The maggot in the bacon

As in every crisis, there are many losers but also winners. While during the Corona pandemic, it was the vaccine manufacturers such as Moderna or BioNTech with Pfizer, the primary beneficiaries of the Ukraine war have been clearly identified. Arms companies such as Germany's Rheinmetall AG have been undergoing a renaissance since the outbreak of the conflict, both in terms of orders and reputation within society and the financial world. In the recent past, for example, they were still to be classified as "socially harmful" under the social taxonomy, which would have significantly worsened their access to financing from banks and the capital market. However, these discussions have since been discarded by the European Commission. Today, the industry is even considered a sustainable investment, opening the door for funds or ETFs to invest only in ethically clean companies.

Beneficiaries of ailing defenses

For decades, Germany saw no reason to invest in armaments and security. The result is an ailing Bundeswehr, which has understated deficits in terms of equipment and combat capability. It was not until the well-known events in Eastern Europe that the German government reacted and ended the deep sleep that had lasted since 1989 by increasing the Bundeswehr budget on the occasion of a government declaration by Chancellor Scholz. In addition to the announcement of a EUR 100 billion injection, an investment of 2% of economic output annually is to secure security, freedom and democracy in Germany in the long term. Other NATO countries and their partners also announced an increase in defense budgets in order to be able to guarantee national security in the future.

Relatively promptly, the enterprising CEO of Rheinmetall AG, Armin Papperger, presented a comprehensive list of offers for a volume of EUR 42 billion. The supplier to the German armed forces would be in a position to supply a large part of the special assets. At the time, the package consisted of ammunition, helicopters and tracked and wheeled tanks. The visionary company leader also expected orders from other NATO countries. At that time, there were already inquiries, especially from Eastern Europe. Over the past few months, these have gradually been added to the Company's full order books. As Papperger now told "Stern" in an interview, he assumes that the EUR 100 billion from the special fund will be used up in three or four years. In total, for a fully equipped Bundeswehr, as much as EUR 300 to 400 billion will be needed, spread over the next ten years. That means the Düsseldorfers will likely have to spend far more than the EUR 42 billion they were advised to spend just under a year ago.

Forecast increase and the Leopard

2022 was a record year for the Düsseldorf-based company. The final figures for the full year 2022 and the outlook for the current year are to be published on March 16. Based on preliminary and unaudited figures, Rheinmetall AG generated consolidated sales of EUR 6.4 billion in fiscal 2022. Measured against the previous year's sales of EUR 5.66 billion, this represents an increase of around 13%. According to initial estimates, the MDAX-listed company expects operating earnings to grow by more than 20%. Accordingly, Rheinmetall raised its previous operating margin forecast from over 11% to at least 11.5%. In addition, the Company's leader leaked in the "Stern" interview that he expects sales of between EUR 11 and EUR 12 billion for 2025. Previously, the Company was still assuming revenues of between EUR 10 billion and EUR 11 billion.

The reason for the rising optimism could be the current debate about the delivery of the outdated Leopard tanks as well as further armored vehicles such as the Marder. According to the defense company, the main battle tanks intended for so-called ring exchanges with Slovakia and the Czech Republic will be fully overhauled in the spring. By the end of March, Rheinmetall had around 29 Leopard 2A4 main battle tanks and 40 Marder ready for deployment, which had been earmarked for the ring exchange. On the Leopard 2 main battle tank, the Company is aiming for a pre-tax profit margin of at least 10%, with costs here ranging between EUR 3 and 9 million, according to Papperger.

Cleared for launch

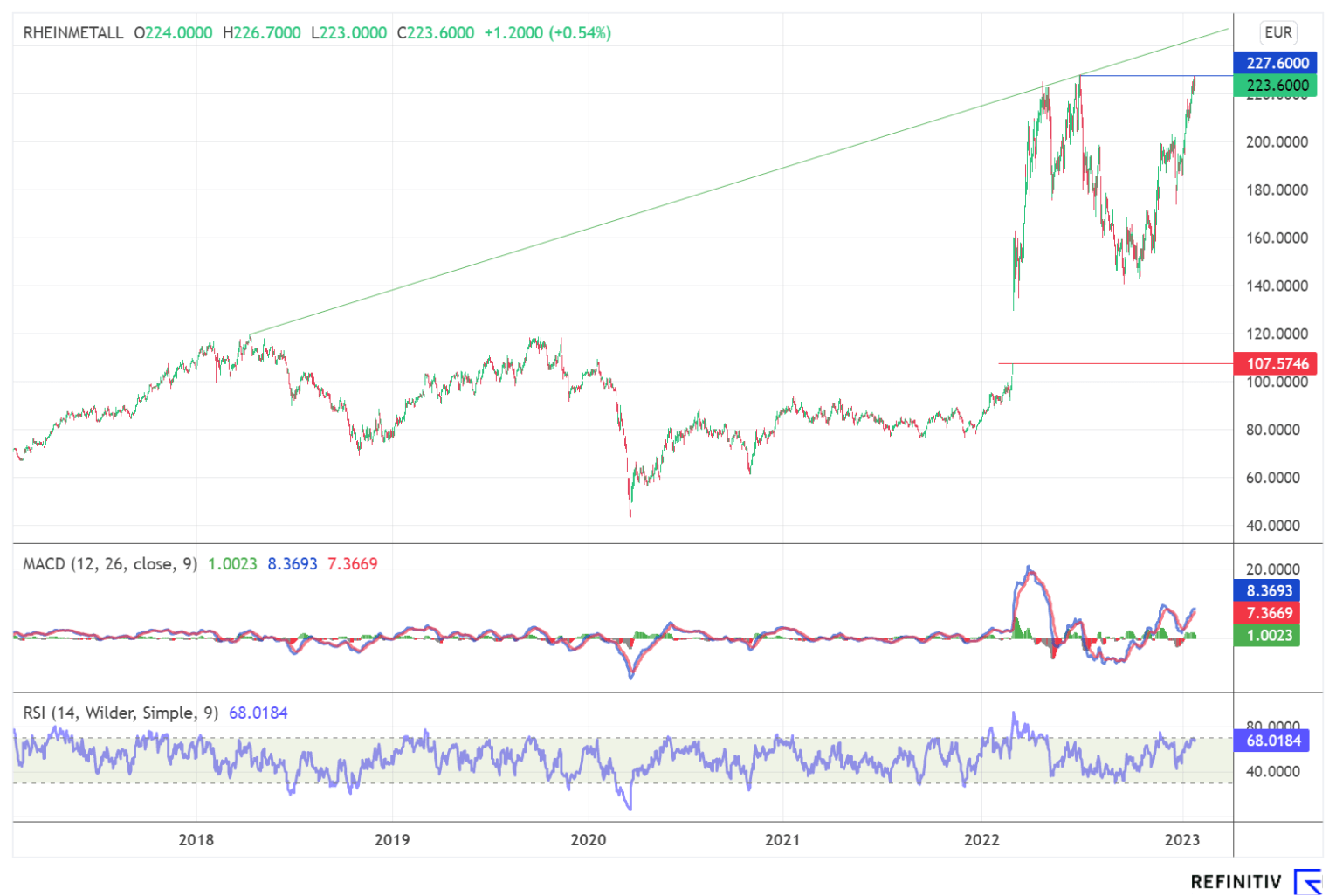

The positive order situation and the continued positive sentiment for defense companies is reflected in the share chart of the Düsseldorf-based company. Since the start of the invasion, the share price has risen by almost 150% and is once again on the verge of reaching a new all-time high. A march through the front line at EUR 227.90 would generate an advance to the upward trend formed since April 2018 at currently EUR 246.50. Should this also be overcome, a further move into the EUR 300 range is not unlikely. The share price continues to receive fire protection from the indicators. The trend-following indicator MACD is still in the green zone, and the relative strength indicator is neutral and shows no signs of overheating.

Interim conclusion

Without a doubt, Rheinmetall AG is one of the main beneficiaries due to the strong increase in geopolitical tensions. At the same time, the trend towards increasing military spending is probably only just beginning and will accelerate significantly in the coming years. The Düsseldorf-based company is very well positioned, especially in its home market of Germany, and can hardly be ignored when it comes to allocating budgets. As a result, we expect results in subsequent years to be somewhat higher than the estimates already published. A breakout above the previous all-time high would open up new share price potential to the EUR 300 range. The analysts at Goldman Sachs take a similar view, rating the Company a "buy" with a price target of EUR 290. Additional impetus could come from a possible inclusion in the German DAX benchmark index. Here, Rheinmetall could benefit from the delisting of the Linde share.

The update is based on the initial report 03/2022