The Powerhouse of Europe's Arms Industry

Do you remember the time before the outbreak of the war in Ukraine? Back then, stocks of arms companies were frowned upon. Even in the European Commission, there was a discussion about whether the arms industry should be classified as "socially harmful" under the social taxonomy, which would have significantly hindered access to financing from banks and capital markets. But then, with Russia's invasion, the formerly controversial industry got its breakthrough. With the announcement of the increase in the German military budget on the occasion of a government declaration by Chancellor Scholz at the end of February 2022, the triumph of Rheinmetall's stock began, which has since achieved a price performance of almost 190% on the stock market.

Seizing the opportunity

Since then, hardly a week has passed without new orders and cooperation agreements being announced. The important role played by the defence company in the Ukraine conflict was recently demonstrated at a meeting between Rheinmetall CEO Armin Papperger and Ukrainian President Volodymyr Zelenskyy. The Düsseldorf-based company plans to set up a maintenance and logistics center in Romania for tanks, howitzers and military vehicles supplied to Ukraine by the West for its defence. The service station in Satu Mare is to start operations as early as April. The aim of this center is to maintain the operational readiness of Western combat systems used in Ukraine and to ensure their logistical support. This means that the Leopard 2 and the Challenger supplied by Great Britain can be serviced, as can howitzers, infantry fighting vehicles, armoured transport vehicles and military trucks. In addition, combat vehicles of the NATO forces and their logistic vehicles are to be serviced there.

Significant jump in earnings expected

The Group's figures naturally reflect the trend toward rearmament in the Western world. As early as 2022, Rheinmetall reported a record year with sales of EUR 6.4 billion. For the current fiscal year 2023, the Company's management expects revenues of between EUR 7.4 billion and EUR 7.6 billion. Likewise, the operating margin is expected to increase to 12%. In addition, the Company's CEO said in a "Stern" interview that he expects sales of between EUR 11 and 12 billion in 2025. Previously, the Company still expected revenues of between EUR 10 billion and EUR 11 billion.

Chart clearly depressed

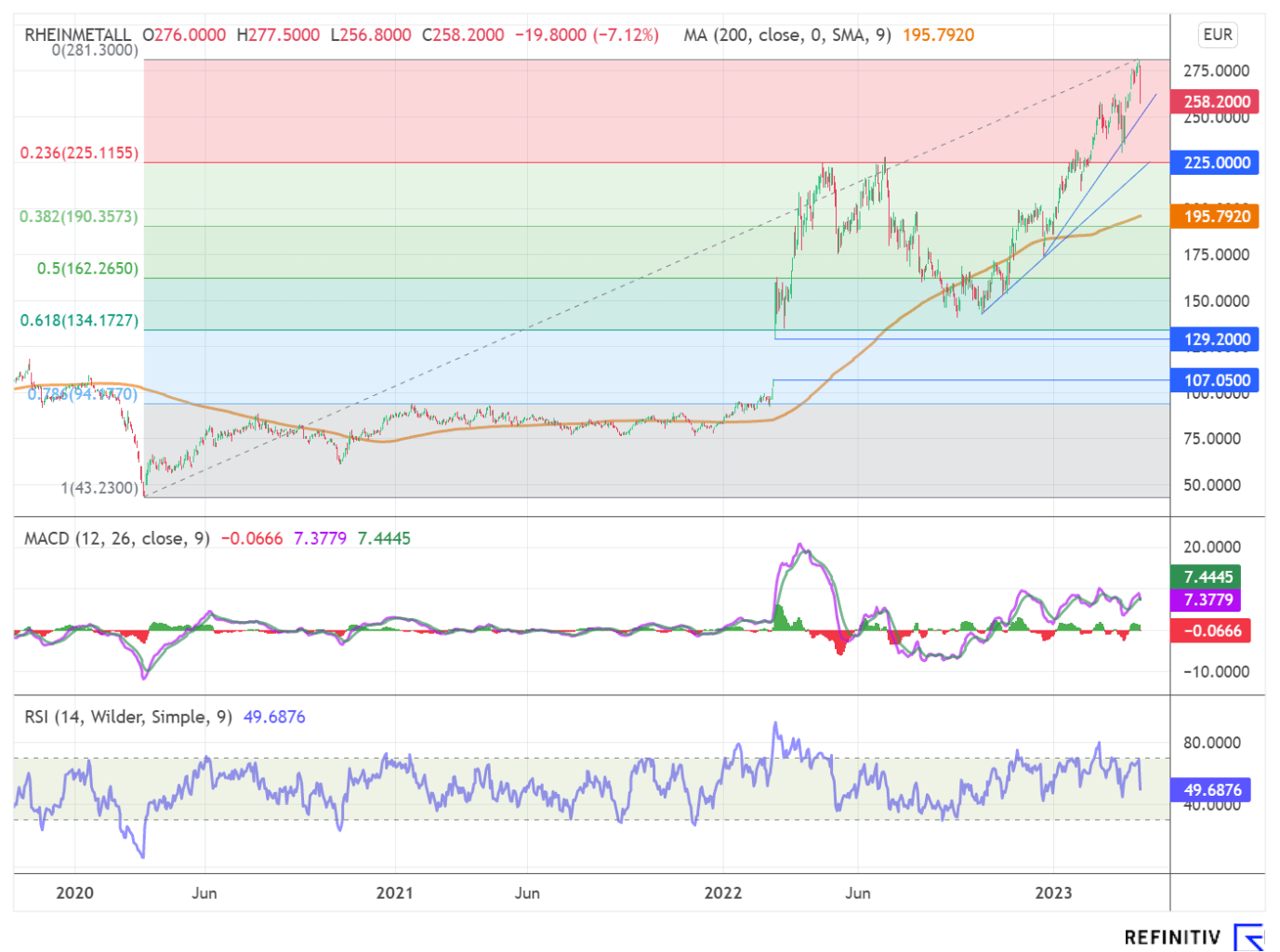

The Rheinmetall share could no longer replicate the positive news of the last few days. After reaching an all-time high of EUR 281.30, the stock fell by over 7% or EUR 23.10 to EUR 258.20 without news and with high trading volume, which clearly damaged the chart picture and could indicate a trend reversal.

The next weak support is provided by the uptrend formed since December 2022, currently at EUR 250.24. In contrast, the area around EUR 225.12 offers a potential retracement zone. This is where the 0.236 retracement and last year's highs from April and June are located.

Another support is provided by the currently still rising 200-day line at EUR 195.79. Another cause for concern is the weakening momentum in the indicators. Both the trend-following indicator MACD and the relative strength indicator RSI did not come close to confirming the last high reached and have formed negative divergences** since April 2022. Furthermore, the MACD sent a sell signal on a daily basis with the recent price drop. The negative chart pattern would naturally brighten with the climbing of new highs.

Interim conclusion

Since the outbreak of the Ukraine war, Rheinmetall AG has established itself as a partner of the Western armed forces and should continue to benefit from increasing orders from the German Bundeswehr and its NATO partners. However, after a price increase of almost 190%, the first cracks in the chart of the DAX newcomer are showing, so a stronger correction cannot be ruled out.

The update is based on the initial report 03/2022