The Greentech wave is rolling

While the political camps try to outdo each other in their fulfilment of climate agreements, it is clear to market participants today - the race will be won over access to critical and strategic metals. In an increasingly unstable economic environment, however, experts see major supply risks for critical elements. Tungsten is a chemical element with the symbol W and atomic number 74. It is a whitish, high-density heavy metal that becomes brittle at very low levels of impurities. It is indispensable in industry because it is the chemical element with the highest melting and boiling points. The largest deposits are found in China, Peru, the USA, Korea, Bolivia, Kazakhstan, Russia, Austria and Portugal.

Whether in the semiconductor business, aerospace, automobiles or smartphones - tungsten is used in small quantities everywhere. Nothing works without the metal.

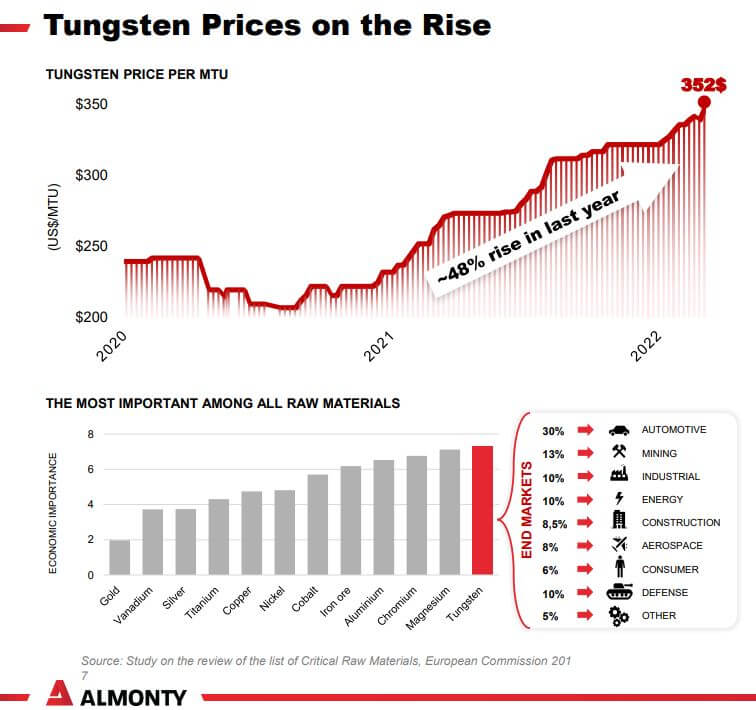

Whether e-mobility or alternative energy supplies, the rare metal tungsten is part of the game. Lately, tungsten is also considered a battery material, as the metal is suitable for replacing the controversial cobalt. Asian manufacturers such as BYD also hope to increase charging performance, endurance and safety by increasing the tungsten content in the sought-after traction batteries. If the development continues, tungsten demand could go through the roof. Currently, however, there is too little available material on the world market. Market experts, like CEO Lewis Black, stress that the industry must now work with the metals that are on the market. "There is no other option at the moment," the Company leader said in an interview with Cheddar News. At the same time, Black clarifies how risky it is to have no other options, "especially when you are dealing with jurisdictions that declare one thing and act completely differently," he said. This makes it clear that Almonty Industries is one of the upcoming key producers for the strategically important metal tungsten.

Production in Europe and soon in South Korea

Almonty is already producing approximately 78,000 metric tons of tungsten trioxide from the Panasqueira mine in Portugal. This is generating more than CAD 20 million in gross revenues per year. However, Almonty owns the largest asset through its subsidiary Woulfe Mining Corp. at the Almonty Korea Tungsten (AKT) project in South Korea. The deposit hosts one of the largest tungsten resources and was the leading global tungsten producer for more than 40 years.

"Almonty Industries specializes specifically in the strategic metal tungsten." | Lewis Black, CEO

With suspected reserves of 8.5 million tons containing up to 0.49% tungsten oxide, it has the potential to produce 50% of the world's tungsten supply (ex-China). About 264,000 tons of tungsten trioxide can be recovered here. Approximately 450,000 tons of ore will be processed in the first full year of operation in 2024. The Korean operating environment is highly competitive, with projected production and capital costs significantly lower than most comparable Western projects. With a planned mine life of 90 years, it is expected to supply at least 30% of the non-Chinese global market share. In 2022, the Austrian Plansee Group has been secured as a new major shareholder, and an industrial customer for the tungsten mined at Sangdong.

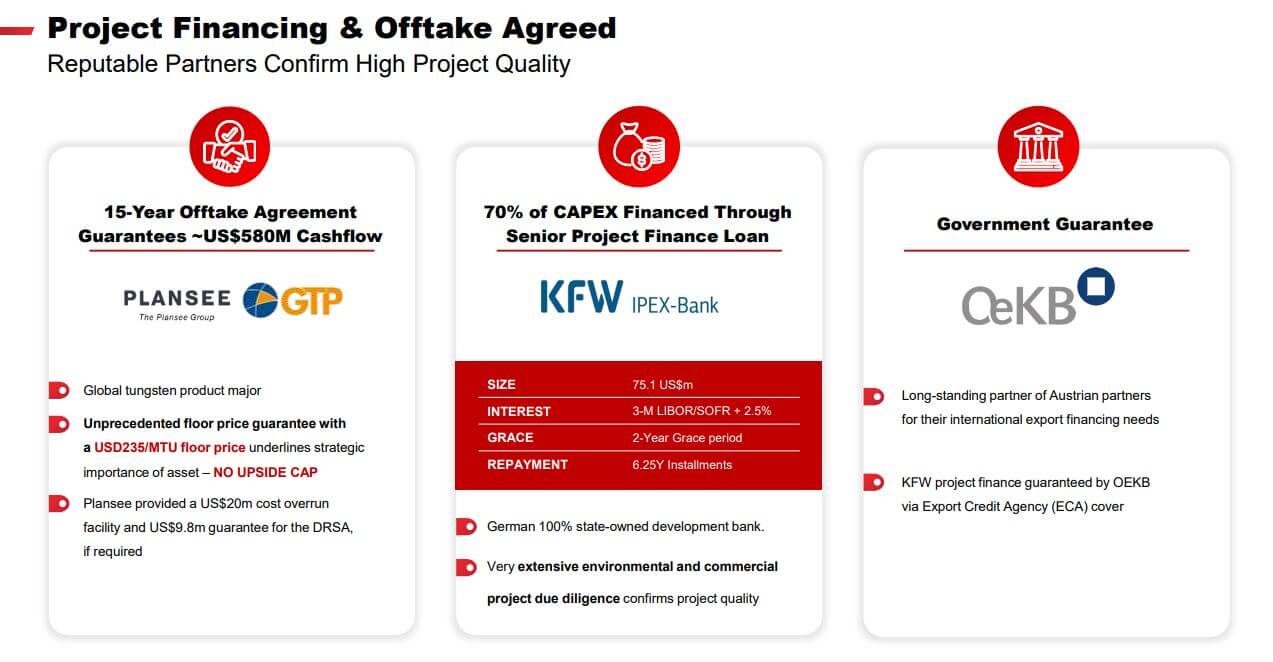

The mine expansion in South Korea will be granted pro-rata through a loan from KfW-IPEX Bank and totals USD 75.1 million. Disbursement will be made according to project progress, and construction of the mine is expected to be completed by mid-2023 when production will begin.

Update at the 6th International Investment Forum - IIF

CEO and founder Lewis Black will provide an update on mine construction at the 6th International Investment Forum on February 15, 2023, at 4pm (CET). According to estimates, the Sangdong mine is expected to be the largest tungsten mine outside of China once commissioned next year.

A vertically integrated downstream nano tungsten oxide processing plant will also be created to supply the South Korean battery anode industry. The long-term purchase agreement with the Plansee Group shows how great the hunger for the rare raw material is. The agreement has a term of 15 years and guarantees Almonty a cash flow of USD 590 million. The current tungsten prices have increased by around 50% over 12 months, making the project even more profitable.

The construction progress is currently slightly above plan, so from today's perspective, commissioning is already expected in the third quarter of 2023. **The industrial state of Korea currently obtains 94% of its required tungsten from China; this figure should be history from 2024 onwards.

Conclusion: about to ramp up

Almonty Industries is one of the core producers of tungsten outside of China, with the goal of significantly reducing the Western world's dependence on China. In addition to the tungsten mine in Sangdong, the Company also sits on a significant molybdenum resource. Added to this is its geographical location, on the one hand in Europe, and on the other in South Korea, one of the most advanced Asian countries with battery producers Samsung and Toshiba. This gives Almonty high strategic importance and makes the Company a hot takeover candidate.

Almonty has now taken all the steps to make this critical project successful. Mine construction is fully funded and progressing according to plan. With the mines already in place, Almonty is moving into a new size category in the medium term. Almonty was recently able to issue 2.5 million subscription rights to shares at a price of AUD 1.25 in a private placement. This generated AUD 2.0 million for the Company, which is available for operating purposes after deducting placement costs. If the mine goes into production, based on a processing scenario of 1.2 million tonnes per year and an estimated price of USD 300/MTU for ammonium paratungstate (APT), annual EBITDA is approximately USD 72 million. Adjacent to the Sangdong mine, Almonty also still owns the molybdenum deposit; it is currently not part of the profit calculation for the coming years.

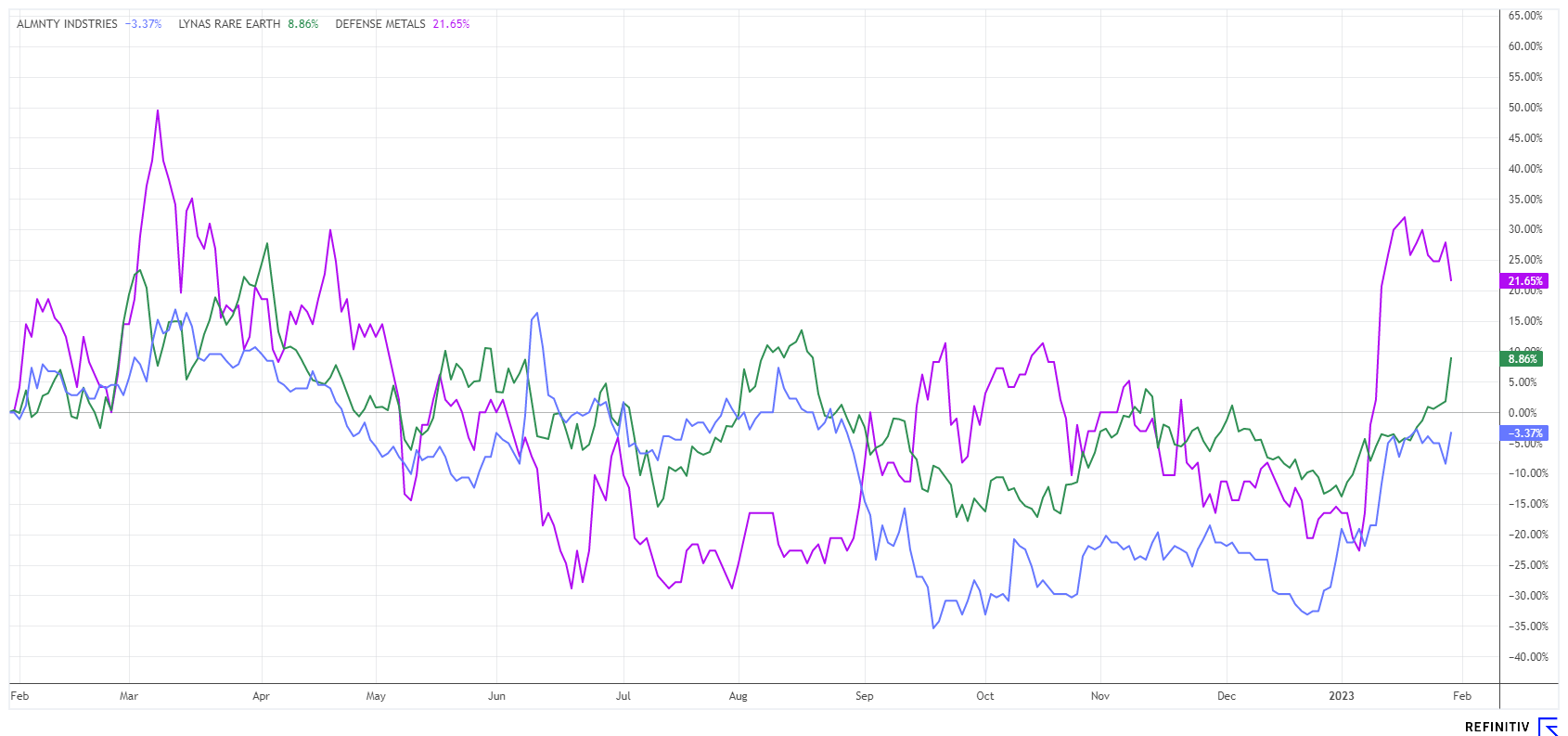

This changes the perception of international commodity investors for Almonty from explorer to producer. If the market realizes that new tungsten capacity is finally available outside China, there could also be a bidding war for Almonty. With the backing of other major companies looking for a reliable source of the metal, Almonty Industries is well positioned in the strategic metals market.