Rheinmetall benefits as a supplier

"Done", Finance Minister Christian Lindner sent out this tweet during the night. Jointly, EUR 100 billion in investments for the German Armed Forces have been secured. "At the same time, the debt brake remains in place for all other projects," the FDP politician emphasized. That an agreement would be reached should already have been clear to everyone after the special budget was announced at the end of February. Certainly, however, to the charismatic Rheinmetall boss Armin Pappberger. As we reported in a initial report, only a short time later he compiled a list for the delivery of equipment consisting of tanks, helicopters and ammunition in the amount of 42 billion euros for the Bundeswehr.

Bulging order books

In addition to the Bundeswehr, Germany's largest defence contractor is also in demand as a supplier from other NATO countries and partners. Recently, for example, a NATO customer placed several major orders for the supply of protective equipment components in the already bulging order books. In total, the orders have a gross value of almost EUR 250 million. In addition, a comprehensive ammunition package worth several hundred million euros was delivered to Hungary. The British Army decided on a contract extension for the delivery of 100 additional Boxer wheeled vehicles, to be delivered in 2024. In addition, orders were received from Canada, Spain and Slovenia, among others.

Solid first quarter

With its first quarter figures, the integrated international technology group for mobility and safety confirmed its positive business development. However, a significant increase in forecasts for the year as a whole was not forthcoming. At EUR 1.26 billion, Group sales in the first quarter of 2022 were on par with the same period of the previous year, while operating profit climbed to EUR 92 million, compared with EUR 84 million in the first quarter of fiscal 2020. The operating margin rose from 6.7% to now 7.3%. The annual forecast already published in March remained unchanged. Annual sales in the Rheinmetall Group are expected to grow organically by 15% to 20% in the current fiscal year. In this context, sales in 2021 would amount to EUR 5.66 billion.

This growth forecast assumes that the German government's plans regarding possible procurements from the defense budget for 2022 and from the special assets to be created for the German Armed Forces will materialize as announced. Based on this current sales forecast, Rheinmetall expects the Group to improve operating profit and achieve an operating return on sales of over 11% in the current fiscal year 2022, compared with 10.5% last year, including holding costs.

Availability of raw materials as a constraint

Blown supply chains and the limited availability of semiconductor components and other raw materials were already a major problem at Rheinmetall before the Ukraine conflict. Last year, for example, these led to reduced delivery call-offs by key customers. The sanctions resolved will further exacerbate the shortage in supply. This is likely to put further strain on supply chains and lead to supply bottlenecks concerning customers, lower customer call-offs and thus additional sales shortfalls. In addition, price increases for raw materials such as aluminium, steel, silicon, magnesium or rare earth metals, as well as exploding energy and freight costs, could lead to a reduction in margins.

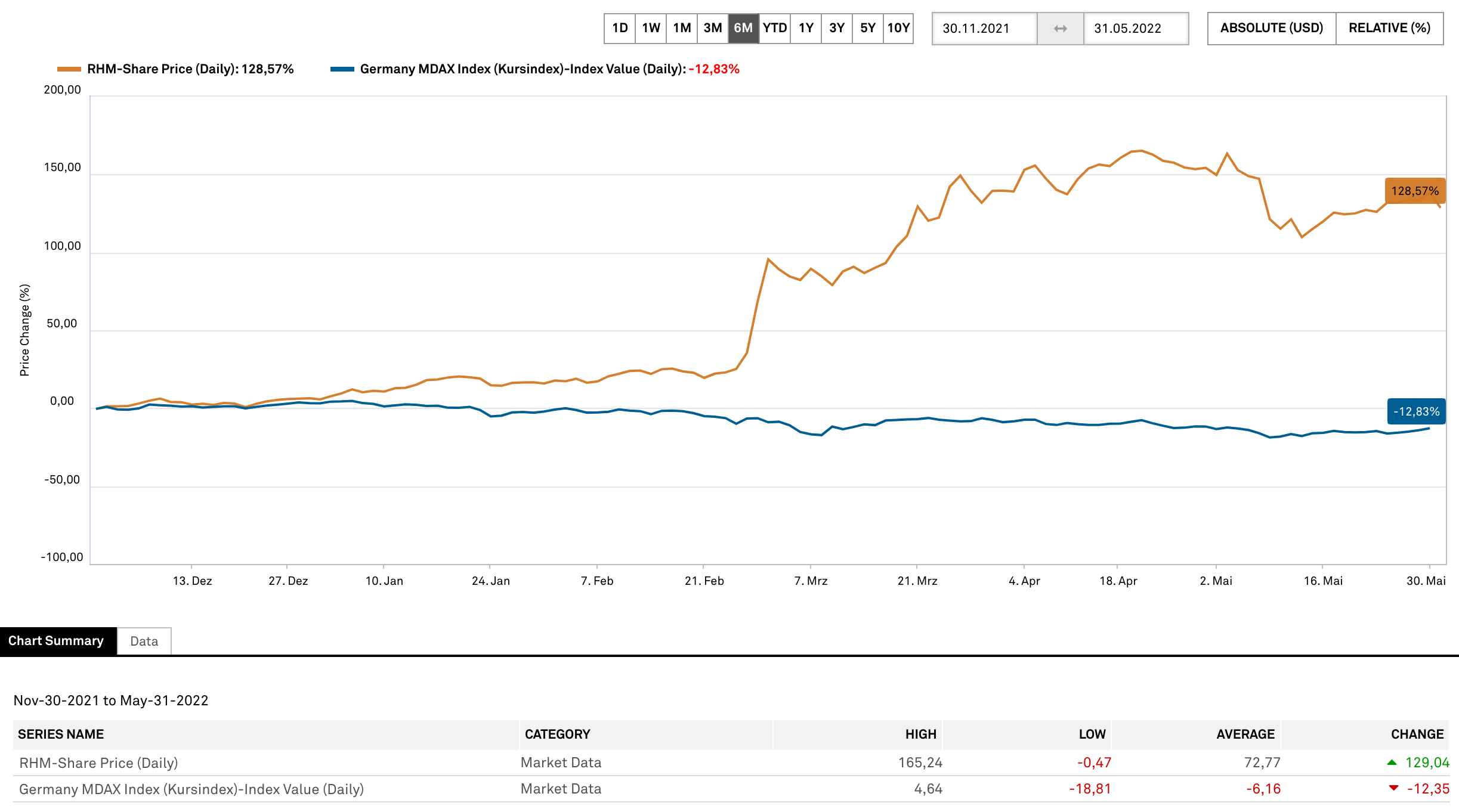

Optimistic analysts, negative chart picture

Analysts continue to be positive about Rheinmetall. Hamburg-based private bank Berenberg raised its price target for Rheinmetall from EUR 215 to EUR 240 and reiterated its "buy" rating. Investment bank Stifel also left its rating for Rheinmetall at "buy" with a price target of EUR 247 following the agreement reached by politicians on a special fund for the German Armed Forces. Germany's defense spending is now expected to sustainably increase by more than a third compared to current levels, analyst Alexander Wahl wrote. Despite the positive news with regard to the agreement on the special fund, the share loses around 3% to EUR 191.50. The relative strength, which was still enormous weeks ago, has clearly weakened. In addition, both the Relative Strength Index RSI and the trend-following indicator MACD sent a sell signal. The first short-term correction target would be the March high at EUR 162.95.

Interim conclusion

There is no question that Rheinmetall is one of the main beneficiaries of the Ukraine conflict. By providing further funds, the supplier of the German Bundeswehr is likely to get a big slice of the orders pie. More orders from other NATO members and partner nations are also likely to fill the books in the coming months. Nevertheless, the question is whether the necessary raw materials are available to meet customer requirements and, if so, at what price. In times of exploding energy and raw material costs, we are at least more than skeptical that the targeted margin can be maintained. With a P/E ratio of over 28, Rheinmetall is already extremely ambitiously valued.

The update is based on our initial Report 03/22.