Global defense industry on an upward trend

With the reunification of Germany and the end of the Warsaw Pact in the spring of 1991, the military policy situation in Europe eased, and defense and armaments spending worldwide declined from $1.45 trillion in 1990 to a low of $992.00 billion in 1996, where it remained until the turn of the millennium. Since then, led by the United States, spending increased significantly again, surpassing the old peak in 2011 with a budget of $1.625 trillion - the old high.1

Since Russia's annexation of Crimea in 2014 and NATO's target commitment to invest 2% of each member state's GDP in defense, a new supercycle in the defense industry began. The return to treaty and territorial defense, as well as the buildup and modernization of armed forces and their systems, has led to a steady stream of new records in defense spending in recent years. According to a report by the Swedish SIPRI Institute in Stockholm, global defense spending reached USD 1.981 trillion in 2020, which represented a 2.6% increase over the previous year despite the economic dislocation caused by the Corona pandemic.

In this context, the USA invested by far the most in armaments with $778 billion and a global share of close to 40%, followed by China with around $252 billion, India with $73 billion and Russia, which provided $61.7 billion. Germany followed in 7th place with $59.2 billion 2

| Country | Expenditures (in USD billion) | Share of gross domestic product (in % |

|---|---|---|

| USA | 778 | 3,7 |

| China | 252 | 1,7 |

| India | 72,9 | 2,9 |

| Russia | 61,7 | 4,3 |

| UK | 59,2 | 2,2 |

| Saudi Arabia | 57,5 | 8,4 |

| Germany | 52,8 | 1,4 |

"Growth Market" NATO

The "North Atlantic Treaty Organization" NATO is the central pillar of European and North American security and defense policy and sees itself as a community of values of democratic states. The North Atlantic Treaty was signed between 12 countries as early as April 4, 1949. In addition to the United States and the United Kingdom, the founding members included Belgium, Canada, Denmark, France, Iceland, Italy, Luxembourg, the Netherlands, Norway and Portugal. To date, the alliance has 30 members; Germany joined in 1955. In addition, 40 third countries cooperate with NATO on political and security issues.3

To strengthen NATO, each member pledges to work for the unity of the alliance and invest in the readiness of its armed forces. In 2014, NATO set a goal that each member country invest at least 2% of its gross domestic product in defense by 2025. Defense spending has been increasing for seven years, but despite the economic impact of COVID-19, there has been no flattening of the curve.

is to be allocated to the German armed forces via a special fund for investments and defense projects in 2022. In addition, more than 2% of GDP is to be invested in defense each year from now on.

According to a report by NATO Secretary General Jens Stoltenberg, European allies and Canada spent about 3.9% more in real terms in 2020 than the previous year. 4 . Germany alone increased its 2020 budget by 8.4%, and since 2014 spending relevant to NATO has increased by as much as 35%. Still, with a GDP share of 1.56%, the 2% target was far away. Besides the US with 3.7%, only ten other member states met the targets in 2020.

German armed forces upgrades

However, with the announcement of an increase in the German defense budget on the occasion of a government statement by Chancellor Scholz over the weekend, the Federal Republic of Germany is already jumping over the 2% hurdle in 2022. In addition to the announcement of the EUR 100 billion injection, an investment of 2% of economic output annually is intended to secure security, freedom and democracy in the long term. An increase in the defense budget is also more than likely in other member states due to the current Ukraine conflict, so there should be increased demand for defense equipment in the coming years.

Special boom for the defense industry

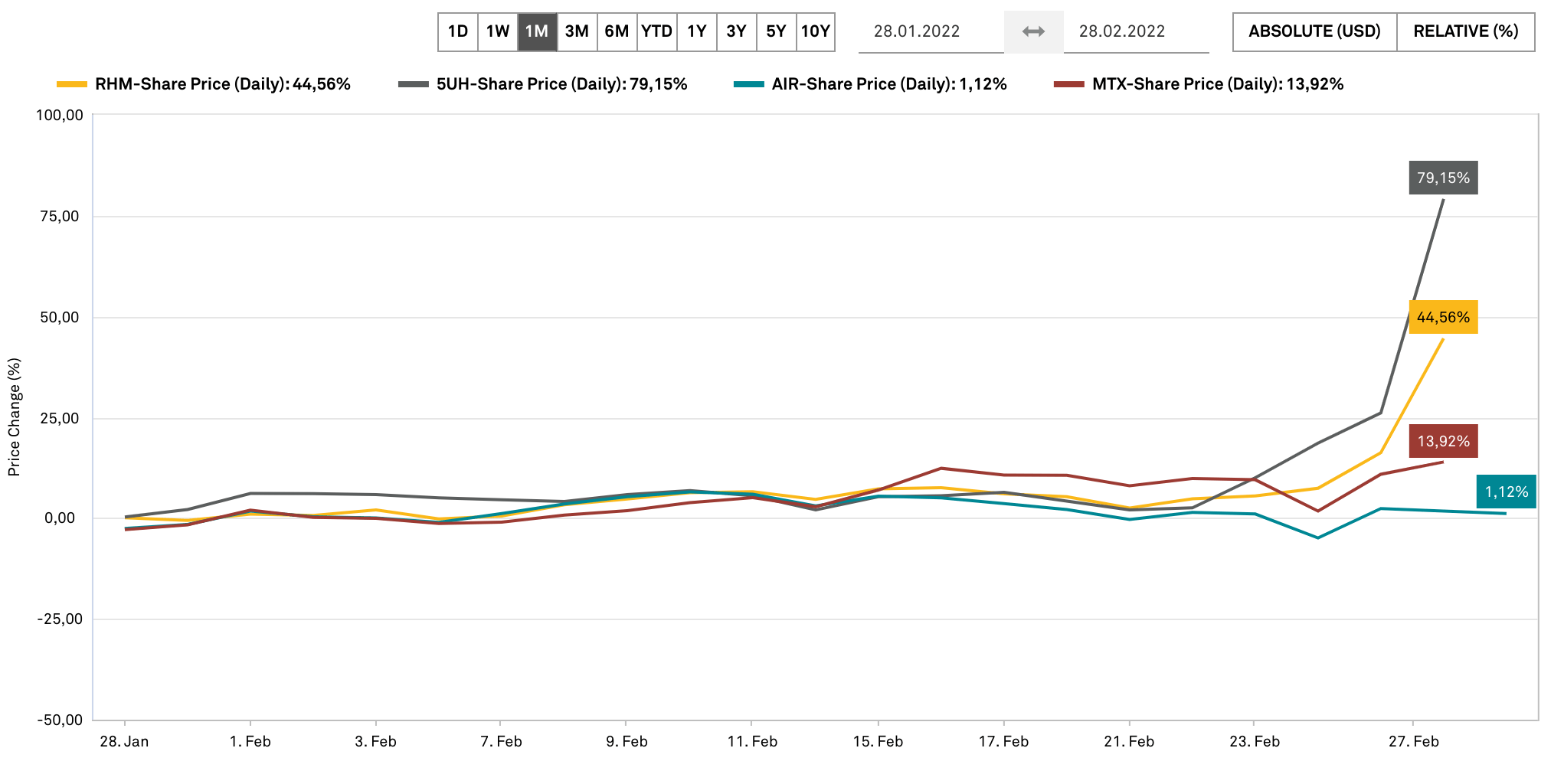

As recently as last month, the European Commission was discussing whether the defense industry should be classified as "socially harmful " under the social taxonomy, which would have significantly worsened access to financing from banks and access to the capital market. However, this discussion is likely to be shelved in the longer term due to the current situation. In addition to the opening of the pots by the German government and the very likely improved access to financing**, the defense industry is facing a special boom in the near future. Already in the past weeks, defense-related companies made significant gains in the stock market, which ended at the flagpole after the announcement of the increase in the federal defense budget.

Rheinmetall - Long history

In the long history of Rheinmetall AG, such events as the current Ukraine conflict are not new. On April 13, 1889, the Hoerder Bergwerks- und Hüttenverein under General Director Joseph Massenez founded the "Rheinische Metallwaaren- und Maschinenfabrik Aktiengesellschaft" to supply munitions for the German Reich. Today, Rheinmetall AG is regarded as a development partner and direct supplier to the global automotive industry and maintains the established Kolbenschmidt, Pierburg and Motorservice brands. The mainstay of sales, however, is Security Technology, in which the MDAX-listed company, as Europe's leading systems supplier, maintains long-standing customer relationships with Germany's armed forces, NATO and its partner nations. Rheinmetall employs a total of over 25,000 people at 129 locations worldwide.

Strategic realignment completed

As a result of the Group's strategic realignment, a new Group structure was introduced last year, the previous separation of the Automotive and Defence segments was abolished, and the reorganization into the five divisions "Vehicle Systems", "Weapon and Ammunition", "Electronic Solutions", "Sensors and Actuators" and "Materials and Trade" is intended to promote the transfer of technology between the individual sectors and support the focus on future-proof technologies and business areas with great potential for sustained value enhancement. In addition, the small and large-bore piston business has been classified as a discontinued operation and is to be sold in the near future. The intermediate holding company of Rheinmetall Automotive AG was dissolved and integrated into the Group structure. The Group is to become less dependent on the automotive business. According to plans, the share of sales is to fall from almost 30% today to 20% by 2025. According to information, Security Technology would then contribute around 70% to Group sales. Rheinmetall expects electric drives and new applications to account for between 10% and 15%.

Close interlocking

The main revenue driver, accounting for 34%, is the Vehicle Systems Division for military vehicles. It is divided into Tactical Vehicles, which includes the Lynx KF41 medium tracked vehicle family, the Marder infantry fighting vehicle, the Kodiak armored engineer vehicle and 3 Buffalo armored recovery vehicles built on a Leopard 2 chassis, as well as the new Bundeswehr Puma infantry fighting vehicle manufactured in industrial cooperation, and Logistic Vehicles, which includes high-performance logistics vehicles such as the HX series of Rheinmetall MAN Military Vehicles. The close links between the individual divisions can be seen from the fact that only sensors, command systems, protection technologies, and effectors from the partner divisions turn wheeled and tracked vehicles into highly effective systems.

group sales in the five divisions are expected to rise to EUR 8.5 billion, with an operating return of at least 10%.

Green technology for climate change

The focus on sustainability is an integral part of Rheinmetall's strategy. By 2035, the Company aims to achieve CO2 neutrality. Alongside security, mobility is the second main area. Thus, the challenges of mobility such as downsizing, reducing emissions and increasing efficiency while optimizing performance are to be addressed. The theme of alternative drive systems is to be systematically expanded in the future and contribute more than one-fifth of total revenues in 2025. Recently, major orders in the double-digit million euro range were booked for the supply of fuel cell components. Leading fuel cell manufacturers have commissioned the Company to supply hydrogen recirculation blowers and cathode valves.

Current challenge and assessment

Record results and supply chain issues

For the first time after the Group's realignment, the performance of each division will be highlighted when the annual report is published on March 17, 2022. However, the Düsseldorf-based company has already been able to show the positive development with the announcement of the preliminary annual figures. In fiscal 2021, Rheinmetall AG generated an operating profit of EUR 595 million, exceeding the previous year's figure by EUR 149 million, or around 33%. This operating profit exceeded analysts' forecasts, which had assumed EUR 570 million.

The operating profit margin of an anticipated 10.5% stood out, exceeding the Company's forecasts by 0.5%. In the fourth quarter alone, Rheinmetall closed with an operating margin of 16.4%, topping analysts' estimates of 14.5%. In addition, operating free cash flow in fiscal 2021 significantly exceeded expectations and was above the target corridor of 3% to 5% of sales.

By contrast, Rheinmetall's sales fell short of expectations. Although revenues climbed by around EUR 253.00 million to EUR 5.66 billion, the increase amounted to just 4.7%, compared with estimates of 6%. The reason given here was limited availability of raw materials and semiconductor components, which led to reduced delivery call-offs by key customers.

Failures due to supply shortages

Demand for semiconductor components in the consumer, IT and communications sectors has increased significantly since the onset of the corona pandemic. This is also likely to act as a negative factor for Rheinmetall AG in the coming year. The global supply shortage is expected to put further strain on supply chains and lead to delivery bottlenecks concerning customers, lower customer call-offs and thus to further sales shortfalls. In addition, price increases for raw materials such as aluminum, steel, silicon and magnesium, as well as skyrocketing energy and freight costs could lead to a reduction in margins. It is therefore questionable to what extent Rheinmetall will be able to handle the enormous additional business - around EUR 45 billion is likely to come into question for Rheinmetall from the EUR 100 billion pot.

Significant dividend increase

In view of the significant jump in earnings, Rheinmetall intends to reward its shareholders with a 60% higher dividend. After EUR 2.00 in 2020, the Düsseldorf-based company intends to distribute EUR 3.30 to loyal shareholders. In view of the strongly growing defense business, a further dynamic adjustment of the payout ratio in the future would not be unlikely.

Optimistic analysts, positive chart picture

A total of 12 analysts gave Rheinmetall stock a positive rating, as shown by the forecasts and price targets compiled by Vara Research. However, the share price exceeded all price targets following the German Chancellor's announcement to increase the budget of the German Armed Forces by EUR 100 billion. 5 Thus, the major Swiss bank UBS already moved up its price target to EUR 121 and reiterated its "buy" rating. The DZ Bank raised the fair value for Rheinmetall from EUR 121 to EUR 175 due to the announced increase in defence spending. From a chart perspective, the share was able to climb to a new all-time high after breaking out above EUR 119.35. However, a large upside gap was formed here, which could close again when the situation calms down. A setback after the current euphoria in defense stocks is not unlikely here.

SWOT analysis

Strengths, opportunities

- leading systems house for army technology in Europe

- long-term contracts with NATO armed forces and partners

- leading brand as automotive supplier

- new revenue sources in the field of alternative propulsion systems

- increase in German defense budget leads to jump in sales

Weaknesses, threats

- rising raw material costs burden margins

- shortage of technical components leads to production downtime

- long-term decline in defense budgets

Is the investment worth it?

Conclusion: Much euphoria in the share price

The Ukraine crisis, which is currently threatening to escalate, is driving up the share prices of defense companies in particular. With the government declaration by Chancellor Olaf and the increase in spending on the German armed forces to the tune of EUR 100 billion, Rheinmetall saw its share price rise by more than 27% yesterday to EUR 138.70 and reach a new all-time high. There is no question that Rheinmetall, as Germany's leading systems supplier, will benefit.

The target seems ambitious in view of high raw material and energy prices.

In an interview with Handelsblatt, CEO Armin Papperger said that Rheinmetall had already offered the German government a comprehensive supply of armaments. In total, the package consisting of ammunition, helicopters and tracked and wheeled tanks would have a volume of EUR 42 billion. In addition, the CEO expects orders not only from Germany but also from other countries. He said he had already received inquiries from a number of NATO countries, especially from Eastern Europe.

Overall, the Company is broadly positioned with its realignment and should generate increasing sales in the long term as a result of growing defense budgets in several countries. Nevertheless, the rise is currently exaggerated, and with a price/earnings ratio of 13.63 based on estimates for 2023, Rheinmetall is no longer cheap either. Should the geopolitical situation ease, prices should normalize back to the EUR 100 range. Moreover, due to high raw material and energy prices, there is enormous pressure to maintain the margin target of 10% in the long term.