Changing times require a change in thinking

Investor behavior toward precious metals such as gold and silver changes significantly during war, inflation, and currency devaluation. Conflicts such as the war in Ukraine or tensions in the Middle East have led to sharp increases in the price of gold in recent years. Central banks in many countries also increase their gold reserves in such times to hedge against economic uncertainty. In 2024, these increases reached 1,045 tons worldwide. Precious metals are traditionally seen as a hedge against inflation because they retain their value over the long term, while paper money loses its purchasing power. When inflation rates rise persistently, the demand for physical gold increases – as it did in 2021–2023 when inflation in the US and Europe reached record highs. Over the long term, gold remains a preferred investment for those looking to safeguard their wealth in times of crisis. Cryptocurrencies like Bitcoin are also increasingly being seen as "digital gold", albeit with significantly higher volatility. Gold and silver are likely to retain their status as a "safe reserve", an asset with the character of insurance.

Raw materials from A to Z – Now with 255 projects

Iron, copper, and tin, as well as almost all other metals in the periodic table, are what make our modern civilization possible in the first place. Whether it is gallium, chromium or rare earth elements – many elements are indispensable for modern technology. Without them, most technical applications would not exist – from vehicles to computers to televisions or cell phones. Climate activists criticize the low rate of renewal of our supply cycles. In this context, it is easy to forget that the necessary resources must first be extensively searched for, their extraction approved, and ultimately efficiently extracted. According to today's environmental standards, installing a mine takes at least 5 to 10 years. Market experts know that, for example, the current shortfall in copper and lithium cannot be made up in the next decade despite all political and entrepreneurial efforts.

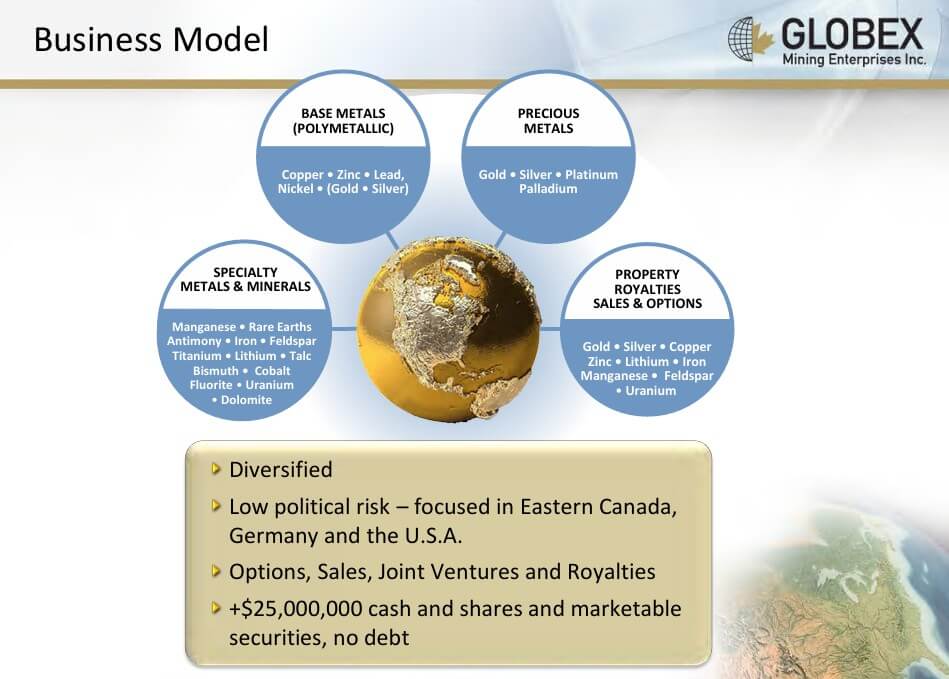

Broad diversification in precious, non-ferrous, polymetals, specialty metals, and rare minerals. Over 100 royalties and some options.

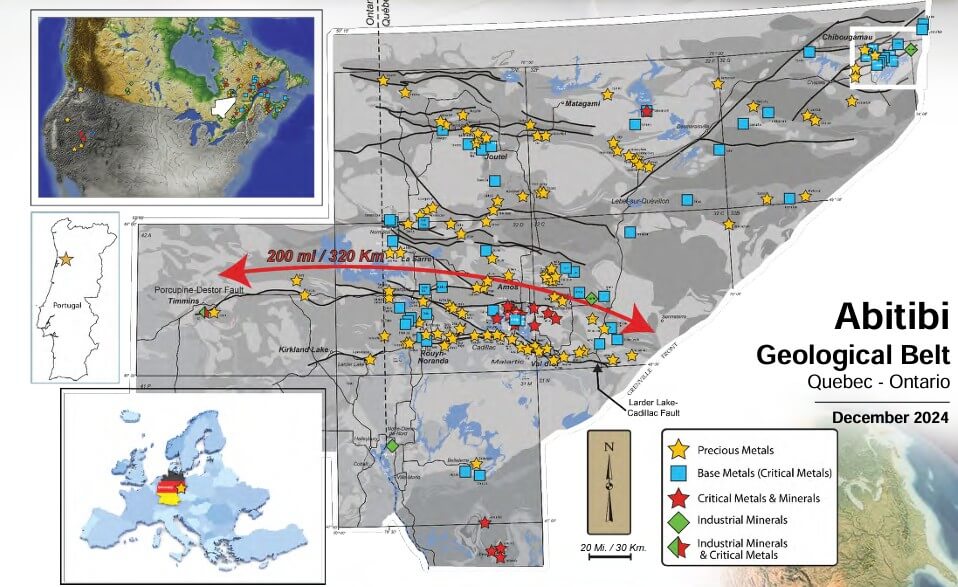

Globex Mining Enterprises Inc. was founded over 70 years ago under the name Lyndhurst Mining Co. Ltd in 1949 to bring a copper mine into production. CEO Jack Stoch specializes in acquiring and subleasing project areas with raw materials, primarily in Canada. Over the past 40 years, he has steadily expanded the resource holding company and, at the beginning of the year, was involved in a total of 254 resource projects. Half of the projects are in the precious metals sector, involving gold, silver, platinum, and palladium. The other projects cover base metals, industrial minerals, energy metals such as lithium, uranium, and cobalt, and rare earths, which are currently in greater demand again. Globex holds 106 royalties most of which are the result of companies earning an interest in a Globex mineral asset. Several (Fayolle and Agregat) have provided Globex with funds recently and a number of projects are expected to produce royalty income in coming years subject to market conditions, metal prices, etc. such as the Bell Mountain gold/silver project in Nevada, Mont Sorcier Iron project and Magusi Copper/Zinc property in Quebec as well as the Ironwood Gold project in Quebec. Currently the bulk of Globex’s income is derived from optioning or in some cases selling assets.

Metallurgical Advances on Two Fronts

In February, Globex Mining provided its shareholders with brief updates on metallurgical test work related to two Globex royalty properties. First, Radisson Mining Resources Inc. provided initial results of grinding tests on gold ore from the O'Brien Project, which includes the Kewagama Gold Mine on which Globex receives a 2% net smelter royalty, and the New Alger gold mine (also called the Thompson-Cadillac) on which Globex receives a 1% net smelter royalty. Radisson reported gold recovery rates between 86 and 96% based on a range of flow sheet options compatible with the Doyon-Westwood mill and requiring minimal or modest additional capital. Radisson, therefore, concluded that the Doyon-Westwood mill represents a viable processing option for the O'Brien ore.

Brunswick Exploration Inc. also reported the metallurgical test work results on drill core samples from the Mirage Project (Globex's Lac Escale 3% gross metal royalty claims). Preliminary results show potential for a best-in-class flowsheet consisting of only a single stage of comminution followed by dense medium separation with no requirement for flotation. Projects with similar flowsheets have consistently demonstrated lower operating costs for comminution to achieve the industry standard concentrate grade of 5.5% Li2O (lithium oxide). Preliminary recoveries of 76% to produce a spodumene concentrate grading 5.5% Li2O in HLS tests and 68.4% to produce a spodumene concentrate grading 5.7% Li2O in DMS tests, both at coarse grind size. The low iron concentration in both the HLS and DMS concentrates indicates high-grade spodumene with few impurities. The current test work indicates that no deleterious elements have been identified in either concentrate. Further test work is planned for 2025 to build on these initial results, with opportunities to increase DMS recovery already identified. With these positive test results, Brunswick is planning further metallurgical work and is focusing on continuing drilling exploration to advance the project to an initial resource estimate.

Impressive news at the beginning of the year

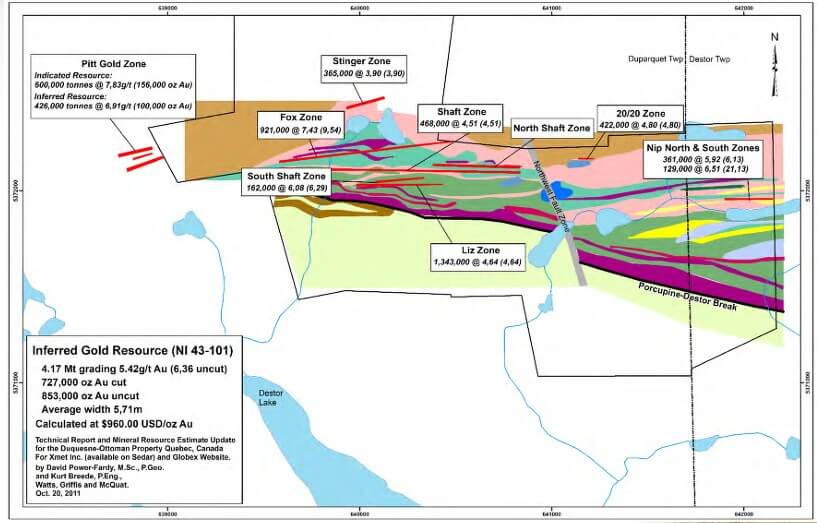

Globex Mining continues to report progress on its projects. In early February, an update was provided on Emperor Metals Inc.'s work on the Duquesne West property in Quebec, which has been optioned by Globex. There Emperor reports that the Company has completed a total of 19 holes totaling 8,166 meters in 2024, as well as analyzed approximately 8,000 meters of historical drill core held by Globex. 100% of the results of the 2024 drilling have been reported, but only 55% of the results of the historical drill core.

John Florek, President of Emperor, commented: "With intercepts such as 43.9 meters of 0.74 g/t Au (gold) in previously unsampled historic drill core and 2.5 meters of 8.62 g/t Au, we are becoming more and more confident that we can add additional ounces outside of the known lenses. We are identifying new zones with both high-grade and low-grade potential for open pit mining while also expanding these zones, which is crucial to realizing our open pit vision. We continue to expand the potential open pit area, both at the margins and at depth."

Emperor Metals Inc. continued to report metal screen assay results from several drill holes at the Duquesne West gold property, which is being developed by Globex's 50% owned Duparquet Assets Ltd. Of particular interest are the results from drill hole DQ24-12, which previously returned 57.8 g/t Au over 2.5 metres using standard fire assay. A re-assay using the metal-screened fire assay method, particularly useful when assaying samples with coarse gold, returned 301.1 g/t Au over 2.5 meters.

Furthermore, Radisson Mining Resources Inc. reported additional drill results on the O'Brien gold project, including gold assays on the gold mine portion of the Kewagama project, where Globex Mining Enterprises Inc. retains a 2% net smelter royalty. Several gold intersections have been reported on Globex royalty claims, including drill hole OB-24-358 which intersected 8.36 grams per tonne gold over 15.0 metres within a broad mineralized interval with multiple veins, including 56.0 g/t Au over 1.0 metre and 41.1 g/t Au over 1.0 metre.

CONCLUSION: Globex Mining is showing its strengths in the commodity supercycle

CEO Jack Stoch offers investors a lucrative business model. Unlike other explorers in the industry, Globex Mining owns its properties. The properties have proven resources and reserves, mineralized drill intercepts, and expandable geophysical targets in Canada, the United States and Germany (Saxony). According to recognized analysts, the commodity markets can expect a new supercycle in the next few years. Strategically important metals are entering a dangerous supply gap, which could cause the spot prices on the exchanges to rise enormously. For Globex, the positive sentiment is crucial. There are signs, particularly in North America, that politicians and investors are paying attention to this issue and that a new investment cycle is imminent. Major geopolitical uncertainties are drawing investors' attention to safe jurisdictions, such as Canada and the United States. Commodity experts also see precious metal prices continuing to rise. Analysts see a price range of USD 2,950 to USD 3,250 for gold, and its smaller brother, silver, is expected to reach USD 350 to USD 450. With these price prospects, Globex's current portfolio would have to appreciate by 200 to 300%.

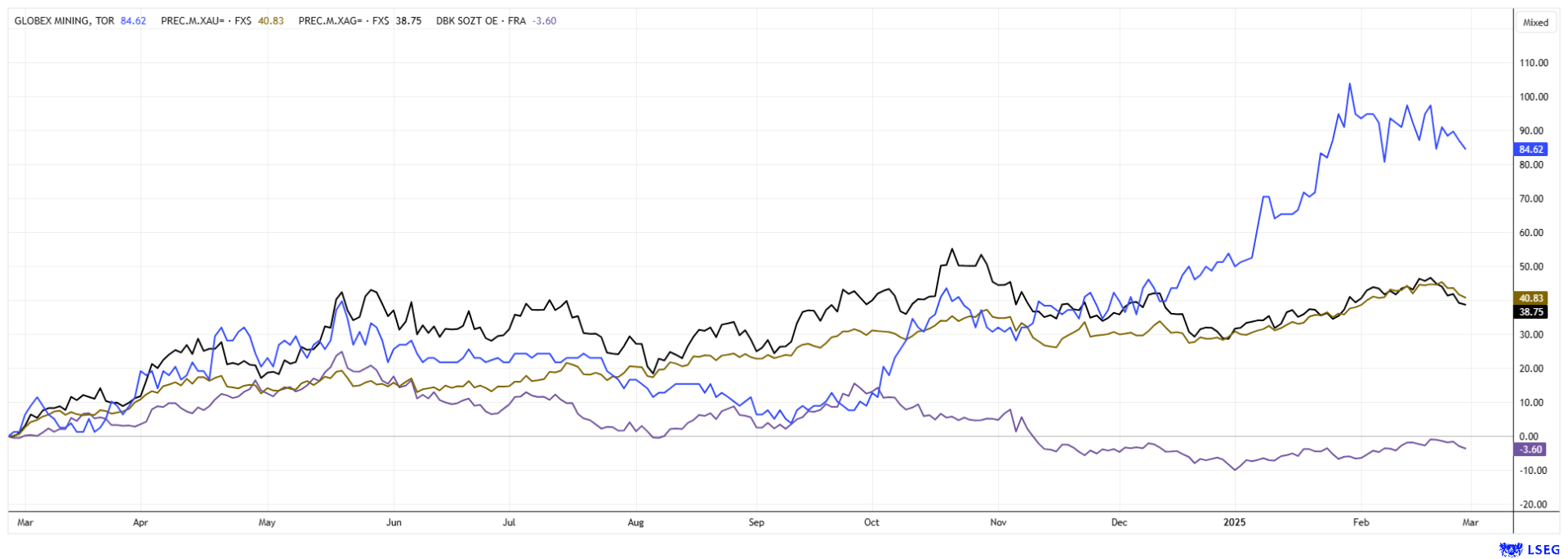

GMX shares continue to rise after a good 76% increase in the last 12 months in the range of CAD 1.40 to 1.60. The volume confirms the positive development, and the size could now also attract the attention of institutional investors. With 56.1 million shares outstanding, the current market capitalization is approximately CAD 81.4 million. The price is boosted by a constant deal flow, ongoing option income, and new royalty deals. In addition, as of December 31, 2024, the Company had approximately CAD 25 million in available funds and valued company shares. Commodity investors can benefit from an investment in Globex Mining thanks to the decades of experience of CEO Jack Stoch. Due to the large number of high-quality projects, GMX shares will likely continue to outperform the resource sector. In the last bull cycle, the share price reached CAD 1.70, and this may not be the peak of the movement this time.

This update follows the initial report 11/2022.