Vision: Fully integrated ecosystems for emission-free mobility

The only way for large parcel delivery companies and other logistics providers to achieve both their commercial and climate protection goals is to convert their fleets to emission-free technologies such as battery or hydrogen fuel cells. First Hydrogen (EUR 0.51 | WKN: A3C40W | ISIN: CA32057N1042) began several years ago with the technical development of small Sprinter-class delivery vehicles equipped with fuel cells, which represent an ESG-compliant alternative to diesel-powered logistics vehicles. The results achieved in the three test series with Rivus, SSE PLC, and the Wales & West Utilities gas supply network exceeded the Company's expectations and clearly demonstrated the advantages over battery-powered delivery vehicles. Multinational logistics companies such as DHL, Amazon, UPS, Hermes, and FedEx have shown great interest in these vehicles. However, there is still a long way to go before they are ready for series production.

Following the election of Donald Trump, who vehemently downplays climate change, Europe remains the first choice for hydrogen projects. This also confirms that First Hydrogen's regional expansion into Europe was a good strategic decision. An office in Germany was opened in 2024. CEO Balraj Mann commented at the time: "Europe has shown a strong commitment to transitioning from fossil fuels to clean hydrogen. First Hydrogen is now bringing hydrogen-powered fuel cell vehicles to Germany. We were the first on the market with successful trials with various fleet operations in the UK."

With its "Hydrogen-as-a-Service" model, First Hydrogen aims to supply customers in the Montreal-Quebec City region with clean, green hydrogen fuel for the first time in the coming years. This could pave the way for the first emission-free transport ecosystems in the future. The general energy crisis is now bringing the additional aspect of "nuclear energy" to the fore. Major IT companies are planning to invest billions in this market. The goal is to install small modular nuclear reactors (SMRs), which are particularly well-suited for flexible, regional deployment.

New business area: Using SMRs for hydrogen production

Hydrogen from nuclear energy could catch on in the coming years. Many countries are pushing ahead with their commitment to nuclear energy under the environmental banner of "NetZero." The industrial group Samsung C&T has already commissioned Nel ASA to supply a 10-megawatt plant for alkaline electrolysers to produce hydrogen from surplus nuclear power. First Hydrogen is also investigating the potential of producing green hydrogen using electricity from small modular reactors (SMRs). This is because, in the medium term, power grids will no longer be able to keep pace with the rising energy demand of the modern age. Nuclear energy, which has had a rather negative connotation since Fukushima, is now once again recognized by international bodies as a green energy source because it is capable of generating large amounts of electricity with minimal greenhouse gas emissions. First Hydrogen wants to install these SMRs in areas where grid power is limited or unavailable to produce storable hydrogen for local fueling stations and meet rising energy demands.

The EU has also already classified nuclear energy as part of its taxonomy, paving the way for further investment. By combining SMRs with electrolytic hydrogen production, the Company is addressing not only European energy needs but also global demand for stable, CO2-free energy sources. The market for SMRs is estimated to be worth almost USD 300 billion by 2043. A subsidiary called First Nuclear has already been launched to drive forward the global SMR business. The ambitious plan could become a game-changer for the Company, as First Hydrogen once again demonstrates its strong focus on innovative and sustainable energy solutions to drive the necessary energy transition.

Cooperation with the University of Alberta

To get the project off the ground as quickly as possible, First Hydrogen announced a strategic collaboration with Professor Muhammad Taha Manzoor of the University of Alberta in early June. The partnership aims to further develop SMR technology, with a focus on fuel reactor materials and reactor design optimization, taking into account the growth of data centers with artificial intelligence (AI). The reason: AI computing systems consume up to ten times more electricity than normal data centers. The project will take into account the global increase in AI data centers and the associated energy requirements. Led by Dr. Manzoor, an expert in the thermohydraulic properties of molten salts and Head of the Renewable Thermal Laboratory, the project will draw on experience in thermal energy storage, including small modular nuclear reactors. Molten salt is the future of nuclear energy as a coolant and nuclear fuel because it can be used safely, flexibly, and efficiently.

SMRs, known for their compact design, scalability, and ability to provide a continuous, weather-independent power supply, form the cornerstone of this initiative. By using them, First Hydrogen ensures a stable, cost-effective, and efficient process for producing green hydrogen, responding to the growing global demand for clean energy solutions. According to McKinsey, the AI megatrend is driving significant investment in data centers. Current research suggests that by 2030, approximately USD 5.2 trillion in capital expenditure will be required globally to meet the growing demand for computing power. First Hydrogen is perfectly positioned to play a significant role in this growth market.

CEO Balraj Mann commented: "We are delighted to be working with the University of Alberta. We will leverage their expertise in core research to significantly advance core fuels for SMRs. This collaboration underscores our commitment to advancing innovation in clean energy solutions that will play a critical role in the transition to a zero-emission future."

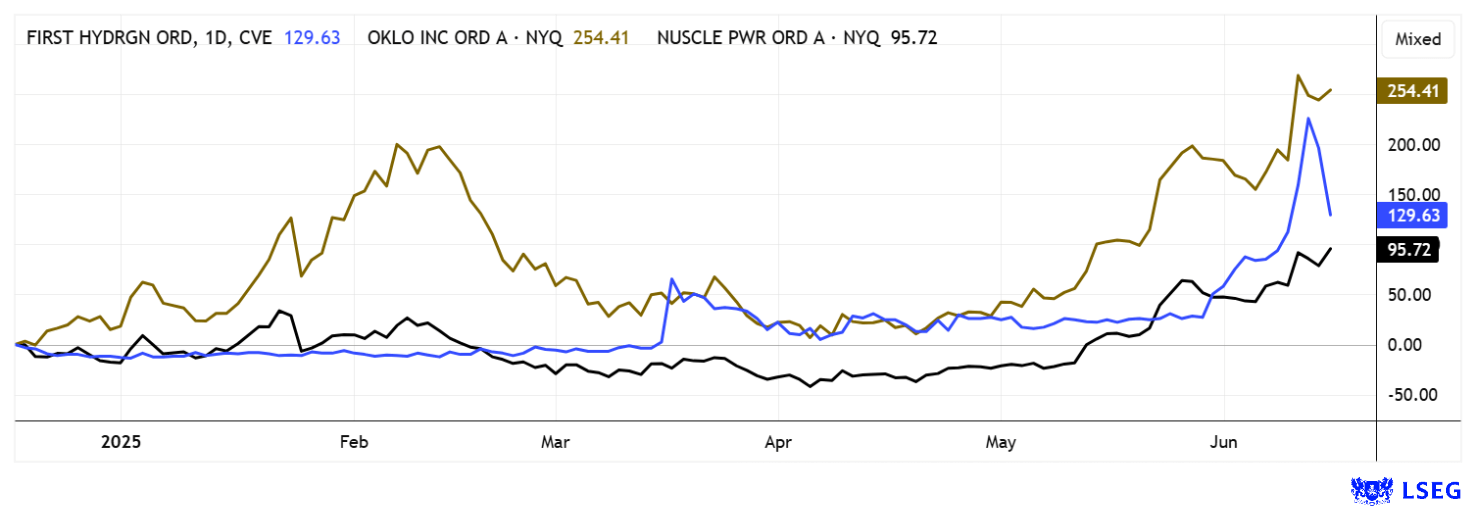

A strong rally within the peer group

The entire sector has seen dramatic gains in recent weeks. It appears the starting signal has been given for the global deployment of SMR technology. With its subsidiary and a well-thought-out cooperation agreement, First Hydrogen is already well-positioned to accompany the high market growth. Therefore, the relative performance in the sector and the long-term prospects point to further gains for First Hydrogen shares.

Conclusion: First Hydrogen is gaining momentum

The technical movement, which began in February at around CAD 0.36, rose steeply and quickly. At its peak, prices reached CAD 1.35 or EUR 0.84. Currently, a consolidation is underway in the CAD 0.85-0.95 range with significantly lower trading volumes. Applying the 50% correction rule, this would be exactly the right zone for a new entry. With a very low market capitalization of currently EUR 57 million, the FHYD share could prove to be a top favorite for 2025 due to its good positioning in the new field of core energy H2 business. The entire sector is expected to become a new megatrend under the current political conditions, especially in North America.

This update is based on the initial report report 07/2022.