Immediately available bridge technology

As we already described in our researchanalyst.com/en/report/dynacert-with-hydrogen-into-the-mass-market, the transition from combustion engines to alternative drive systems is likely to take decades. At the end of 2020, European manufacturers committed in a joint declaration to stop producing trucks with diesel engines from 2040 to be able to achieve climate neutrality from 2050. But the clock is ticking, and whether the ambitious plan can be implemented in the remaining 27 years is at least doubtful.

Bridging technologies are therefore needed to drastically reduce CO2 emissions today. In 19 years of research and development and investments in the order of about CAD 90 million, Toronto-based dynaCERT Inc. has developed the patented HydraGEN technology, which, in addition to reducing fuel consumption and CO2 emissions, also significantly lowers NOx emissions (nitrogen oxides) as well as CO and THC emissions. In addition, engine power and torque are increased, resulting in extended engine and oil life.

Major mining producers showing strong interest

The HydraGEN product line consists of four series that can be customized for different engine sizes and installation specifications. This gives the Canadians a broad clientele, from mining to transportation to construction to agriculture. In terms of sales volume, the HG2R series, for the engine between 1 and 8l, which is used in small and medium commercial vehicles, among others, has the greatest potential. However, CEO Jim Payne told us in an interview at dynaCERT headquarters that promising discussions with major mining producers were reported during the PDAC regarding the HG-4C series. This is used for diesel engines with a displacement of between 40 and 60l, mainly used in heavy-duty vehicles in the mining industry. The price of a unit is around CAD 50,000, and the payback period on purchase is just 5 months.

Another record quarter expected

After a strong 2022 fourth quarter, dynaCERT sold 137 units to companies such as Codelco, Vale, Nexa Resources and Antamina. Experienced company director Payne expects another record quarter and further increasing pre-orders regarding the larger HG4C and HG6C series. The homework has already been done by dynaCERT. Significant improvement and modification of the series have met the clientele's needs. The pre-production is in full swing, and the warehouses are filling up to satisfy the increasing demand in the next months. The clear turnaround should become apparent at the latest when the sales figures for the first quarter are announced at the beginning of April.

Research and development department with further innovation

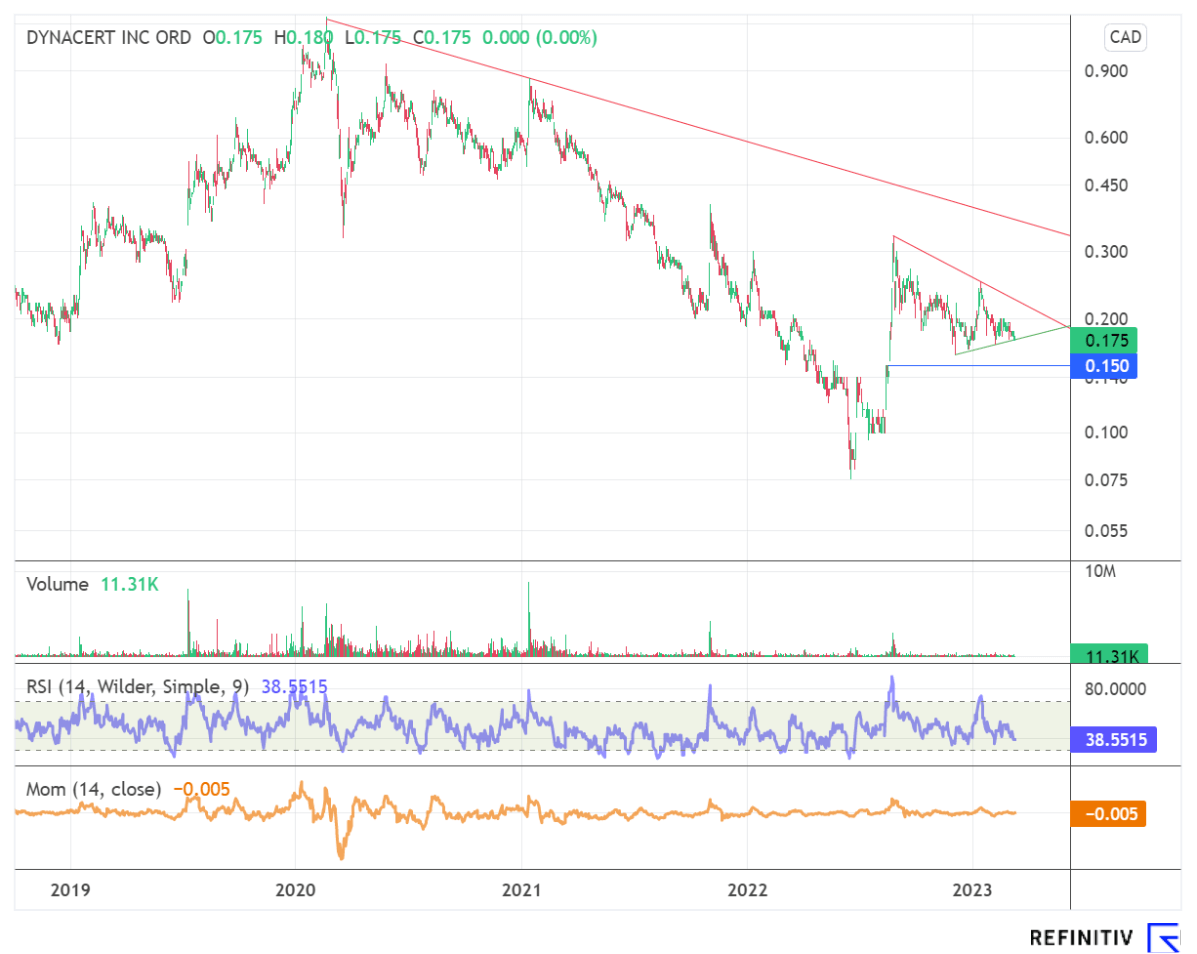

In addition to the increasing order volume, two other things should boost the value of the dynaCERT share. First, the long-awaited inclusion in Verra's Verified Carbon Standard - the world's most widespread greenhouse gas crediting program - is expected next month, providing the Company with recurring additional income from trading carbon credits. Second, the already announced cooperation with Cipher Neutron could create a major player in the production of low-cost, green hydrogen. dynaCERT, which currently has a market capitalization of CAD 64.74 million, would thus enter into direct competition with companies such as Nel ASA (market capitalization EUR 2.1 billion) or the German Enapter (EUR 348.10 million).

Ready for the market as early as the end of the year

Cipher Neutron focuses on electrolyzers for the production of green hydrogen and reversible fuel cells for power generation and energy storage solutions. The products developed to date offer significant advantages over other hydrogen production, energy generation and energy storage solutions. A typical electrolyzer consumes more than 51 kWh of energy to produce 1kg of hydrogen or achieve 77% efficiency. In comparison, the 5 KW AEM electrolyzer jointly developed by Cipher Neutron and dynaCERT reduces energy consumption to 48 kWh and achieves 82% efficiency. The 5 KW prototype was presented to us and is expected to be ready for the market by Q4 2023. The AEM electrolyzer would then offer the largest single-stack capacity currently available on the market. According to the head of dynaCERT's R&D department, Gavy Singh, the goal is to reach prices below CAD 2 per kg of green hydrogen. Currently, the price is still between CAD 4 and 5.

Interim conclusion

In a personal interview at dynaCERT headquarters, CEO Jim Payne expressed optimism for a strong turnaround in the current year. In particular, demand from large mining companies regarding the HydraGEN HG4C series should continue to fill the order books and ensure another record quarter. In addition, the long-awaited inclusion in Verra's Verified Carbon Standard should loosen the knot. Moreover, dynaCERT's stock could move to other levels in the longer term if the innovative AEM electrolyzers are successfully launched. With a market value of CAD 64.74 million, a revaluation would eventually be needed.

The update is based on the initial report 11/2022