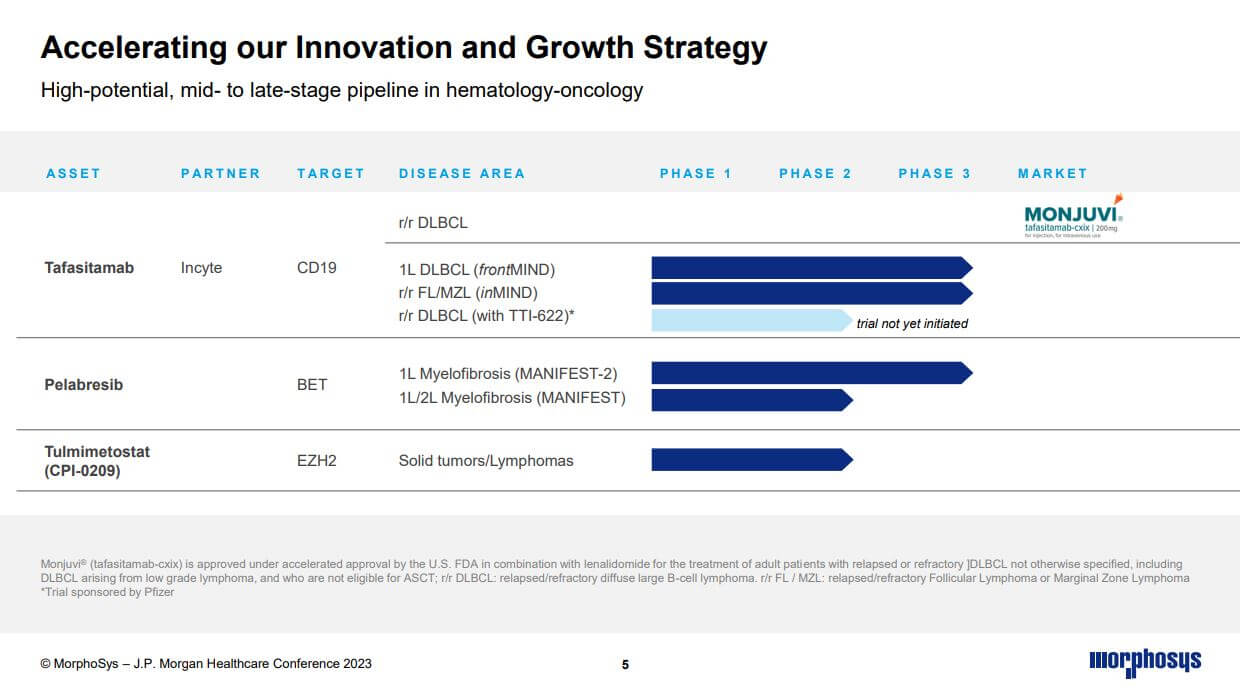

Currently, the focus is on the four products Monjuvi, Tafasitamab, Pelabresib and Tulmimetostat. The areas of application and phases could be taken from the following overview.

Monjuvi as a revenue generator

"We are proud that around 2,000 patients have been treated with Monjuvi in the US since launch and that we continue to have the leading market share in new patient enrollment in the second-line setting", CEO Kress said in a mid-2022 interview. Kress continued, "Looking ahead, we are focused on continuing to advance the commercialization of Monjuvi and rapidly advancing our pivotal studies for pelabresib in myelofibrosis and tafasitamab in 1L DLBCL, FL and MZL."

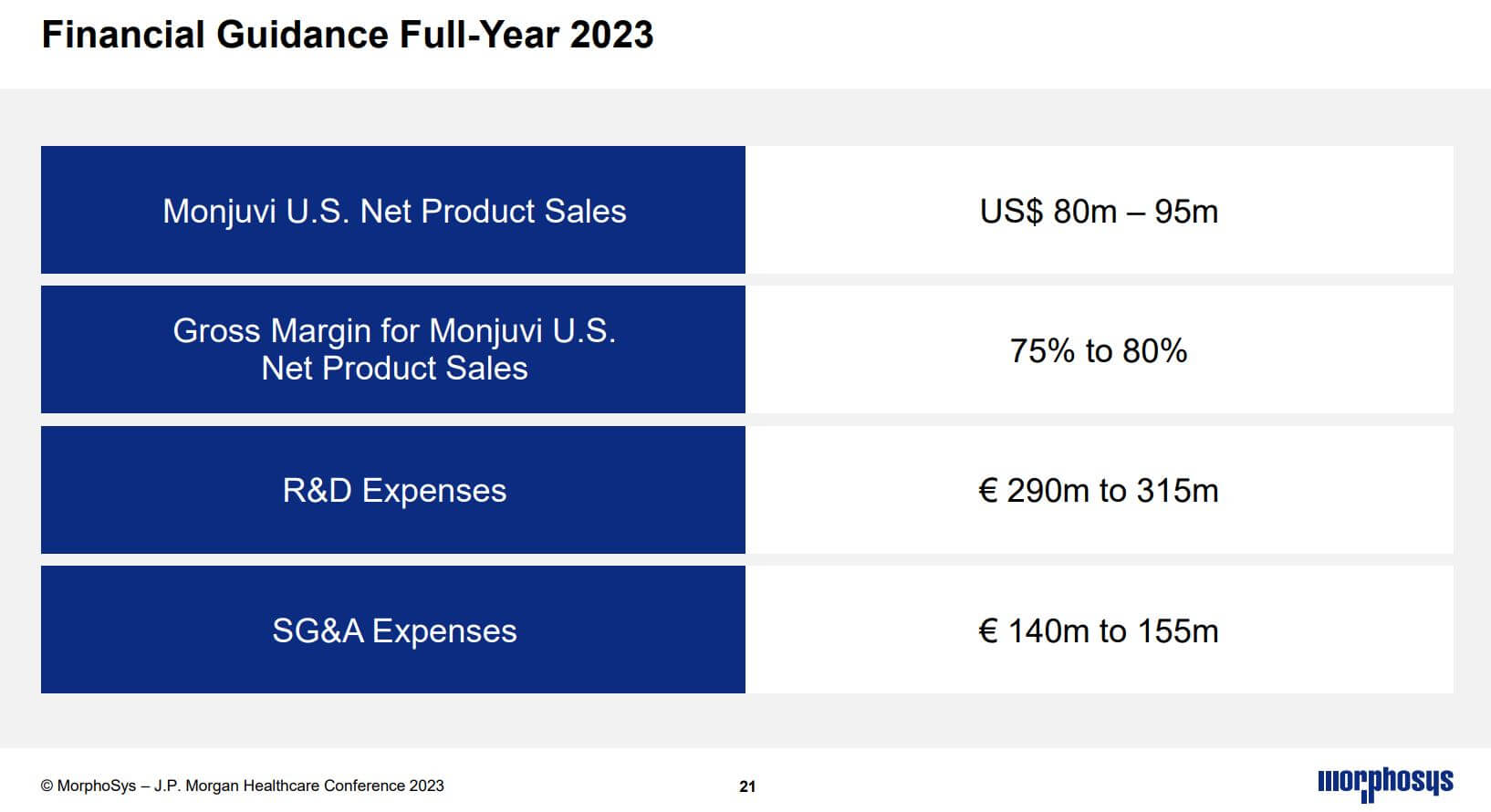

Unfortunately, especially the important commercial product Monjuvi is struggling with competition. Thus, sales expectations in 2022 had to be revised downwards several times. In 2023, the cancer drug is expected to generate between USD 80 and 95 million in sales in the US, with a gross margin of a high 75-80%.

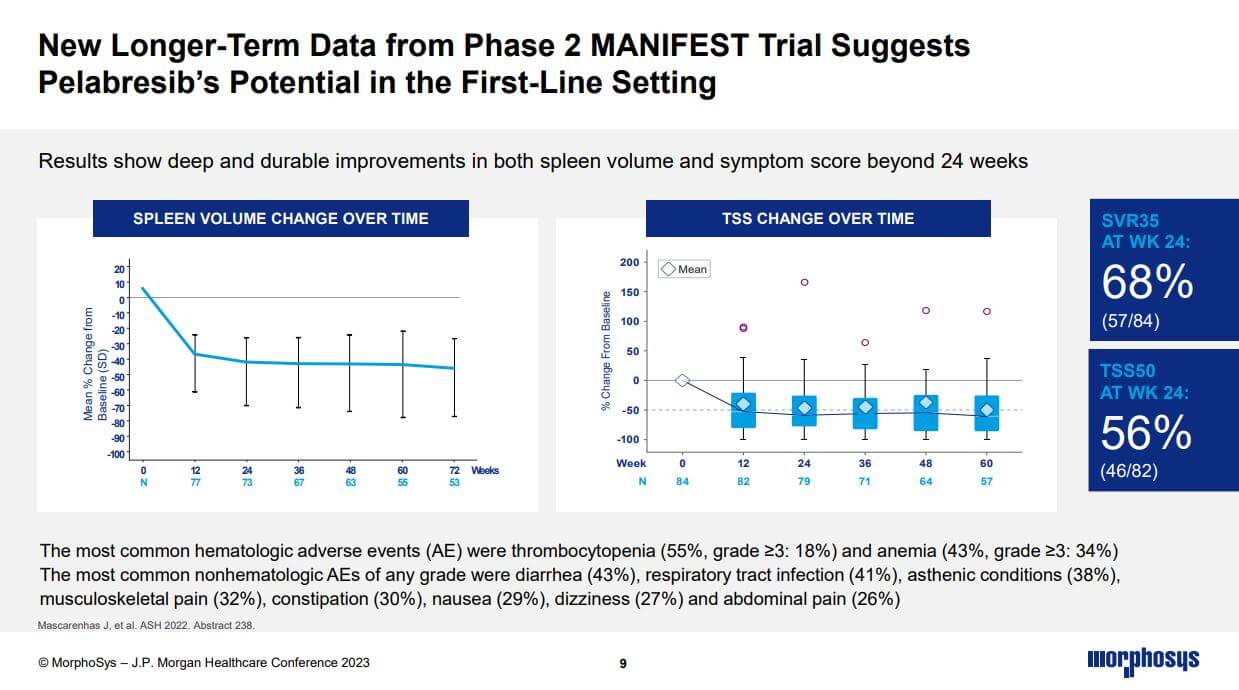

Pelabresib as a major hopeful

The biggest hope in the current pipeline is the compound pelabresib, which Morphosys is currently investigating in a Phase 3 trial for the first-line treatment of myelofibrosis, a rare form of bone marrow cancer. Pelabresib is one of the compounds acquired through the acquisition of Constellation Pharmaceuticals. With pelabresib, Morphosys has an excellent opportunity to improve the standard of care in myelofibrosis and expand its use to other myeloid diseases with a high unmet medical need.

Patients with myelofibrosis do not respond adequately to current first-line therapy and only for a limited time. The most recently presented Phase 2 data suggest that pelabresib may have the potential to improve on the current standard of care, which increases our confidence in the Phase 3 MANIFEST-2 trial. Top-line data from the pivotal MANIFEST-2 study are expected in early 2024, as announced at the J.P. Morgan Healthcare Conference in San Francisco. CEO Jean-Paul Kress believes pelabresib will have a sales potential of more than USD 1 billion.

Outlook and targets

"We could bring pelabresib to market in three years, which is not long for our industry. And by 2026, we want to be profitable and cash flow positive," Kress said at the recent release at the J.P. Morgan Health conference in San Francisco.

Further development steps:

- continue to advance the use of Monjuvi as a second-line treatment for DLBCL

and expand into additional new indications, most notably DLBCL first-line therapy - continue to explore the potential of tulmimetostat and provide proof-of-concept in multiple potential cancers

Click here for the latest presentation at the J.P. Morgan Healthcare Conference January 2023 in San Francisco.

Viewed through analytical glasses

The peer group companies at a glance

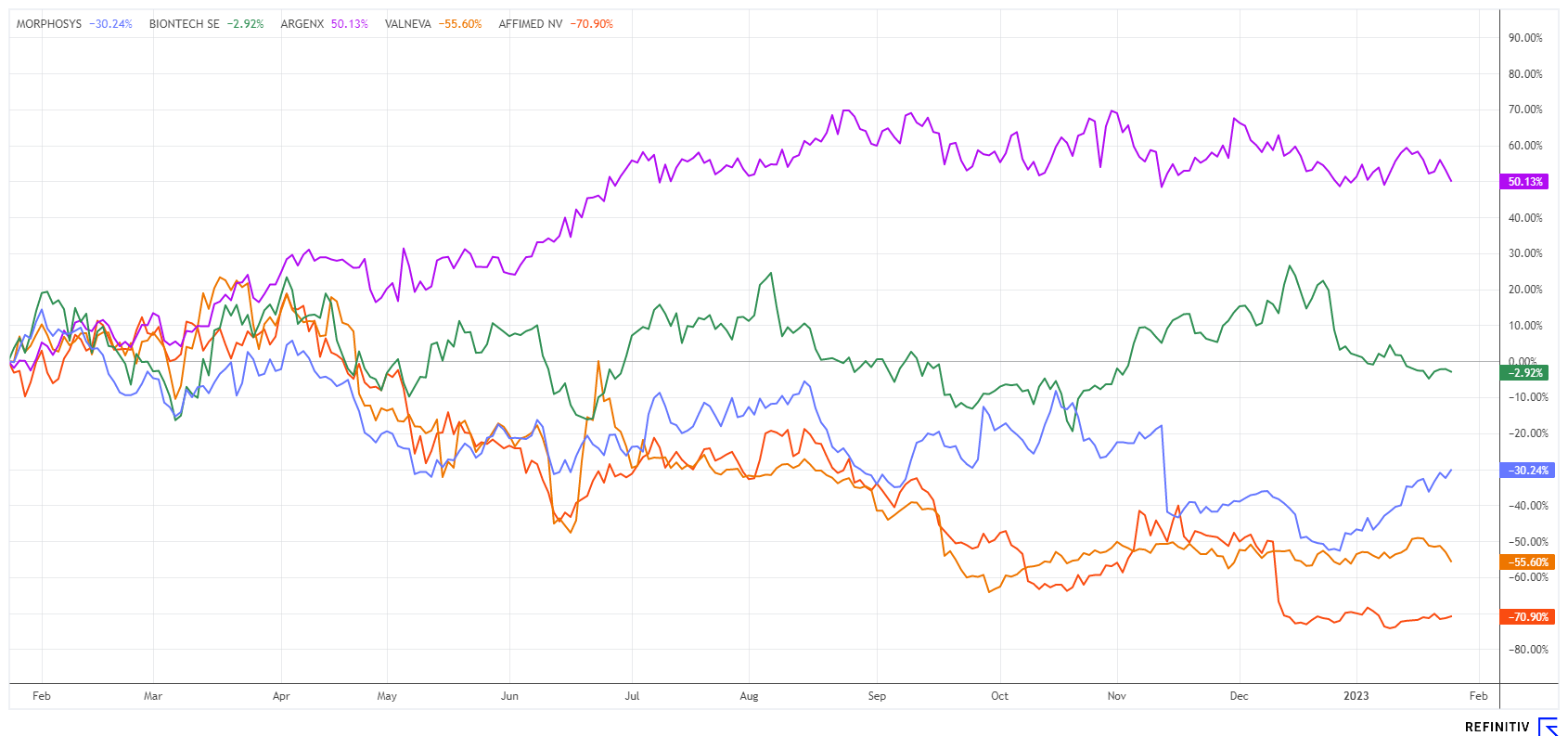

BioNTech SE (Mainz, Germany): the shooting star among German biotech companies with a research focus on immunotherapy. The main areas are developing therapies for cancer, infectious diseases and rare diseases. The Company combines immunology research, advanced therapeutic platforms and bioinformatics tools to rapidly advance the development of novel biopharmaceuticals. BioNTech is the largest German biotech stock with a market capitalization of approximately EUR 32 billion.

argenx SE (Breda, The Netherlands): develops antibody therapies to fight autoimmune diseases and cancer. The Company specializes in the discovery of novel targets and therapeutic antibodies. With a market capitalization of EUR 19.4 billion, argenx SE is one of the major European biotech companies.

Valneva SE (Saint-Herblain, France): is a vaccine developer with a portfolio of specialized products for diseases with limited preventive or therapeutic treatment options. In 2021, it developed the first inactivated vaccine against the SARS-CoV-2 virus. The current market capitalization is approximately EUR 882 million.

Affimed N.V. (Heidelberg, Germany): is a biopharmaceutical company focused on developing cancer immunotherapies and already has therapy candidates in the clinical stage. The Company's product candidates are being developed in the field of immuno-oncology (I-O). The market capitalization is approximately EUR 159 million.

All four companies and Morphosys have the same status as a biotech growth company. With the exception of BioNTech, all of the industry representatives listed have made losses to date. The Company's development is made possible by ongoing financing rounds. The year 2022 was a successful stock market year for only argenx SE, but almost all biotech stocks worldwide suffered significant losses simultaneously. The Nasdaq Biotechnology Index lost up to 42% within the last 2 years from its high in the summer of 2021.

Analyst Opinions: The picture is mixed

US investment bank Morgan Stanley downgraded Morphosys from "Equal-weight" to "Underweight" and lowered its price target from EUR 17 to EUR 12.50. Analyst James Quigley and colleague Mark Purcell expect investors to take a more defensive approach in an existing pharma sector report in the biopharma sector.

CEO Dr Jean-Paul Kress expects to break even in 2026

Investment bank Stifel also lowered its price target for Morphosys - from EUR 16 to EUR 13, but the vote is Hold. The disappointing 2023 US sales target for the blood cancer drug Monjuvi points to minimal growth for the biotech company, analyst Victor Floch wrote. Away from Monjuvi, the analyst also sees little reason for optimism in 2023.

In recent weeks, Citigroup and Goldman Sachs, two major US investment houses had already advised selling the stock. Nevertheless, Morphosys has a strong cash position and has several options to finance its strategic priorities. Meanwhile, a lot of negativity is priced into the share, and this could attract one or the other larger interested parties.

SWOT analysis - a brief overview

Strengths

- Strong pipeline with close events

- Ongoing phase 1/2/3 studies

- Good refinancing and a high cash balance of around EUR 1 billion

- Stable partnerships

Weaknesses

- Very high investor expectations

- Disappointment in the field of Alzheimer's disease

- Track record still manageable

- High expenses for research and development

Opportunities

- Positive environment for innovative biotechnology companies

- Cancer therapies as potential blockbusters

- Higher Monjuvi sales and international licensing

- Approval of Pelabresib slightly earlier than expected

Threats

- Competition from well-funded large corporations

- Decisive study results in the current year

- Excessive increase in costs due to internal and external factors

Conclusion and outlook

The study results for Pelabresib should be available as early as the beginning of 2024. Morphosys hopes for approval in 2025, which would then be the second drug of the former contract manufacturer. Morphosys has been in the red for years due to its costly research and is therefore under tremendous pressure to succeed because even with the revenue generator Monjuvi, it is becoming apparent with the increasing competition that the trees do not grow to the sky.

After strong sell-offs, Morphosys shares had suffered almost 70% losses in the previous year. Since the low of around EUR 11.80, however, the share price turned sharply upwards and is heading towards EUR 20. On the way, there are still some technical resistances lurking, but the extensive short quota of currently about 3% of the capital could help in the case of good fundamental news. In terms of the chart, the share recently surpassed the 50-day line, and the 200-day line at EUR 18.40 is not far from the current price of EUR 18.15. The MACD and relative strength are also sending out strong signals. Morphosys reached a high of EUR 146 in 2020 and is currently trading 50% below its cash position as of September 30, 2022. 2023 should therefore be a very exciting year for the Munich-based company.