Barrick and Newmont at the top

Canada's Toronto-based Barrick Gold Corporation is one of the world's largest gold producers, along with Newmont Mining and Agnico-Eagle. Its business activities include the production and sale of gold and copper, as well as exploration activities and mine developments. Precious metals account for approximately 90% of sales, while copper, an industrial metal, accounts for 8%. The Company holds interests in 14 gold mines, including six tier-one gold assets, i.e. prospects that produce at least 500,000 ounces of gold p.a. over a ten-year period or more. The Company's gold mines are well diversified geographically and are located in Argentina, Canada, Côte d'Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania and the United States. In 2021, they launched a joint venture with Newmont Mining called "Nevada Gold Mines". Barrick owns 61.5% of the mining complex, which brought it to a total production of 1.86 million ounces of gold in 2022.

In the wake of climate change, the Canadians' copper assets have taken on a high profile. The red metal is in demand worldwide and indispensable for achieving key goals in environmentally friendly power generation and storage. The Company's copper operations are located in Zambia, Chile and Saudi Arabia.

Full year 2022 performance below expectations

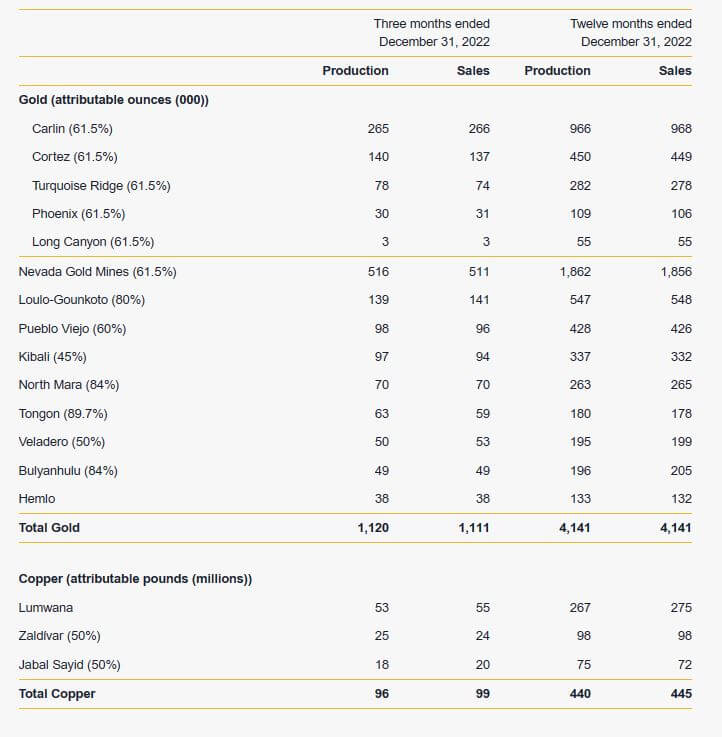

Somewhat disappointing production numbers last year. However, Barrick's production in the final quarter showed strong sequential gains, up 13% from the previous quarter. While preliminary gold production for the full year of 4.14 million ounces was about 1% below the previously forecast 4.2 million ounces, preliminary copper production of 440 million pounds landed in the expected range of 420 to 470 million pounds.

Barrick delivers another production record in 2022

The average realized market price for gold in the fourth quarter was USD 1,726 per ounce, and for copper was USD 3.63 per pound. Due to good recoveries at the Cortez, Carlin and Tongon gold properties, Barrick achieved its historically best production result. Compared to the third quarter, production costs per ounce in the final quarter were expected to be 4% to 6% higher. Still, all-in sustaining costs (AISC) per ounce are expected to be 1% to 3% lower than the previous quarter due to declining energy costs. Fourth-quarter copper production was lower than the third quarter due to higher stripping, lower throughput and lower grades at Lumwana. In addition to lower sales at Lumwana, Zaldívar also incurred higher input and operating costs.

The following table provides preliminary gold and copper production and sales results from Barrick's properties:

The acceptable quarterly data confirmed the continuation of a good operating performance from 2019 to 2021, even if management's expectations were missed. The full annual report will be released on February 15, 2023.

Aggressive growth is driving the fantasy

For years, the natural resources industry has been shaped by several key trends. Globally, project mineralization grades are declining. In addition, an increasing shortage of high-quality development projects and reserves, i.e. unmined gold deposits at active mines, are declining. Major producers such as Barrick are, therefore, increasingly focusing on acquisitions in addition to the further development of their own projects and exploration activities. Experts expect a significant increase in M&A activity in this area, as significant funds are available for acquisitions in the wake of the currently rising gold prices and strong cash flow generation.

In the slipstream of the recent gold price rise, Barrick announced a new joint venture just a few days ago. We are talking about the "Reko Diq Project", a gold-copper property in Pakistan. Mark Bristow, President and Chief Executive Officer of Barrick, has informed the Pakistani government and the owners of the lands in Baluchistan that the Company aims to complete the update of the feasibility study for Reko Diq by the end of 2024. Following that, it plans first production at the copper-gold mine in 2028, of which Barrick owns 50%. The remaining shares are shared 25% each by the government of Balochistan and three Pakistani state-owned companies.

First production forecasts are already available on the Company's website. The project is expected to produce an average of 280,000 ounces of gold in the first 5 years of production (2028 to 2033). During a three-day project review that began in Quetta, Bristow, accompanied by senior Barrick executives, met with some provincial leaders to brief them on the extensive social and economic development opportunities that the mine, with an expected life of at least 40 years, will bring. Following the meeting, Bristow and the chief minister signed an agreement setting out the timeline for the disbursement of the committed funds to the province, including royalties and social development funds. **The agreement calls for an initial payment of USD 3 million this month.

Analyst opinions are mixed

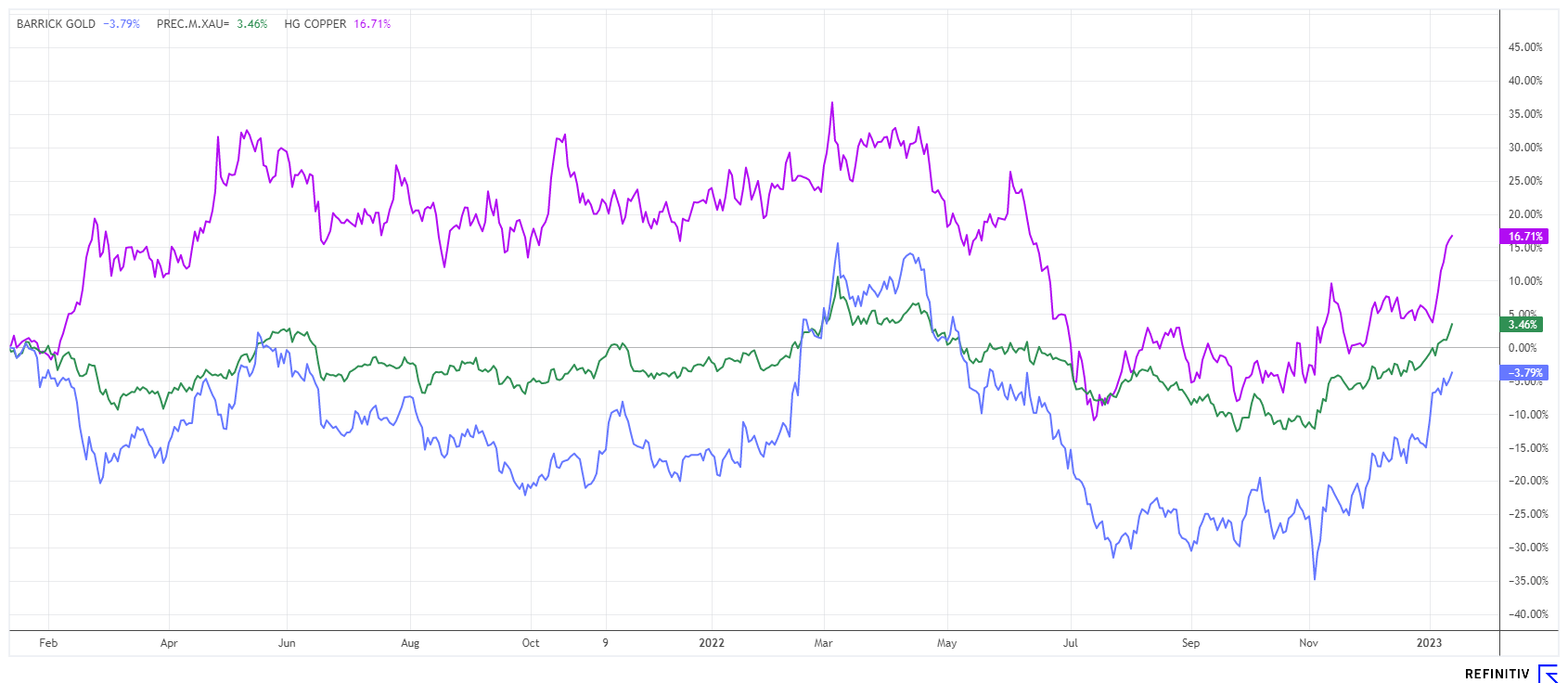

Significant cost increases on the production side have prompted analysts worldwide to lower their expectations for the commodities sector. Now, however, continued increases in metal prices could have the opposite effect. Despite rising costs, a possible breakout of the gold price this year above the magic mark of USD 2,000 is within reach. Globally, mining stocks are still underrepresented in investors' portfolios after years of underperformance.

Analysts, on average, expect Barrick Gold's revenue to increase from USD 11.1 billion to around USD 11.7 billion. Operationally, however, earnings (EBIT) are expected to settle in the USD 3.1 billion to USD 3.4 billion range, depending on cost dynamics each year. The resulting net income is estimated at around USD 1.5 billion, USD 500 million lower than in 2021, with a recovery to just under USD 1.7 billion not expected until 2024.

This is the average net income analysts expect for 2022

While the consensus of Refinitiv Eikon's experts is positive on the stock, price expectations range from CAD 24 to CAD 31, with the arithmetic mean calculated at CAD 28.95. At a current price of CAD 25.30, this implies a potential of about 14%. With rising precious metal prices, however, the scenario as described above could improve. After all, Barrick continues to buy back shares and has been able to report a net debt of zero since 2022. Balance sheet quality has significantly improved over the last 5 years.

Interim Conclusion

A departure from the lows is inevitable

Barrick benefits from higher gold prices and production volumes. When looking at the big picture, several aspects support a medium-term rise in gold prices. Gold has historically proven to be an effective tool against inflation, and currently, it is also benefiting from geopolitical instability. **In terms of climate protection, Barrick is a sought-after supplier of the red metal through its copper assets, for which experts predict a 30% undersupply in the market in just 5 years.

Inflation numbers in recent months are likely to be slow to rebound. However, based on declining economic momentum, energy prices, which are important for mines, should trend downward more strongly again. That will significantly improve the operating picture for the major mining companies. The bottom line is that the current price level of Barrick shares is an attractive entry opportunity for long-term investors, as commodity shares are undervalued compared to the sharp rise in metal prices. In the short term, rising operating costs still pressure the balance sheets, but this trend should subside.

This update is based on the initial report 11/2021