Gold and silver production declines slightly

Due to constraints during the COVID pandemic, global gold and silver production declined slightly in recent years, with gold production falling from a record 3,652.5 tons in 2018 to 3,560.7 tons in 2021.

gold has historically been mined, estimates the World Gold Council

The world market price for gold and silver has now returned to the USD 1,920 and USD 23 zone after peaks of USD 1,950 and USD 48 in 2011 and USD 2,050 and USD 29 in 2020, respectively. Because of strong inflation, precious metals should be well supported at the moment. Due to the sharp rise in energy costs, the global production costs average USD 1,170 or 17.90, which could go even higher in 2023 due to wage adjustments. Thus, more suppliers will gradually disappear from the market, and the amount of gold in circulation could decline further. Mexico offers the possibility of cheap open pit mining in most parts of the country, which means that even low-grade mineralization can still be mined profitably.

Sonora - In the desert lie the treasures

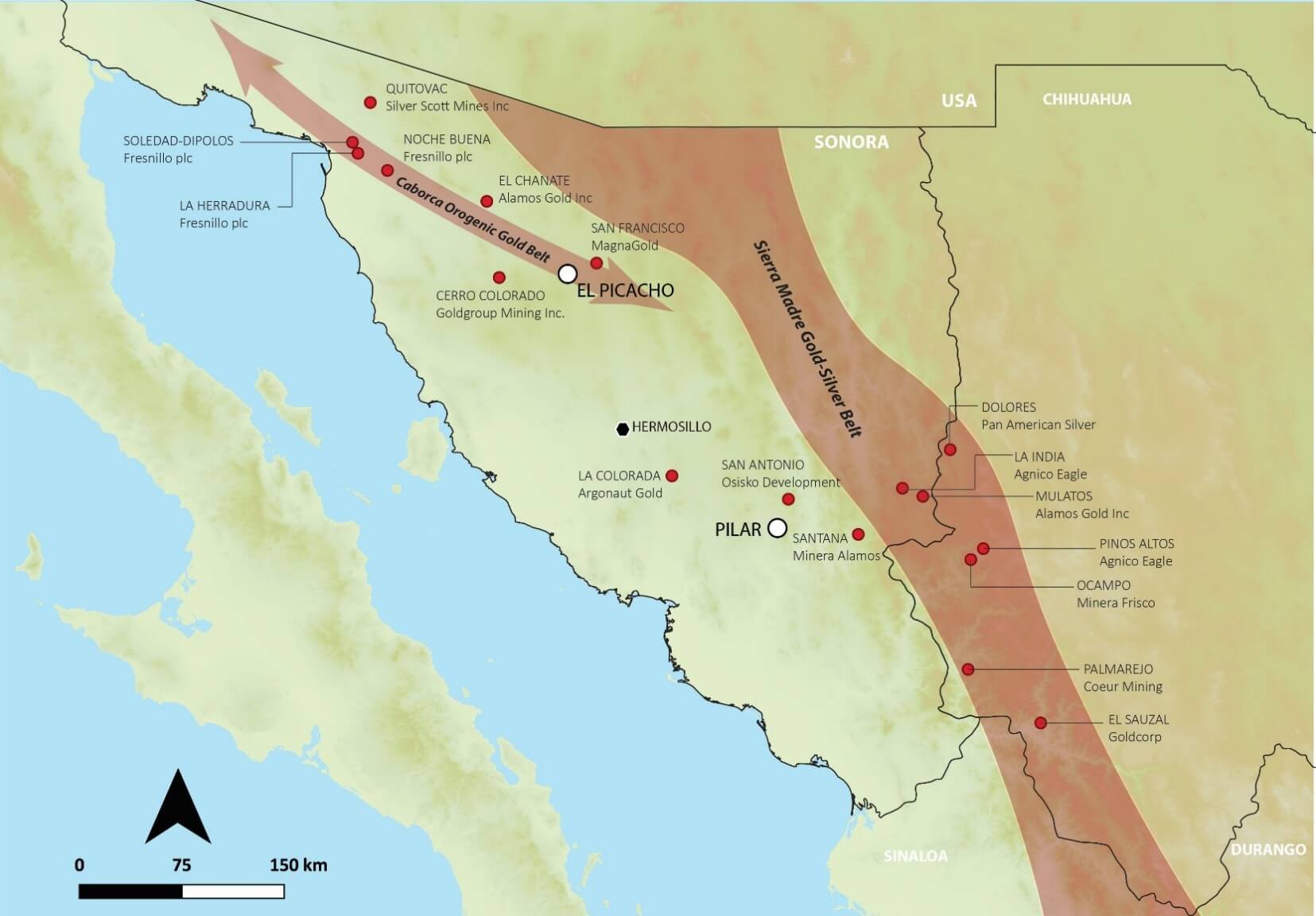

Sonora is Mexico's best-known state when it comes to the mining industry in the Central American nation. The region has long been the world's largest producer of silver, but gold can also be found in industrially recoverable quantities. Locally, several well-known mining companies, such as Fresnillo, Argonaut Gold and Minera Alamos, are bustling about. With its barren landscape and desert-like structure, Sonora is known for low-cost, open-pit, leachable deposits. These parameters provide a small hedge against inflationary spikes and highly volatile metal prices. Resident producers at the San Antonio, La Colorada and San Francisco properties are operating at grades ranging from 0.4 to slightly above 1.0 g/t Au, with recoveries ranging from 50 to 90%, according to the latest published NI 43-101 reports. The results already determined for the Pilar project are above the regional average by comparison. Good conditions for Tocvan to gain a foothold in the region with profitable production.

Tocvan Ventures - In the thick of things instead of just being present

Tocvan Ventures has secured two gold projects on-site called Pilar and El Picacho and has already done some exploration work since 2020. Trenching work has been done on Pilar, rock samples have been taken, geophysical analysis has been done, and most importantly, drilling has been done. Almost 23,000 meters of drilling have been completed, and the results are more than impressive. The last drill program delivered up to 1.6g/t Au over a length of 94.6m. A section of this drill hole even came to 10.8g/t Au and 38g/t Ag over a proud 9.2m. These are outstanding values, considering that here, just as across the Nevada border, economic open pit mining can be done with as little as half a gram of gold per ton. In some cases, the results of Tocvan's drilling teams are better than those of the already-producing mines of Argonaut and Minera Alamos.

The mineralization at Pilar occurs at surface in a highly fractured and oxidized host rock; the gold and silver oxides are heap leachable. Metallurgical studies show that gold recovery is above the regional average, making the Company very confident about bulk sampling. The work is facilitated by excellent infrastructure that allows full access. Pilar is located 130km southeast of Hermosillo, the capital of Sonora. It takes only 150 min to reach the project site near the town of Suaqui Grande on a mostly paved road. The El Picacho concession area is located about 145km north of Hermosillo and can be reached within 2hrs of Hermosillo. The long mining history in Sonora has led to the settlement of industry experts, enabling rapid mine development. The permitting process with local authorities and jurisdictions is simple and has not caused any problems to date.

First class drill results to start the year

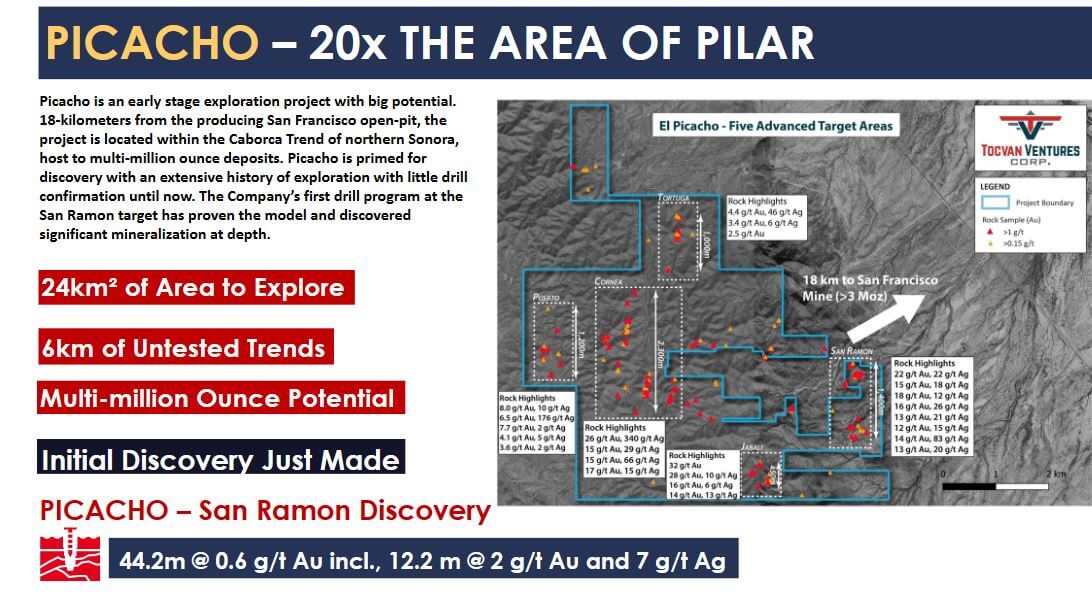

Tocvan Ventures Corp. recently released results from the remaining drill holes at its El Picacho gold-silver project in Sonora. 10 drill holes totalling approximately 1,075 meters were completed on the San Ramon property. Drilling was aimed at testing various structural orientations to determine the best way to target the existing mineralization.

The good grades of the historic underground mine have been confirmed. Drill hole SRA-22-010 returned the most significant results to date, intersecting 44.2 metres of 0.6 g/t Au, including 12.2 metres of 2 g/t Au and 7 g/t Ag from a hole depth of 41.2 metres (approximately 25 metres from surface). Analysis and interpretation of these data will be used to plan follow-up drilling. El Picacho hosts several other target areas that have been approved for drilling and extend across the 24 sq km project area.

"We are extremely pleased with the results of this initial program at El Picacho as we have not only confirmed mineralization associated with the old pits but also discovered even better mineralization at depth. We look forward to analyzing these results to plan the next phase of drilling at El Picacho." said CEO Brodie Sutherland."

How do things now progress technically in the current year, 2023?

In order to move the projects forward, Tocvan Ventures has now entered into an agreement with a neighboring mining company. A bulk sample of approximately 1,000 tonnes of material will be assayed at the operation 25 km away for expected ore grade and associated percentage gold recovery.

The total time required to process and analyze the bulk sample is expected to be three to four months. The information obtained from the sample will be used to plan and coordinate the permitting process for the full-scale mining and processing facilities on Pilar. A good overview of current activities on site is provided by CEO Brodie Sutherland in this short video.

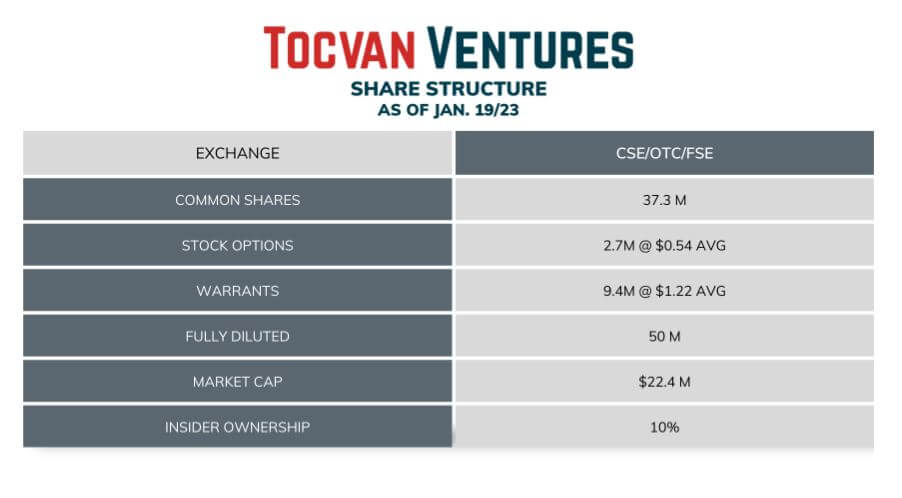

Good shareholder structure and still few shares issued

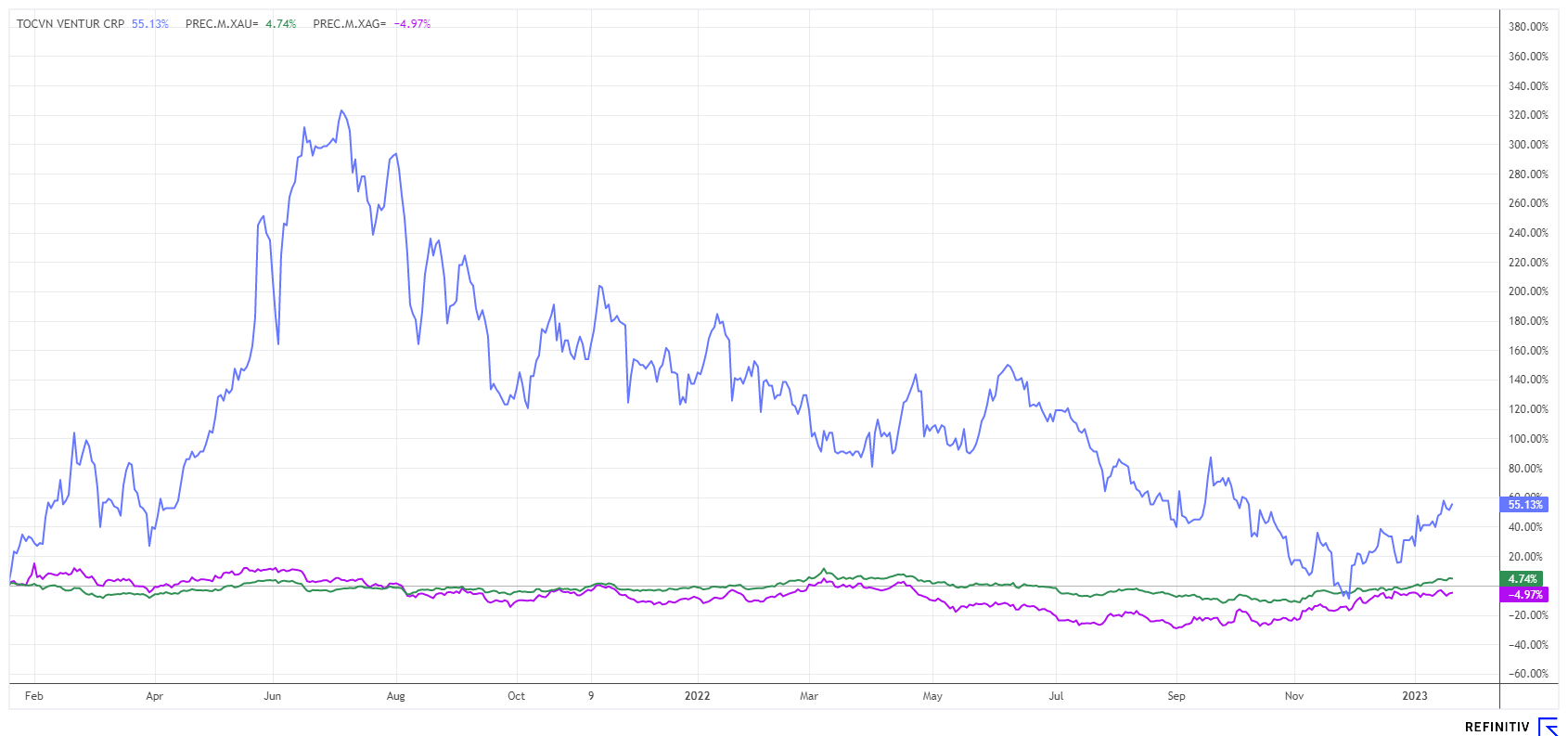

The low number of Tocvan shares issued, totaling 37.3 million, and the manageable amount of options (2.7 million at an average of CAD 0.54) and warrants (9.4 million at an average of CAD 1.22) are convincing. The Company has had little dilution to date, with significant blocks of shares (15%) held by founders and management. With a current share price of about CAD 0.61, the stock is roughly in the middle of its 12-month price trend, with the recent trend pointing steeply upwards again after the "tax-loss season" in Canada.

In a 24-month performance comparison, TOC shares outperform gold and silver by about 50%. The precious metals have already made a good start in 2023, giving hope for the coming months. In an inflationary environment, further rises should be inevitable. This also applies to the Tocvan share. It should make stronger progress, especially due to further drill results. Within the junior sector, the TOC share has good comparative parameters in the "Explorer Mexico" sector comparison. The share is relatively liquid and trades over 200,000 shares on a good day. It is listed in Canada and Germany and is well-known within the sector.

Interim conclusion: Excellent projects, the number of strikes is increasing

As drilling programs continue, there is more transparency on the level of the resource in the properties. In the evaluation of the last drilling programs, Tocvan has enlisted the help of a local major. In our opinion, this is not done without a larger background. The high attractiveness of the examined zones can very quickly lead to a strategic deal, which will certainly attract attention again in the promising mining zone "Sierra Madre Gold-Silver-Belt". A sale of the properties would immediately make the current discount to intrinsic value transparent. Should a major acquire a significant stake in the shares (>15%), alarm bells will ring loudly.

The update is based on the initial report 09/2022