A bargain in the rating

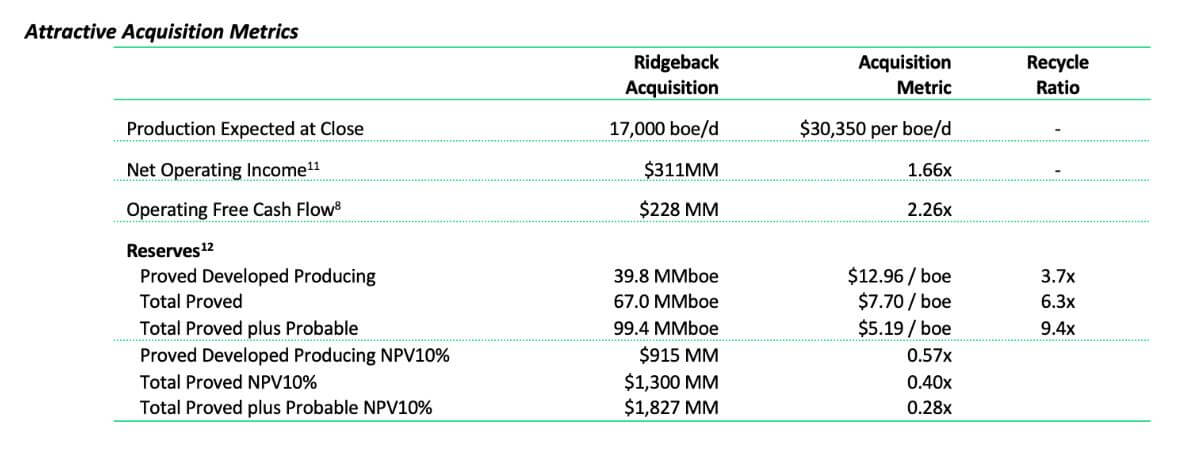

One can understand why Saturn Oil & Gas had to act quickly here. For just CAD 525 million, they are acquiring a private oil and gas producer focused on light oil in Saskatchewan and Alberta. The Ridgeback assets comprise over 430,000 net acres of land in four core areas in Saskatchewan and Alberta. The synergies could not be better as all of the properties are located within an already known footprint of the Company. After obtaining all regulatory approvals, Saturn now awaits shareholder approval to close the deal in the first quarter of 2023.

The numbers speak for themselves. The new transaction will increase production by a further 140% to up to 30,000 BOE/day. At the same time, the present value of the proven reserves of the properties is approximately CAD 1.8 billion.

140% production increase due to Ridgeback acquisition

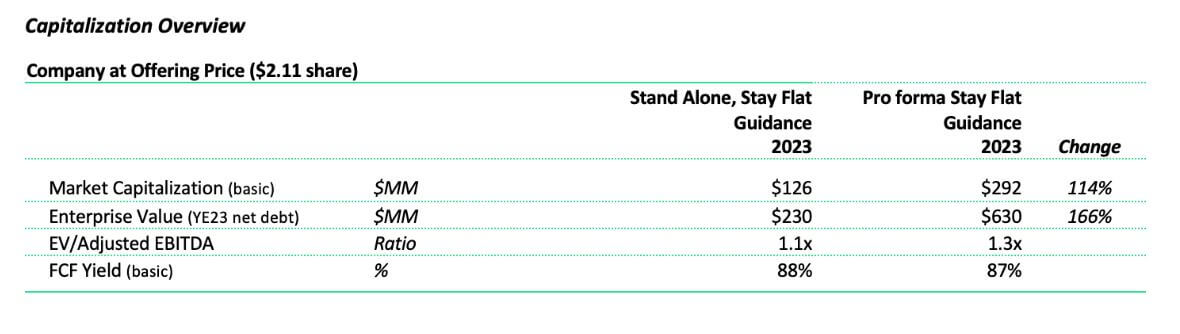

WTI (West Texas Intermediate) oil prices are expected to generate operating returns of approximately USD 48.55 per BOE, resulting in annualized net operating income (NOI) of CAD 311 million. That will result in annualized free cash flow of approximately CAD 232 million, which can be used for debt repayment and exploration. The entire area covers around 700 drill sites with a life of roughly 15 years. The Ridgeback acquisition is thus another quantum leap for the Canadians, as it promotes Saturn adhoc from the district league to the top league. The market capitalization of the combined company will be just under CAD 300 million after approval of the new share capital, with net debt projected to drop to CAD 345 million by the end of 2023. The new calculations assume a WTI price of USD 80.

The combined figures are inspiring

Saturn Oil & Gas expects the acquisition to be approved quickly and formally closed by February 28, 2023. The new high-quality development projects in Alberta add to Saturn's inventory of light oil-focused drilling locations. They include the high-yield, fast-amortizing Montney development at Kaybob and many low-risk Cardium drilling locations in the well-defined light oil fairway in Greater Pembina. With over five years of operating history, the advanced Waterflood project at Deer Mountain offers long-term light oil production with 100% owned infrastructure. Saturn expects to achieve increased primary production from its enhanced oil recovery programs for other light oil projects in the expanded development portfolio. Similar success has already been demonstrated in the acquired Viking and Oxbow fields.

The attached table summarizes the Company's updated pro forma operating and financial guidance for 2023; the WTI oil price estimate has been adjusted to reflect reality and lowered from USD 90 to USD 80. Assumptions are based on the timely closing of the transaction on February 28, 2023, and average production of 30,000 BOE/day by year-end.

New anchor investors emerge in the deal.

The acquisition of Ridgeback is being implemented under a court-approved plan of arrangement. Simultaneously with the closed agreement, shareholders representing 80% of Ridgeback's capital signed a commitment in which they agreed to exercise their voting rights in favour of the resolution. The new shares issued with the transaction are subject to a 12 to 15 month hold period from closing.

In concert with the underwriting, Saturn has entered into an agreement with respect of the Offering whereby Echelon Capital Markets, as sole bookrunner, Canaccord Genuity Corp. as co-lead, and with a syndicate of underwriters including Eight Capital, Beacon Securities Ltd. and Paradigm Capital Inc. to issue and sell approximately 59.2 million subscription receipts on a bought-deal basis. The certificates will be offered at a price of CAD 2.11 for total gross proceeds of approximately CAD 125 million. The Company will use the net proceeds from the offering to pay a portion of the cash consideration for the Ridgeback acquisition. Saturn has already generated strategic interest in advance from new shareholders GMT Capital, Libra Advisors and other institutional investors and has received lead orders equivalent to more than CAD 110 million. The deal should thus be considered secured.

Interim summary: Integration and growth into a new dimension

Saturn Oil & Gas also shows with this transaction that it will stick to its strategic direction and is not afraid to integrate very large units into the Company. From a current production level of just under 13,000 BOE, the acquisition will immediately take it into the 30,000 BOE range. The Ridgeback acquisition thus doubles light oil production from Saturn's existing and adjacent core growth project in southeast Saskatchewan, targeting Frobisher and Midale light oil development and increasing the Bakken regional light oil business. The Ridgeback concession areas in southeast Saskatchewan are directly east and adjacent to Saturn's existing production and development area. This makes them a perfect synergistic fit, operating out of Saturn's Carlyle operations center.

With projected capital expenditures of about CAD 161 million, free cash flow should reach more than CAD 230 million. It is assumed that the average WTI price for the coming year will be USD 80. With this, Saturn already achieves a significant debt reduction to about CAD 345 million in 2023/24. The Company's total valuation (EV) increases with the new number of shares and using the transaction price of CAD 2.11 to currently just under CAD 630 million. The path to becoming a mid-tier producer is thus no longer far. For Saturn Oil & Gas, this transformation opens up the opportunity to enter institutional portfolios.

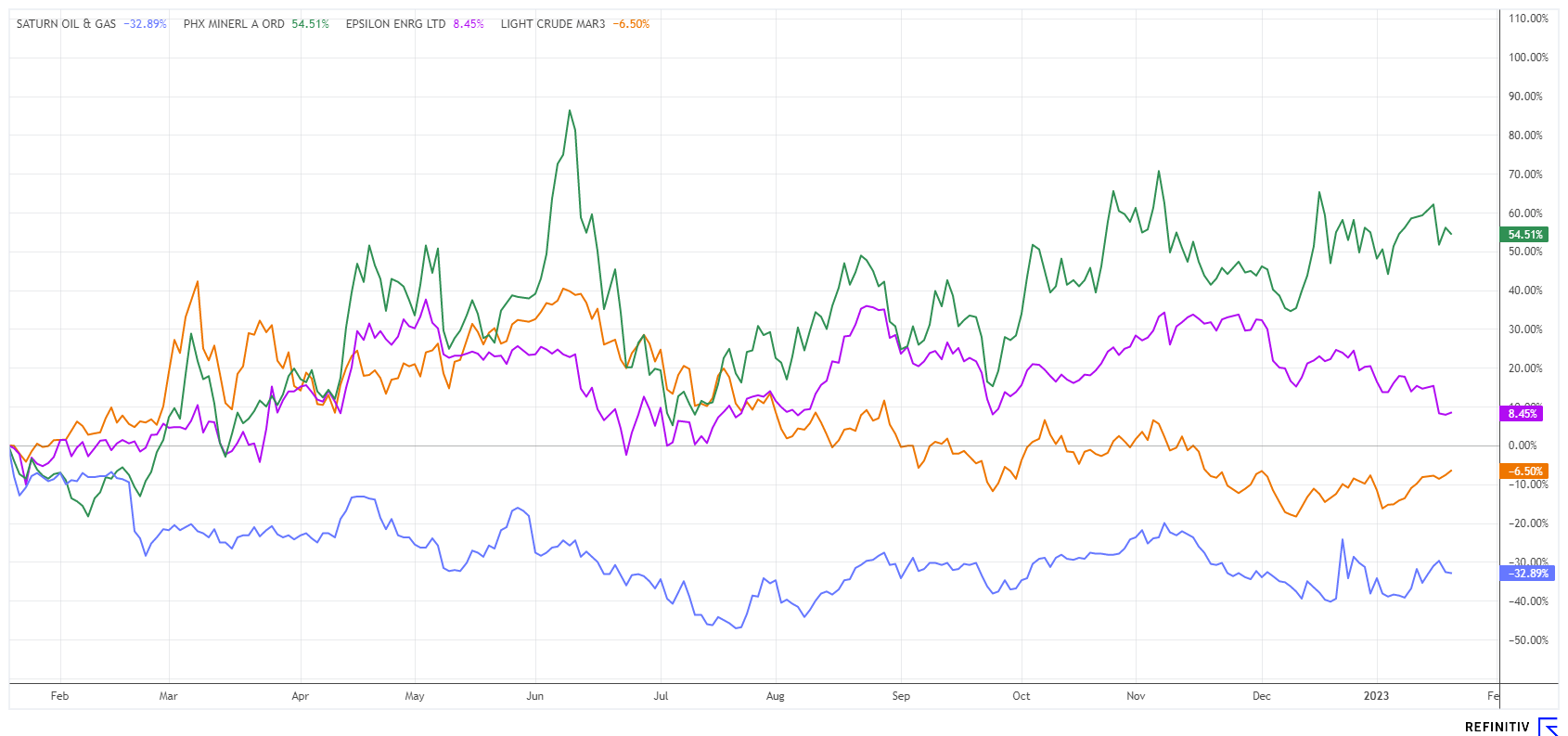

This increases the share of important, long-term oriented investors compared to the recently very volatile free float. Fundamentally, Saturn is trading at an EV/adj EBITDA ratio of about 1.3 after the transaction. In the entire North American oil sector, there is no more favourable company with such strong growth metrics. It is, therefore, expected that the valuation GAP will close at a factor of 5 times EV/adj EBITDA in the medium term. From today's perspective, this would be a fair value per share of around CAD 10.00. Before the transaction, the research house Beacon had already issued a "Buy" rating and a 12-month target of CAD 9.00. The calculated price target should adjust further upwards with the further doubling of production.

This update is based on the initial report 11/2021