In Germany, around 240,000 people die of cancer every year. Almost everyone is familiar with acute cases. Even though the possibilities for treatment have made progress in recent years, cancer remains a horror scenario for many people. In recent years, the Canadian biotech company Defence Therapeutics has come closer, step by step, to finding solutions in the fight against this widespread disease. The patented drug enhancer Accum™ is suitable for channelling effective drugs and vaccines into malignant cells with pinpoint accuracy. In this way, extremely effective active ingredients can be used without the risk of side effects being too great. After the detailed preliminary work of the past months, the first mRNA vaccines against cancer will be available in January 2023, which can be combined with the Accum™ drug enhancer. The goal: To put a vaccine with Accum™ and a vaccine without Accum™ against each other in studies with mice. A study that could be a breakthrough for Defence Therapeutics.

A matter of weeks: Will Accum™ provide a breakthrough in the fight against cancer?

Most recently, Defence Therapeutics announced the successful production of its mRNA vaccine against cancer cells. The Company is working together with a European partner. The next phase is to combine the mRNA vaccine with Accum™ to ultimately begin in vivo studies in mice, all of which carry solid tumours. "The development of our Accum mRNA vaccine is progressing according to plan. Our in vivo study in animals with established solid tumours is planned for this quarter to demonstrate that Accum can significantly increase the therapeutic efficacy of a given mRNA vaccine," said Sebastien Plouffe, CEO of Defence Therapeutics.

Therapeutic mRNA vaccines are on the rise

mRNA technology has become known to the general public in the course of the successful vaccines against COVID-19 from BioNTech and Moderna. The advantages of this method, which have been the subject of research for many years, include its flexibility. mRNA vaccines can be produced and adapted relatively quickly. Unlike conventional vaccines, proteins that are to act as antigens do not first have to be grown in a complex process, as is the case with flu vaccines in chicken eggs. mRNA is obtained comparatively quickly from the DNA of pathogens and used in vaccines.

Market volume for mRNA therapy products by 2030

Simply put, mRNA vaccines carry the genetic blueprint of the pathogen and enable the body to produce antibodies based on these blueprints. The actual mRNA is subsequently degraded in the body. In addition, mRNA vaccines are particularly suitable for patients with a weak immune system because they are dead vaccines. mRNA itself has properties that can stimulate the immune system. Therapeutic mRNA vaccines against cancer, as envisaged by Defence Therapeutics, are, therefore, a very obvious option. The market researchers at Research And Markets assume that mRNA-based therapeutic products will offer a total market value of USD 37.8 billion by 2030. Although this corresponds to annual growth of only 1.7% in terms of market volume in 2022, the base effect of COVID-19 vaccinations, which will lose relevance in the coming years, takes effect here. According to the market researchers, vaccinations against cancer, in particular, are considered promising.

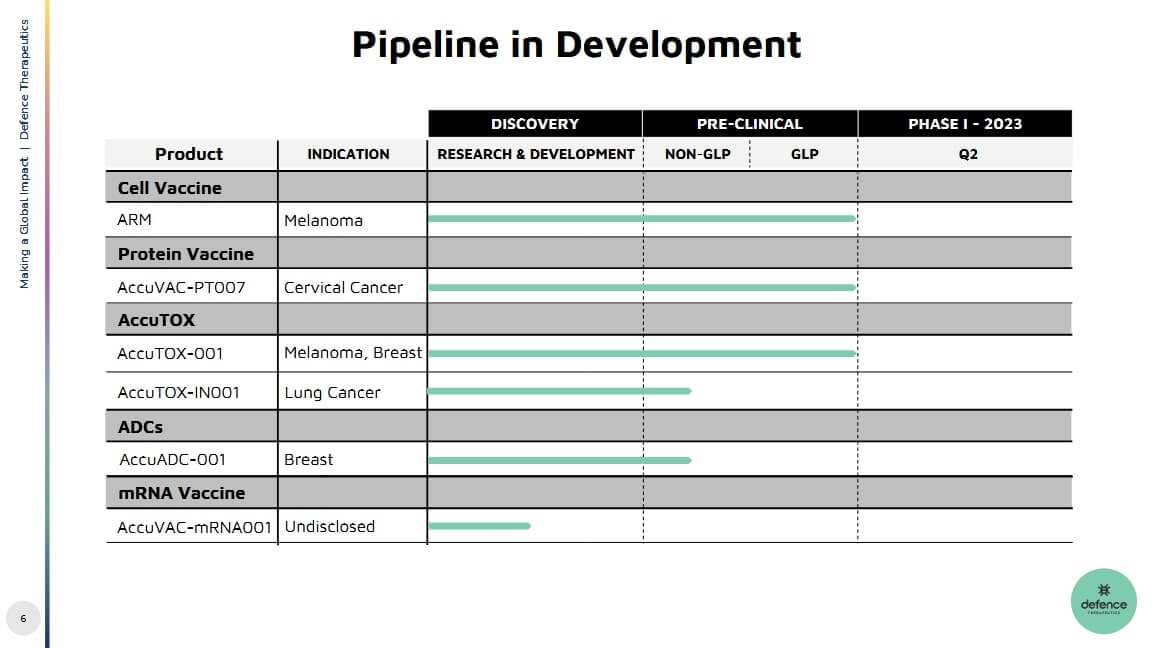

Several phase 1 trials are imminent

If the combination of mRNA vaccines with the Accum™ drug enhancer succeeds and the results show the benefits of this application as expected, Defence Therapeutics should have succeeded in taking a major step towards human clinical trials. The main reason for this is that Defence Therapeutics has been working on several projects in parallel for months. In addition to the above-mentioned in vivo study around the combination of mRNA vaccines against cancer with Accum™, the Company also plans to test its drug enhancer as a stand-alone agent in a Phase 1 study.

Growth for lung cancer drugs by 2030

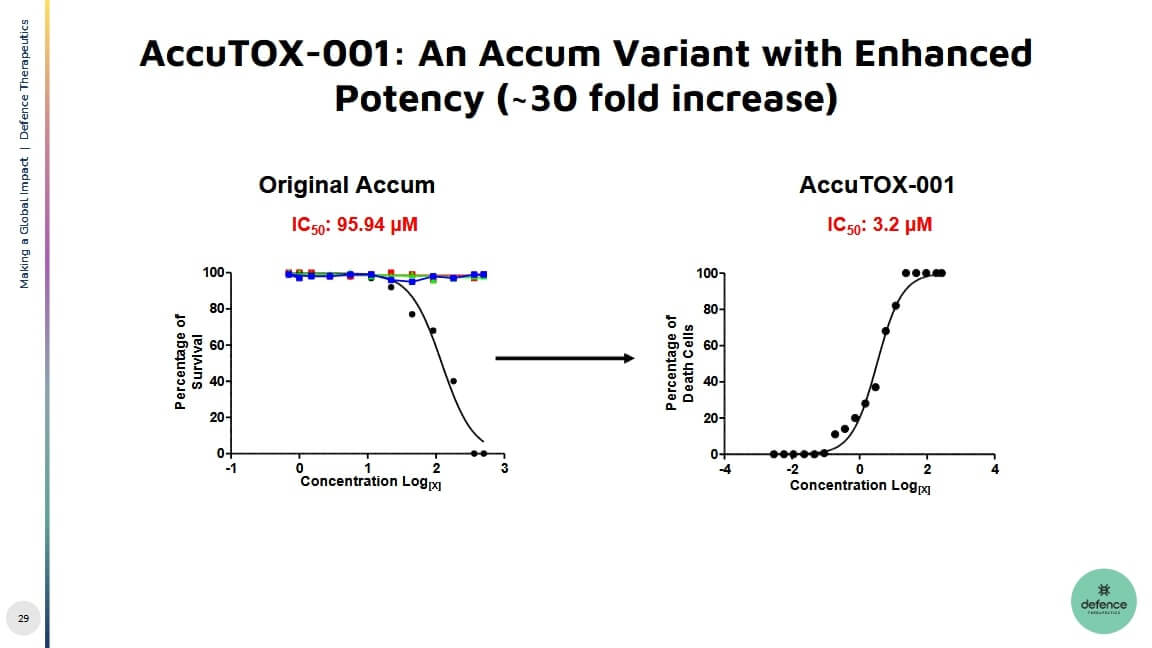

Defence Therapeutics had already shown in the summer that the significantly more concentrated product AccuTOX™ is capable of causing cancer cells to die. Cancer cells are characterized by the fact that they no longer initiate their own cell death - this is precisely where Defence is targeting AccuTOX™ and intends to launch new findings in the coming months. GLP studies, which are preparatory in nature, have already been completed by the Company. "The finding that AccuTOX™ can act as a chemotherapeutic, targeting cancer cell DNA and as a booster for immune checkpoint inhibitors is a new discovery that is very valuable for Defence's pipeline and potential future developments," CEO Plouffe said a few months ago. AccuTOX could be used for the treatment of lung cancer, for example. According to Precedence Research, the market for therapeutics in this area could grow by 8.1% to USD 55.6 billion by 2030.

the market for HPV vaccinations will grow to USD 12.7 billion by 2027

Phase 1 trials for skin, lymphoma, breast and colorectal cancer are also scheduled for 2023. If the Company makes progress in vaccine development and if combining mRNA vaccines with the in-house vaccine enhancer Accum™ proves promising, Defence Therapeutics would offer the prospect of further trials for several types of cancer. In addition, Defence Therapeutics is also working on a protein-based vaccine against HPV, which can cause cervical cancer. Although there is already competition in this field, for example, from Merck and GSK, these vaccines are not yet considered perfect. According to market researchers from Fortune Business Insights, the market for HPV vaccinations is expected to grow by 16.3% annually to USD 12.7 billion by 2027. Given that the Company now enjoys patent protection in numerous relevant markets and its proprietary Accum™ platform could score with flexibility, Defence Therapeutics is likely already on the radar of companies in the sector.

Takeover merry-go-round: Platform solutions around mRNA in demand

The takeover merry-go-round around innovative solutions in the biotech sector is spinning fast: A few days ago, Moderna grabbed OriCiro Genomics for USD 85 million. BioNTech acquired British artificial intelligence specialist InstaDeep. While BioNTech is focused on accelerating future research using innovative methods, the acquisition of OriCiro Genomics aims to improve mRNA production. OriCiro Genomics is considered a specialist in synthetic biology and enzyme technologies, and its solutions can strengthen the platform approach around mRNA technologies.

Defence Therapeutics has been pursuing the same approach around Accum™ for some time - the strategy has put the Company in a position to start several Phase 1 studies around cancer vaccines and their delivery into the cell in the coming months. In addition, Accum™ is not only suitable as a drug enhancer of mRNA vaccines but can, in principle, be combined with various molecules. So the technology could also be licensed and, in this way, help active ingredients that were toxic at high doses in the past to get a second go in clinical trials. In this case, Defence Therapeutics could earn licensing fees and establish further contacts in the industry.

Interim conclusion

EUR 74 million valuation meets potential USD 100 billion pipeline

It can be assumed that Defence Therapeutics has long been on the list of major players in the industry. The cooperation with a European pharmaceutical company for the production of its own mRNA vaccines is not the only indication of this. The encouragement received in the financing round last fall also shows that professional market players see prospects in the portfolio of Defence Therapeutics. Moderna itself only recently emphasized that it is continuing to look for acquisitions: the US company is particularly attracted by the platform approach and mRNA technology. With its product pipeline for various diseases, all of which have a market potential of more than USD 100 billion by 2030, and its flexible platform approach, Defence Therapeutics is predestined to profit from the growth in the biotechnology market in the medium term at the latest. The share is currently trading at around EUR 2, corresponding to a valuation of around EUR 74 million. For pharmaceutical and biotech companies focusing on mRNA, such as Moderna, BioNTech, CureVac, GSK, Argos Therapeutics or AstraZeneca, a takeover of Defence Therapeutics** would be easily manageable.

The update is based on the initial report 12/2021