The figures for 2022 were in line with expectations

"2022 was a pivotal year for MorphoSys. We were able to further develop our pipeline by advancing our Phase III clinical trials with pelabresib in myelofibrosis and with tafasitamab in lymphoma. We also out-licensed promising early and mid-stage product candidates, allowing us to focus exclusively on oncology," said Dr Jean-Paul Kress, Chief Executive Officer of MorphoSys.

Group revenues amounted to EUR 278.3 million, up 55% compared to EUR 179.6 million in 2021. The increase was mainly due to higher royalty revenues resulting from out-licensing agreements with HI-Bio and Novartis. Royalties in 2022 include EUR 3.0 million from the sale of Minjuvi outside the US by partner Incyte and EUR 96.9 million from the sale of Tremfya®, which will be fully passed on to Royalty Pharma. Research and development expenses increased from EUR 225.2 million to EUR 297.8 million, primarily due to higher development activities and the inclusion of expenses from the Constellation acquisition since the third quarter of 2021. Selling expenses totalled EUR 92.4 million (previous year: EUR 121.5 million), and general and administrative expenses also fell slightly to EUR 60.1 million (previous year: EUR 78.3 million). The operating loss was EUR 220.7 million (previous year: EUR 508.3 million due to depreciation), leaving a net loss of EUR 151.1 million (previous year: EUR 514.5 million).

The lower net loss in 2022 is mainly due to the recognition of financial income, which was triggered by the reduction of financial liabilities from cooperations. As of 31 December 2022, the Company had cash and cash equivalents and other financial assets of EUR 907.2 million, around 8% lower than the previous year. Overall, the figures were in line with expert estimates. Therefore, it is important to look ahead.

"In 2023, we will continue to prioritize the Phase III trial of pelabresib in myelofibrosis to be able to publish top-line results in early 2024 and to investigate the potential use of pelabresib in other myeloid diseases. We remain committed to developing and bringing to market novel therapies designed to be safer and more effective for cancer patients, and we look forward to the future." CEO Kress said on the sidelines of the financial press conference.

Progress in the pipeline is tangible

At the end of 2022, MorphoSys's subsidiary Constellation Pharmaceuticals entered into a global licensing agreement with Novartis to research, develop and commercialize its preclinical inhibitors for a novel cancer target. Under the terms of the agreement, Novartis will assume full responsibility for all further research, development and commercialization activities of the programme. In return, MorphoSys received an immediate upfront payment of USD 23 million. Upon achieving certain milestones, MorphoSys is eligible for further payments and royalties in the mid single-digit to low double-digit range on the net sales of the programme.

The major hopeful in the pipeline is the compound pelabresib, which MorphoSys is currently investigating in a Phase III trial for the first-line treatment of myelofibrosis, a rare form of bone marrow cancer. Pelabresib is one of the compounds acquired through the billion-dollar acquisition of Constellation Pharmaceuticals. With pelabresib, MorphoSys has a great opportunity to improve the standard of care in myelofibrosis and expand its use to other myeloid diseases where there is a high unmet medical need. The most recently presented Phase II data suggest that pelabresib may have the potential to improve on the current standard of care, adding to confidence in the Phase III MANIFEST-2 trial. Top-line data from the pivotal MANIFEST-2 trial are now expected as early as late 2023, according to recent publications. CEO Jean-Paul Kress believes pelabresib will have a sales potential of more than USD 1 billion.

Currently, there are new results on the cancer drug Monjuvi. MorphoSys, together with its distribution partner Incyte, published further data from the 5-year follow-up period of the Phase II study L-MIND in mid-April. These show a prolonged and durable response to Monjuvi in adult patients with relapsed or refractory diffuse large B-cell lymphoma.

"For oncologists, 5-year data demonstrating the durability of response is important when considering the most appropriate treatment option for a patient. The prolonged and durable response rates observed in the L-MIND trial in relapsed or refractory DLBCL patients at 5 years show that treatment with Monjuvi may have the potential to cure the disease", says Johannes Düll from the Medical Clinic of the University Hospital Würzburg.

Interim conclusion: the decision is getting closer

On 2 March 2023, MorphoSys announced discontinuing its preclinical research programmes and all related activities to optimize its cost structure. As a result, MorphoSys will reduce its workforce at its headquarters in Planegg by approximately 17% This measure and other steps already taken last year will allow MorphoSys to focus its resources on its mid- to late-stage oncology pipeline.

CEO Dr Jean-Paul Kress expects to break even in 2026

At the turn of the year, the company still had cash and financial assets of over EUR 900 million. The funds for research and development are thus sufficient until well into 2025. Currently, shareholders would not be happy if the Company were to dilute at this low level. The market capitalization is currently only EUR 650 million, which means that the stock market is discounting the intrinsic value. Tactically, MorphoSys has made a buyback offer to the outstanding bondholders of the EUR 325 million convertible until 2025 at a price of 64%. The market is unlikely to provide much material at this level, but the positive signal effect cannot be denied.

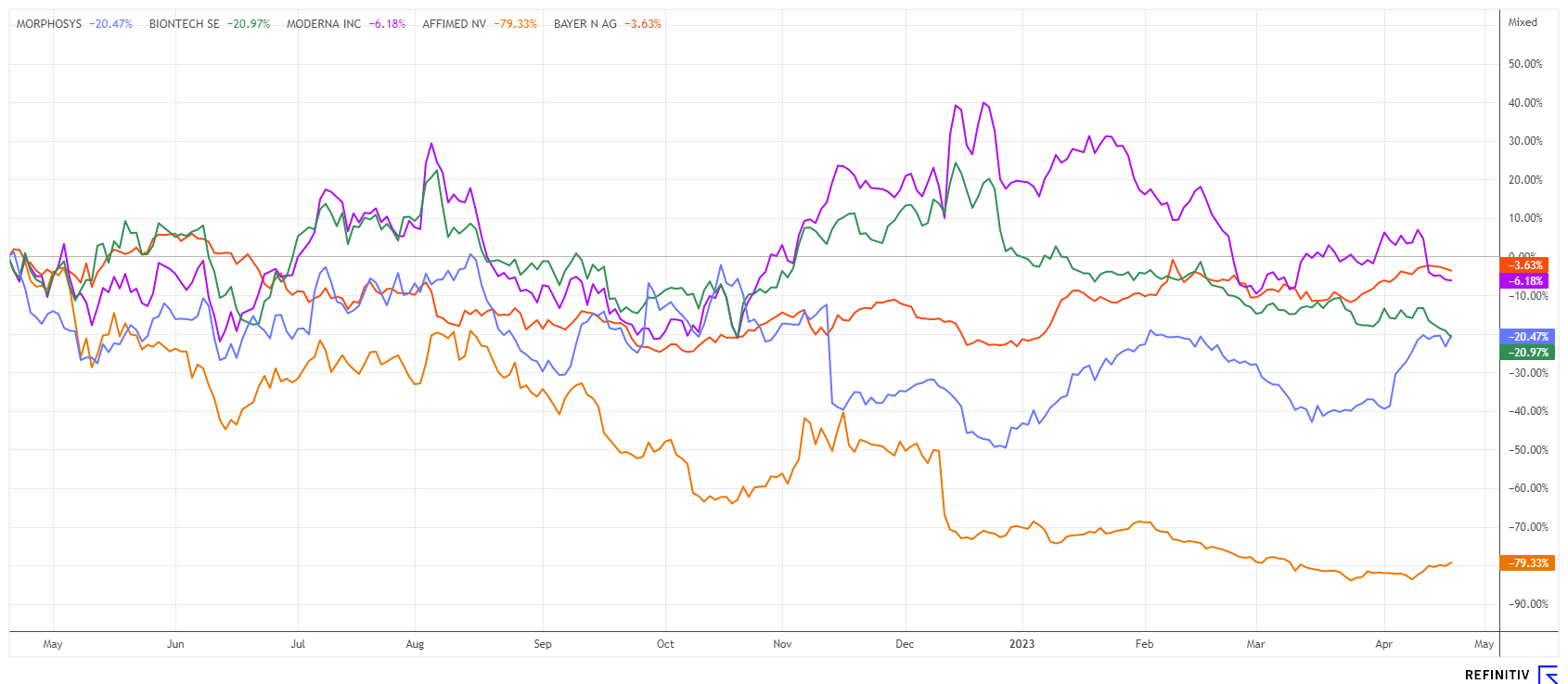

Still among the laggards in the biotech sector

The 1-year price trend of the MorphoSys share shows a 2-fold bottoming in the EUR 12 to 14 range. With the renewed run-up to over EUR 19, the share is now demonstrating technical strength. The high for the year at EUR 19.77 is in sight. Now it would be technically important that the 200-day line in the region of EUR 17 is no longer undercut. Short sellers have also become cautious and have reduced their lavish minus rate of over 3% at the turn of the year to 1.4% by the end of the first quarter. From this perspective, the pressure on the share should continue to decrease. If good clinical data come in again, the buybacks will further strengthen the upward pressure on the share. The technical picture could not be better at the moment.

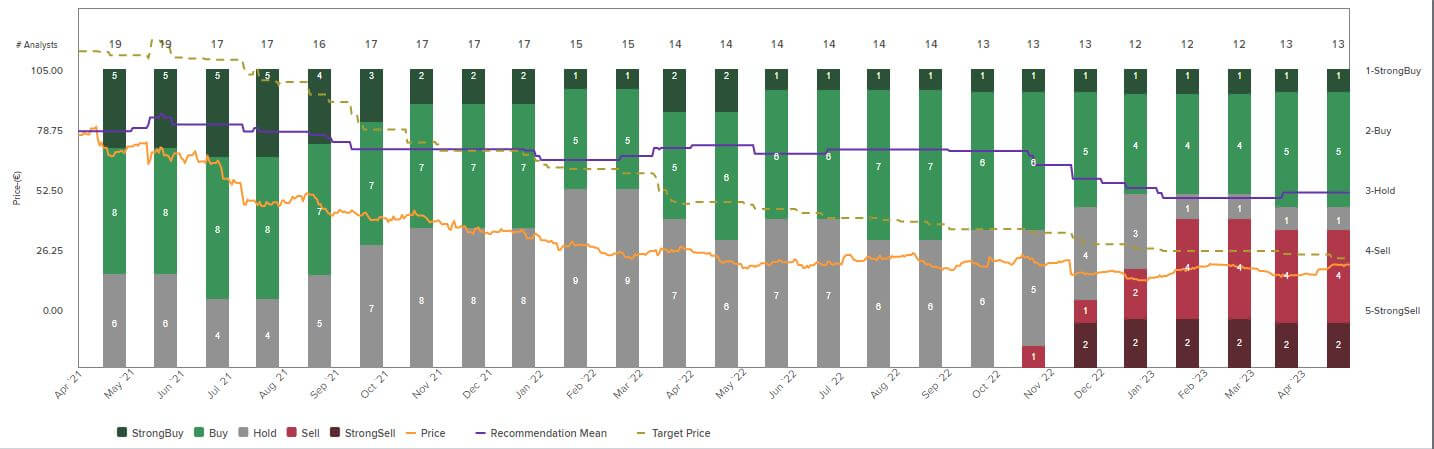

Experts are still divided

The spread of price recommendations on MorphoSys has been very broad for months. Out of 13 recommendations, the buy and sell votes balance each other out. The price targets also fluctuate conspicuously between EUR 10 and EUR 25, with a median of EUR 13. The experts have factored in the subdued figures for the 2022 financial year, so there is still a wait-and-see attitude across the board as to how MorphoSys has started the new year. However, the new study data give hope that the turnaround can succeed in 2023. On May 3, the Munich-based company will publish its figures for the first quarter, and on May 17, the Company will hold its annual general meeting.

Be sure to mark the following date: Head of IR, Dr. Julia Neugebauer, will provide a deep insight into the current pipeline at the International Investment Forum (IIF) on May 10 at 12:30 pm. Click here for free registration.

The update is based on the initial report 01/2023.