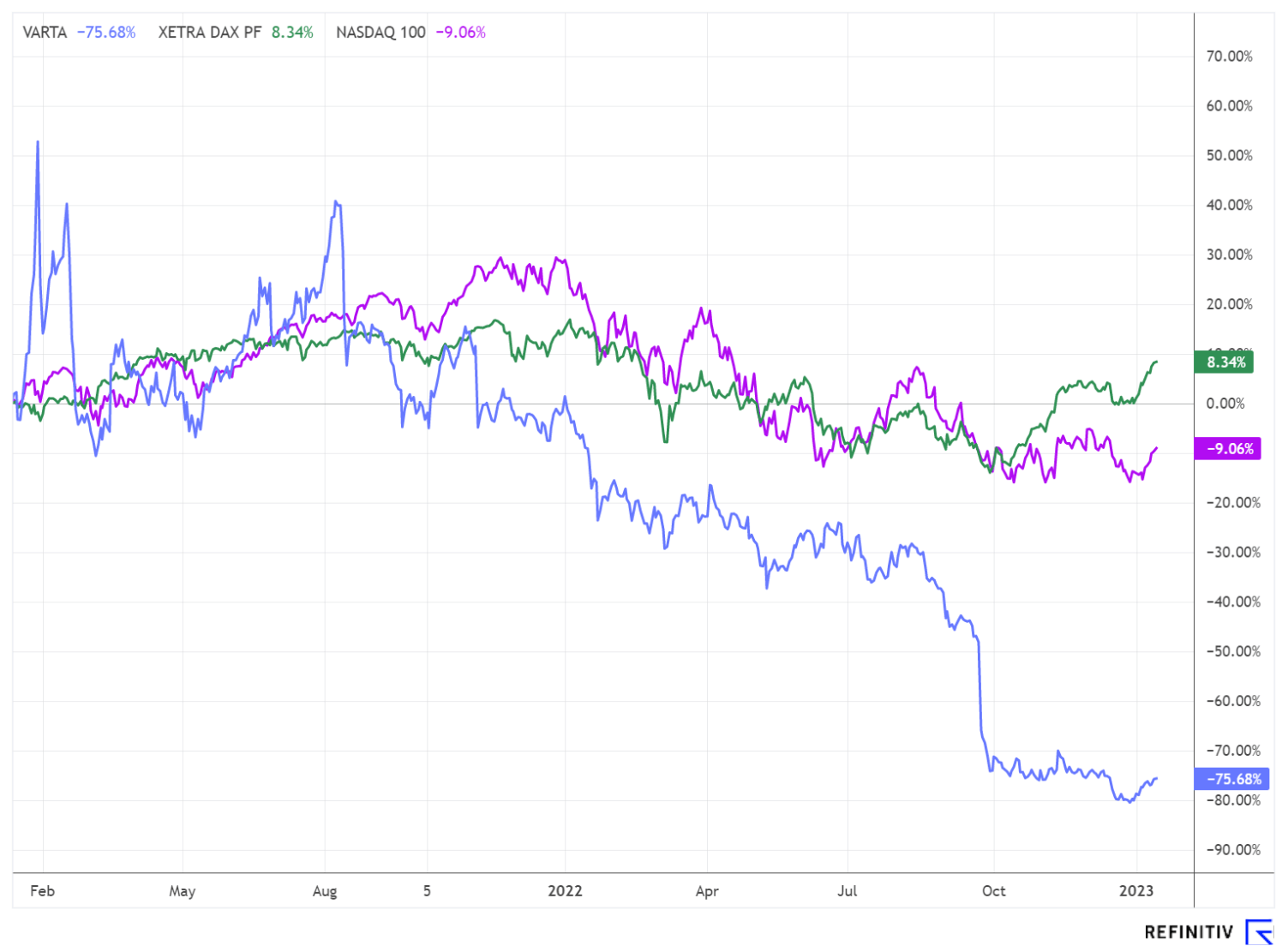

Tabula rasa for the battery manufacturer from Ellwangen, Germany.

For a long time, investors had hoped that the battery manufacturer from Ellwangen would be able to come up with groundbreaking news on e-mobility. Instead, since the start of the war in Ukraine, market conditions have tightened to such an extent that Varta has even had to fear for a contract extension with its most important customer Apple. Varta has a good position in its core markets. Nevertheless, the significant weakening in demand for CoinPower cells (TWS division) and higher raw material and energy prices have led to a significant drop in sales. This drags earnings and causes the stock market's valuation to fall.

The main effect is that the increased costs can only be partially passed on to customers and with a significant delay. While the direct impact of the war in Ukraine on the Company is small, Varta is indirectly strongly affected. That is because raw material and energy costs have risen sharply, and it is not assessable how long these increased levels will continue or if they will even rise further. Customer projects in the high-margin segment "Lithium-Ion Solutions & Microbatteries" were not called off as planned, resulting in a decline in sales and earnings. Other business areas, e.g. Consumer, were able to increase sales slightly. However, due to a significantly higher proportion of raw materials, these products are subject to disproportionately high price increases.

The developments in the two segments "Lithium-Ion Solutions & Microbatteries" and "Household Batteries" have led to an overall negative change in the sales and earnings mix. The Company is currently attempting to pass on cost increases to customers, at least in part, through price increases. However, this is being done with caution and depending on the market and competitive situation. In order to optimize the operating cash flow, the Company aims to reduce inventories and make general adjustments to working capital.

Revised expectations for the year 2022

In view of the multiple risks and uncertainties, the Company expects consolidated sales of EUR 805 to 820 million in fiscal 2022 (2021: EUR 902.9 million). Adjusted operating profit (adjusted EBITDA) is expected to be between EUR 55 and 60 million in 2022, significantly below the previous year's figure of EUR 282.9 million. The above-mentioned charges have a strong negative impact on earnings development.

2022 sales forecast is approx. 10% below the previous year

After management's cautious statements, the analysts consulted at Refintiv Eikon estimate sales in 2022 at EUR 809 million. The 2021 revenues are not to be exceeded again until 2024. Due to ongoing restructuring and consulting expenses, estimates call for a net loss of EUR 1.14 and EUR 0.28, respectively, in 2023/24. The experts also expect a dividend cancellation for 2022 and 2023.

Measures to increase earnings and outlook

In order to meet current and future challenges, the Management Board has launched a comprehensive package of measures to reduce costs. CAPEX, i.e. cash outflows from the purchase of intangible assets and property, plant and equipment, will be below the previous year and amount to between EUR 105 and 115 million. CoinPower cell (TWS) capacity will be reduced but may be reduced, but may be increased again in the short term depending on the demand situation. As part of these adjustments, the Company is also taking personnel measures and has temporarily registered short-time work at the Nördlingen production site in the Lithium-Ion CoinPower business unit.

For the fiscal year 2023, the management board of Varta AG expects a reduced turnover between EUR 850 and 880 million and assumes an adjusted EBITDA of EUR 90 to 110 million. The analysts of Refinitv Eikon expect EUR 103.70 million here. Management's forecast is based on the assumption that the challenging economic situation and the existing global crises will continue in 2023, with corresponding negative consequences for manufacturing costs and consumer demand. However, the further development of input factors for the current year can only be estimated to a very limited extent. Therefore, the forecast for fiscal 2023 is subject to higher uncertainties than otherwise. **In our view, the recovering supply chains offer hope.

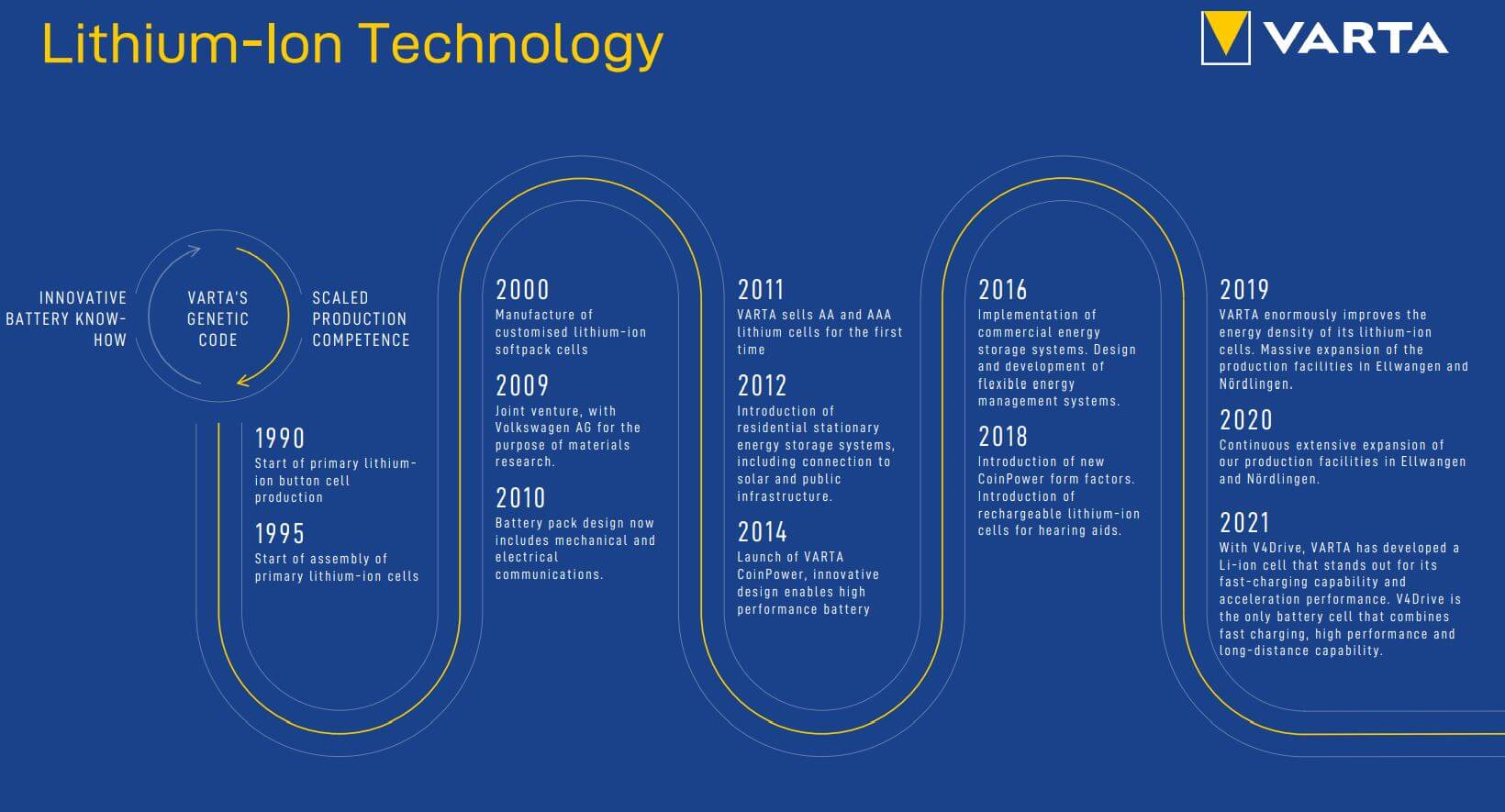

Hopefuls electric mobility and energy storage

The stock market continues to look eagerly to electromobility at Varta. The new factory construction for the round cell "V4Drive" will only be continued after binding customer commitments. However, the operation of the first series production plant will continue as planned. It will provide the necessary cells in the future to fulfill the OEM contract with a premium car manufacturer. Following several announcements last year on the subject of high-performance automotive batteries, the market still assumes that the medium-term plan for the e-offensive is still in place. Arguably, however, it will take more time than expected. Management emphasized in recent publications that everyone in the industry is currently talking to everyone else. This means that the first partnerships could sometimes come as a surprise to the market. However, the development of Tesla and other producers of e-mobiles has also started the new year with big question marks, as the total market based on registrations in 2022 has increased by 32% from 356 to 471 thousand vehicles, but the majority of the 1.18 million new registrations were achieved by hybrid vehicles. However, their tax subsidy will no longer exist from 2023.

From today's perspective, it is questionable whether the "e-wave" of the last few years can thus be increased again in 2023, especially since electricity costs in Germany increased by 50% on average at the turn of the year, but fossil raw materials from their high in 2022 have already fallen again by 40%. At present, consumers have seen a sharp increase not only in the purchase costs for an e-mobile but also in consumption costs. Another area of hope is the field of energy storage. Due to the high demand for grid availability and stability of supply in Germany, public utilities and private individuals have to think about power storage solutions.** Here, too, Varta can offer solutions - a clear growth area for decades to come.

Analysts revise their forecasts

After several revisions of expectations, it has become difficult for analysts to derive a fair valuation. While Berenberg (target lowered again from EUR 45 to EUR 35) and DZ Bank (target lowered from EUR 40 to EUR 25) are rating Neutral or Hold, Warburg still sees potential downside and reiterates its "Sell" rating with a price target of EUR 17.50. After strong adjustments to the discounting models, it should not be very difficult for Varta to initiate the hoped-for upside revisions with a bit of luck. This will happen very quickly with positive figures.

With the current business plan, the share is valued at a price-to-sales ratio of 1.4; this ratio also reached values of over 5 in 2021. Even in the current environment, it is expected that Varta will be able to sell its produced goods, but the achievable profit will be eaten up to a large extent by the high costs. A renewed outlook for 2023 will come with the presentation of the 2022 annual figures on March 30, 2023. At that point, the results of the cost adjustments should also be known. They should be at least EUR 100 million to turn the operating trend around.

Interim conclusion: wait and see

Among all analysts surveyed, there is currently no active buy recommendation for Varta AG. The average price expectation of the 10 experts from Refinitiv Eikon is EUR 27.50 on a 12-month view. This corresponds approximately to the current stock exchange price. For new investors, this offers a comfortable situation because one can wait for the publication of the annual figures for 2022 or concentrate on the next analysts revisions. After the loss of confidence in 2022, the share price will oscillate volatilely in a range around the current target price of the experts. Only when there are upgrades is there likely to be upward momentum again.

In our estimates, we had secured an exit price of over EUR 100 through recommended technical stops. In line with the operating performance, analysts lowered their expectations several times from EUR 99.8 to EUR 27.5 in just 6 months. Technically, the share price would have to climb back up to EUR 33 and later to the EUR 58 mark, which is probably not expected from today's perspective. Our last report discussed the prospect of a technical correction down to EUR 25. Investors should maintain their observation position until the fundamental scenario develops for the better or Varta can show new successes in some important sectors.

The update is based on the initial report 11/2021