Company Profile

Bayer AG is a global life science company headquartered in Leverkusen, Germany. Its operations are managed by three subgroups: Crop Science, Pharmaceuticals and Consumer Health. 1

Crop Science includes the agricultural topics of crop protection, seeds and plant traits, and digital agriculture. Pharmaceuticals includes the prescription therapeutics market, focusing on cardiovascular and women's health. In addition, it focuses on oncology, hematology, ophthalmology and, in the medium term, cell and gene therapy. A subsegment serves contrast agents for diagnostic imaging. Consumer Health serves the area of over-the-counter (OTC) medicines that enhance consumer well-being in the areas of cold, allergy, pain, skin and skincare, gastrointestinal health and nutritional supplements.

Other service companies support the operating business of the three divisions as "enabling functions", e.g. Group Finance, Information Technology and Human Resources.

Management Team

Since 2016, the CEO and Chief Sustainability Officer has been Werner Baumann, who studied economics. With his company affiliation of 34 years and four months to date, he is a Bayer veteran.2 Starting in the Group Finance department, he learned his trade as assistant to the GF of Bayer Hispania Commercial and passed through executive and board positions in the Pharmaceuticals Division, took on the CFO role of Bayer AG, and was Labor Director. Now, Chief Executive Officer of the Bayer Group. He is also Chairman of the Deutsches Aktieninstitut.

Rodrigo Santos heads the CropScience Division. The graduate agronomist from Latin America sat in the saddle for Monsanto for over 19 years.3 The Pharmaceuticals are headed by Stefan Oelrich. He is an experienced pharmaceutical manager and looks back on many years at Sanofi and Bayer, including in the areas of marketing, diabetes, and cardiovascular. He sits on the supervisory board of one of Europe's largest university hospitals, Charité Berlin.4 Heiko Schipper has been the frontman of the Consumer Health division since 2018. A native of the Netherlands, Schipper spent two decades at Swiss-based Nestlé, mainly in the Nutrition division.5

Corporate History

The chemical and pharmaceutical group is characterized by an eventful history. M&As of companies and business units provide movement. The Company's future business is influenced by this, as are the decisions of shareholders and other stakeholders.

How it all began: chemical color production as the cornerstone

The Bayer Group can look back on a history spanning more than 150 years. Its roots are based on a successful friendship between men. On August 1, 1863, in Barmen, merchant Friedrich Bayer and natural dyer Johann Friedrich Weskott founded the small fuchsine manufacturing and trading company "Friedr. Bayer et comp." Bayer came from a family of silk weavers and learned his commercial trade in a chemical shop. His surname traces back to ancestors in Upper Lusatia, where "bajer" means storyteller.6 Weskott comes from a family of natural yarn dyers and began his independence with a dyeing business. 7 Both are experienced in the production of natural dyes. With the foundation stone of "Friedrich Bayer et comp," they start producing and trading synthetic dyes. Their aniline, a basic material for dyestuff production, and fuchsine impress in quality and color intensity. The family business quickly grew to 50 employees. The turbulent times caused by the Franco-Prussian War and the working conditions in the chemical laboratories caused the founding fathers to pass away early. Both of them lived to be only 55 years old. Their family members continued to run the Company in key positions.

Growth and expansion

In 1881, the foundation stone of the stock corporation is laid. The Company invests in research and development. Carl Duisberg, a chemist by training, was the driving force here. After five years, Duisberg became authorized signatory and head of scientific trials in 1888.

It is said to have been concern for his father, who was suffering from rheumatism, that led the employed chemist Dr. Felix Hoffmann on August 10, 1897, to refine salicylic acid, which had been used until then, into acetylsalicylic acid.8 The breakthrough met with little interest from his superior. Only Duisberg's assertiveness for clinical trials helps to achieve commercial success. Its name: Aspirin™. In 1897, another active substance is synthesized in Bayer's laboratories. Heroin. Patents are filed. The Company grows so strongly that expansion in and around Barmen seems impossible. Leverkusen becomes the new site. Thanks to space and a river, the Company can expand to accommodate its growth. In 1913, Bayer employs around 10,000 people, about 1,000 of them abroad. Subsidiaries follow in France, Great Britain, Belgium, Russia and the United States. Exports accounted for about 80% of the Company's sales in 1913.

Wars and world economic crisis

The turbulent times of the First and Second World Wars posed economic and ethical challenges for the chemical and pharmaceutical company. The U.S. confiscates patents and company assets. In Russia, the Company's headquarters there are expropriated. Duisberg remained inventive. From his trips to the USA, he took with him the idea of the Interessengemeinschaft (I.G.): Associations of companies that together generate large orders that would be unthinkable individually. Thus the liaison between Bayer, BASF and Agfa was born. Later known as IG Farben. During the Second World War, Bayer is considered by the Nazi regime to be "essential to the war effort" within the IG. Dark chapters with forced labor, experiments on prisoners and material procurement for warmongers are the result.

The Company has survived a number of crises in its history, whether price- fixing or drugs that cost patients their lives due to contraindications. In the U.S., the first wave of lawsuits due to the side effects of its cholesterol-lowering drug "Lipobay" rolled toward the Leverkusen-based company in 2001.9 The stock slides, almost destroying the pharma division. "Lipobay" is taken off the market. The in-house legal department has to process over 14,000 claims for damages. The Group is paralyzed until it reaches a settlement of USD 1.1 billion. This incident delays the Group's U.S. IPO. Bayer makes a brief guest appearance on the NYSE. Five years after its listing in 2002, the Company is delisted.

GlaxoSmithKline, Abbott, Johnson & Johnson, Syngenta, Novartis, Roche Inc.

As of December 31, 2021, Bayer has 99,637 employees worldwide (previous year: 99,538). Bayer has a global presence with around 374 companies in 83 countries. The Group has operations in Latin America, Asia/Pacific, North America, Europe, Middle East, Africa. 40% of the workforce works in the Pharmaceuticals Division, 33.9% in Crop Science, 10.7% in Consumer Health and 15.4% in the "Enabling Functions" service companies.10

Challenges, outlook

Disrupted supply chains, rising energy prices

The Russia/Ukraine conflict is causing interrupted trade flows and shortages of materials and raw materials. Rising energy prices and inflationary pressures are causing dislocations. Natural disasters such as hurricanes also led to losses. The war is not yet priced into Bayer AG's forecasts.

Lawsuits from takeovers

The Leverkusen-based company continues to face financial challenges from the United States. In 2013, Bayer bought the U.S. company Conceptus for its women's health division. Manufacturer of the metal coil Essure™, intended to provide contraception in the fallopian tubes of childbearing women. 40,000 lawsuits have reached Bayer so far. Lawsuits filed by women suffering from uterine and fallopian tube injuries, consequent hysterectomy, pain, nickel allergy, and depression after use of the metal device.11 "By February 1, 2022, Bayer has reached agreements with plaintiffs' attorneys to settle approximately 99% of the lawsuits in the U.S."12

Monsanto. Bayer integrated the U.S. takeover candidate into the Group in 2016 - under CEO Baumann - and thus assumes responsibility for the weedkiller 'RoundUp'. Its active ingredient glyphosate could be carcinogenic in humans.13 Insects such as bumblebees can decline in population due to contact with glyphosate, disrupting the natural growth of crops. In Germany, 320 investors become plaintiffs in the Cologne Regional Court, seeking damages of around EUR 2.2 billion. 14 In the U.S., lawsuits are again looming. One case is before the Supreme Court. Bayer wants to clarify whether U.S. federal law is superior to state law. If the Supreme Court accepts the case, this could give rise to a liability issue for Bayer.If the Court rejects the case, Bayer's 5-point plan will take effect.15 The Group has so far set aside around EUR 10.7 billion for the lawsuits and claims for damages. In case of failure, a further EUR 4.1 billion has been set aside since Q2/21, planned for future handling of NHL diseases; non-Hodgkin's lymphomas.16 Malignant lymphoid nodal tumors. Since "Lipobay" Bayer has a well established legal department. Reserves have been formed.

Loss of exclusivity of patents

Two exclusive rights to patents are expiring: Xarelto and Eylea combined sales of EUR 6.62 billion in 2019 after double-digit growth.

Outlook

So Bayer has to deliver and plug its logistics holes at the same time. To compensate, Bayer relies on pricing. To strengthen supply chains and production sites in the Pharmaceuticals Division, about EUR 2 billion will be invested over the next three years.

"Health for all - Hunger for none." delivered through science for a better life.

A large part will go into biotech for future cell and gene therapies as well as the expansion of the production site in Berkeley, California, USA.17

Bayer has spent around EUR 5 billion on acquisitions and partnerships in this division to date.

Bayer currently covers a quarter of its energy needs through renewable energies. "As far as security of energy supply is concerned, this is once again of much greater relevance and, in addition, our buyers are in the process of securing energy sources for our energy purchases," CEO Baumann emphasized.18

In oncology, additional benefits are being filed around the therapeutic Nubeqa. So far, the active ingredient darolutamide has been used in the fight against non-metastatic prostate cancer.19 In addition, therapeutics for the treatment of diabetic kidney disease and agents for the treatment of menopausal symptoms are coming onto the market. They are considered suitable for the mass market and thus have blockbuster potential. A blockbuster is defined as a drug that is successful in the pharmaceutical market and generates annual sales of more than USD 1 billion. But it is "mathematically impossible" for growth in newer drugs to compensate for the loss of patent protection for Xarelto and Eylea, says Bayer pharma head, Stefan Oelrich.20

In the CropScience division, the Group is currently focusing on pest-resistant hybrid corn varieties. By jumping into digital agriculture, results from seed data are evaluated in real time, to the detriment of competitors. **For seed prices in LATAM, Bayer expects a 10% price increase.

In Consumer Health, Bayer is growing in the areas of dermatology at 7% and nutrition at 5%. Cold, allergy and skin will be the core topics, e.g. with dermatological product expansions in sunny countries like Brazil. With SARS-CoV-2 as a seasonal virus, sales of cold products will increase at the end of the year.

SWOT

Strengths

- Increasing world population and life expectancy = supply of seeds/foods

- Strong brand

- Portfolio mix of agriculture, pharma and consumer health

- Strong focus on R&D

Weaknesses

- Expiring patents, patent infringements

- Loss of exclusive rights to drugs such as Xarelto and Eylea

- Strong competition in pharma and soy market

- Long development cycles in biotech and pharma (~ 7 years)

Opportunities

- Innovations in pharma and CropScience product pipelines

- Optimization and diversification of existing products in Consumer Health

- Joint ventures with companies that own products, markets and patents

- Aging population (preservation and expansion of health)

- Therapies to cure diseases based on genetic defect

Threats

- Damage to brand image

- Disrupted supply chains

- Shortage of raw materials

- Rising energy prices

- Political regulations due to health and environmental risks

- Trade stoppages due to sanctions/wars

Valuation

Bayer's sales grew by 8.9% to EUR 44.1 billion in 2021. As a global health and nutrition company, Bayer's three divisions are well positioned to generate profits in growing markets through innovative research and technology. Of the 18 analysts polled by S&P Global Market Intelligence, 11 give a positive consensus rating, while 4 are opposed.

| Bayer AG in Mio. EUR | 2020 | 2021 | 2022e | 2023e |

|---|---|---|---|---|

| Sales | 41,4 | 44,08 | 46,62 | 48,00 |

| Net debt | 37,57 | 33,13 | 34,53 | 32,29 |

| EBITDA | 11,46 | 11,17 | 12,27 | 12,93 |

| EBIT | 7,09 | 7,29 | 8,2 | 8,8 |

| Free Cash Flow | 2,48 | 2,47 | 3,08 | 4,3 |

| Group earnings | 6,28 | 6,39 | 7,02 | 7,55 |

| Earnings per share (EPS) | 6,39 | 6,28 | 7,14 | 7,69 |

| Book value per share (BVPS) | 31,07 | 33,61 | 37,51 | 41,71 |

Interim conclusion

In the wake of the lawsuits, Bayer is banking on high free cash flow for liquidity in expected damage payments - and dividends. That is already priced into the share price.

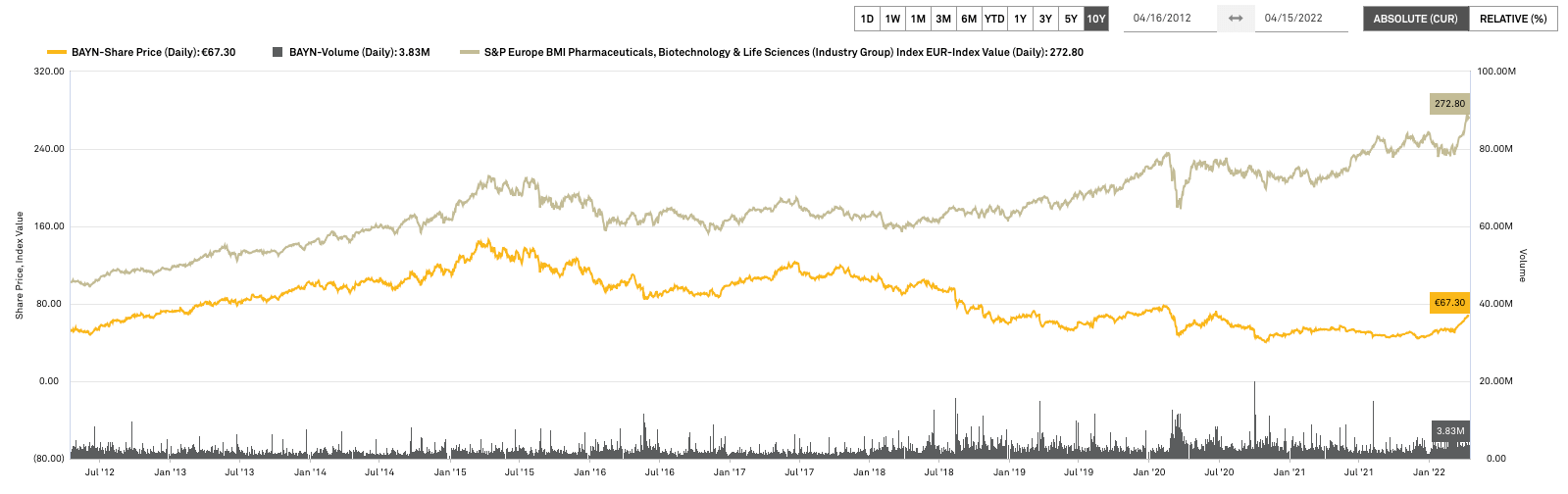

Inflationary trends, energy prices, supply chains and the impact of the war on current business remain to be seen. A comparison with the S&P Europe BMI Pharmaceuticals, Biotechnology & Life Sciences Index clearly shows the downward trend of the share price in relation to the Monsanto case. In the medium term, the Bayer share is a solid value that can continue to grow. Due to expiring patents and the pricing power of competitors, modesty is the order of the day.