Additional Accum™ patent underscores the versatility of the technology

Canadian biotech company Defence Therapeutics continues to advance its commitment around mRNA vaccines in combination with its patented drug enhancer Accum™. Most recently, the Company announced the grant of a US patent on the use of Accum™ as a so-called drop-in enhancer to increase the immunogenicity and performance of virtually any cell-based or protein vaccine. "The granting of the patent paves the way for us to develop new, safe and effective vaccines and agents in the fields of cancer and infectious diseases," comments Sébastien Plouffe, CEO of Defence Therapeutics, referring to the great flexibility of the Accum™ drug enhancer.

Currently, the Company is working with a European partner to combine proprietary mRNA vaccines against cancer with its Accum™ technology and test them against the vaccine without Accum™ in a trial. This study is designed to show that Accum™ is capable of improving the efficacy of vaccines and other substances. In parallel, Phase 1 studies around skin cancer, lymphoma, breast cancer and colon cancer are planned in the coming weeks and months. In addition, a Phase 1 trial around AccuTOX™, a high-dose variant of Accum™, is scheduled for use as a chemotherapeutic agent in lung cancer. If all the studies are successful, there would be great potential thanks to Defence Therapeutics' flexible platform approach. Adding up the market potential around mRNA therapeutics, lung cancer and the vaccination against the HP virus, which can cause cervical cancer, among other things, also addressed by Defence Therapeutics, creates a market potential of more than USD 100 billion by 2030, according to estimates by several renowned market research companies. Further details about the Company's various projects, including the market potential calculated by independent experts, can be found in the report published a week ago.

Great share price potential lies dormant in pharmacological details - share kissed awake

But what do the next few weeks hold for the projects of Defence Therapeutics? The Company cites the manufacture of the ARM vaccine and the receipt of regulatory approval in Canada to begin a Phase 1 trial, the application for a corresponding trial also around AccuTOX™, and the start of the already outlined comparative study between an Accum mRNA vaccine and the naked mRNA vaccine as near-term goals. All three projects contribute to the goal of being able to test a comprehensive anti-cancer product pipeline in human clinical trials. Nearly every corporate announcement that comes out of Defence Therapeutics in the coming weeks is likely to be watched warily by market peers and investors.

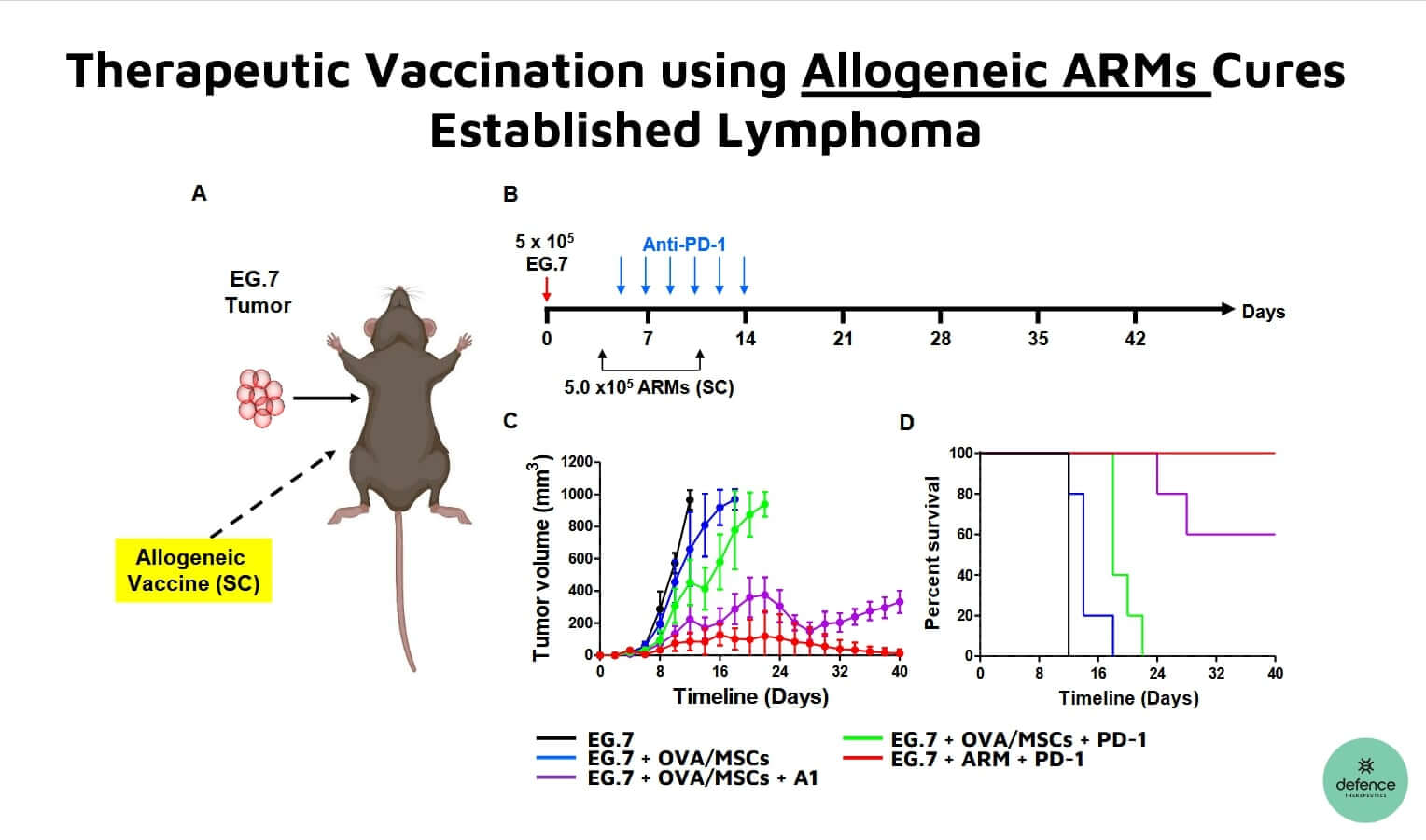

That there is great potential for investors amidst pharmacological details is evident from the very fact that a discovery Defence reported in August 2022 is only now gradually being realized by the market. At that time, Defence reported that its A1 vaccine variant transforms mesenchymal stromal cells into potent antigen-presenting cells. The resulting cells are suitable in the context of cancer vaccination. Specifically, the A1 vaccine is expected to move into a Phase 1 trial around skin cancer before the end of the first half of 2023. It seems that the mixture of promising projects at the company level, the approaching phase 1 trials and the running takeover fever in the biotech sector has kissed the shares of Defence Therapeutics awake.

Vaccines as revenue generators - WHO: cancer cases to double by 2040

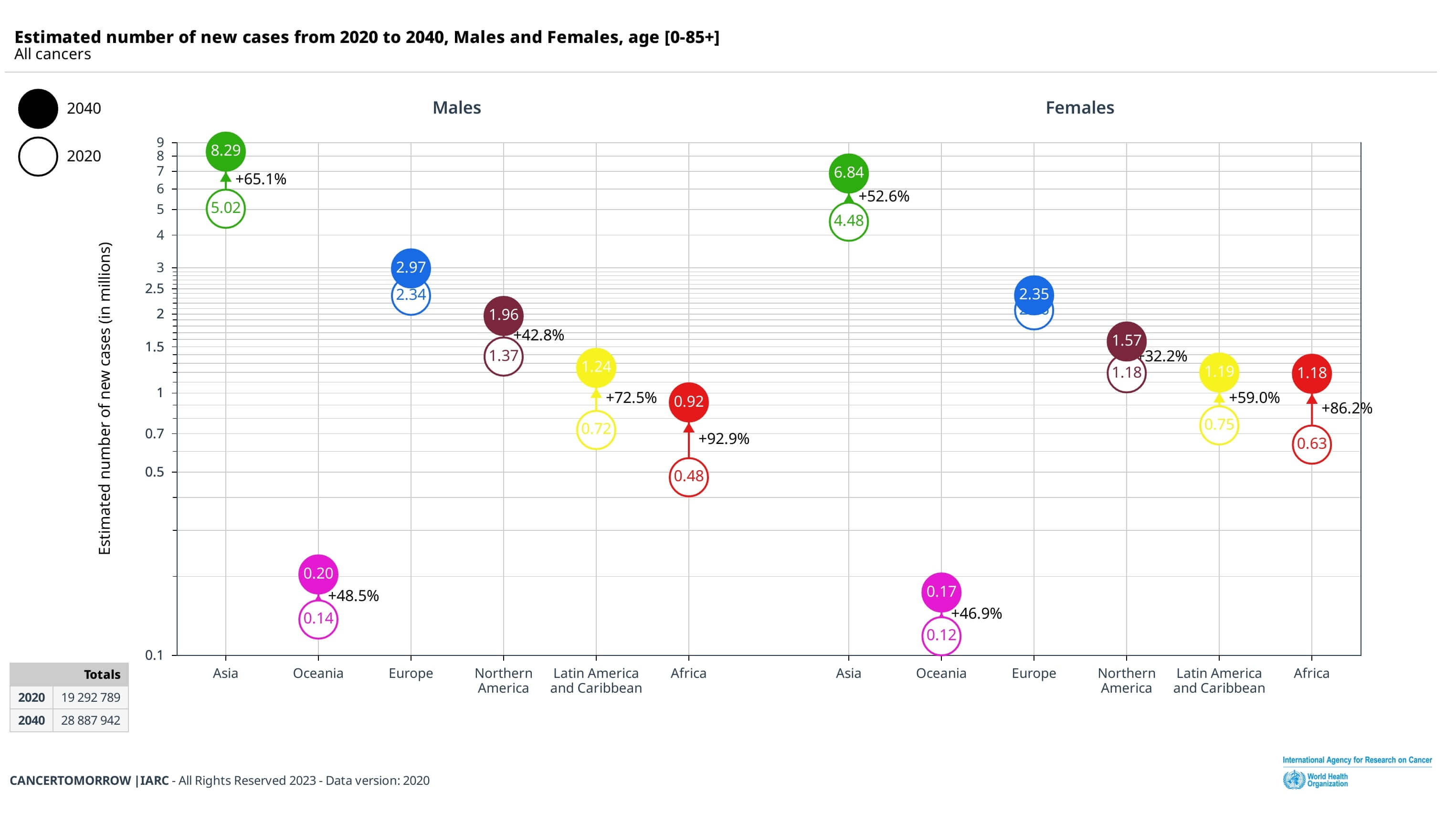

could develop cancer each year by 2040, according to WHO.

Despite the price gains achieved during the past trading days, the Defence Therapeutics share remains interesting. The Company is still only valued at around EUR 100 million - given the valuations that the Company already held two years ago and the prospects of the product portfolio, investors can see the significantly higher potential. By comparison, Pfizer now expects annual sales of around USD 34 billion from its COVID-19 vaccine Comirnaty alone. Although this figure is still due to the "special boom" in the wake of the pandemic, vaccines are considered revenue generators in the industry. GlobalData market researchers expect flu vaccines to generate sales of USD 6.5 billion annually by 2028. Although vaccines developed predominantly by Defence Therapeutics are considered therapeutic vaccines to be administered for acute cancers, demand is also expected to increase.

The World Health Organization (WHO) warns the number of cancers could double by 2040. Between 29 and 37 million people worldwide could develop cancer within one year alone. According to the WHO, the causes are longer life expectancy and an increasingly unhealthy lifestyle. Defence Therapeutics is perfectly positioned for this with its vaccine projects around skin cancer, lymph node cancer, breast cancer and colon cancer, as well as the flexible platform around the drug enhancer Accum™. In addition, there is the protein-based vaccine candidate against the HP virus and the potential use of AccuTOX™ as an effective chemotherapeutic agent. Hardly considered by the market is also the fact that the flexible drug enhancer Accum™ could be licensed to other biotechs to provide additional revenue streams for the Company.

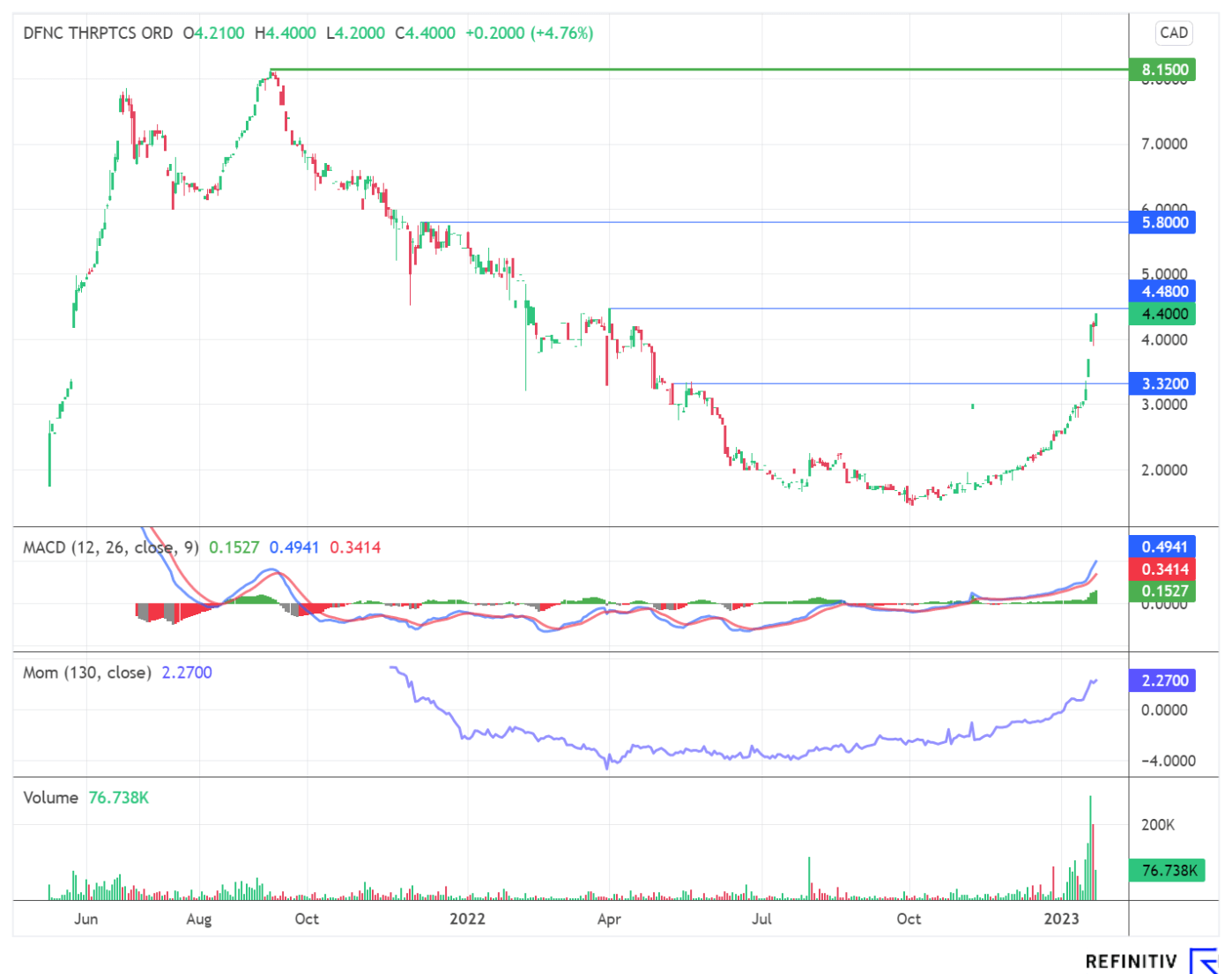

When comeback potential meets momentum

This multi-layered perspective of the Company has now also spread to the capital market. At a time when companies such as BioNTech and Moderna are buying up, and flexible procedures involving mRNA are in demand as never before, the shares of Defence Therapeutics have developed strong momentum. After a dynamic rise of around 50% within a few days, Defence entered a consolidation phase in which investors used every minor setback to enter the market. This relative strength is a good sign for the further development of the share. Added to this is the historical comparison: For much of 2021, Defence Therapeutics was trading at an operationally much earlier stage between CAD 5.80 and CAD 8 - valuations from the bear market of 2022 should not be used as a reference given the Company's outlook.

From a chart perspective, Defence Therapeutics presents a promising picture. The moderate uptrend established in the fall has been exited to the upside. Also, two breakaway gaps suggest that the market is completely re-evaluating the stock. Momentum and MACD indicators signal momentum and trend strength. The above-average trading volumes also fit into the positive chart picture. If the share succeeds in rising above the CAD 4.50 mark, the way to the CAD 5.80 mark is clear from a chart-technical perspective. Given the momentum and trend strength, even chart marks above this are not unrealistic. On the way there, however, the probability of price corrections will likely increase. In the area of CAD 3.32, the share appears solidly supported - a relapse into the downward trend remains unrealistic given the currently bullish overall picture.

Interim conclusion: The momentum decides

With several upcoming Phase 1 trials around cancer vaccines and the flexible Accum™ drug platform, Defence Therapeutics is striking a chord - with big pharma and investors alike. Market researchers estimate the potential of all Defence Therapeutics' activities to exceed USD 100 billion by 2030. In particular, there is enormous potential in therapeutic vaccines against cancer - reliably curing cancer has been a dream of humanity for centuries. Defence Therapeutics' stock can also be a great opportunity for investors. The impending newsflow surrounding the Company's various synergistic activities in mRNA vaccines, Accum™ as well as AccuTOX™, should continue to draw attention to the stock.

While investors should always expect increased volatility following share price gains, the stock has recently shown great relative strength. Any further corporate news also has the potential to tip the balance for large companies to consider a takeover bid for Defence Therapeutics. This mix should continue to support and boost Defence Therapeutics' share price - even old highs are within the realm of possibility, given the share's momentum. However, the stock remains a highly speculative investment that should be reserved for experienced investors. They should, however, have a lot of fun with Defence Therapeutics. Shares with such momentum and operating prospects are currently rare on the market. These days, all eyes are on Defence Therapeutics.

This update is based on the initial report 12/2021