Bayer AG is a German multinational pharmaceutical and biotechnology company and one of the largest pharmaceutical companies in the world. Headquartered in Leverkusen, Germany, Bayer's businesses include pharmaceuticals, consumer health, crop science including seeds, and biotechnology products.

Pharmaceuticals division fills the patent hole with new blockbusters

At the J.P. Morgan Healthcare Conference 1 , Stefan Oelrich, member of the Board of Management and Head of the Pharmaceuticals Division, raised his sales forecast for the heart drug Kerendia and the prostate cancer drug Nubeqa to EUR 3 billion each. Both products represent growth drivers for the Company. Together, they represent a sales potential of more than EUR 12 billion. Bayer is thus recouping nearly half of its blockbuster drugs, the blood thinner Xarelto and the eye drug Eylea, whose patent loss led to a financial gap 2 in the portfolio.

Bayer is hoping for a drug called Asundexian, which has yet to be approved. Currently, it is in Phase III testing. It is intended to prevent stroke, atrial fibrillation and heart attack. Expected sales are estimated at EUR 5 billion.

Another mass market target of Bayer Healthcare Pharmaceuticals is menopausal women. Around 50-75% of all women in their late 40s to mid-50s experience hot flashes during their hormonal transition. Now Bayer AG's new product promises relief: Elinzanetant is supposed to be an alternative to hormone replacement therapy. The latter increases the risk of breast cancer. 3 By 2030, the proportion of menopausal and postmenopausal women in the world population is expected to grow to 1.2 billion. A further 47 million new women will be added each year.

Consumer Health on growth course due to increased awareness of self-medication

Bayer provides a total of more than 150 products for self-medication and care around the world, including both international brands and local products. The range is extensive. It includes skin protection and care, nutritional supplements, pain, cardiovascular prevention, gastrointestinal health, cold and allergy. The overall market remains attractive, with a growth forecast of 2-4%. Due to the Corona pandemic, sales for home self-medication increased, including over-the-counter (OTC) pain relievers, cardiovascular risk prevention products, and dietary supplements. Bayer reached 46 million people in FY 2021 (43 million in FY 2020). Consumer Health achieved a 6.5% increase in currency- and portfolio-adjusted sales to EUR 5.293 million.4

Crop Science: Litigation against Monsanto continues

Since agreeing to the Monsanto deal in 2018, Bayer AG has endured recurring litigation in the dispute over the effects of the active ingredient glyphosate in its weedkiller Roundup®. Bayer paid a total of EUR 58.7 billion for the acquisition at the time. The plan: to generate high sales through the acquisition of Monsanto in 2018 by combining its pesticide business with Monsanto's seed and high-tech crop expertise. Faced with growing demand for food from a rising global population, farmers should become even more productive with their limited arable land.

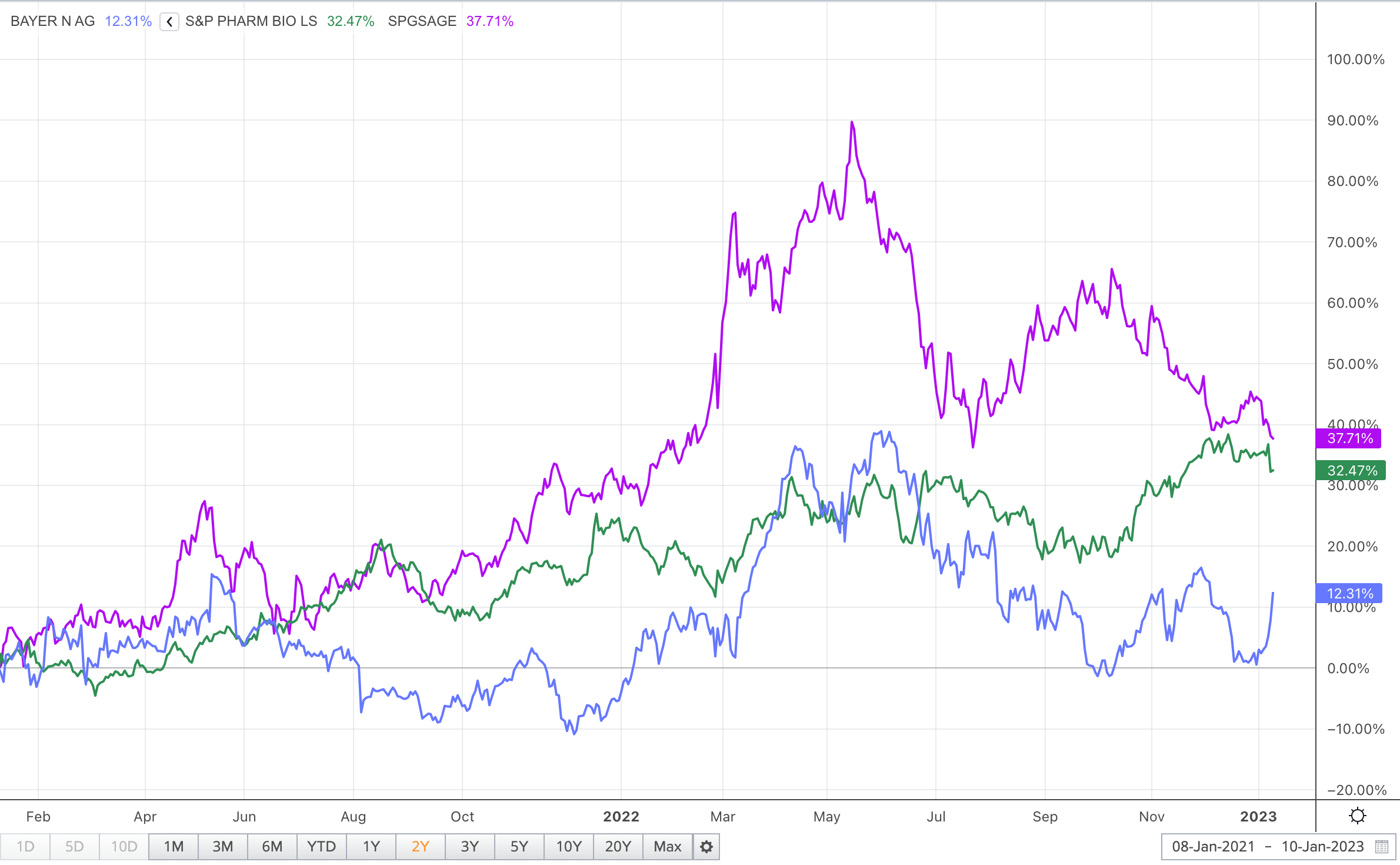

Instead, Bayer is being hit with a wave of lawsuits related to malignant secondary diseases, possibly caused by glyphosate, an ingredient in the herbicide Roundup®. Since the Monsanto acquisition, Bayer's stock price has nearly halved. One of the key masterminds of the Monsanto deal, Liam Condon5 , moved to Johnson Matey in 2022. Liam6 worked for the Schering and Bayer groups for over thirty years, including nine years as head of Bayer's Crop Science Division.

The second proponent of the Monsanto deal is CEO Werner Baumann. He still leads the group in the usual Bayer manner. That is where he has his roots. But is the corporate culture with his management style still up to date? Voices calling for a change in leadership are growing louder. With US impact investor Jeff Ubben, Baumann has brought one of his harshest critics into the institutional investor pool. Ubben holds 0.8% of Bayer shares with his investment firm Inclusive Capital Partners7

Inclusive Capital Partners, L.P. ("In-Cap") is an SEC-registered investment adviser based in San Francisco, California. In-Cap seeks to positively impact capitalism and corporate governance to achieve a healthy planet and the well-being of its inhabitants. In-Cap seeks superior long-term shareholder value through active partnerships with sustainable companies. "Inclusive Capitalism" advocates, among other things, the theory of generating equitable and sustainable growth that empowers others and meets the needs of society. It seeks to ensure that neither one generation makes short-term gains at the expense of future generations, nor does one actor unfairly receive benefits at the expense of others. In addition to Jeffrey Ubben, one of the co-founders of Inclusive Capital is none other than Lynn Forester de Rothschild8 , an American-British entrepreneur and billionaire.

At Bayer, there is an obvious discrepancy in credibility regarding their annual report communications and actively placed advertising campaigns. Claims made in advertising are not reflected in their annual reports. For example, under the title "For Every Life We Touch," it is claimed that "a changing environment should mean caring for the land that cares for us all." ("Bayer - For Every Life We Touch"). Yet the Crop-Science division's top products are pesticides that deprive the land of vital nutrients and disrupt neighbouring fields, plants and insects in their development cycle.9 No wonder Rothschild is speaking out. Ubben and Rothschild are not the only ones who dislike Bayer's business practices.

According to Bloomberg10 , a split of the group's divisions is to be pushed. Bluebell Capital has amassed an undisclosed stake and is seeking an overhaul of Bayer's corporate governance. Corporate governance rules are fundamentally tasked with reducing the scope and motivations of actors for opportunistic behaviour through appropriate legal and factual arrangements.

Bluebell has asked Bayer to separate its Crop Science business from its Pharmaceuticals business, which could provide shareholders with a gain of more than 70%. Especially in Crop Science, it is clear that Bayer's statements are inconsistent vs its actions. Between Desire for Sustainability and Reality of Herbicide Use11 to maximize profits is worlds apart. Bayer is not the driving force behind this dissonance here. Instead, it demonstrates a need for new regulations for corporate governance, as Bluebell seeks to do. After all, no investor can or should rely on legal regulations. But it is worthwhile to analyze the Company in its entirety and, in addition to the annual reports and earnings calls, also their handling of litigation and its plans in the agricultural sector and involved industries 12 .

Owners of 57 vineyards in the Texas High Plains seek to prevent a catastrophic threat to their state's $13 billion wine industry. They filed a lawsuit in the summer of 2021 against Bayer Crop Science/Monsanto Company and BASF Corporation, the makers of a "seed system" composed of dicamba-tolerant seeds and dicamba herbicides used by cotton growers in North Texas. The plaintiffs are seeking $560 million in compensation for economic damages. The lawsuit and accompanying documents accuse Bayer and BASF of knowingly promoting the use of products that could kill grapevines in the High Plains.

Interim Bottom Line:

Bayer is the cheapest stock of any Big Pharma company in Europe. It is calculated to have a valuation of less than 7 times the projected EBITDA in 2023, compared to the sector, which has a valuation of 12 times. Splitting the Company would not resolve the ongoing uncertainty around the Monsanto liability and the lack of confidence in management, but it would minimize the risk affecting the other businesses. The Monsanto deal clings to the Crop Science division like a dark shadow, dragging in one lawsuit after another. Pharma and Consumer Health are recovering thanks to their new launch products in mass markets and other pipeline products that have promising sales up their sleeves. Thus, the patent gap may soon be closed in terms of sales. Investors should remember that the share price halved after the Monsanto deal. The opportunity for further growth of the entire group is feasible with the handbrake on as long as the Crop Science Division continues to be overwhelmed by legal actions.

This update follows our initial Report 04/22